Seismic shifts within the healthcare market have pushed the pharmaceutical industry toward some painful transitions in recent years. It’s evident the traditional commercial model has been upended permanently. Next year, expect economic pressures, sweeping industry-wide changes in competition and market expectations as well as tightening of the global regulatory environment, to intensify.

Addressing these challenges requires an urgent pivot to a new market-driven model–but as history continues to remind us, that is much easier said than done. Our recently released Numerof & Associates 2024 Global Pharma Outlook highlights some of the key areas where pharma companies will continue to face great challenges as they fundamentally rethink old assumptions about their current business model.

One major challenge is the increased consolidation in healthcare delivery. Of the more than 6,000 U.S. hospitals, only 1,500 operate independently today. An uptick in mergers and acquisitions (M&A) has created fewer but larger, more complex and powerful healthcare systems, shifting the power dynamics of drug purchase decision-making.

Physicians who once drove those decisions are now just one voice in the room. C-suite executives and population-based decision-makers (PBDMs), who sit on cross-functional committees within massive integrated delivery networks (IDNs), now hold the clout. This has necessitated a new approach to managing large enterprise accounts.

As I explained in a recent column, our 2023 Commercial Model Report survey found that commercial leaders are building more experienced account teams led by National Account Managers, Key Account Managers or Strategic Account Directors. These leaders and the teams they orchestrate increasingly bring advanced skill sets required to engage IDN administrators and answer a range of pointed questions–from pricing considerations to reimbursement assurances to demonstrating a product’s value relative to competitors and articulating the evidence of improved clinical outcomes over current standard of care. This new approach to strategic account management is still very much a work-in-progress, as organizations struggle to align internally on an optimal approach. As one respondent told us, “it feels radical, though far from smooth as it’s turning the whole organization upside down.”

Increased hospital consolidation has prompted other changes at the customer level. Not only does the customer look far different than just 5 short years ago, but the means by which manufacturers engage their customers has also shifted. When Covid-19 hospital lockdowns forced sales teams to communicate via Zoom calls and email, many executives thought it would be a temporary setback. However, even as hospital access has largely resumed, continued staffing shortages and increased workload demands have placed a premium on physicians’ time. Diminished access, in turn, has forced manufacturers to rethink their customer engagement approach.

While in-person meetings will still be important in certain instances, virtual engagement is here to stay. Our Commercial Model report found that in most organizations, 50-70% of customer engagement now occurs virtually. While this has given rise to omnichannel and other novel forms of engagement, including enhanced digital marketing and data analytics capabilities, customer engagement remains difficult. According to one survey respondent, “the effectiveness of digital continues to be a moving target. We are not confident that we are really reaching the targets we need to reach effectively with this format.”

As manufacturers think strategically about how they manage large enterprise accounts and engage with customers, operational complacency has also been shattered by increased regulation.

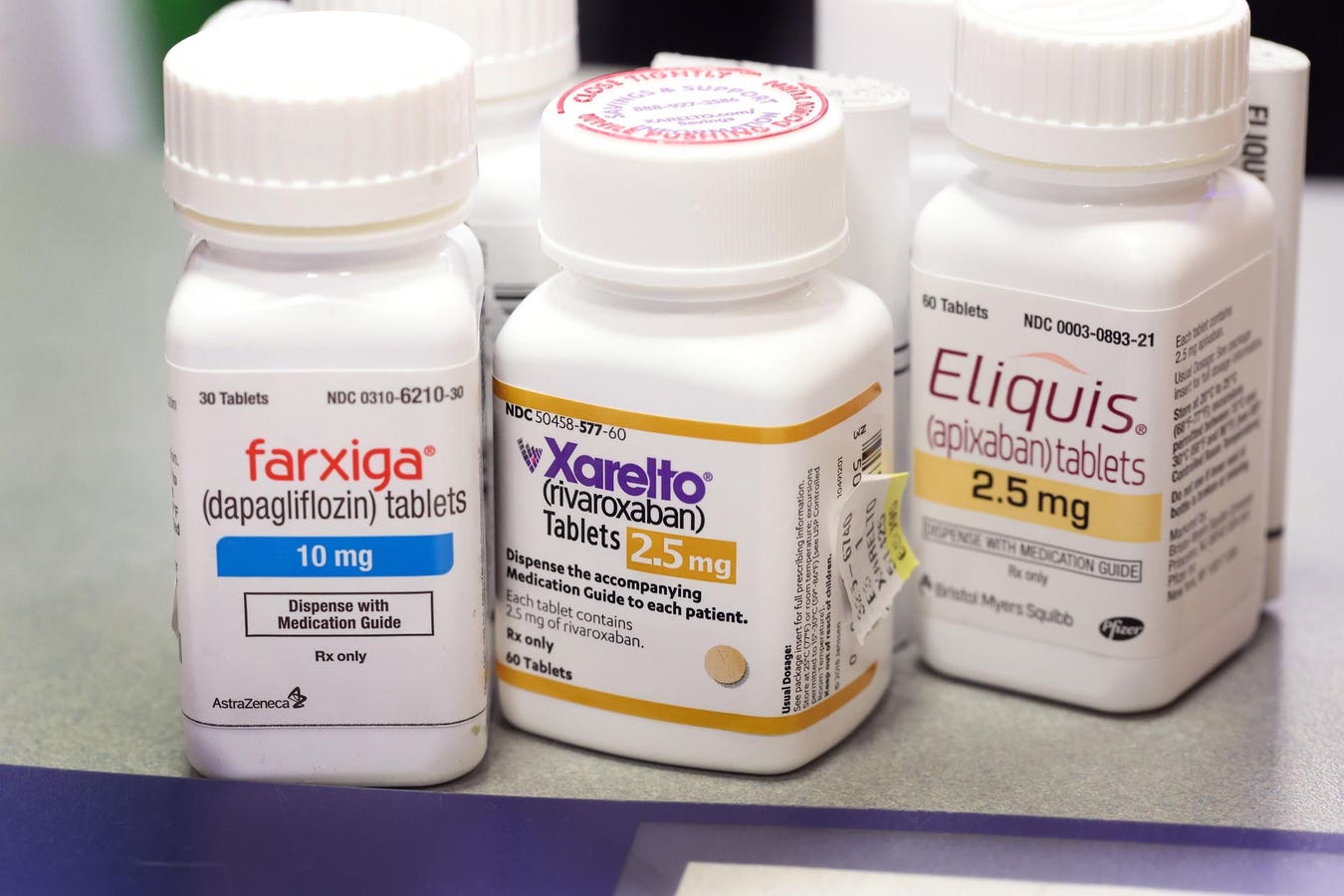

In my last column, I discussed how price regulations in the Inflation Reduction Act (IRA) in the U.S., coupled with sweeping regulatory industry reforms across Europe, have forced manufacturers to re-examine core assumptions about their approach to research and development (R&D), portfolio pricing, market access, budgets and underlying costs. With respect to the IRA, companies are waking up to a hard, new reality–that it will have broad, downstream impacts on their portfolios. “While our product will likely not be subject to the IRA in the near term, it will catch up very soon in the negotiation process,” warned one survey respondent. And, while pharma companies have filed court challenges to the IRA, the fallout from the law is already underway. And the industry must brace for further pushback from lawmakers, regulators, and other stakeholders who, emboldened by the IRA victory, continue to try to rein in big pharma.

For years, the influence of an array of healthcare delivery stakeholders has been growing. As I explained in my book, Bringing Value to Healthcare, payers’ power has increased as drug purchase decision-making moves further away from physicians. Payers and providers are holding the line on healthcare costs by saying no to new products and price increases. They are also demanding that manufacturers demonstrate hard economic and clinical data to justify any changes to bottom line impact. In the year ahead, pushback on drug prices will continue to intensify from payers, pharmacy benefit managers (PBMs) and especially consumers, who are shouldering more of the cost burden as health insurance premiums continue to skyrocket.

The pharmaceutical landscape is more volatile than ever before, as regulatory requirements increase the cost and time required to develop new products, payers globally clamp down on new products, physician clout diminishes, and public distrust of the industry and government scrutiny reaches new highs. Collectively, these factors will have significant implications for commercial strategy going forward.

Manufacturers must think in new ways about all three pillars of commercialization– product development, getting those products reimbursed at a price that is profitable, and market adoption. As one commercial leader in our survey rightly said: “mastering these pillars is key to success,“ adding “the market demands scientific proof of value, and we need to engage the large, organized customers strategically and in a more sophisticated fashion to be successful.”

But just as we did not get to this perilous juncture overnight, pivoting to a new model continues to be a slow and bumpy journey. As our survey revealed, one of the biggest hurdles for executives is often demonstrating to their own senior leadership the impact of their new commercial approaches and making the case for why they should continue to build on the changes already in progress.

The old commercial model is rapidly becoming obsolete. For an industry that continues to recover from long standing self-inflicted wounds, and could not capitalize on their historic achievements during the pandemic with Operation Warp Speed (OWS), failure to transition to a new strategic and integrated approach, will continue to have devastating consequences.

Read the full article here