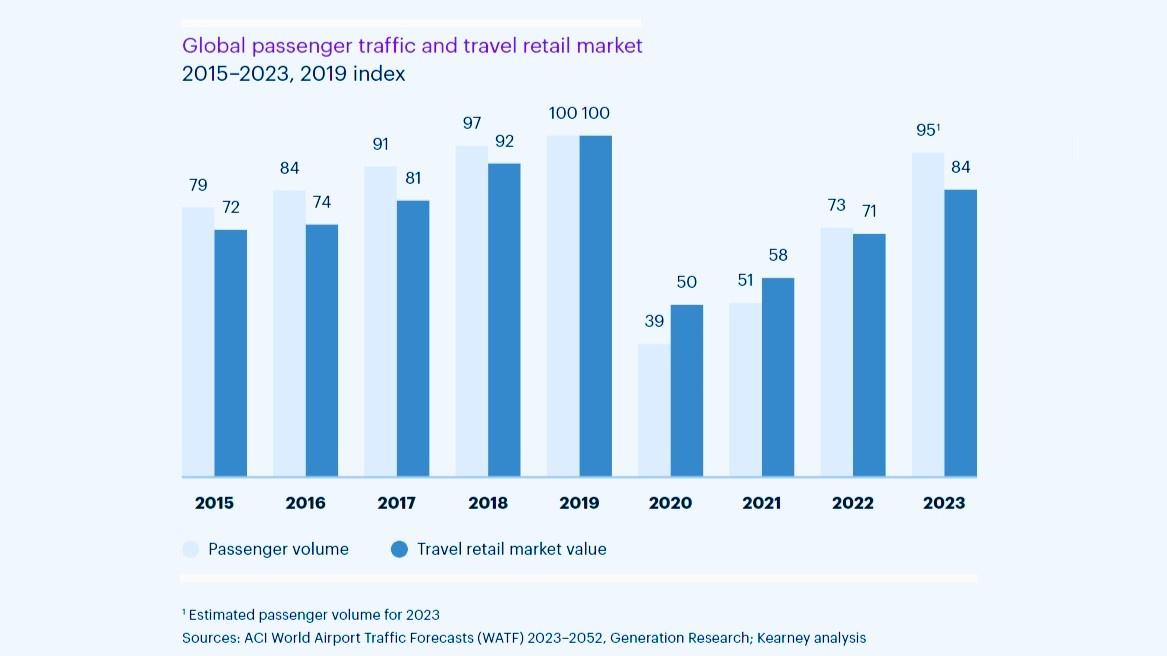

In its glory years, the travel retail channel had it easy: annual passenger traffic grew steadily lifting retail sales at the same, if not higher, growth rates. Domestic retailers looked on in envy. However, in a post-Covid world, this correlation has disappeared.

At last week’s Tax Free World Association ((TFWA) exhibition in Cannes, France—where the movers and shakers in the duty-free world gather annually—a new report shattered a few industry illusions.

One of them is that China would be a continuous source of high-spending travelers. Post-Covid, this has proved not to be the case despite their numbers rapidly returning to key markets like South Korea. There are several other factors constraining sales.

A new report from Kearney, commissioned by TFWA, shows that last year, passenger volumes grew by 30%, easily outstripping travel retail sales which rose by only 18% (see chart above). According to the global management consulting firm, the retail rise resulted in a global market valued at $72 billion, but last year’s numbers also “broke the mirroring between the two trends (of traffic and sales) for the first time in the industry’s history.”

As well as the Chinese spending less, which has hit the Hainan market severely, Kearney says that travel retail’s price advantage is facing long-term erosion. “While enthusiasm for shopping in airports remains strong, behavioral patterns and expectations across generations of customers are evolving under new pressures,” the firm stated.

Mixed messages on travel retail pricing

Data from m1nd-set, a dedicated travel retail consultancy, indicate an attitudinal evolution from 2019 to 2024 with prices no longer top-of-mind for passengers. Over this period, m1nd-set’s traveling consumer surveys show that the relevance of pricing advantage dropped significantly from 30% to just 13%. The same surveys—using a panel of more than 230,000 shoppers—point to promotions and value-for-money also decreasing in importance over the same period.

It seems strange that price could become so insignificant that quickly given the cost-of-living crises seen around the world in recent years. In July, the IMF left its 2025 growth forecast unchanged at 3.3%, broadly in line with 2024 and last year.

In airports, price competition remains evident. Another travel retail research agency, Pi Insight, ran a price comparison of the gin brand, Bombay Sapphire. Across 14 airports, it found large price variations of between +23% at Istanbul Airport and -29% at London Heathrow using Frankfurt Airport as the index (0%).

Gebr. Heinemann, a retail operator at both Istanbul and Frankfurt airports, told me: “The price varies across airports as Bombay Sapphire is a global bestseller which is regularly available in promotional offers.”

According to Kearney, price is still a “crucial concern” for consumers, especially given ongoing inflationary pressures. In its own survey of 3,700 customers across 10 countries, 30% of respondents cited price as a barrier to purchase and 27% are using price-comparison tools to see if ‘deals’ are real or not.

As well as challenging price, 29% of respondents cited unsatisfying assortments as a reason not to purchase. The firm’s report finds that spending by passengers has been steadily decreasing with average spending in 2023 down to $16 per passenger which is below pre-Covid levels. Between 2009 and 2018 the average was $17.50.

Experiences and tech, please step forward

Importantly, younger travelers—Millennials and Gen Zs—prioritize unusual experiences over competitive prices and are becoming the largest single demographic. These generations are not being sufficiently addressed by travel retailers according to Kearney which said that they “continue to place too much of an emphasis on discounted transactions to the detriment of storytelling, innovation, and personalized offers.”

The firm’s top solution for greater sales conversion is the rapid adoption of technology, more personalized offers, and collaborative partnerships across the relevant stakeholders in the airport ecosystem.

One of the authors, Vincent Barbat, a partner at Kearney, said: “The industry needs to move away from being price-centric to being more traveler-centric. The fact that revenues are no longer correlated with air passenger growth is further proof that new consumer dynamics resulting from a rapidly evolving travel retail landscape remain inadequately addressed.

“While technology alone will not guarantee blue skies and future prosperity for the industry, it does hold real promise. Some of its tools will allow for enhanced customer experiences and greater product personalization. The true challenge lies in striking the right balance between high-tech and high-touch, keeping the industry both efficient and human.”

There is consensus around tech: airports have been busy automating and digitalizing every step of the travel journey, for example at Abu Dhabi International. Speeding things up will give passengers more time to shop. More passengers are also tech enthusiasts; 45% say they frequently use in-store tools to enhance their shopping experience. This gives retailers an easy route to drive conversion using AR/VR and eventually AI-powered personal shoppers.

Read the full Kearney report on travel retail here.

Read the full article here