- Goldman Sachs just reported its worst earnings in years, including a 58% drop in profit.

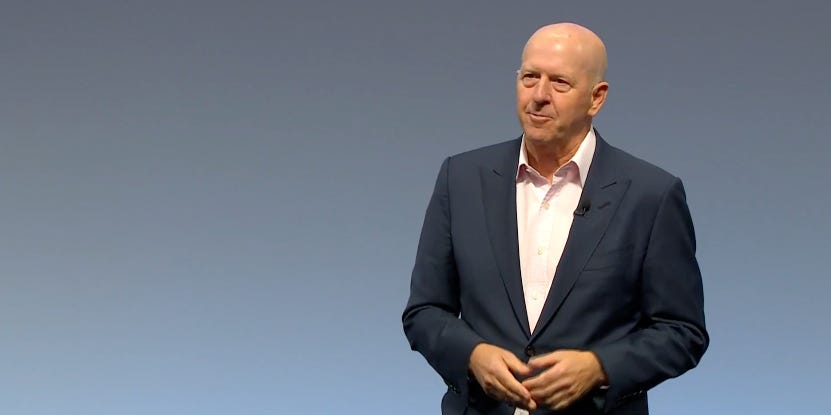

- David Solomon said it’s the result of the bank’s “journey” toward more diversified and stable revenue streams.

- These five numbers, from ROE to its equity underwriting revenues, shed light on the state of Goldman.

Wall Street earnings season has been challenging across the board, but perhaps none have had it as tough as Goldman Sachs.

The bank reported significantly lower profit, down 58% to $1.2 billion, as it shifts away from its ill-fated move into consumer banking amid an industry-wide slump in M&A and IPOs. Goldman reported earnings per share (EPS) of $3.08, below the $3.16 per share that some analysts expected.

Though peers like Morgan Stanley and Citigroup also suffered profit declines, Goldman’s was the steepest. Meanwhile, competitors like JPMorgan and Wells Fargo saw profit increases thanks in part to their large consumer banking operations.

Despite the losses, Solomon and Chief Financial Officer Denis Coleman presented the gloomy results in an upbeat tone, repeatedly describing their efforts to yield better returns as a “journey.” And investors sent the stock higher as bank officials suggested the worst may be over.

“This moment in the economic cycle creates meaningful headwinds for Goldman Sachs and our business mix. At the same time, we are making tough decisions that are driving the strategic evolution of the firm,” said Solomon in the call. “Given both these factors, that should come as no surprise that we’re going to a period of lower results. I remain fully confident that we will deliver on our through-the-cycle targets of mid-teens returns at significant value for shareholders.”

Solomon and Coleman used the word “journey” to describe Goldman’s strategic evolution seven times on Wednesday, according to a transcript of the call by data provider AlphaSense.

While Solomon’s return on equity promises are contingent on M&A and other investment banking business coming back, investors sent the stock up 2% during Solomon’s presentation. The stock closed up 0.97% at $340.55 a share.

Here are the five numbers explaining the complex story of Goldman Sachs’ second-quarter earnings and its shift from consumer banking to asset management fees.

Real estate writedowns: $485M

Goldman’s second-quarter earnings were dragged down by $485 million in impairments related to real estate investments made via its asset management unit, including those tied to properties it sold. The company broke down its exposure to office properties, which have struggled from the rise of remote work.

The sales come as Goldman shifts away from using its balance sheet to make investments, which can result in volatile returns. The firm has been turning instead to raking in fees from investing money on behalf of investors and said that effort has been successful. Assets under supervision increased by $42 million during the quarter to a record $2.71 trillion.

The bank said its equity investments generated losses of $403 million, including roughly $305 million of net losses in its private portfolio primarily due to markdowns on office-related commercial real estate investments.

The bank broke down its firm-wide real estate exposure for investors in a slide that showed a combination of loans and other investments. The slide showed the bulk of loans, or $11 billion, tied to warehouse properties. Office property loans were $2 billion.

ROE: Down to 4%

The return on shareholders’ equity fell to 4% this quarter, down from 11.6% last quarter. ROE indicates how well the firm generates revenue from the money invested in it. But it’s also one of the most critical numbers for Solomon personally as he has made it his mission to run the bank for the benefit of shareholders, and they are expecting a return on tangible equity of 14% to 16%, per the company’s promises on its last Investor Day.

Solomon said the biggest contributors to the decline came from the process of “shifting our asset wealth management business to a less capital-intensive model and the pivot to narrow our consumer ambition” and that “all in, these items reduced our EPS for the second quarter by $3.95 and our ROE by 5.2 percentage points.”

But Solomon pointed out that they expect to generally meet expectations set out on Investor Day in February if investment banking picks up.

“The investment banking returns right now are at a very, very significant low, but we do have a 14% ROE to date in Global Banking and Markets. So an improved environment should help us,” Solomon said. “The asset management journey is going to take, and we were very clear about this in February, it’s going to take two to three more years for us to continue to make progress on the journey with respect to the continued reduction of the balance sheet and the revenue growth and the margin uplift. And we’re working on it. We see a clear line of sight, and we’re going to make progress.”

Headcount: Down 2%

Overall headcount was down 2% from last quarter, a slower continuation of reduction the firm began in January when it laid off more than 3,000 employees. And from a year ago, headcount is down about 8% (but 5% if you count analysts about to start in Q3).

The good news for Goldman employees: Layoffs appear to be over, for now.

Solomon said the firm does not plan to make more cuts apart from normal end-of-year culling that comes after annual performance reviews. But he does not regret being among the boldest in handing out pink slips earlier this year.

“I think that with hindsight, I’m very glad that we were early in January in starting to work on the headcount sizing,” Solomon said. “I’d remind everybody, and we’ve said this before, that we are resuming our regular performance-based process that we do with compensation at the end of the year, which we had stopped during the pandemic… but we have no other specific plans on the headcount now.”

GreenSky impairments: $504M loss

At the firm’s February Investor Day, Solomon said the firm was “considering strategic alternatives” for its consumer platforms — which includes the Apple credit card and home-improvement lending platform GreenSky — after it lost $6 billion from the strategy.

Goldman pointed to their selling processes of GreenSky and the Marcus loan portfolio as some of the biggest contributors to their overall losses this quarter.

As they’ve been looking at selling options for GreenSky in particular, Goldman lost $504 million this quarter alone on “goodwill impairment” — industry jargon for the cost of holding the asset as its value decreases.

“Losses from our historical principal investments within Asset and Wealth Management, and results related to GreenSky, including a goodwill impairment in consumer platforms,” Coleman said. “In aggregate, for the second quarter, these three items impacted net earnings by $1.4 billion, and reduced our EPS by $3.95 and our ROE by 5.2 percentage points.”

Equity underwriting: up 133%

One bright spot was equity underwriting, or the process of helping companies raise money through the sale of stocks. The bank said equity underwriting revenues rose to $338 million, up 133% from this time last year, and up 33% from the first quarter.

“We saw some signs of reopening in the capital markets, although volumes continue to remain well below medium and long-term averages,” Coleman said.

Investment banking and trading were still down, especially compared to the boom days of 2021. The bank reported advisory fees of $645 million, down 46% year-over-year. Debt underwriting came in at $448 million, down 2%.

“Activity levels in many areas of investment banking hover near decade-long lows and clients largely maintained a risk-off posture over the course of the quarter,” Solomon said on the conference.

But he also said the bank is seeing activity “begin to pick up in a few spots already, particularly equity capital markets and M&A dialogue.”

Read the full article here