A Financially Valid Approach To Consolidating, Simplifying, and Optimizing the Commercial Technology Portfolio

Today, we have reached a tipping point where growing a business involves so much capital investment in technology and analytics it has broken the back of traditional models for planning, allocating, and managing growth investments. In all, the average business-to-business (B2B) enterprise uses over 30 digitally enabled marketing, sales, and service channels to engage prospects and customers over the revenue cycle. Some operations leaders report as many as 100 tools are in use. At the front of the funnel, the digital marketing tech stack has exploded to included thousands of potential solutions that engage customers through email, digital and mobile touch points. Mid funnel, sales teams use an average of 10 tools just to close deals in the lead to booking phase of the revenue cycle according to research by Salesforce. Deeper in the customer journey Finance and product teams are investing in tools to help get control over proposals, pricing, contracts and forecasts to give them better visibility and control over the revenue cycle and manage revenue leakage.

ADVERTISEMENT

This growing portfolio of tech tools – and the operations, content, and data that support them – are getting very expensive. Collectively, the command an astounding two thirds of operating budgets. And the capital investment in the digital selling infrastructure, customer databases, and technology solutions that enable digital selling channels and teams are some of the biggest financial assets on the company balance sheet. In some cases, the customer data within a business can be more valuable than the business itself.

This growing cost and complexity of commercial technology investment – coupled with the threat of a recession and market slowdown in SaaS solutions – has shifted the focus of commercial technology investment and management from grow at all costs to sell more for less. “The pendulum has really swung on commercial technology investments in the last quarter,” says Stephanie Brookby, VP of Global Enablement, Pendo Systems. “Up until the first quarter of 2023, the prevailing mode of operations at most SaaS organizations like ours was to grow at all costs. The answer to every problem was to throw more humans and technology at it. In 2023, concerns about the economy – coupled with the growing cost and complexity of the commercial technology portfolio – have changed the mindset to grow more for less.” As a result of all of this confusion and cost pressure almost every (94%) sales organization is actively consolidating, simplifying, and optimizing their commercial tech stack in an effort to reduce “technology mayhem”, simplify selling, and multiply the financial returns on these growing technology portfolio – according to a survey of 7,700 B2B sales organizations by Salesforce.

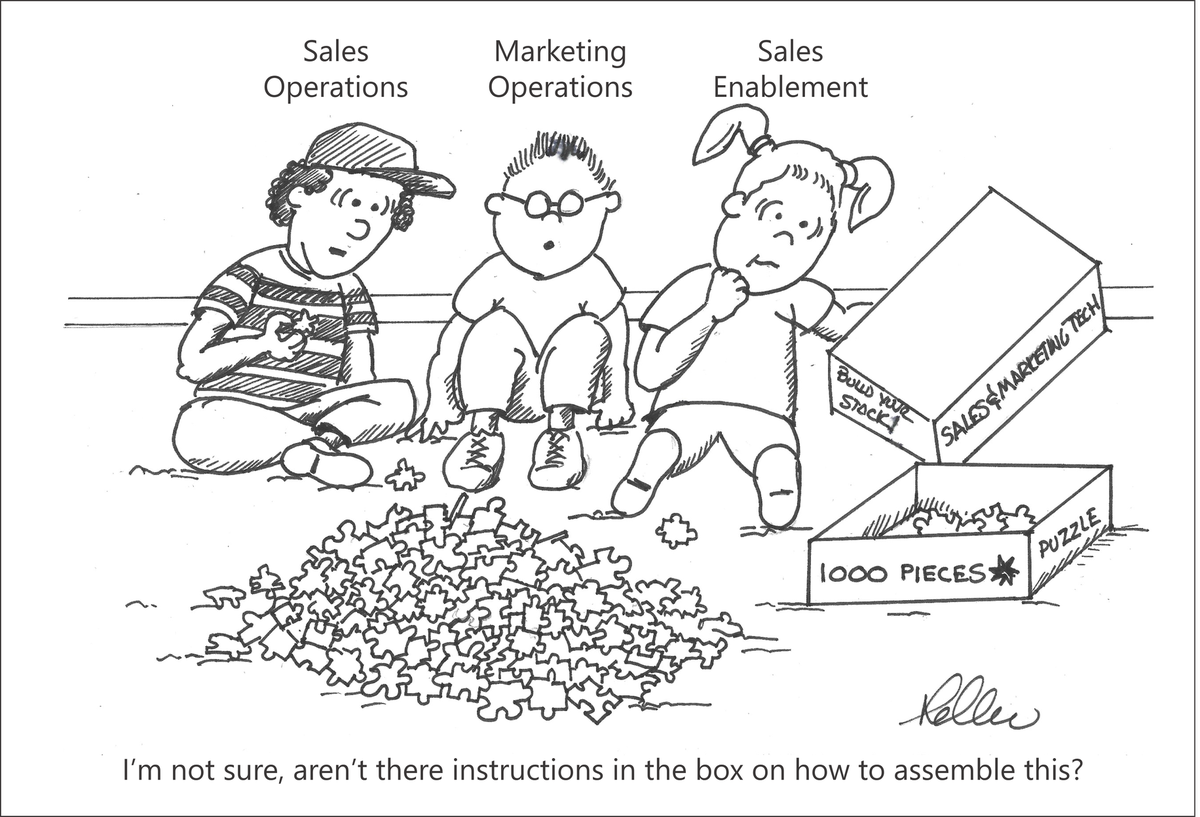

These efforts present managers with an unprecedented opportunity to unlock the vast potential of these technologies to generate more scalable and consistent growth. But it won’t be easy. The business case for investing in growth technology is not well understood. There’ no established blueprint to help managers configure, connect, and organize the many different technologies in modern commercial tech stack. Business leaders also lack an operating system for managing these increasingly expensive and important growth assets, systems, and processes. The operations leaders tasked with consolidating these systems lack a senior executive mandate to coordinate and rationalize the dozens of operating teams that buy, administer, and support the commercial technology portfolio. To succeed they will need to get five things right.

ADVERTISEMENT

1. A full accounting of the fully loaded cost and investment in commercial technology

2. A financially valid and consensus business case for investing in growth technology

3. An objective and holistic blueprint for connecting and rationalizing the commercial technology portfolio

4. A focus on simplifying and augmenting the value and performance of their revenue teams

5. A senior leadership mandate to improve the cost, adoption, and impact of sales and marketing tools

Until these fundamental issues are addressed, the potential of technology and AI to unlock consistent, profitable, and scalable growth will not be fully realized.

ADVERTISEMENT

1. Calculate the true cost of your commercial technology portfolio. Sales enablement professionals report the growing spend on sales technology has become one of the largest expense line items in their budget. The fully loaded cost of arming a front line customer facing employee with technology exceeds $5,000 per rep when you count all the information, automation and digital channel capabilities they need to compete in the new market reality according to the Revenue Operating System Report. The problem is very few growth leaders, or their CFOs, are counting. One reason is the operations leaders within organizations lack the aperture or operational reporting to calculate the fully loaded cost of their commercial technology investments. A bigger reason is nobody in finance is asking the question. If they did, they would quickly learn the fully loaded cost of commercial technology that supports welling routinely exceeds $10,000 of technology and related services per selling resource at many of the enterprises we spoke with. Several reported costs exceeding $25,000 they reallocate funds to more scalable investments in digital technology and analytics that improve the targeting, allocation, personalization, performance, and value of selling effort. “You need to add up all the tools and services that support front line sellers, according to Tim McGee, a VP Sales Operations at Elsevier. “That includes home growth tools as well as solutions you license. And services that provide reps data and information are usually tracked differently than tools – but they can cost thousands of dollars per rep if you are not careful.” Armed with this analysis, you will identify a large number of opportunities to eliminate waste, redundancy and unproductive assets and reduce the number of systems and operations that support the entire revenue cycle, according to Greg Munster, who has led commercial transformation programs at IBM, Lenovo, and Red Hat.

2. Agree upon a financially valid business case for investing in growth technology. “Understanding the ROI of our enablement investments has really helped us unlock more growth potential from our data and technology investments while optimizing our enablement philosophy,” according to Christian Smith, Chief Revenue Officer, Splunk. This is a challenge because few of the senior executives who must allocate and prioritize funding for commercial technology can agree on its financial contribution to firm value and financial performance. Nor do they understand the relationship between growth investment and future revenues, margins, and cash flow. “The business case for commercial technology is not well understood,” says Sugato Deb, a Customer Success Executive who runs Value Management programs at Ansys Software. “Business leaders lack a good understanding and consensus about the core drivers of value (e.g. win rate, time to close, ABM) and the financial contribution of sales and marketing technology to firm value and financial performance and also to the customer value.” Until business leaders, and their CFOs, take a step back and try to understand the financial contribution of growth capex to their firm value and share price, the impact technology as a driver of scalable and sustainable growth will be sub optimal. “In my experience, without sustained engagement and a documented business purpose – most sales technology sits on the shelf or is poorly adopted,” says Brookby.

3. Find an objective and holistic blueprint for connecting and rationalizing the commercial technology portfolio. The number of sales and marketing solutions has grown to over ten thousand. And there are many more apps. The available universe of available commercial technology exceeds the ability of operations teams to keep up, according to Mary Lee, the Global Head of Revenue Operations at Lionbridge Technologies. “There are so many different tools – the landscape has exploded,” says Lee. “There is an app or an integration for anything you can think of – demand gen tech, CRM, sales enablement. It’s a matter of money and priorities. They are all in silos because of how they bought them, who uses them, and the function that owns them. The big questions are who is the leader who brings all these pieces together and what type of holistic framework can we use that lets us see how these different things come together to create value?” The core problem is managers lack an objective or holistic blueprint that describes a practical way for connecting and rationalizing these technologies into a commercial technology portfolio that supports growth. “The way we bought commercial technology in the past five years was not intentional, accountable or sustainable. We had no standards for how and why a particular technology would be used, no roadmap for how they would work collectively to generate growth, and no enablement and re-enablement plan.” adds Stephanie Brookby. Sugato Deb points out that most advice about deploying, organizing and optimizing commercial technology comes from analysts and point solutions providers “Both (analysts and software solution providers) are good at describing the problem, but less so at solving the integrated problem outside of recommending adding more features and point solutions,” adds Deb. “The most advanced and forward looking organizations are taking an outside-in approach to commercial transformation, by working backwards from the things that deliver highest value to the customer, and then defining changes to the commercial processes and capabilities that address them to provide the biggest business impact for both their organization and the customer.”

ADVERTISEMENT

4. Focus your efforts on simplifying and augmenting the value and performance of your revenue teams. Sales operations and enablement executives to walk a fine line between automating and enabling tasks and adding extra work. Simplifying the day to day seller experience needs to be the focus “Sales operations and enablement leaders tell us that the more they invest in tools to help sellers work better, the most it feels like sellers are working “for” the tools,” says Greg Munster, who co- authored the Tuning the Revenue Growth Engine report. “The proliferation of sales technology has made most sales technology solutions so complex they are creating more friction and work for reps instead of eliminating it. Sellers complain about having to learn and use too many different systems, look up too much information, and spend too much time logging requested information,” he continues. “The relationship between the number of selling tools you have, and the quality of the seller experience, and as a byproduct the customer experience, is inverted.”

5. The operations leaders tasked with improving the cost, adoption and impact of selling tools need a senior level mandate to do so. The typical Revenue Operations leaders charged with commercial technology consolidation generally lacks the span of control, mandate and influence to get other parts of the organization to cooperate with their efforts. CEOs and the executives that have the ability to deploy capital, take risks, and control incentives across functions often push too much change management burden on more junior operations managers. But only they have the authority and span of control to establish the common purpose required to align the many stakeholders in finance, marketing, product, sales and technology required to pull off a commercial transformation project. Sugato Deb reinforces this point. “For a technology implementation to succeed, it has to deliver value at all three levels of the internal organization and extend the value all the way to the customer,” he emphasizes. “The C-level executives who direct growth strategy, the customer facing employees that execute it, and the operations team that activates them.”

“The solution to this problem is clear,” says Munster. “A new blueprint for architecting, managing, and monetizing commercial technology is urgently needed. One that configures the commercial technology portfolio to generate more growth from the expensive solutions, platforms, digital infrastructure and data assets that are the foundation of modern selling.”

ADVERTISEMENT

Read the full article here