Student-loan borrowers will still be expected to pay their bills if the government shuts down, but they could face challenges getting help assessing their options.

“Key activities” at the Office of Federal Student Aid, which oversees the student loan portfolio, will be able to continue “for a couple of weeks,” in the event of a shutdown, a Department of Education spokesperson wrote in an email.

“However, a prolonged shutdown lasting more than a few weeks could substantially disrupt the return to repayment effort and long-term servicing support for borrowers,” the spokesperson wrote. The agency will “do its best to support borrowers as they return to repayment,” the spokesperson added.

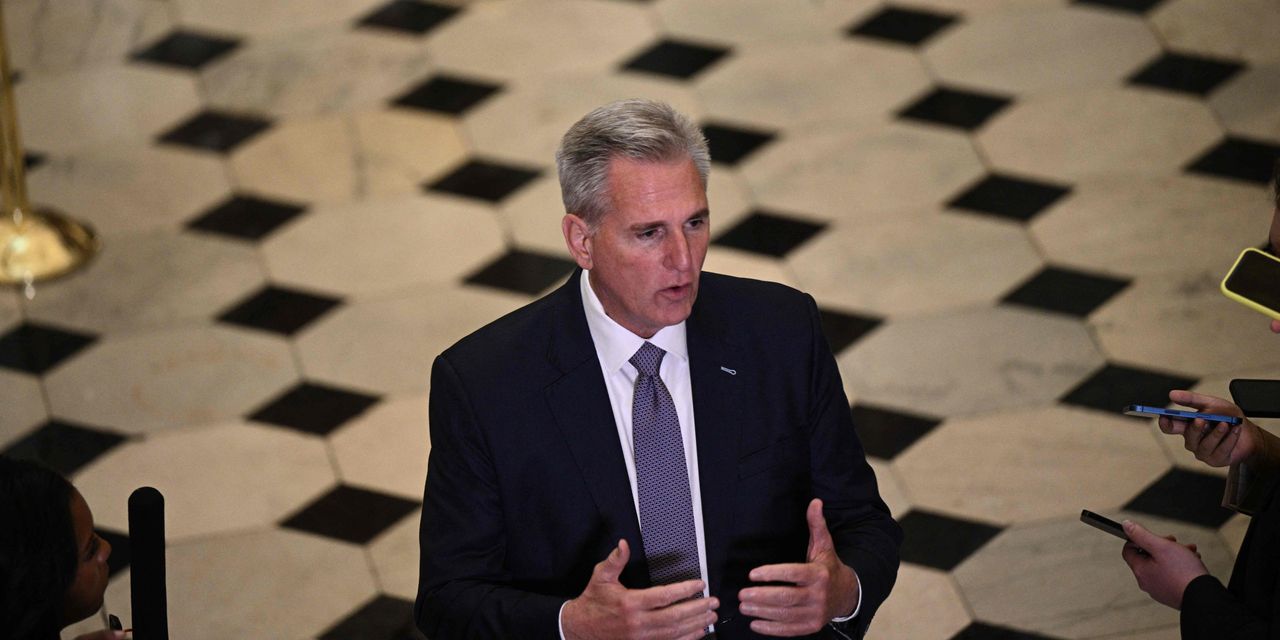

“Extreme House Republicans should stop playing political games with people’s lives and abide by our bipartisan agreement to keep the government open,” the spokesperson wrote.

If lawmakers don’t pass a spending bill before Sunday, when the federal government’s new fiscal year starts, the government will shut down partially because it lacks the funds to operate. Hardline Republicans are holding up the process with demands for bigger spending cuts and other priorities.

The government has endured 20 shutdowns or gaps in funding since the late 1970s, according to Congressional Research Service data. During shutdowns, passport applications could be delayed and many workers at agencies like the Securities and Exchange Commission would be told not to show up at the office, but other government functions would continue, such as the payment of Social Security and Medicare benefits.

This year’s potential shutdown comes just as roughly 28 million borrowers are set to resume student-loan payments for the first time in more than three years after a pandemic-era pause.

In the past, a shutdown hasn’t been too disruptive to student-loan borrowers because with enough notice the Department of Education can advance funding to its student-loan servicers to ensure they can continue to operate, said David Bergeron, who worked at the Department of Education for more than three decades.

In addition, in the past, the agency could use models of typical call activity during a potential shut-down period to ensure servicers and the agency have the resources necessary to support borrowers, he said.

“All of those models, all of those projections are out the window,” Bergeron said. That’s because the level of call volume and other activity with so many borrowers returning to repayment at once is unprecedented.

“There’s just a lot more risk to loan servicing today than there has been in the history of the student loan program,” he said. “It’s not going to be pretty. The shutdown certainly increases the risk to the system.”

Already, borrowers have been complaining of long wait times while they’re on hold to reach their servicers, delays in paperwork processing and other logistical challenges as they look for their best options to resume student-loan payments. In the months before the return to repayment, servicers cut call center hours and staff after Congress didn’t fulfill the Department of Education’s funding request for the Office of Federal Student Aid.

In a 2021 contingency plan for a government shutdown, the Department of Education said basic operations, including servicing federal student loans “could continue for a very limited time,” but could “also experience some level of disruption.”

FSA would also “designate the minimum number of employees necessary to keep these programs operational,” according to the 2021 plan.

“Excepted staff and contractors associated with these programs will continue to work as appropriate; only skeletal program operations would continue,” the plan reads.

The Office of Management and Budget didn’t immediately provide an updated version of the plan. Still, if it looks similar to what officials expected in 2021, the limited staff could mean borrowers have trouble reaching their servicers.

Scott Buchanan, the executive director of the Student Loan Servicing Alliance, which represents student-loan servicers said a few days of a shutdown shouldn’t impact borrowers.

“Certainly if it was a long shutdown that could have some implications,” he said.

He’s keeping an eye on negotiations surrounding the government’s funding because servicers and the Department of Education have been eager for more resources to make the experience of repaying student loans smoother. “We’re looking to hopefully get some meaningful investment so we can increase the quality of service,” he said.

With or without a shutdown, borrowers will be protected from the worst consequences of falling behind on student loans, including having their tax refunds and Social Security checks seized, for a year following the end of the payment pause. Still, if the shutdown delays borrowers’ ability to find and get the most appropriate payment plan, their loans will keep accruing interest if they fail to make a payment, Bergeron noted.

At “the very moment” borrowers need to be making decisions about how best to approach their student loans for the long-term, “they’re not going to be able to reach the people who can give them the best advice,” Bergeron said. He added that in many cases, even when borrowers can reach servicers, they still may not get the right or enough information to make the best decision.

Persis Yu, managing counsel and deputy executive director at the Student Borrower Protection Center, an advocacy group, worries that a shutdown and fewer staff working at the Department of Education could mean less oversight over these contractors.

“There’s going to be even fewer people minding the shop and making sure that servicers do what they need to do,” she said, adding that there will also likely be less “trouble shooting for the problems that we know exist.”

Read the full article here