PHILADELPHIA — High mortgage rates are hammering home buyers, but expect rates to fall over the next year, one industry group says.

Mortgage rates are over 7.5% as of mid-October, but expect rates to fall to 6.1% by the end of 2024, according to a forecast by the Mortgage Bankers Association. The group also expects the 30-year mortgage rate to fall to 5.5% by the end of 2025.

A big driver pushing down rates will be a slowing U.S. economy, Mike Fratantoni, chief economist and senior vice president at the MBA, said during the group’s annual convention in Philadelphia on Sunday.

Not only is the group expecting a recession in the first half of 2024, but the MBA also forecasts unemployment to rise and inflation to slow, which are signs of a weakening U.S. economy. That will, in turn, push rates down, as the market will expect the Fed to back off on hiking interest rates, they said.

“The Fed’s hiking cycle is likely nearing an end, but while Fed officials have indicated that additional rate hikes might not be needed, rate cuts may not come as soon or proceed as rapidly as previously expected,” Fratantoni said.

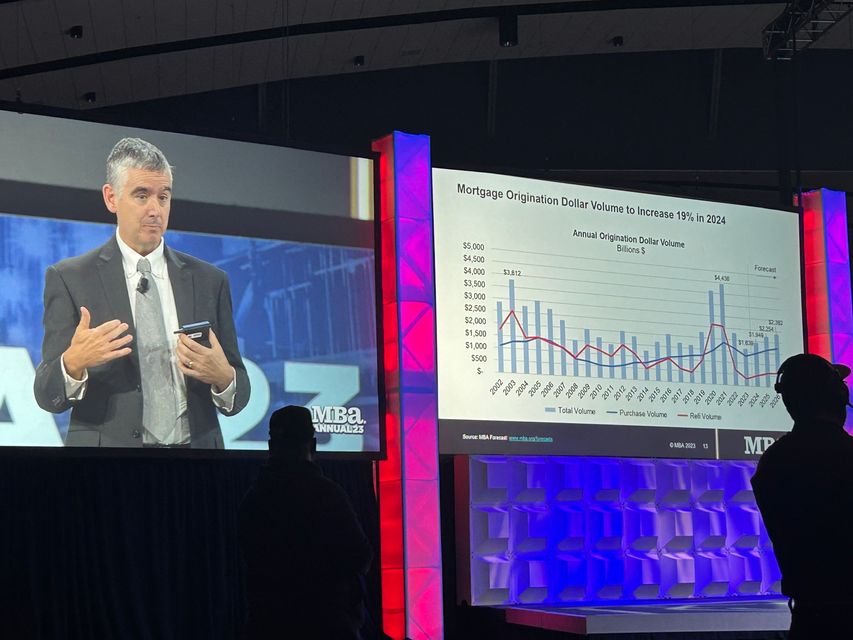

Consequently, mortgage lenders could see origination volume to increase 19% in 2024, to $1.95 trillion from the $1.64 trillion expected this year. Purchase originations are expected to rise by 11%, the MBA said.

The pandemic years were boom times for the mortgage industry. 2021 was a record year, when $4.4 trillion in mortgages were originated.

But after the Fed began hiking interest rates in the middle of 2022, surging rates have put a damper on home-buying activity. Homes are far more expensive to purchase due to high rates, with the median principal and interest payment rising to $2,170 in August, compared to $1,284 in August 2021, according to MBA data.

Fratantoni on Sunday said that he believed the “Fed is done” with rate hikes. There are two Fed meetings left this year. The MBA said it does not expect the Fed to hike interest rates in November, and to potentially hold off in December, depending on the data.

But for now, lenders should brace for “a little bit more pain” for the next few months, which is generally a slower season for home sales, until a turnaround at the end of spring in 2024, Marina Walsh, vice president of industry analysis at the MBA, said during a presentation.

Home prices will still continue to rise over the next three years, the MBA added, due to the persistence of tight inventory.

Millennials are entering their prime home-buying years, said Joel Kan, deputy chief economist at the MBA, which will keep prices from falling.

“The forecast is for low single-digit growth over the next few years supported by [low] inventory,” he said. “We’re not expecting national declines yet.”

Read the full article here