Argentina heads to the polls on October 22nd. There are three frontrunners: the controversial outsider Javier Milei, the centre-right politician Patricia Bullrich and, leading the “Peronists”, Sergio Massa. The vote is very likely to end up in a second round. The country is deep in a prolonged economic crisis, and the three present ambitious programmes—to different degrees.

Massa’s plan is to ramp up exports in order to fix the trade and government deficits, including non-conventional sectors. He was minister of the economy under the incumbent, although he has remained somewhat of an outsider with his “Peronist” base. He has been part of proposing the idea for a common currency between Brazil and Argentina, and renewing the $18bn swap line with China, the top trade partner.

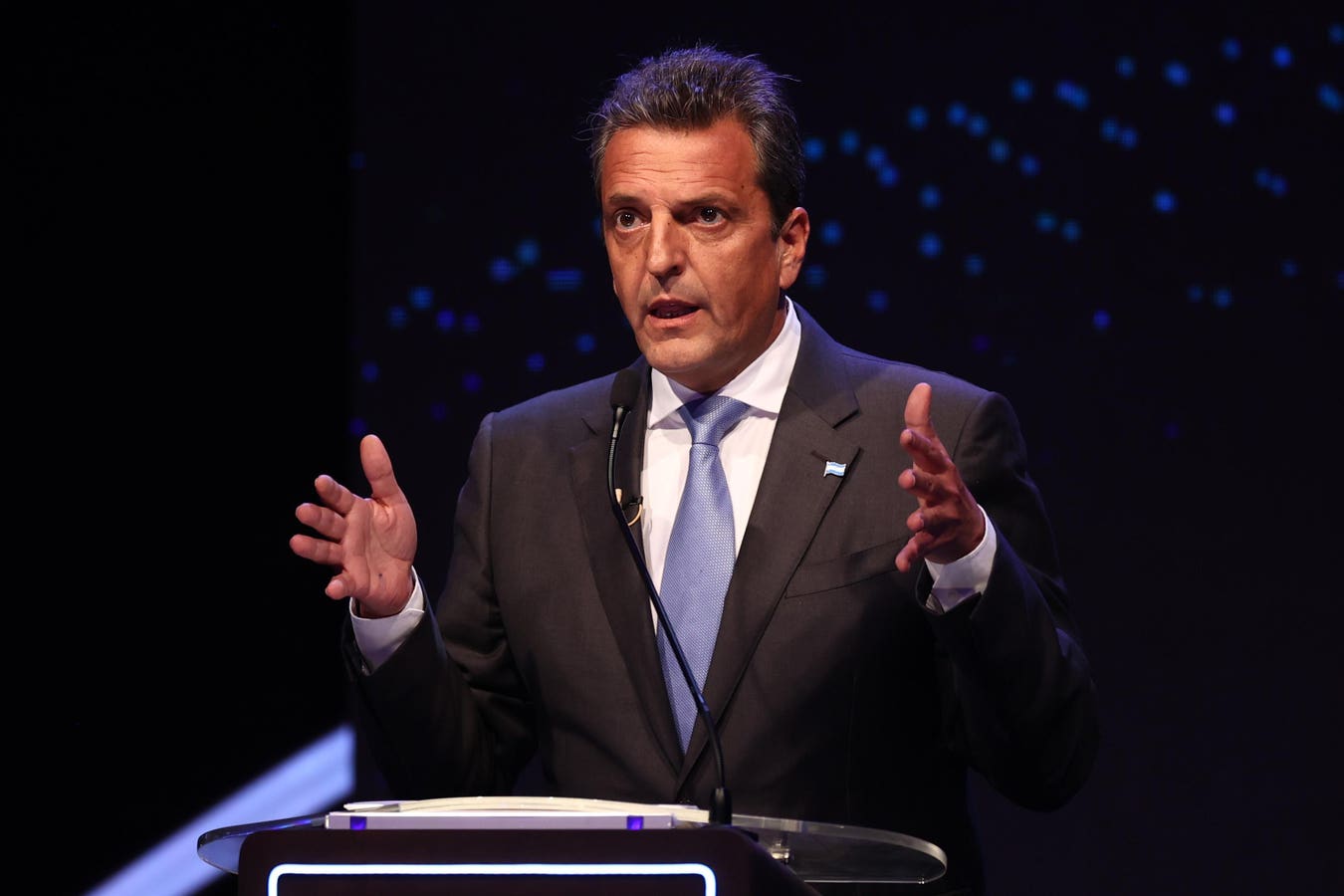

Now a candidate, Massa was appointed in July 2022 to create an economic “super-ministry”—in layman’s terms to come in and fix the economy. Argentina was experiencing one of the highest levels of inflation in the world and a crippling twin deficit: trade and budget. Though the term has not been used often, he could be thought of as a technocrat, which has to be made compatible with his party’s working-class base.

The economic picture has only been getting worse. Adding to woes, a historic drought cut Argentina’s key agricultural exports by $20bn. The peso keeps depreciating, especially since frontrunner Javier Milei proposed a full dollarisation of the economy. Businesses and ordinary Argentines are preparing for the eventuality when their national currency would become worthless. Since the primary vote that put Milei at the top of the leaderboard, the peso has lost 40% of its value.

While the peso is pegged at around 350 per dollar since August, the informal exchange rate—commonly called the “dólar blue”— reached 1,010 per dollar, on October 10th. This level was only stabilized from 1,050 after an intervention of $220 million from the central bank.

Simple: Export more

Now Massa hopes to become president, after a year at the “super-ministry” taking Argentina through a deepening crisis. His proposals include paying the IMF in full, “so that it does not intervene in our policies any more”. Also, recovering incomes in his working-class base, and “fiscal order”—buget cuts, though not to the same scale as the other two contenders.

The essential one, nonetheless, is to ramp up exports. That is how the deficits will close and the country will be able to pay debts and imports. Energy would be central to this export drive, if Massa were to win. So far, Argentina has depended largely on agriculture—the top three are soybean, corn, and wheat. In the plan, however, shale gas and lithium take precedence. The potential becomes more interesting since these exports are positioned on the global energy transition.

Argentina’s energy trade balance has been negative for the last two decades, despite its vast natural wealth; there is an enormous potential for fossil fuels, mining, and renewables. However, the environment has not always been favourable for investments. In 2011, a key argument to justify nationalising YPF was that the parent company, Spain’s Repsol, was planning on divesting away from Argentina.

Argentina is sitting atop the world’s third-largest lithium reserves, or second-largest “resources”— the latter includes not easily accessible deposits. It is also the fourth producer, and this year it has been promoting a “lithium OPEC” with fellow South American countries: Chile, Brazil and Bolivia.

Gas pipeline Nestor Kirchner, which would link the Vaca Muerta gas extraction area with San Jerónimo on the Paraná, a navigable river. The first use of the pipeline will likely be to use domestic production in lieu of imports. The government says that it will initially mean saving $4.2bn annually by substituting fossil fuel imports. Later, the pipeline would allow to export any surplus.

In June, energy secretary Flavia Royon said that the energy trade balance will start to be positive this year, in part thanks to the new pipeline and other investments. She also added that “by 2030 we project a revenue of $18bn.” Royon also pointed out that investment is on the rise in the sector: “Vaca Muerta will go from receiving $6bn to $8bn this year,” including a $500mn investment from Chevron

CVX

Read the full article here