As gambling companies jockeyed in 2019 for market share during the early days of legal sports betting in the US, FanDuel was preparing to launch a secret weapon.

The daily-fantasy-sports company, which European gambling giant Flutter Entertainment had acquired, was racing to introduce its “same-game parlay” to the US.

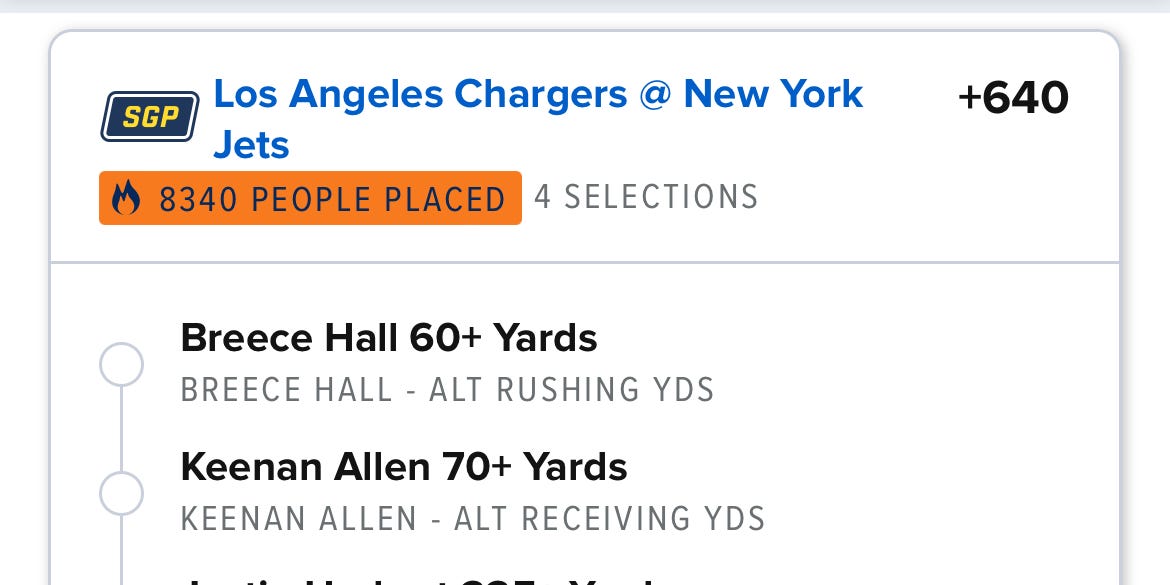

No one had yet rolled out a way to combine bets on multiple events — a popular type of wager known as parlay — within a single match. It’d allow you to stack bets on which NFL team will win, the over or under on the total score, and on a certain player to score a touchdown. But you’d need to get all three right to win.

FanDuel’s Australian sister sportsbook, Sportsbet, had cracked the code a few years earlier, and Flutter had expanded the bet-builder format to the UK and other markets.

FanDuel was eager to bring the technology to the US as it grasped for a competitive edge.

The same-game parlay, a phrase FanDuel coined, has since caught fire, meshing well with the high-scoring, stat-driven, athlete-personality focus of US sports — and propelled FanDuel to the forefront of the betting market.

“It became the killer app,” said Scott Longley, editor of the Earnings+More gambling newsletter. “The same-game parlay was the right product in the right market at exactly the right time.”

“It definitely was a catalyst for FanDuel to grow its market share disproportionately at that time,” said Conor Farren, FanDuel’s senior vice president of sports product and pricing.

FanDuel remains the market-share leader in US online sports betting, though rival DraftKings has narrowed the gap in recent weeks. FanDuel captured 45% of gross gaming revenue during the 12 months to June 2023, firmly outpacing rival DraftKings’ 28%, according to research firm Eilers and Krejcik Gaming.

The product has also helped boost FanDuel’s top line in the fiercely competitive industry. Parlays are higher-risk, higher-reward bets since you’re stacking odds against yourself. They translate into higher margins for operators. From each dollar wagered, FanDuel claims it makes about 50% more in gross gaming revenue than its competitors because of the popularity of the product.

Every sports-betting operator, from DraftKings to newcomer Fanatics, now has or is building its version of the same-game parlay. BetMGM’s part-owner Entain recently acquired a pricing and analytics company called Angstrom in part to buoy its same-game-parlay product.

“In US sports betting, who wins with same-game parlays decides who wins the race,” the Earnings+More gambling newsletter wrote in March.

Insider spoke with top Flutter execs who brought the same-game parlay to FanDuel about how it was developed and the strategy that made it a force in US sports betting.

The same-game parlay was built to solve a customer complaint

The betting product that would become a “must-have” in US sports betting, as Longley put it, was born halfway around the world at a company called Sportsbet, two years before legal sports betting would even start spreading in the US.

It was built in response to a common customer pain point.

“Customers for years would’ve complained about the fact that they cannot place a multi or a parlay within a game,” said John Maguire, who led the team that built the “same-game” product at Sportsbet.

A team of roughly 25 analysts, software engineers, and quants based in Melbourne, Australia, went heads down for a year to solve the problem.

Maguire, who led the team, said the biggest challenge was pricing the bets accurately and quickly. Each event in a match can impact the outcome of another, and the relationship between two events isn’t always one-to-one. For instance, a bet on LeBron James to score 30 points against the Houston Rockets would impact the odds of a Los Angeles Lakers win, and therefore the price of such a parlay, differently than a wager on opponent Jalen Green to score 20 points.

Maguire’s team had to build models to work out how each potential outcome in a match would correlate to another, factoring in all the nuances across the sport and team.

“That was really the challenge that we faced and also to do that at scale across numerous games and markets, literally into thousands and thousands of markets where you end up with millions of outcomes is quite the engineering problem,” he said.

Sportsbet launched the first “same-game” product in 2016 with the Australian Football League, followed by Australian rugby and the NBA as organic user adoption ticked up.

“We started to realize that we had really caught something quite unique here and started to really double down on the investment,” Maguire said.

The same-game parlay set FanDuel apart

On the other side of the globe, a May 2018 US Supreme Court ruling was paving the way for legal sports betting to take hold in the country. Sportsbet’s parent company, then called Paddy Power Betfair, struck a deal a week later to acquire the daily-fantasy-sports brand FanDuel.

Farren, who had been Sportsbet’s head of risk and monetization, was one of several Flutter execs who went over to FanDuel that year. He was charged with building out its trading, risk, and sports-modeling center. Farren and FanDuel’s product team were also keen to add the same-game parlay to their arsenal.

They ran the risk that the same-game parlay wouldn’t be the game-changer they hoped and the company would squander much-needed resources at a time when the industry was scrambling to navigate a new regulatory environment and launch in more US states as quickly as possible. But, seeing the success the product had by that point in Australia and other markets, Farren said he had a “high conviction” it would pay off.

“We had good reason to believe that it would work for a US audience,” Farren said. “Then really it was a case of begging, borrowing, and stealing favors from tech-resourcing groups, because we did not have the people that were going to be able to enable this.”

FanDuel launched the same-game parlay in September 2019 with the NFL, and then the NBA. By its fifth month available, adoption had ticked up to about 5% of the online sports betting wagered on FanDuel.

When the pandemic paused live sports for a few months in 2020, FanDuel took another calculated risk: Its marketing team regrouped and made the same-game parlay the star of its ad campaigns as other gambling companies poured money into brand marketing.

“We got some thinking time while we were waiting for the lights to come back on, because it was pretty hectic and busy back then,” Farren said. “In a world where most sportsbooks at that time were really just advertising the brand to get the brand recognition, we went with the product message and we promoted it.”

After the NBA resumed play in July 2020, the same-game parlay grew from 5% to 10% of FanDuel’s bets, Farren said. It kept going. Last year, four out of five active FanDuel customers placed a same-game parlay, according to the company.

Today, while nearly all of FanDuel’s competitors have their versions of this bet type, the same-game parlay branding that FanDuel has since trademarked has stuck.

“It’s really just a parlay, right?” Farren said. “But, it is funny; when you hear anyone in the industry or any customer talk about it, they don’t talk about it as a parlay. They talk about it as a ‘same-game parlay.'”

Flutter has also leaned on cross-collaboration, which it refers to internally as the “Flutter Edge,” to hone the product by offering more sports, more potential bets, and better odds and pricing.

In 2019, a small group of principal engineers, architects, and other minds at Flutter holed up for about a week at a hotel in the middle of England to create a blueprint for how to invest in in-house pricing platforms and models. It led to a multi-year project that later came to include leaders from FanDuel as well, and developed the same-game parlay for college basketball.

The strategy helped FanDuel conquer US sports betting

US sportsbooks, from the incumbents to Penn Entertainment’s upcoming ESPN Bet, are racing today to improve their parlay products in the hopes of catching up to and surpassing FanDuel. Industry leaders have stressed the importance of product differentiation in the next phase of the US gambling wars.

“Everybody else is looking at that and saying, ‘OK this is an arms race and we have to beat each other on product,'” Longley said. He added: “What’s the test for ESPN Bet? It’ll be whether or not their parlay product matches up with market leaders.”

FanDuel, for its part, has also continued to evolve the product to offer more flexibility and choice. It’s now available for most major US sports and the company said it offers up to 1 trillion potential bet combinations to choose from on a single game. It launched a Same Game Parlay+ that combines multiple bets from the same game with more bets from other games in one parlay.

FanDuel’s margin has also kept expanding. It reached 12.2% of online gross revenue during the first half of 2023, versus 8.1% across the rest of the market, according to the company. The growth comes as parent company Flutter, which is publicly traded in the UK, plans to list in the US in the next few months.

The company is searching for the next major product leap forward. Maguire said in-play betting is rife for innovation, as is the potential for promoting bets tied to key moments in live sports. It’s testing a new product called Pulse, which curates a live NBA feed that populates new potential bets based on the what’s happening in a game.

“Surfacing that to you as a customer in a way that’s easy for you then to make a choice around whether you want to bet or not is going to be really, really important,” Maguire said.

But industry-sweeping innovations don’t come every day.

“It was the last great watershed innovation in the industry,” Farren said of the same-game parlay. “Before that you’re probably going back to live betting — so these things don’t come along very often.”

Read the full article here