Who said apparel retailing was tough? Fresh updates from three of the biggest names in U.S. fashion made it look positively easy and pointed to a good start to the year as Abercrombie, American Eagle and Lululemon all reported business updates.

Abercrombie & Fitch

ANF

The apparel retailer said during a business update for fourth quarter and full year fiscal 2023 that it now expects sales for the quarter to rise in the “high-teens” percentage range from the year prior quarter, compared with previous guidance of “low double-digits” growth. For the full year, it expects sales growth of 14% to 15%, above its previous guidance of 12% to 14%.

Abercrombie also raised its operating margin guidance for the fourth quarter to around 15%, up from its previous outlook of 12% to 14%. It increased the full-year outlook to around 11% from 10%.

Shareholders got an early morning boost as Abercrombie’s stock rose circa 5% on early trading, making an incredible circa 256% rise year-on-year as the company’s strategy continues to deliver.

Apparel Strategies Working

“Consistent with the first three quarters of 2023, our customers responded positively to compelling product assortments and engaging marketing leading us to increase our fourth quarter and full year net sales and operating margin outlook,” said Abercrombie CEO Fran Horowitz.

“We believe our increased full year fiscal 2023 expectations will put us ahead of schedule on our Always Forward Plan 2025 financial targets. Importantly, we expect to exit fiscal 2023 poised for sustainable, profitable sales growth fueled by several years of transformational investments in our brands, people and operating model.”

The retailer said that each of its brands continued to deliver solid sales growth led by Abercrombie brands. The Abercrombie & Fitch women’s business is expected to achieve its highest-ever fourth quarter sales, complemented by an acceleration in men’s growth.

“At Hollister brands, we expect to deliver year-over-year fourth quarter sales growth led by the women’s business. Continuing a trend of profitable growth, we expect Hollister brands will also achieve significant fourth quarter gross profit rate expansion, enabled by improved product and inventory management,” Horowitz added.

She insisted that the results showed that “our playbook is working, giving customers compelling reasons to engage, shop and stay with our family of brands”.

The company expects its increased full year fiscal 2023 expectations will put us ahead of schedule on its ‘Always Forward Plan 2025’ financial targets and to exit fiscal 2023 “poised for sustainable, profitable sales growth fuelled by several years of transformational investments in our brands, people and operating model.”

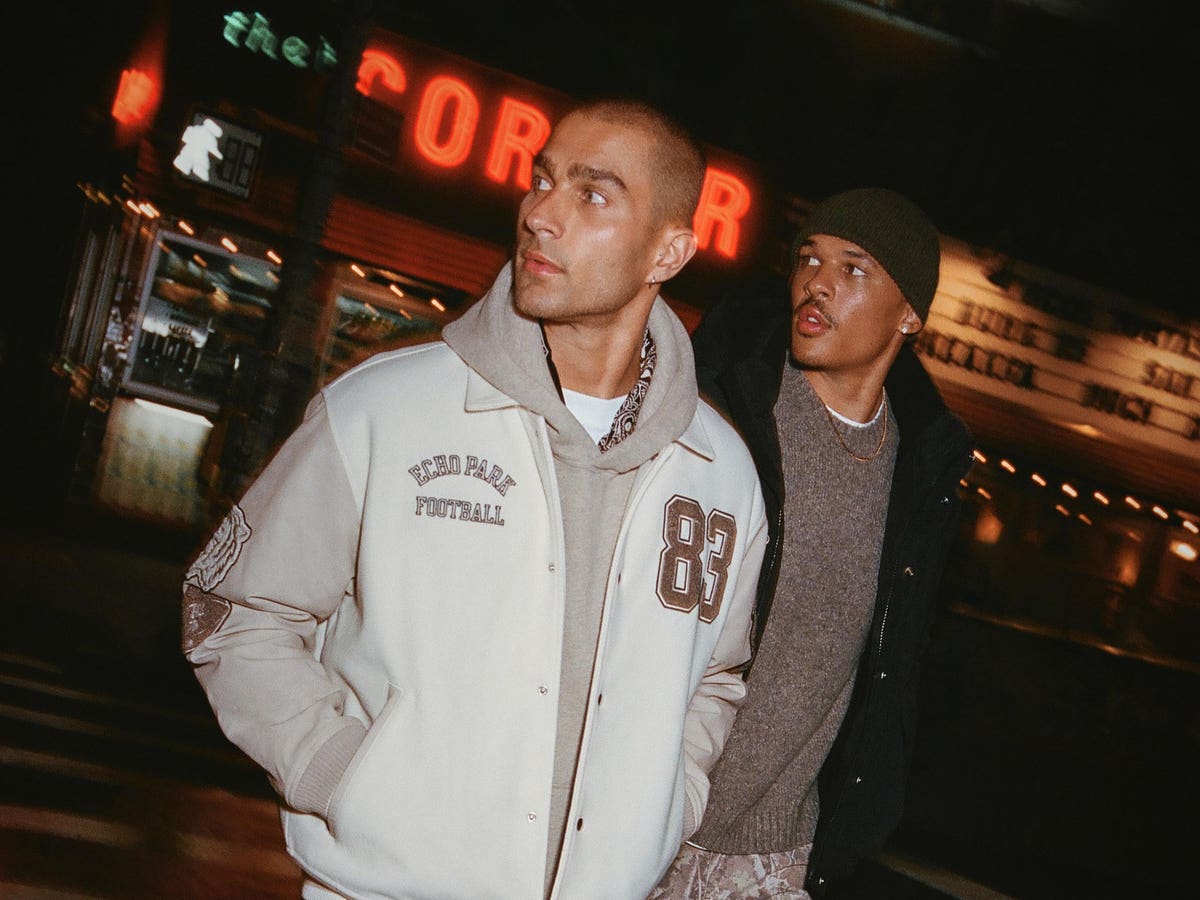

Abercrombie’s stock soared during 2023 as the company, which built its original empire on branded t-shirts and became famous, or perhaps infamous, for its ‘beautiful people’ models.

In the years since Horowitz took over as the brand’s CEO, Abercrombie has transformed its merchandise with a product assortment that has resonated with consumers and has borne fruit over the past 12 months.

American Eagle, Lululemon

Meanwhile, American Eagle said quarter-to-date revenue was up by about 8% as of Dec. 30, with its namesake brand’s sales increasing by high single-digits and Aerie increasing by low teens. It said it expects both revenue and operating profit to be better than expected for the fiscal fourth-quarter.

The company said fiscal fourth-quarter revenue will be up low double digits and operating profit is expected to be about $130 million, a healthy jump on previous guidance of $105 million to $115 million.

Lululemon’s fourth-quarter forecast lead the athleisure retailer to predict net revenue to be in the range of $3.17 billion to $3.19 billion for the fourth quarter, just a tick up on an anticipated a range of $3.135 billion to $3.17 billion.

Abercrombie & Fitch Co. operates approximately 760 stores across its eponymous brand and Hollister brands through North America, Europe, Asia and the Middle East.

Reflecting its new found cool, Abercrombie & Fitch also opened a new store on London’s trendy Carnaby Street just before Christmas.

Read the full article here