“ The economic impact of a shutdown and the potential implications on your portfolio depend largely on how long the shutdown lasts. ”

The potential for a U.S. government shutdown can raise alarm for investors and send the phone of a financial adviser like me ringing off the hook. Headlines in front of them, my clients are increasingly asking about potential portfolio implications and how they should respond.

There is certainly a measured response, which includes not overreacting to the headlines and sticking to your long-term investment plan, and I’ll show you how to draw it.

Government shutdown explained

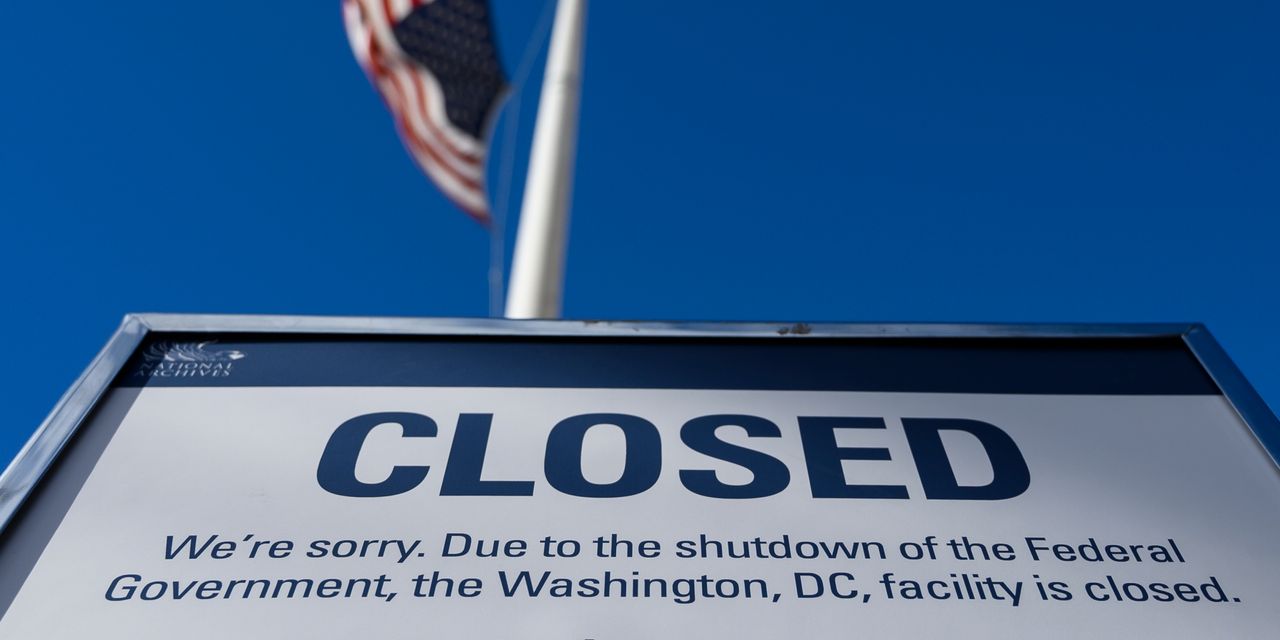

First, it’s important to understand what is happening. During a shutdown, the federal government will suspend all services that are deemed nonessential until a funding agreement is reached. This is much different than a default — which can happen when the government can’t pay its debts or satisfy its obligations. A default can have significant ramifications on U.S. creditworthiness and in turn, the global financial system. You may recall lawmakers’ discussions earlier this year regarding raising the debt ceiling — a solution to avoid defaulting.

A U.S. default has never happened, but shutdowns have occurred more than 20 times since 1976. Unlike a default, a shutdown does not affect the government’s ability to pay its obligations, and many critical government services, like Social Security may continue. When weighing the two, one can presume that markets may react more negatively to a default.

Markets may experience heightened volatility in response to the shutdown uncertainty, but markets do not react consistently to the news. In the past we have seen U.S. stocks — as measured by the S&P 500

SPX

— finish positively after more than half of these shutdowns. Results are similar for fixed-income securities, as we’ve seen an even split between positive and negative returns in the bond markets in shutdowns since 1976.

Of course, all investing is subject to risk, past performance is not a guarantee for future returns, and the performance of an index is not an exact representation of any particular investment.

The economic impact of a shutdown — and the potential implications on your portfolio — depend largely on how long the shutdown lasts. The longer the shutdown, the more Americans experience dampened economic activity from things like loss of furloughed federal workers’ contribution to GDP, the delay in federal spending on goods and services, and the reduction in aggregate demand (which lowers private-sector activity).

Read: Government shutdown: Analysts warn of ‘perhaps a long one lasting into the winter’

A measured response

A government shutdown is just one of many factors, both positive and negative, that can cause fluctuation in the market, so it’s important to treat it just as you would other fluctuations.

With so many variables, it’s impossible to precisely predict the effects the shutdown will have or determine how long it will last. This can seem scary for many, so it’s important to remember your long-term financial plan and focus on the factors you can control.

First, do not try to time the market. Doing so based on short-term events is never a good idea, and volatility is unpredictable. Even if the markets fall, we don’t know when they might recover. If you make an emotionally charged decision, you run the risk of missing out on potentially substantial market gains.

Instead, focus on the following: align your asset allocation with your risk tolerance; control your costs; adopt realistic expectations; hold a broadly diversified portfolio and stay disciplined. Doing so can help you weather any form of market uncertainty, including a shutdown.

Stick to healthy financial habits

In addition to not making any sudden moves in your investment portfolio, now is a suitable time to make sure you are keeping up with healthy financial habits, especially if you are a federal employee facing a furlough. This can look like readjusting your budget based on your current needs, keeping high-interest debt to a minimum, paying the minimum on all debt to keep your credit score in good standing and continuing to save.

Remember, using your emergency fund to navigate tight times is exactly what you have saved for and tapping it in this instance is considered a healthy financial habit. Just be sure to replenish it when you have the funds to do so. As a good practice, Vanguard recommends having three- to six months of expenses saved in readily accessible investments.

With a level, long-term approach and a personalized financial plan, you can be prepared for this potential storm and the inevitable ones to come.

Lauren Wybar is a senior financial adviser with Vanguard Personal Advisor.

More: Bill Ackman says Treasury yields are going higher in a hurry, and that investors should shun U.S. government debt

Plus: Social Security checks will still come if there’s a shutdown. But there are other immediate threats to America’s benefits.

Read the full article here