Nic Brathwaite, Founding Managing Partner of Celesta Capital, is bullish on the worldwide semiconductor industry. “Great technical innovations are built on semiconductors,” Brathwaite explained during an interview. Somewhat modestly, he says that there has not been enough VC money going after hardware startups, so Celesta had the “pick of the litter.” Brathwaite explained that Celesta has three investment themes:

- Technology platforms that enable mass technology proliferation. There are many emerging applications that fall under this theme including AI (artificial intelligence), IoT (Internet of Things), and technologies that transform existing industries such as construction, education, and agriculture.

- Technologies that transform and upgrade existing technology platforms.

- Technologies that sit at the intersection of high-tech and biotech, which Brathwaite calls “bioconvergence.” Medical diagnostics are an example of this type of convergence.

Unsurprisingly, Brathwaite says that he and his partners are big fans of the U.S. CHIPS and Science Act. “Semiconductors are increasingly critical to the global economy,” he says, “and it makes sense for governments to pay attention.” Although semiconductors may not represent a large part of a country’s GDP (gross domestic product), the percentage of a country’s GDP enabled by semiconductors is huge and growing.

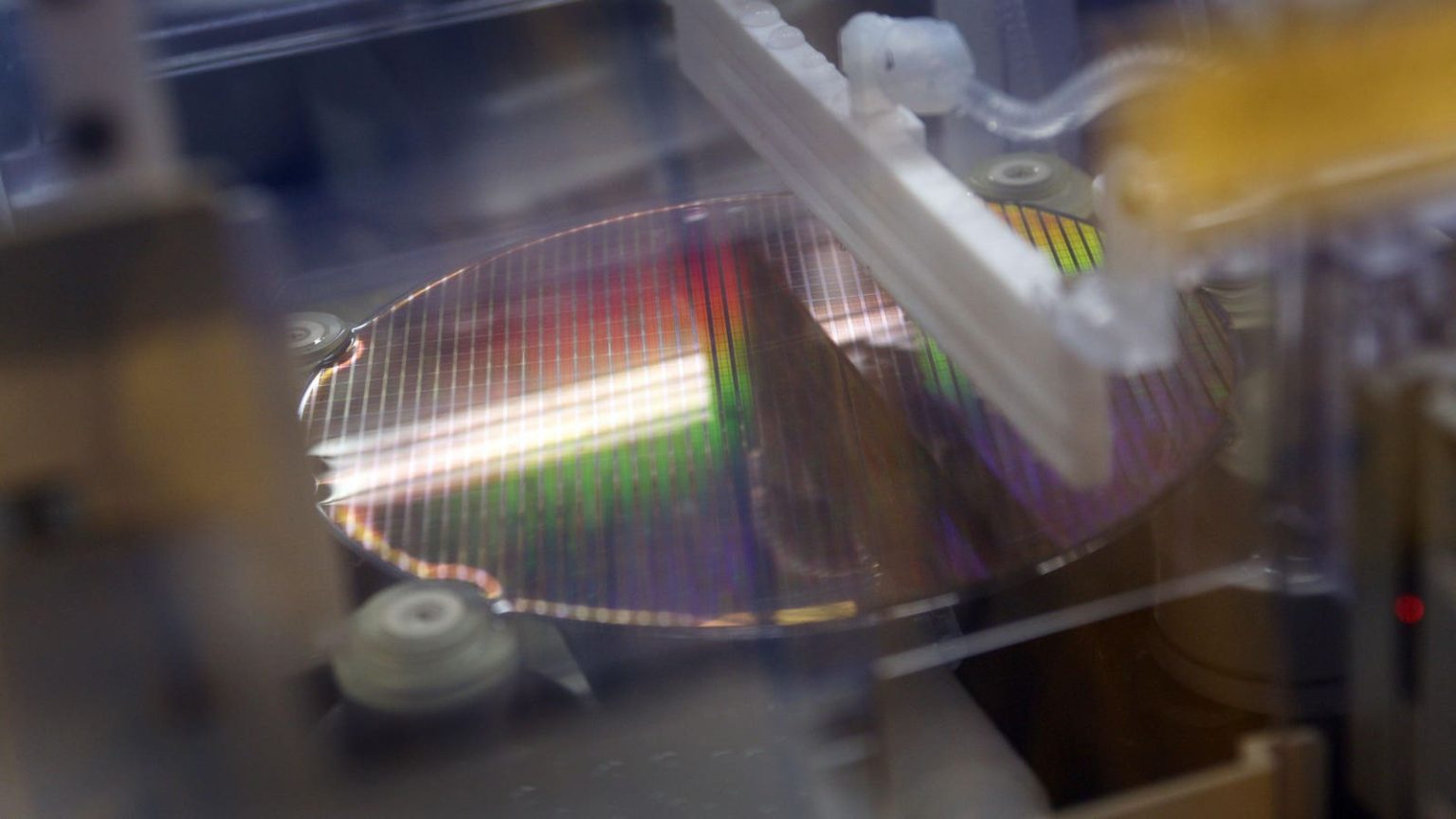

While semiconductors have become ubiquitous in all sectors of the economy (industry, business, agriculture, medical, consumer, military, aerospace, and government), the supply chain has consolidated into fewer and fewer semiconductor manufacturers and OSATs (outsourced semiconductor assembly and test vendors). Brathwaite says this consolidation creates a huge global risk in terms of vulnerability. The failure or elimination of just one semiconductor maker or OSAT puts the entire semiconductor ecosystem at risk.

Brathwaite’s bullish position on hardware and semiconductors is not surprising. His first job in the 1980s was as a semiconductor process engineer at Intel. After Intel, he co-foundeId nChip, became its VP of Operations and Technology Development, and worked on the development of an advanced, multi-chip module assembly process. A little over five years later, Flextronics acquired nChip and Brathwaite became the company’s CTO, where he helped transform the contract manufacturer into Flex, an EMS (electronic manufacturing services) and product development powerhouse. Unusual among VCs (venture capitalists), Brathwaite knows the semiconductor and electronics industry from deep inside the machine.

After 12 years at Flex, Brathwaite founded Riverwood Capital in 2008 and became a VC. His first three investments at Riverwood were Aptina, Ambarella, and GoPro. DRAM maker Micron Technology launched Aptina in 2008 to make CMOS imagers based on technology developed at Micron. Ambarella was founded in 2004 and develops video-compression and image-processing SoCs (Systems on Chips). GoPro, founded in 2002, is the famous maker of compact, digital action cameras that, unsurprisingly, incorporate image sensors from Aptina and imaging processors from Ambarella. Aptina was later acquired by On Semi, which continues to make CMOS image sensors. Ambarella continues to make video- and image-processing SoCs, and GoPro continues to hold the lead in the action camera market that it created. All three companies were and are very successful.

Brathwaite left Riverwood in 2013 because the company’s attention had veered towards today’s most popular startup investment targets: software and Internet startups. He founded a new VC firm, Celesta Capital, along with Michael Marks (also from Riverwood and Flex), Sriram Viswanathan (also with an Intel background), and Lip-Bu Tan (founder of Walden Capital and former CEO of Cadence Design Systems). Celesta continues Brathwaite’s preferential focus on investing in early-stage, deep-tech startups. He prefers hardware startups, which is no surprise given his pre-VC background, and he’s clearly been successful investing in hardware companies. By the end of 2013, Celesta had invested in thirteen semiconductor startups. Celesta’s semiconductor investments now include:

- Alif Semiconductor – secure, low-power, high-performance edge processors

- Altair – LTE chip sets, acquired by Sony

- Annapurna Labs – hypervisor and network stack acceleration hardware, acquired by Amazon

- Aquantia – high-speed Ethernet physical-layer chips, acquired by Marvell

- Aurasemi – IoT radio chips,

- CNEXLabs – NVME and Open-Channel solid-state disk controller chips

- Credo – high-speed SerDes transceivers

- Dust Photonics – high-speed optical transceivers

- Eliyan – chiplet technology

- EtherWhere – GPS chips

- Fungible – data-processing units for disaggregated data center storage

- Habana Labs – artificial intelligence (AI) processors, acquired by Intel

- HiDeep – touch interface chips, IPO

- Ineda – low-power automotive and IoT processors, acquired by Intel

- Innovium – Ethernet switch chips for data centers, acquired by Marvell

- Lion Semiconductor – battery-management chips

- Nebulon – hybrid, cloud-defined data storage

- Netspeed Systems – network on chip (NoC technology, acquired by Intel

- Nuvia – Arm-based CPU cores, acquired by Qualcomm

- ProteanTecs – fault-prediction semiconductor IP

- Quantenna – high-performance WiFi chips, acquired by ON Semi

- RF Pixels – beamforming IP for 5G, acquired by Skyworks

- Recogni – AI-based vision systems for automotive applications

- SambaNova Systems – generative AI platforms

- Stathera – micro electro-mechanical (MEMS) timing chips

- Talgore Technology – GaN (gallium nitride) semiconductors

- VeriSilicon – system on chip (SoC) design services and IP, IPO

Note that Celesta has exited from several of these investments through IPOs and/or acquisitions.

During his interview, Brathwaite observed that the U.S. still leads in semiconductor innovation, on the design side, but not in manufacturing. “Fabless semiconductor companies don’t innovate on the process side,” he elaborated. From Brathwaite’s perspective, if the U.S. lacks sufficient semiconductor manufacturing capacity, it risks losing its device leadership.

Although the U.S. CHIPS and Science Act emphasizes the importance of semiconductors to national security and reduces the risk of losing more U.S. semiconductor manufacturing capacity by providing government subsidies, Brathwaite believes the U.S. government can be even more innovative when it comes to supporting domestic semiconductor manufacturing. For one thing, says Brathwaite, the U.S. government could take queues from the VC community and provide non-diluting, side-by-side funding with VCs. Perhaps this opinion is not especially surprising, coming from a VC. However, Brathwaite goes further by noting that several countries, including Canada and China, have sovereign funds that directly invest in companies. Six of these funds (Singapore, China, United Arab Emirates, France, Norway, and Saudi Arabia) have assets of a trillion dollars or more. The U.S. has no such fund, he says. Although eleven U.S. states do have sovereign funds, they’re all much smaller than the funds backed by countries.

Brathwaite sees U.S. investment in domestic semiconductor manufacturing as a natural because it would create many high-paying jobs in the U.S. and therefore represents a solid investment for the future. As a VC who specializes in semiconductor startups, Celesta’s investments clearly align with Brathwaite’s bullish opinions about the U.S. CHIPS and Science Act.

Tirias Research strongly agrees with Brathwaite. If semiconductors are a strategic asset, which would seem self-evident given their pervasiveness throughout all sectors of the economy, then the U.S. government needs to help ensure that the country retains that asset. Letting Adam Smith’s invisible hand manage this asset by default like a commercial commodity has predictably resulted in a mass migration of semiconductor manufacturing to other parts of the world. The U.S. CHIPS and Science Act represents a single shot in the arm for the industry, albeit a big shot. Very likely, this one shot will not suffice to maintain U.S. semiconductor leadership. Regular consultations with experts in the VC community such as Brathwaite and semiconductor company CEOs such as Intel’s Pat Gelsinger, AMD’s Lisa Su, and Nvidia’s Jensen Huang constitute a unique and valuable knowledge resource that could provide the U.S. government with far more insight into the complicated ecosystem that the global semiconductor industry has become, and possibly drive better strategic investment decisions going forward.

Read the full article here