PublicSq. bills itself as a patriotic site for shoppers to buy from companies that support conservative values.

For the last decade, Michael Seifert has listened to right-wing shoppers grumble when large corporations take vocal political stances they don’t agree with. Their only recourse — to boycott — struck him as insufficient.

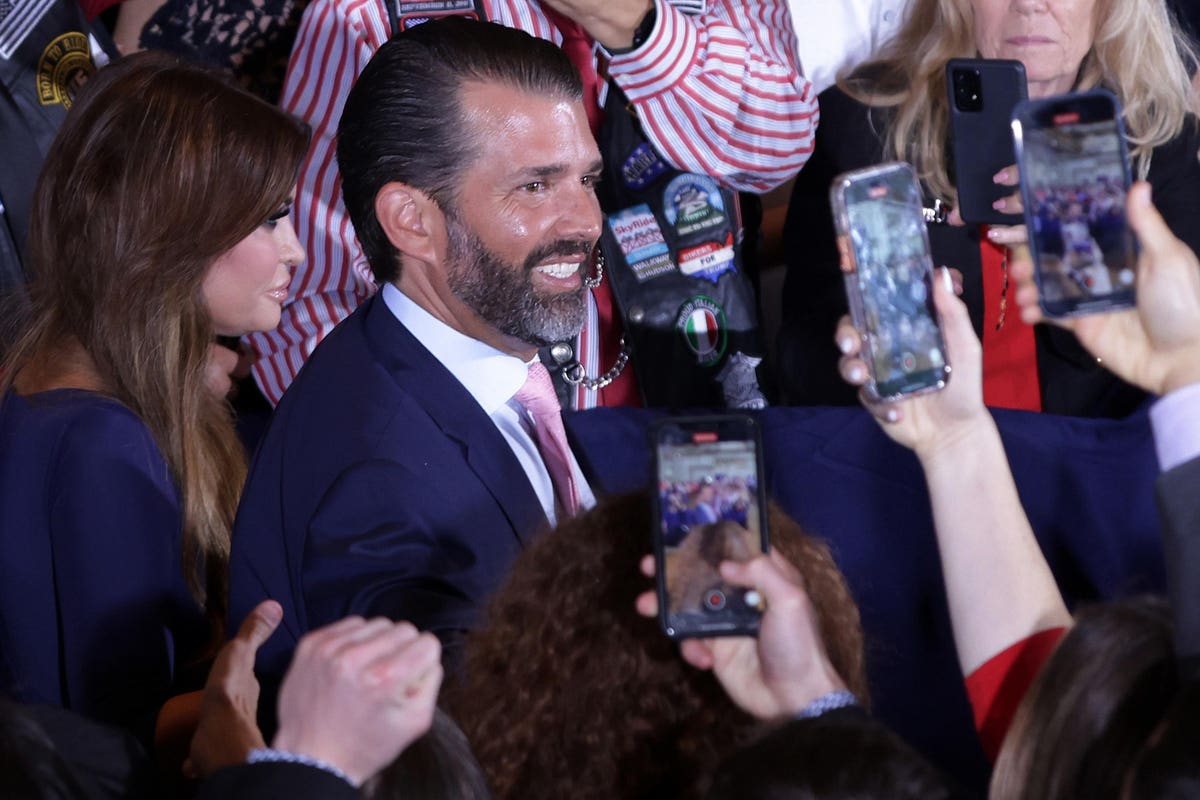

So in 2021, the former marketing director created PublicSq. to offer those shoppers an alternative. The online marketplace has raised over $20 million from investors including Donald Trump Jr., according to filings with the Securities and Exchange Commission. Since launching nationwide on July 4, 2022, it says it has attracted 50,000 conservative-minded businesses and 1.1 million people who have created accounts but not necessarily purchased anything. On Thursday, it began trading on the New York Stock Exchange via a special purpose acquisition vehicle.

“My wife and I just had enough,” Michael Seifert, founder and CEO of PublicSq., told Forbes. “We felt like no companies were talking to us anymore.”

PublicSq. is going public at a time when few companies are hitting the market and SPACs are all but dead. In the first three months of 2023, just ten companies went public via SPAC, raising about $738 million, according to Mayer Brown, a law firm that advises companies on financial transactions. In the same period last year, 55 companies went public via SPAC and raised $9 billion.

Seifert said he’s not concerned. He wants the company to be owned “by the people” and plans to put the proceeds to further developing and improving the site, launching its own products and marketing. He’s spent very little to advertise, but plans to ramp up those efforts. PublicSq. recently struck a $1 million deal with Tucker Carlson, who’ll run ads for the marketplace on his Twitter show. Axios was the first to report that agreement.

Redemption Requests

The PublicSq. transaction is being handled by blank-check company Colombier Acquisition Corp., started by Omeed Malik, a former managing director at Bank of America Merrill Lynch who’s also an investor in conservative news site The Daily Caller. The board includes Blake Masters, a former Republican candidate for U.S. Senate from Arizona, and Nick Ayers, who worked in the Trump White House and was chief of staff to former vice president Mike Pence.

The company hoped that the deal could help it raise as much as $158 million in proceeds. However, it stands to bring in about $35 million because of the high volume of redemption requests it received from investors interested in cashing out before the stock began trading.

On Thursday, shares had risen by over 100% during the first few hours of trading under the ticker symbol PSQH.

The retailer offers arguably the best glimpse at what a parallel economy might look like, where political and religious beliefs determine the brand of soap, pet food and eyeglasses that customers buy.

“We have an alternative to pretty much every brand you can think of,” Seifert said. “They’re going up against giants.”

‘All-American Dogs’

Participating retailers include Nimi Skincare, which describes itself as a company for women who value femininity, faith, family and freedom. Old Guard Pet Co. was started by an industry veteran who wanted to sell pet food to owners of “All-American dogs.” Zivah, a Christian eyewear company, sells glasses with a Bible verse engraved on the temple and has seen a 1,000% increase in visits to its website since joining PublicSq., according to cofounder Jim Schneider.

To join the site, businesses must say they’re pro-life, pro-family and pro-freedom and agree to a vetting process that includes scrutiny of their internet histories.

At its current stage, PublicSq. is just a directory. Shoppers must leave the site in order to make a purchase. That’s a hard way to make money, and explains why PublicSq. generated revenue of just $500,000 last year, cobbled together from brands who paid to advertise on the site. It racked up losses of $7 million in 2022 and another $6.7 million in the first quarter of this year, according to filings. That left it with $3 million in cash as of March 31.

By the holidays, the plan is for shoppers to be able to make purchases directly on PublicSq. with the company taking a cut on each transaction. PublicSq. is also beginning to launch its own brands, based on popular search queries. For instance, a significant number of people came to the site looking to buy diapers, but there weren’t any options. So last week, PublicSq. started its first company, a pro-life diaper brand called EveryLife.

The goal is to create an alternative to Amazon

AMZN

“There’s a hole in the market,” Seifert said. “People are tired of being lectured when they go to buy a cup of coffee.”

Read the full article here