Happy Friday! Start your day off with this delightful story from Katie Notopoulos — a new addition to Insider — poking fun at how X CEO Linda Yaccarino “tweets like your aunt texts.”

In today’s big story, we’re looking at Sam Bankman-Fried’s conviction and what it means for the future of crypto.

What’s on deck:

But first, the verdict is in.

The big story

Guilty

Down goes Mr. Crypto.

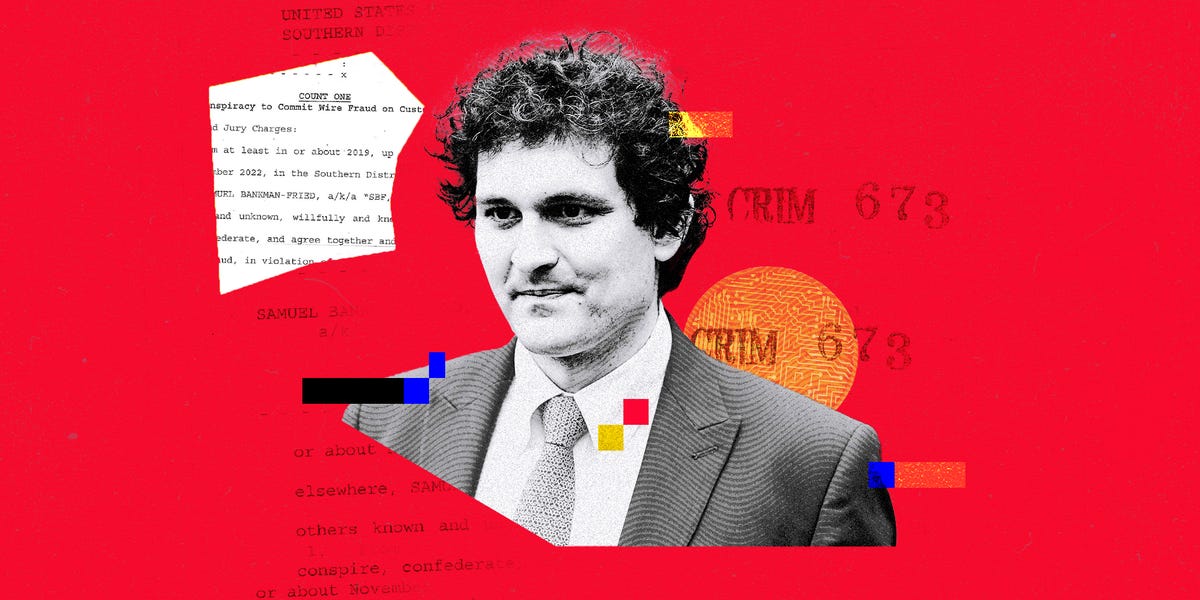

Sam Bankman-Fried, the crypto industry’s most recognizable face (and head of hair), was found guilty of seven counts of fraud and conspiracy on Thursday night.

Charges against Bankman-Fried included wire fraud, conspiracy to commit wire fraud, conspiracy to commit securities fraud, conspiracy to commit commodities fraud, and conspiracy to commit money laundering.

It took the jurors less than a day to reach a decision. Bankman-Fried, nicknamed SBF, now awaits sentencing, which is tentatively scheduled for March 28. He faces up to 110 years in prison for the charges.

The conviction came, perhaps fittingly, on the first anniversary of the CoinDesk scoop that sent FTX, the crypto exchange Bankman-Fried co-founded and led, into a tailspin. Reporting on a leaked balance sheet, CoinDesk detailed how SBF’s hedge fund, Alameda Research, had its assets tied up in FTX’s in-house token.

The rest is history.

The downfall was swift, with Bankman-Fried resigning as CEO and FTX collapsing just over a week after the initial report.

Insider’s Katie Balevic and Jacob Shamsian, who have done a fantastic job covering the entire trial, have a recap of the biggest bombshells from the case.

Bankman-Fried’s inner circle played a crucial role in the proceedings. SBF’s former executives’ testimonies proved vital to the prosecution’s case, ultimately sealing his fate, Katie writes.

SBF’s conviction signifies the end of a chapter the crypto community will happily close.

From courting Wall Street firms and venture investors to schmoozing politicians, the crypto industry was working hard to legitimize itself. FTX’s downfall was the exact type of situation skeptics of the space had long warned about.

Crypto is now in a much different place. Startups with skyrocketing valuations and high-flying tokens and NFTs are all but extinct. Even the city that embraced the crypto boon — Miami — feels like a much different place these days.

That’s not to say crypto is a complete wasteland. There are signs of life, most notably a bitcoin ETF that seems on the cusp of getting approved.

But it’s unclear what the post-SBF crypto landscape will look like. Big players like BlackRock and PayPal are pushing deeper into the space.

The entrance of these financial titans raises questions about the role native crypto firms will have in the industry’s future.

So, while crypto will undoubtedly live on after SBF, it will also never be the same.

3 things in markets

- Jamie Dimon says the Fed isn’t done hiking rates. The JPMorgan boss suspects another rate hike — by 0.25 percentage point to 0.75 percentage point — could still be in the cards. He also said the markets could see more turmoil amid the Fed’s fight against inflation.

- The Bond King’s bummer of an economic outlook. Veteran bond investor Jeff Gundlach is adamant the US economy is headed toward a recession. The yield curve is “extremely unstable,” and Gundlach believes “layoffs are coming” next.

- Betting against the grain. The founder of an independent investment research firm shared 10 stocks with low average analyst recommendations but rising earnings expectations. The disconnect between the two could present prime contrarian investing opportunities.

3 things in tech

- Inside Amazon’s cloud deal with Microsoft. Amazon’s commitment to use Microsoft 365 includes more than 1.5 million license seats, according to a person with direct knowledge of the deal. The five-year deal involves Amazon spending more than $1 billion, according to an internal Microsoft document viewed by Insider.

- Block signals cuts are coming. Jack Dorsey, the CEO and founder of the fintech, said the company’s growth has not matched its headcount, according to a note sent to staff seen by Insider. A separate internal company announcement informed employees there would be a 10% cut to the workforce in the coming months, according to a person familiar with the company.

- Tech on the Street. Financial firms are hiring loads of technologists to help them deploy AI across their orgs. Recruiters, hiring managers, and executives detailed the tech skills that are most in demand on Wall Street.

3 things in business

- WeDidn’tWork. The company is reportedly on the cusp of filing for bankruptcy. We’ve got the definitive account of the start of its downfall as a $47 billion startup eyeing an IPO back in 2019.

- The state of the housing market. These four charts — covering rates, prices, inventory, and sales — give a good overview of the state of play. On a more granular level, home sellers in these 13 cities, including St. Louis and San Antonio, are slashing prices. And here’s a rundown of the cities where home values are rising and falling the most.

- Meet Goldman Sachs’ newest managing directors. The bank gave 608 employees the coveted title, a slightly smaller class than the previous cohort. Check out all the names here. And for a rundown on what it takes to reach MD status, we’ve got you covered.

In other news

What’s happening today

- The jobs report is in. The Bureau of Labor Statistics will publish data on unemployment, new labor force participation data, and other US labor market figures.

- Financial Stability Oversight Council meeting. Treasury Secretary Janet Yallen is leading the meeting meant to give an overview of the stability of the US financial system.

- I love rock & roll! The 38th Annual Rock and Roll Hall of Fame Induction Ceremony honors new inductees Sheryl Crow, Missy Elliott, and Rage Against the Machine, among others.

News Quiz

How well do you know the news?

Test your knowledge of the week’s top stories with Insider’s news quiz

- From Monday: This billionaire sports owner shared thoughts on crypto, an NFT comeback, and taxes.

- From Tuesday: The checkout survey at this retail giant has confused and annoyed customers and workers.

- From Wednesday: This billionaire investor isn’t a fan of venture capital.

- From Thursday: What did the Fed decide to do with interest rates?

- From Friday: This prestigious investment bank recently announced its newest crop of managing directors.

Check Saturday’s edition of Insider Today for the answers.

The Insider Today team: Dan DeFrancesco, senior editor and anchor, in New York City. Diamond Naga Siu, senior reporter, in San Diego. Hallam Bullock, editor, in London. Lisa Ryan, executive editor, in New York.

Read the full article here