U.K. heavyweight retailers Marks & Spencer and Next have made early expressions of interest for vegan beauty chain The Body Shop for a potential rescue bid as administrators prepare to launch an auction.

FRP Advisory announced last week that The Body Shop would be put up for sale for the second time within a year after its initial plans for a so-called company voluntary arrangement – broadly the U.K. equivalent of Chapter 11 – fell through.

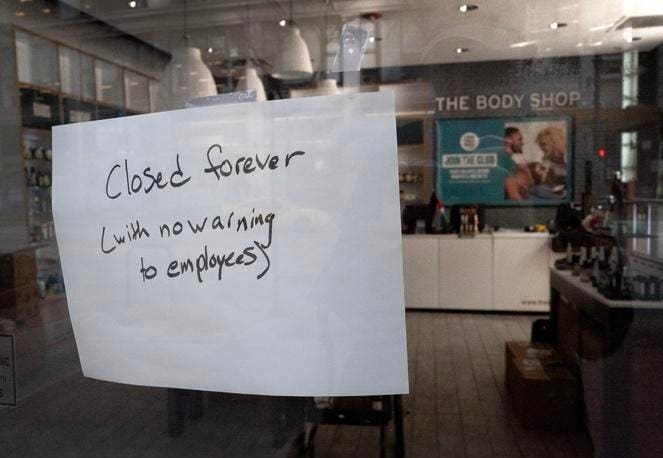

The Body Shop’s administrators decided to launch an auction of the chain after deciding that an alternative restructuring was not viable despite the store closure and redundancy program undertaken in recent weeks, which has roughly halved the U.K. store estate for 198 stores to around 100 stores.

That had prompted senior politicians in the U.K. to call for a review of how the retailer ended up in a tailspin and why there were job losses and store closures despite its British arm being profitable.

In March, The Body Shop fell into administration in the U.S. and Canada and shuttered operations.

Private equity firm Aurelius, which placed The Body Shop into administration within months of acquiring it late last year, is also understood to be preparing a bid to regain ownership of the business, according to a report in The Times.

FRP wrote to creditors last week to say that it had been “encouraged” by the early interest shown in the retailer, with the administrators receiving expressions of interest from over 70 potential bidders, However, it is likely that many of these will be eliminated as they are not considered suitable buyers.

Bidders Consider Offers

Once the bids have been evaluated, FRP expects to conclude a sale of the business during the summer and the latest decision comes after a hugely challenging year for The Body Shop, still known for its visionary late founder Anita Roddick.

Last year, Brazilian beauty group Natura & Co sold the high street chain to Aurelius in a deal that valued it at just shy of $260 million. However, it emerged last month that the private equity company had only paid circa $4.5 million upfront for the chain.

According to a report in The Telegraph, European private equity business Aurelius handed over the very small cash down payment to the retailer’s former owner, with the shortfall expected to come largely from a $115 million performance-related payment that the firm was set to pay over the next five years subject to certain conditions.

However, this now looks highly unlikely to be executed given that the retail chain was placed into administration in February.

Unsurprisingly, The Body Shop’s collapse has therefore raised questions over just how much Brazilian beauty giant Natura can actually expect to receive for the retailer beyond the $4.5 million it was initially paid.

Cut Price Deal

It had already looked like a cut price deal from Natura &Co, which acquired the retail chain from L’Oréal in 2017 for $1.04 billion and had appointed Morgan Stanley

Morgan Stanley

It was understood to have valued the business at $492 million, which proved significantly more than it actually achieved for the company. The decision to offload The Body Shop came after Natura sold its Aesop business to L’Oreal for $2.4 billion in April of last year, as it affirmed that it was “focusing on strategic priorities.”

The Body Shop, which is headquartered in London and employed around 7,000 staff before the acquisition, had operations in 89 markets with over 900 company-owned stores in 20 countries and partnerships with head franchisees which operated circa 1,600 franchised stores in a further 69 geographies.

It has already slimmed or closed operations in a number of markets as part of the reorganization of the business.

Read the full article here