Shopify revealed the newest version of its fulfillment offerings as part of its semiannual product event, Shopify Editions, on January 31.

The new app has a familiar name: Shopify Fulfillment Network. It’s the same name Shopify previously used for the network of physical warehouses it planned to operate itself before selling off its entire logistics business and laying off workers in 2023. Shopify had also previously called that business unit Shopify Logistics.

But despite the familiar name, the new fulfillment services are much more hands-off for Shopify. They’re starting with the e-commerce company’s partnership with Flexport, which bought Shopify’s logistics business in May 2023. That purchase included Deliverr, the fulfillment startup Shopify bought for more than $2 billion in 2022.

After Shopify sold off its logistics business, CEO Tobi Lütke said that the e-commerce company viewed logistics as a “side quest” that was distracting from its “main quest” of building software for merchants. Since then, Shopify has shifted much of its focus to enterprise retail and AI.

For many investors, the decision to abandon its multibillion-dollar fulfillment efforts came as a relief. By relying on a third-party partner to execute on fulfillment, it’s following through on that vision, Oppenheimer analyst Ken Wong said.

“They recognize that that’s just not one of their core competencies,” Wong said. “It’s not one of their main goals.”

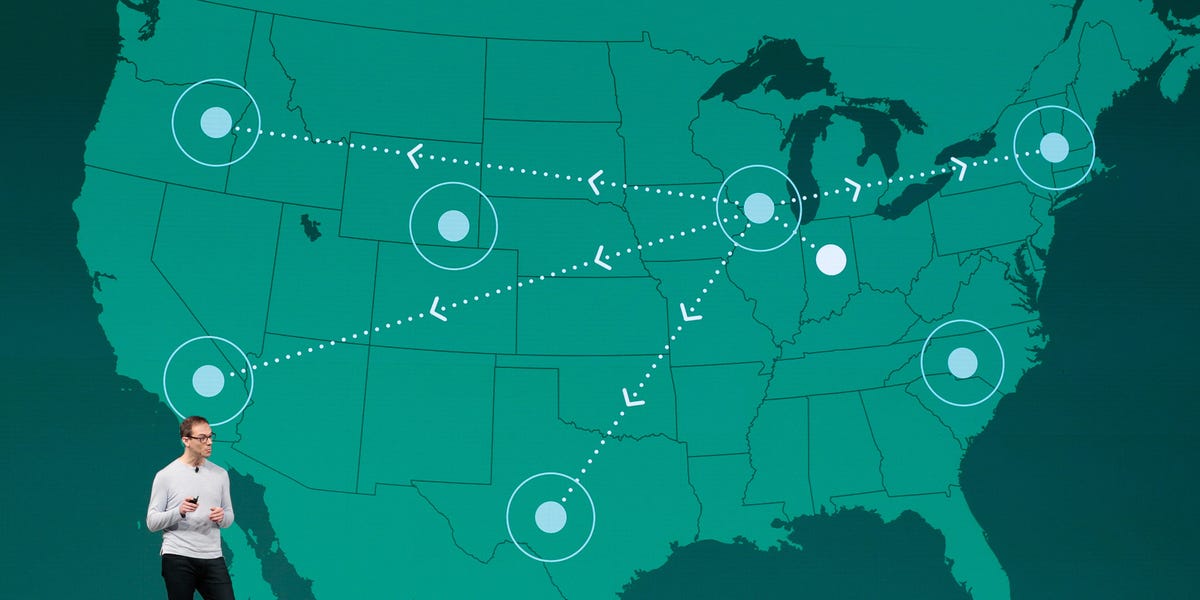

With the new Shopify Fulfillment Network, merchants can sign up to use Flexport’s services through Shopify’s app. Merchants can send their inventory to Flexport’s warehouses and have the company handle fulfillment, wholesale distribution, packaging, return processing, and more. It’s also promising quick delivery speeds — two or three days — through Flexport.

Flexport has had its own struggles lately, but Shopify has a vested interest in seeing the logistics company succeed.

Shopify invested $260 million in Flexport in the form of an uncapped convertible note in January. Shopify previously invested an undisclosed amount in Flexport in 2022 and was given a 13% stake in Flexport as part of its sale of the logistics business.

Shopify uses similar partnerships to power other business lines. Affirm is the exclusive tech partner for Shopify Pay Installments, the company’s buy-now-pay-later service. Global-e powers Shopify Markets Pro, which aims to make it easier for merchants to sell in new international markets. And Shopify Payments is powered by Stripe. Shopify is an investor in all of those companies as well.

The newly named Shopify Fulfillment Network is not merchants’ only option for fulfillment. Following tense negotiations with Amazon, Shopify now offers an official Buy with Prime app that streamlines how Shopify merchants can use Amazon’s fulfillment services. Wong said the company had also indicated Flexport would not be the exclusive provider for Shopify Fulfillment Network.

“They’ve definitely given themselves more choices than there were before when it was just Shopify Fulfillment Network or bust,” he said. “So not all their eggs are in one basket here, although they are definitely starting to pile more eggs in the Flexport basket.”

Got a tip? Contact this reporter at [email protected], at [email protected], or on the secure-messaging app Signal at (646) 889-2143 using a nonwork phone.

Read the full article here