- Temu may have better deals than Amazon during Prime Day.

- Amazon excludes Temu from its price-comparison algorithm, Reuters reported.

- Consumer user data indicates that Temu could be a serious threat to Amazon’s mobile app traffic.

Prime Day shoppers may find lower prices on Temu. Amazon, for its part, isn’t even trying to compete on prices with the e-commerce site that’s quickly becoming the internet’s dollar store.

As Reuters first reported, Amazon has excluded the ultra-cheap e-commerce marketplace from its price-comparison algorithm, which helps Amazon keep tabs on competitors’ prices. Amazon told the news site that Temu does not meet its fair pricing standards, which ensure it does not compare prices against products that risk being counterfeit.

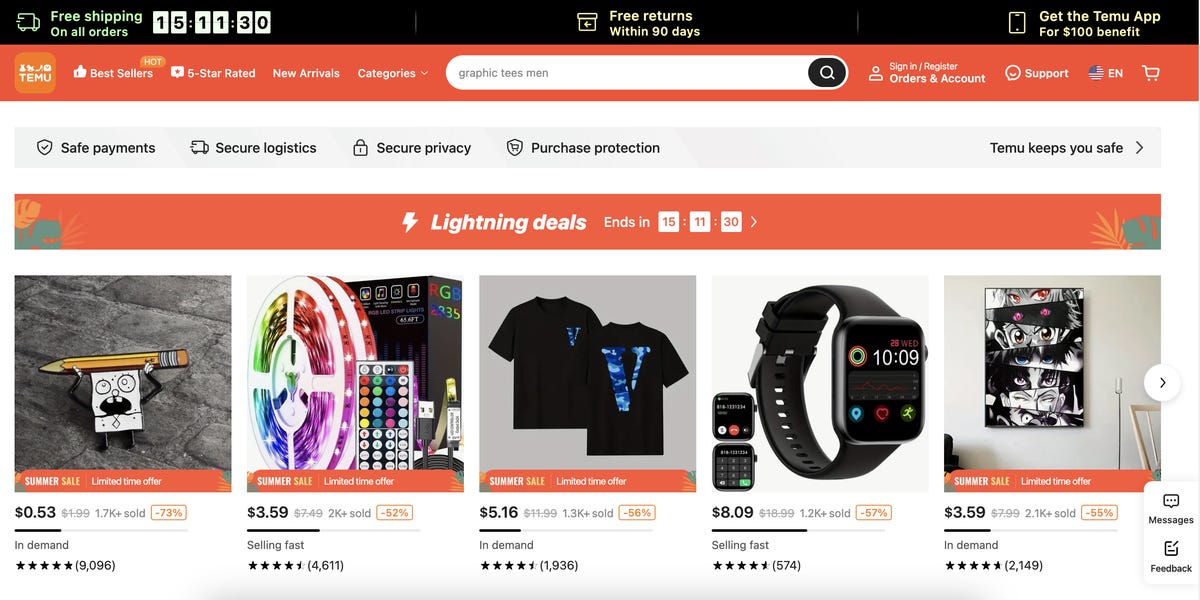

On Temu, it seems like every day is “Prime Day.” The online retailer, owned by Chinese company PDD Holdings, offers daily flash sales and lists many products for as low as $2. The shopping app stocks several categories, from electronics to home goods, making it a serious competitor to Amazon.

Temu has been criticized for its questionable prices and third-party listings. While the site has been known to sell counterfeit and knockoff goods, in some cases, Temu sellers have copied product photos, descriptions, and keywords directly from original Amazon listings, a recent Wired article found.

Temu has skyrocketed in popularity since it first launched in the US in September 2022. It’s the most downloaded iOS app, Bloomberg reported.

In January, Temu’s gross merchandise value reached nearly $200 million, according to Insider Intelligence data. Though that pales in comparison to the $12 billion in GVM that Bank of America estimated Amazon will hit from Prime Day alone.

Temu added nearly 10 million new daily users this year and now has about 16.5 million users, Intelligence firm GWS found. The firm also saw a decline in Amazon’s daily app from 54 million to 46 million users daily. Amazon disputes these findings. That said the company still boasts double the number of daily users than its nearest competitor, Walmart.

One significant way that Amazon competes is by tracking its rivals’ prices, like Walmart, through its price-matching algorithm.

The company’s “competitive monitoring tool,” described by Jason Del Rey in his book “Winner Sells All,” tracks prices across the internet and then determines when to match or beat another site’s prices. Keeping Temu out of its price-matching technology could mean merchandise on Temu would undercut prices offered by Amazon’s marketplace sellers.

“Retail prices fluctuate all the time, and our prices change based on us meeting the lowest competitive price from other retailers,” an Amazon spokesperson told Insider. “We know our customers worldwide are looking for savings now more than ever, and we are doing the hard work for them – finding the best prices out there and matching them for all customers every day.”

“For years, Amazon has gone all but unchallenged when it comes to offering the complete ecommerce package to consumers, and much of its success has been via its mobile app,” Paul Carter, chief executive at GWS stated in an email. “Brand loyalty on retail shopping apps moves quickly during challenging economic times, and retailers need to stay on top of the curve or risk getting left behind.”

Temu did not immediately respond to Insider’s request for comment.

Read the full article here