In this article, I attempt to tackle the question of how much oil Venezuela could produce in the short term. That is, if restrictions by the US Treasury are removed in negotiations between Washington DC and Caracas. Beyond that, there are obvious questions regarding political stability, corruption, economic policy, and others, that will be approached in the future.

It is clear that the Biden administration is attempting to counter Saudi and Russian efforts to drive up oil prices, as they will affect inflation in an election year. Starting from Reuters in December 2020: “Sanctions on from Iran and Venezuela have blocked up to 3 million barrels per day (bpd), or 3% of world supply.” Professor Francisco Rodríguez, a Venezuelan economist in Denver, also calculates that about 59% of Venezuela’s drop in oil production since 2017 can be attributed to US sanctions. However, beyond responsibility for what already happened, what can we expect from the industry if sectoral sanctions are lifted tomorrow?

Already Chevron

CVX

In an article in early September, I already put together some estimates from economists and experts. There are some insights there by Professor Francisco Monaldi, who argues among other things that if sanctions are lifted, Venezuela could be producing 250,000 more in two years.

The sources I spoke to also pointed out that there are many more considerations than just sanctions. Any sustainable rise in output will need increased political stability and guarantees. Can investors be certain their projects will not be expropriated or harmed by corruption? If the opposition wins, will investments be questioned?

Sources in Venezuelan finance argue that attitudes towards the private sector have been changing, especially since 2019. While we should not expect mass privatisations, there is increasing space for the private sector. Think of the issuance of shares by state-owned enterprises and the creation of special economic zones. We can also see an effort towards extracting natural gas, which was shunned for offering too low revenues to the state, when compared to oil. Without further ado, here are the insights from three experts based in Venezuela:

Reinaldo Quintero, Argos Energy Services

Reinaldo Quintero is president of Argos Energy Services, a firm that provides goods and services to the domestic oil industry. He is also business development vice president at VEPICA, and he was president of the Cámara Petrolera (oil businesses association). He argues that foreign corporations have been investing in minimum maintenance and protecting their installations. The latter point has been crucial. These firms not only prevented infrastructure from wearing down, but also protected them from vandalism during the worst of the economic crisis. PDVSA, on the other hand, had to concentrate its more limited resources into the areas where it was still operating.

Quintero estimates that the joint-enterprise fields have a considerably higher capacity than they are currently producing. “Chevron’s current fields produce 135,000 bpd but have a capacity for up to 300,000 bpd; Maurel & Prom 40 to 60,000 bpd; and Eni and Repsol 60 to 80,000 bpd – although the last two are more interested in natural gas”. These estimates amount to 540,000 bpd, with a margin of error of 30,000.

“At the end of the day, oil is 90% politics,” he said in a telephone interview. “Venezuela should be producing roughly 3 million bpd. About 1 mbpd was lost due to the wrong policies made by our government, and another 1 mbpd we can’t produce due to sanctions. Add that to the 700-800,000 bpd we are producing, and there you have it.”

José Chalhoub, Venergy Global and Azur Global Consulting

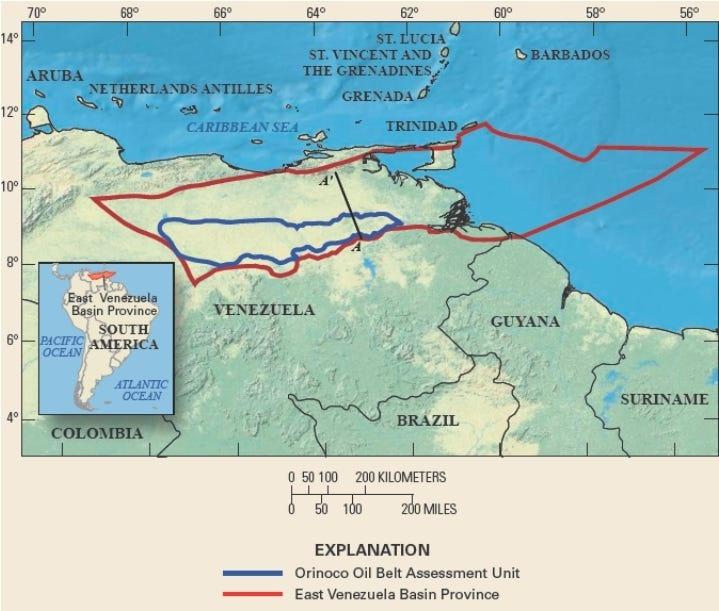

José Chalhoub is a senior consultant at Venergy Global and Azur Global Consulting. He also worked at PDVSA, Venezuela’s state oil firm, until 2016. “The Orinoco belt could produce 2 mbpd within two years without sanctions and with sizeable investment. The region’s potential is due to its multiple almost untapped wells, unlike in the west and other parts of the east. One of the main reasons for the decline in production, besides insufficient investment and corruption, was the depletion of wells, for a purely geological reason.”

He also added that “extraction in this region is more recent. Historically, it started off in the west, around Lake Maracaibo. Meanwhile, the Orinoco belt is home to the largest reservoir in the world. It had become a hub for foreign oil firms, especially before then-president Hugo Chávez’s expropriations. They included ExxonMobil

XOM

Antero Alvarado, Gas Energy Latin America

Antero Alvarado, director of Gas Energy Latin America, offers a more conservative estimate that Chevron’s capacity could be 250,000 bpd. This would also “require dredging Lake Maracaibo, so that larger tankers can sail through it, which has to be done by Venezuela”. Furthermore, he said, lifting sanctions will also need to be accompanied by trust. For example, foreign investors may be wary of instability, corruption and other problems; likewise, PDVSA may not open accounts in western banks that previously froze assets, instead preferring Chinese or Russian counterparts.

Business leaders in the energy sector are calling for a reform of the “Hydrocarbons Law” of 2009, which gave exclusive rights to the state. Alvarado said that a new bill that enables the private sector will have to be approved by a National Assembly that is recognised by all sides – referencing the situation whereby the opposition still recognises a parliament elected in 2015, and argues that any elections after were fraudulent.

Read the full article here