- Former CAA and WME agent Will Ward is using his entertainment connections to build businesses around celebrities.

- He’s invested in 9 firms as part of Fourward, his production and management firm.

- Read the deck he’s using to raise his first venture round of $50 million.

At CAA and WME and then at his own firms, Will Ward has represented some of the biggest names in Hollywood and music, from Adam Sandler and Ryan Reynolds to Chris Hemsworth and Zac Brown Band, among others.

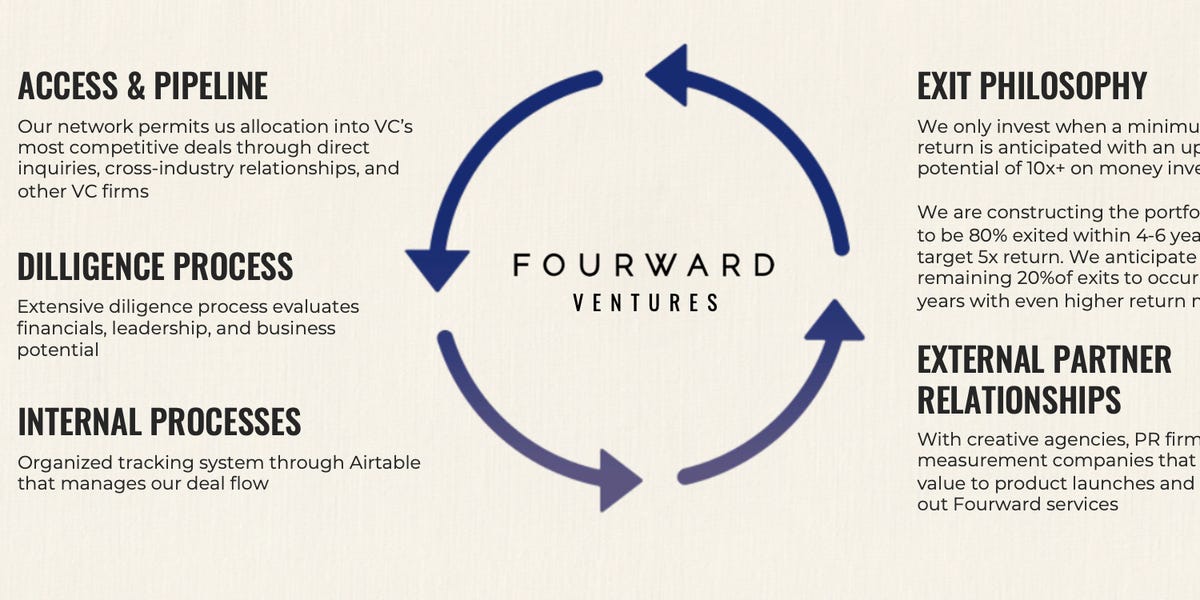

He’s also an investor. In 2018, he left Roar, the management company he started in 2003, to launch Fourward, a management, production, and investment firm. And Fourward has just announced its first VC fund, Fourward Ventures, an early-stage growth fund focused on investments in health and wellness, sustainability, and consumer packaged goods.

Fourward says it’s looking to companies that disrupt traditional consumer categories, drive societal change, and have celebrity tie-ins.

The LA- and Nashville-based company has closed half the fund at $25 million and says it’s on track to close the other half by September 15. So far Fourward has invested in nine companies, including Goodles, a mac-and-cheese brand with a twist (flavors include “Twist My Parm” and “Here Comes Truffle”) that was co-founded by Gal Gadot. And then there’s Partake, an allergen-free food brand that’s also backed by Jay-Z’s VC fund, Marcy Venture Partners.

Other Fourward-backed companies have no obvious celebrity tie-in but drew Ward’s interest with a product he believed in — like Bryn Pharma, which developed a nasal spray alternative to emergency epinephrine injectors.

Backing founders from diverse backgrounds is also a stated priority. Fourward said three of its nine investments are B-Corp certified companies; five are female-founded, and three are led by people of color.

At a time when it seems like every celebrity wants to become an entrepreneur, Ward said he’s discriminating in who he backs, having seen a lot of stars attach their names to ventures in ways that read artificial.

“It has to be meaningful,” he told Insider. “If a celebrity wants to build a beauty brand, I want to see who’s the team, why does he or she want to do a beauty brand, what’s behind this? A lot of it is gut. Why were they involved? Sometimes you feel it, sometimes you don’t.'”

He became convinced there was a big opportunity to invest in celebrity-tied companies, however, with Centr, Chris Hemsworth’s health and wellness fitness app that Ward helped found in 2019. It was acquired in 2022 by Mark Bezos’ (Jeff’s brother) private equity firm HighPost Capital.

With Centr, Ward saw the chance to bring a Hollywood-level content and production quality he felt was missing in other fitness apps and harness the buff Australian actor’s stardom and passion for the subject. “I couldn’t have sold the fitness app in three years without the rocket power of Chris Hemsworth,” he said.

Ward said he believes his Hollywood connections give his portfolio companies a leg up, whether it’s helping brands identify celebrity endorsers or facilitating intros to powerful people — as he did in getting two founders, both people of color — in front of a major grocery chain.

“There’s a lot of similarities” to his work as a manager and agent, he said, adding, “You’re thinking every day, how can I differentiate this person to make them feel special?”

“Once we get involved in a company, we want to add value,” he continued. “Just as I would have with an actor or music act.”

The entertainment industry’s struggles have been a motivating factor in Ward’s professional lane change. From COVID shutting down productions in 2020 to actors getting shortchanged by streaming economics and now, the writers’ and actors’ strikes, there’s not a lot of fun being had in Hollywood. And Ward had seen good outcomes as an investor over the years.

“I had a great run in the heyday when premieres were grand, people had backends, the box office was exciting,” he said of his entertainment career. “To be honest, some of my passion behind this is because the business is not fun anymore.”

Of course, it’s a tough time to be out fundraising, with investors panicky about inflation and the threat of recession looming. Ward said he’s become more conservative in his investment thesis, too, passing on companies that trade in luxury and e-bikes in favor of offerings that feel recession-proof, like packaged goods and personal care products.

“The market has significantly impacted our strategy,” he said. “We’re not investing that big; it’s, is this a company that could sustain a bad time? Is mac and cheese going to be hurt in a recession? No. We want to be careful. We have too much to lose as a first-time fund not to be careful.”

Check out the pitch deck Fourward used to raise the first $25 million of its planned $50 million fund.

Read the full article here