On October 27, 2023, Sanofi reported its earnings, generally beating the estimates. The company also announced that it will put more resources into internal R&D and spin off its consumer division to focus on innovative pharmaceuticals. The market interpreted the news in its own way, sending the stock back to November 2022 levels, erasing the hard-earned gains made during the past 12 months. Sanofi has remained among the top pharma performers year over year, but the twenty percent drop in a single day sent shockwaves throughout the industry despite gradual recovery. To many industry players, this price drop and the following negative news coverage came as a surprise. The industry is facing unprecedented losses of exclusivity, with some companies expected to see 20-70% of their current sales go generic in under a decade.

“The majority of global pharma companies will experience loss of exclusivity in the coming years, but Sanofi is in a better position than most, with our last major LOE of the decade this year. And while I am constantly evaluating a large number of opportunities to bolster our science, honestly, I like our own R&D better. That’s why we decided to double down on our science, at the expense of short-term profitability, with the goal to create long-term value and transform the practice of medicine,” Paul Hudson, the CEO of Sanofi, told me privately at the BioCentury China Healthcare conference in Shanghai less than a week after the announcement. I previously wrote a piece covering Sanofi’s push on AI, and my question was simple – “As a provider of AI software to pharma companies, I have an umbrella view of the industry, and to me, it looks like Sanofi is doing better than any other company in AI. It also has several potentially blockbuster drugs in the pipeline. Why did the market react this way?” From my perspective, it looks like most of the analysts and journalists misinterpreted the clear message the decisive Sanofi CEO sent to the market.

It is important to note that the increase in R&D does not only mean that all of the research will be sourced internally. A substantial part of R&D can also be brought in, refined, and perfected in a similar way as Sanofi’s mega-blockbuster first-in-class Dupixent (dupilumab). Mr. Hudson made it very clear that he fought hard to overcome the “not invented here” attitude.

He also made very bold moves restructuring internal R&D, promoting one of the most talented immunologists in the pharmaceutical industry, Dr. Frank Nestle, to the position of CSO, ensuring that the most promising programs in the company are prioritized. He also brought in the famous British scientist with experience in venture capital and new biotechnology company formation, Dr. Houman Ashrafian as his head of research and development.

Revelations From BioCentury

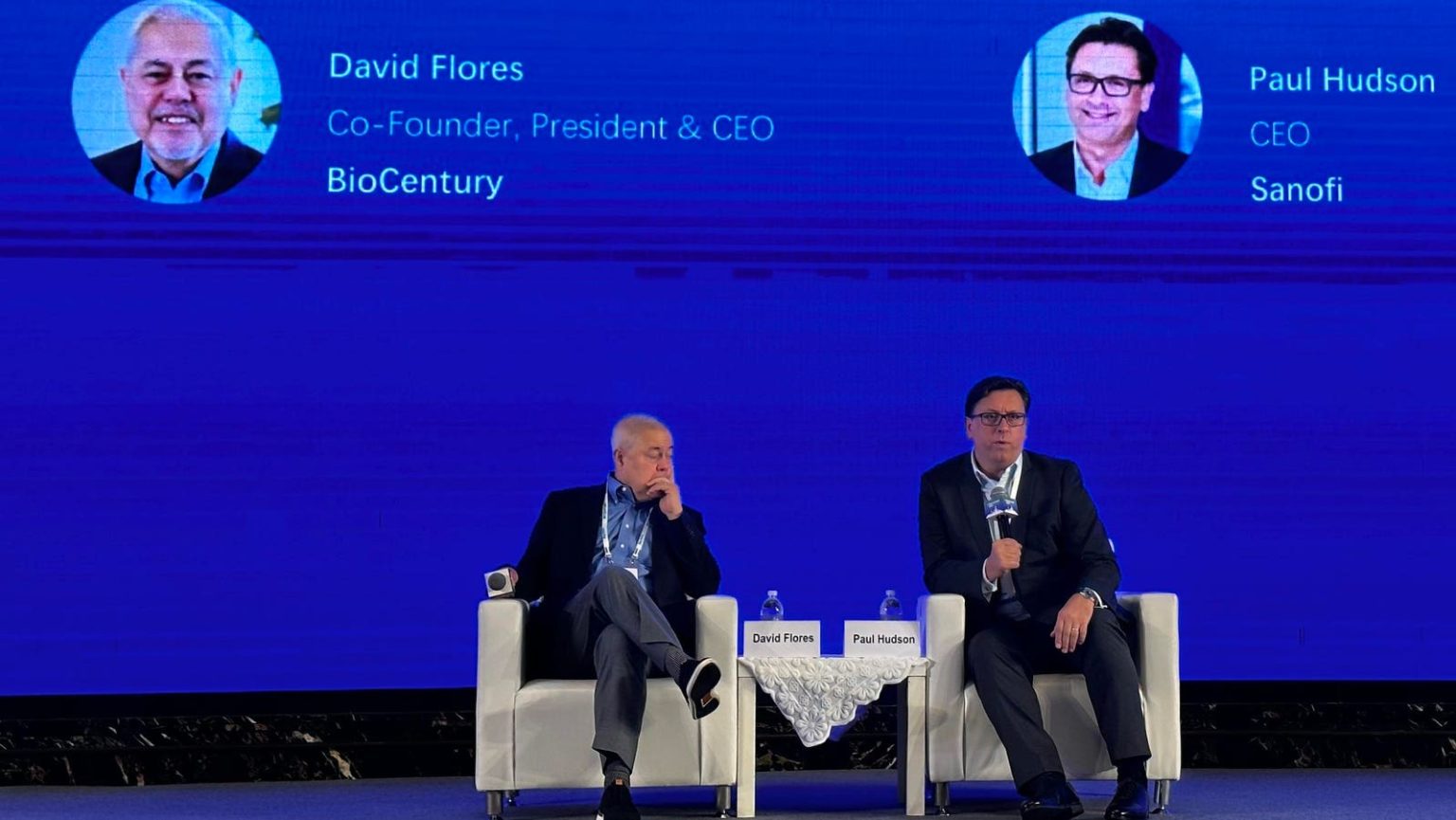

The BioCentury China Healthcare Summit is one of the largest annual gathering of biotechnology and biopharma executives in China, and even during the pandemic, I tried to attend and present every year. In 2023, the summit celebrated its 10th anniversary, and Paul Hudson’s appearance was day two’s crown jewel. While many other heads of big pharmaceutical companies took part in the event, as well as the analysts of some of the world’s largest investor groups, Paul was the most senior global executive.

He also hosted a two-hour closed-door meeting with several innovative biotechnology companies and early-stage investment fund founders to learn firsthand about the true state of the local R&D ecosystem, to better understand which areas of innovative drug discovery the country has made the most progress in and to explore the hottest areas for potential partnerships or acquisitions.

The room was packed with many high-profile delegates standing at the back, but I managed to arrive early and take a front-row seat.

David Flores, co-founder, president, and CEO of BioCentury, asked the questions and acted as moderator. The conference has a rule that whatever is said on stage cannot be quoted directly, so I will provide a summary of the original statements.

As expected, the first questions touched on the recent announcement and market response. Mr. Hudson explained the need to invest more in research and development to avoid the fate of the many pharma companies that are facing loss of exclusivity and need to make spontaneous and often erratic bets.

His bets were very clearly outlined. He wanted to build on Sanofi’s strength in immunology and turn it into the world’s leading immunology company. His strategy is not only about prioritizing immunology as the core therapeutic area but also utilizing AI across the board to ensure that the right patients get the right treatment at the right time in their patient journey. The company will utilize multiple mechanisms, including AI, from very early diagnosis all the way through the treatment and possibly to the cure. He explained that when analyzing patient journeys, they sometimes see cases where they take a patient off the drug, and the patient is disease-free for the entire year.

Hudson believes that with Sanofi’s arsenal of treatments both in place and in progress, as well as its diagnostic products, it may be possible to pick the patients early, just after the diagnosis, use AI to see who the super responders will be, and put them on the optimal treatment protocol to maximize patient benefit. He will also invest more in biologics because, despite the higher costs, sometimes they perform miracles.

His strategy is innovative – and as such, it’s not easily understood or embraced by everyone. Investors and pharma veterans are skittish about change; they are used to doing things the same way. And everyone is trying to outperform the standard of care. But with the right treatment at the right time, it may be possible to go beyond the standard of care and get the patient into a disease-free state. With this approach, he believes, dermatology in particular, is up for a profound change.

Hudson is looking toward a personalized medicine future – providing treatment for every stage of a patient’s journey and precisely targeting specific patient populations.

I was very happy to see that Sanofi’s “All-In-on-AI” strategy continues, and the company is deploying very concrete solutions used by thousands of its employees. In addition to drug discovery and development AI and AI for personalized medicine to maximize the probability of success, Sanofi has developed a variety of AI tools for business and operations.

PowerPoint Slides Are a Disease of Big Pharma

Mr. Hudson explained that when group leaders report their results in PowerPoint slide format, they tend to sugarcoat the current state of affairs and make poor predictions. He also explained the term “Snackable AI” – providing a bit of AI for many people across the organization for real-time decision-making and reporting. Much of real-time reporting is now done in the form of reels – Instagram-style actionable notifications. Unlike people who can sugarcoat poor performance to avoid change, AI does not have a career at risk. And AI does not care if you like it or not. Snackable AI provides radical data transparency and immediate and trustworthy feedback without hesitation or sugarcoating.

He also explained that when the data does not look great or puts the manager in an uncomfortable state, the managers will be working hard not to give you the data. He provided examples where he was continuously told that the results were not ready yet, so he requested the raw data to be uploaded into the large language model(LLM)-based system and it was analyzed and interpreted in hours.

When he joined the company in 2019, the financial analysis report alone consisted of thousands of slides. Today, it is in the range of 30 slides and is delivered using AI. Humans get to analyze and present the cases that fall outside the model.

He also provided several examples where AI was used to solve supply chain problems and field deployment problems in near real-time. For example, there was a case where the reports of leaking syringes could have stopped the supply chain, as humans would have automatically assumed that the problem was with syringe manufacturing. However, the AI system, in near real-time, identified that there was no problem with the manufacturing. Instead, the nurses were not trained to properly use the syringes and wait for a clicking sound before injecting.

He concluded with a very positive outlook on China from both the market and R&D perspective. While some global pharmaceutical giants have shrunk their R&D sites in China even before the pandemic, Sanofi has expanded and set up a drug discovery site in Suzhou, which is located about thirty minutes by train from Shanghai. Most other companies have a very light touch on local internal R&D and predominantly use their research capabilities to scout for in-licensing opportunities, but a brief interaction with that center-left a feeling of a “Tesla Gigafactory.” The team is really focused on delivering its own novel therapeutics as fast as humanly possible.

In brief, Sanofi is in a period of radical transformation where it will invest heavily in research and development, both internal and external, focusing predominantly on immunology, deploying AI everywhere, and making its reporting leaner and fast-paced. It clearly wants to dominate the pharmaceutical industry for decades to come, even if it means investing more in the short term. It also wants to tap deeper into China, invest in local R&D, and increase its market share.

Read the full article here