The sparkle that Disney’s bottom line gets from its theme park complex in Paris has been revealed in research. Since its gates swung open in 1992, Disney has paid $1.7 billion (€1.6 billion) to its Burbank-based parent with annual royalties hitting a record $129 million (€118 million) last year.

The resort on the outskirts of Paris comprises seven on-site hotels, two convention centers, a 27-hole golf course and two theme parks – the movie-themed Walt Disney Studios and the Disneyland Park.

More than 320 million guests have streamed through their turnstiles since 1992, but the resort has rarely made a net profit. Its bottom line has been weighed down by interest payments on the bank loans which funded its construction but this only tells part of the story.

The spell that Disneyland Paris casts was recently revealed by this author in Britain’s Sunday Times newspaper. It lifted the lid on the top line financial performance of the resort’s main operating company, Euro Disney Associés, which is ultimately owned by Disney but files its own financial statements.

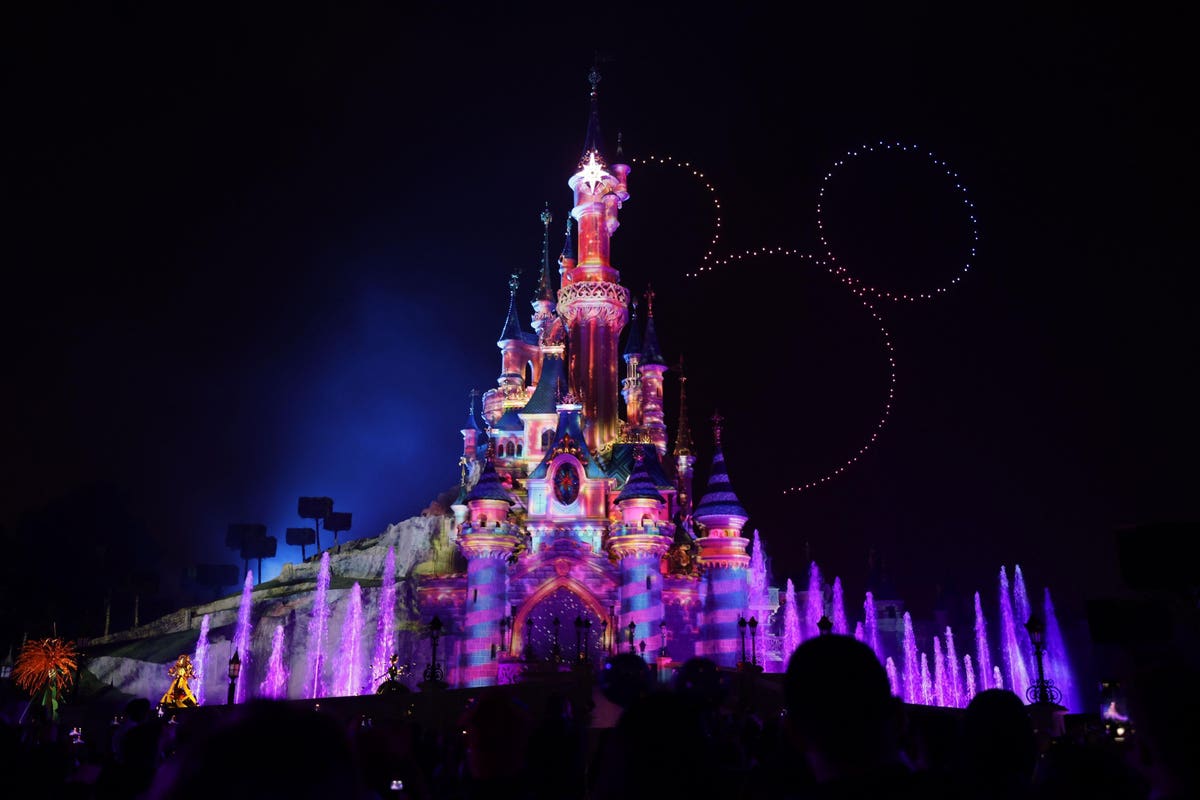

Last year, all the stars aligned for the resort as the end of pandemic restrictions unleashed waves of tourists with pent up demand just as Disneyland Paris launched a ground-breaking new drone show to celebrate its thirtieth anniversary in April. A few months later it inaugurated an Avengers Campus land complete with a ride which uses motion sensing cameras to make guests feel like they are slinging webs as we have reported.

According to the Themed Entertainment Association’s Global Attraction Attendance Report, total attendance at Disneyland Paris rose 183.6% to 15.3 million last year making it Europe’s most-visited theme park resort.

This contributed to EDA’s revenue rising nearly three-fold to a record $2.6 billion (€2.4 billion) in the year to September 30, 2022. Around a quarter of this came from a subsidiary which operates a 44,000-square-meter on-site entertainment district and five of the resort’s hotels aside from the Davy Crockett Ranch and the flagship Disneyland Hotel. The subsidiary even managed to generate $104.2 million (€95.5 million) of revenue in 2021 even though the hotels were closed for more than seven months of that time due to the pandemic.

Last year, the rise in EDA’s revenue outstripped a 57.8% increase in costs which was partly driven by spending on staff. Disneyland Paris is the largest single-site employer in France with 17,000 staff including 15,450 at EDA. They increased by 9.4% last year with employee expenses following suit to a record $830 million (€761 million.)

It left the company with a $51 million (€47 million) operating profit, its highest in a decade. It appeared to be long-overdue but detailed research has revealed that this is far from the first financial happy ending written by Disneyland Paris.

The popularity of the resort is a world away from its early days when the late French president François Mitterrand shunned the launch party saying that it was “not my cup of tea.” The French were put off by high ticket prices, the lack of alcohol in the park’s restaurants and English being its first language. Worse was yet to come for the resort which was 49% owned by Disney itself with the remainder listed on the Paris Euronext exchange.

A severe recession soon brought dark clouds to the magic kingdom and just two years after opening it had to carry out a $990 million (€907 million) capital increase. Saudi billionaire Prince Alwaleed, joined in on the rescue by buying a 25% stake in Disneyland Paris but it took much more than that to turn the business around.

The clouds began to clear when Disney created more affordable tickets, made French the first language across the resort and introduced alcohol to the restaurants for the first time in a Disneyland park. By 1999 it needed a capital increase of $240 million (€220 million) and this time it was used to finance the development of the Studios park.

Only at Disney could lightning strike twice as the Studios premièred in 2002 in the midst of the global tourism downturn following 9/11. Three years later it carried out another financial restructuring including a $276 million (€253 million) capital increase, which was backed by Disney and funded the construction of four new attractions. However, the real villain still needed to be vanquished.

Two decades after Disneyland Paris opened, its bottom line was still being dragged down by finance charges on the bank loans which funded its construction. With a wave of Disney’s magic wand, the debt mountain disappeared in 2012.

Disney took over the debt and refinanced it to significantly reduce the interest rate. It put the resort on course for profitability but that was just the start. In 2014 Disney backed a $1.1 billion (€1 billion) recapitalization of Disneyland Paris and three years later it finally took full control of the company.

The takeover, which we first forecast in Britain’s Daily Telegraph newspaper, saw Disney pay $2.20 (€2) a share for all of the stock that it didn’t own. The offer was a generous 67% higher than the share price at market close the day before the takeover was announced. It has had a magic touch.

The acquisition was followed by a $1.6 billion (€1.5 billion) recapitalization which was again backed by Disney. Crucially, this finally fully de-leveraged the company as documents filed in connection with the transaction referred to the “company’s target debt which is considered to be zero insofar as we have been told that the majority, if not all, of the €1.5 billion capital increase planned after the Offer should be allocated to repayment of debt owed to TWDC [The Walt Disney Company].” That was just the start.

In 2018, Disney followed this up with an another show of support when its chief executive Bob Iger announced with French president Emmanuel Macron that the media giant will spend $2.2 billion (€2 billion) on the Studios park in its biggest-ever expansion. Avengers Campus was the first part of this and it will be followed by two other lands, including one which is currently under construction and is themed to the hit animated film Frozen. There is good reason why Disney has thrown its weight behind the resort.

After just three months of owning Disneyland Paris outright, the Mouse had already begun to get a glow from its French outpost. Disney’s financial statements show that in the year-ending 30 September 2017, parks and resorts generated a third of its $55.1 billion revenue and around a quarter of its $14.8 billion operating income. The division drove more revenue and profit than studio entertainment, consumer products and interactive media and was only eclipsed by Disney’s media networks.

Parks and resorts revenue rose 8% but it only grew by 4% at Disney’s two resorts in the United States. Instead, the majority of the increase was fuelled by a staggering 32% rise in international revenue which in turn was driven by higher volumes and greater guest spending. Disneyland Paris was one of the key drivers of this.

“Theme Park revenue for the fiscal year increased 19% to €868 million compared to €729 million for the previous fiscal year, reflecting an increase in number of visitors from all of the group’s key European markets,” said Disney’s former chief financial officer Christine McCarthy in the 2017 EDA financial statements.

She added that there was a “net increase in theme park attendance, hotel occupancy, average spending per visitor and average spending per room, compared to the previous fiscal year.”

This trend has continued and came into its own last year when Disney’s other international parks suffered from pandemic restrictions for the majority of the year. As a result, the revenue from Disneyland Paris represented a staggering 85.9% of the total generated by all of Disney’s international parks. It doesn’t stop there.

As Disneyland Paris was initially not wholly-owned by Disney it needed a license to use the company’s characters, movies and other intellectual property. This was essential as the vast majority of the attractions in its parks are based on Disney’s IP.

That license agreement is still in force today and although the details of its contents are not widely known, they can be found deep inside documents filed by Disneyland Paris when it was floated.

They state that “on February 27, 1989, the Company was granted a license to use any present or future intellectual or industrial property rights of TWDC [The Walt Disney Company] that may be incorporated into attractions and facilities designed from time to time by TWDC and made available to the Company. In addition, the license agreement authorizes the sale, at the Resort, of merchandise incorporating or based on intellectual property rights owned by, or otherwise available to, TWDC.”

Payment comes in the form of royalties and, as the documents reveal, they “represent amounts payable to an indirect wholly-owned subsidiary of TWDC under a license agreement. This license agreement grants the Group the right to use any present or future intellectual or industrial property rights of TWDC for use in attractions or other facilities and for the purpose of selling merchandise.”

According to the documents, under the license agreement, EDA pays Disney “10% of gross revenues (net of taxes) from rides, admissions and related fees (such as parking, tour guide and similar service fees) at all Theme Parks and attractions; 5% of gross revenues (net of taxes) from merchandise, food and beverage sales in or adjacent to any Theme Park or other attraction, or in any other facility (with the exception of the Disneyland Hotel), whose overall design concept is based predominantly on a TWDC theme; 10% of all fees paid by participants (net of taxes); and 5% of gross revenues (net of taxes) from the exploitation of hotel rooms and related revenues at certain Disney-themed accommodations.”

The hotels at Disneyland Paris are themed to places rather than Disney’s Intellectual Property so it hasn’t paid any royalties on the revenues generated by them since 1992.

The royalties were repeatedly reduced and waived when the resort fell on hard times and the same goes for the management fees that it paid to a Disney subsidiary. Disney completely put the brakes on the management fees in October 2017 following the takeover. However, the royalties are still being paid and even continued throughout the pandemic, albeit at a much lower level than usual.

Last year was a whole new world as the royalties rose by a staggering 462%, giving Disney $129 million (€118 million) from its French outpost. Its $51 million operating profit pales in comparison to this and it shows that the resort packs much more of a punch than previously thought.

As the table below shows, over the past 31 years, Disney has received a total of $1.7 billion of royalties and management fees from Disneyland Paris. Remarkably, even though last year’s tally just came from royalties, it still hit a record thanks to the blockbuster performance of the resort.

It’s a far cry from the early days when Disneyland Paris was in such financial difficulty that Disney waived its management fee and royalties between 1994 and 1998, before reinstating them at half the normal rate until 2004. Then they were waived for three quarters of 2003 and up to $217 million (€200 million) of them was deferred in the 2005 financial restructuring. In contrast, retailers selling branded products rarely get such special treatment if they fall on hard times.

We will never know what Disneyland Paris would have done with the $1.7 billion if it hadn’t needed to pay the money to its parent but a fascinating indication comes from Disneyland Paris historians TheMainStreetNews.

Through analyzing long-lost plans for the resort, TheMainStreetNews concludes that had things gone well for Disneyland Paris, it could have built its Lava Lagoon water park and a third theme park based on the futuristic Epcot in Florida. Revisiting those plans might not be a walk in the park.

In just the past few months the happy ending at Disneyland Paris has become more of a nightmare. In stark contrast to the conditions which fueled its record results last year, the resort now faces a perfect storm of strikes, national unrest and the loss of a key transport route serving one of its biggest markets. Worse still, it is all taking place over the busy summer season.

Parts of Disneyland Paris have been paralyzed by strikes over the past month. As we have reported, more than a thousand disenchanted workers have marched through its theme parks leading to the cancelation of shows and entertainment. Amongst their demands are improvements to the length of service bonus, increased pay for working on Sundays and a monthly wage increase of $215 (€200).

A video of guests booing when the nightly entertainment was canceled quickly went viral after it was Tweeted by the DLP Report social media account which has been expertly documenting the dispute.

Another Tweet shone a spotlight on the protesters’ plight. “Aladdin Need Of A Pay Rise” was the message on one of their placards whilst another was based on one of the resort’s most famous slogans as it said “From Need Magic To Need Money”.

The strikes are reportedly on hiatus until September but not because the air has become more amicable.

Over the past week France has been hit by waves of riots following the fatal shooting of a teenager by the police. President Macron has been castigated for partying with Elton John as violence broke out and it wasn’t long before Disneyland Paris was affected by it. The resort has had to close early twice over the past week and the risk is so great that the strikers have reportedly called off their demonstrations as a precaution.

As if that wasn’t enough, last month France’s state-owned rail operator put the brakes on the direct train service between Disneyland Paris and the United Kingdom. The effect of this remains to be seen but more visitors to the resort come from the UK than any other country outside France and 32% of them arrived by train or plane in 2016, the last year that Disneyland Paris released this data.

“There was something really easy and safe for families to just get in the train and arrive at the Park’s entrance,” said DLP Report. “Yeah was so much easier with the baby than flying,” said one traveler in reply. Another added that they have “used [the direct service] over a dozen times, and any other route will eat into park time now.” The effect this could have was laid bare by one Twitter user who claimed that the loss of the service “sadly will really limit me going to DLP.”

Disneyland Paris is even facing home-grown challenges as DLP Report frequently posts photos of disrepair at the resort including cracked props, exposed plaster, broken doors, peeling paint on the centerpiece castle and even a drone from the night time show that recently crashed into it.

Unsurprisingly, this is all taking its toll on the resort’s appeal to travelers. A recent video about the strikes attracted comments from followers who vowed not to visit Disneyland Paris until the dispute is resolved. “I won’t be booking until it’s all sorted,” said one. “We’re not booking our next trip until Disney make it right,” added another whilst a third said “I haven’t booked for September yet, because I have no idea what the situation is looking like and I refuse to book while they’re striking.”

More immediately, one fan Tweeted that the early closure of the parks due to the riots is “not good for DLP and the future of the parks.” Another added: “really glad I didn’t go to Paris from London and just flew back to the USA.” Perhaps the most pertinent point came from Douglas Rickard who highlighted how ironic it is that Disney’s chief executive “Bob Iger said he only went ahead with the [Studios] expansion after Pres. Macron had got in – wonder what he’s thinking now.”

So far, Iger has stayed silent about the dark spell that has been cast on its French outpost but with Disney’s third quarter results coming up next month we probably won’t have to wait long to find out what he thinks.

Read the full article here