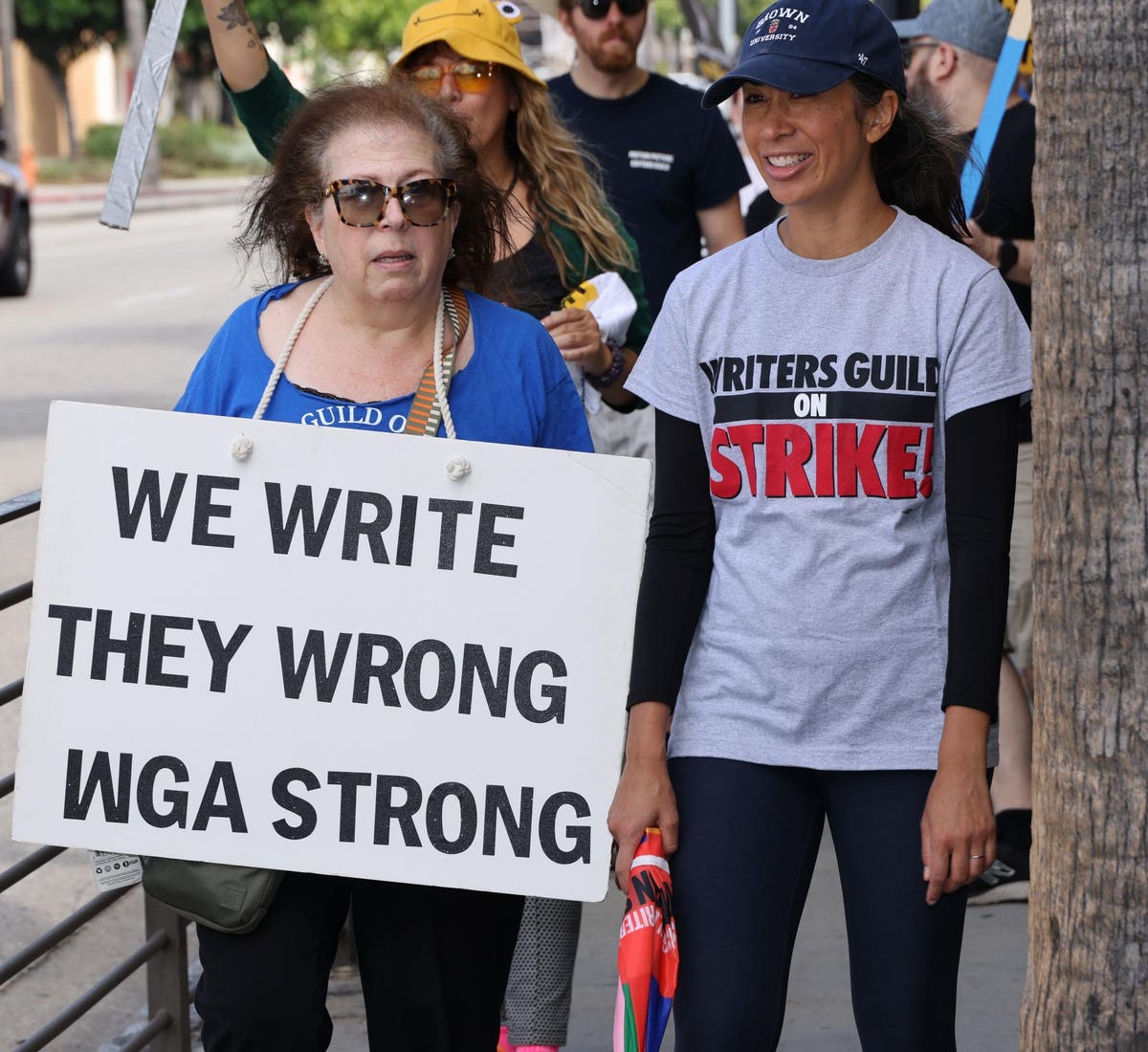

Negotiations between Writers Guild of America (WGA) and the Screen Actors Guild and the American Federation of Television and Radio Artists (SAG-AFTRA) are still at a standstill with the Alliance of Motion Picture and Television Producers (AMPTP), a trade association responsible for negotiating industry-wide guild and union contracts.

In its latest statement, AMPTP member companies assured the public that they are aligned and negotiating together towards a resolution, despite any other statements to the contrary.

But so far, the AMPTP has presented a counteroffer to the WGA which includes a 5% increase in wage rates in the first year of the contract, 4% in the second year, and 3.5% in the third year—a compounded 13% increase over the three-year contract as opposed to the 6%-5%-5% wage increase originally proposed by the WGA.

Also, written material produced by generative AI will not be considered literary material, in addition to other counteroffers made by the AMPTP in its comprehensive counteroffer package released late last month.

Accusing the AMPTP of trying to get the writers to “cave”, the WGA negotiating committee is now calling for studios to negotiate individual deals with the union separately from streamers due to disparities between business models and interests, as well as historical differences and relationships.

“Given the outsized economic impact of the strikes on the legacy companies, their individual studio interest in making a deal isn’t surprising. Warner Bros. confirmed this in a public financial filing just this week”, the WGA negotiating committee wrote in an open letter.

This is in reference to the increased uncertainty about the length and financial impact of the strike that caused Warner Bros. Discovery to adjust its full-year guidance, with an estimated $300 million to $500 million impact to 2023 earnings.

Carol Lombardini, president of the AMPTP, said, “our priority is to end the strike so that valued members of the creative community can return to what they do best and to end the hardships that so many people and businesses that service the industry are experiencing. We have come to the table with an offer that meets the priority concerns the writers have expressed. We are deeply committed to ending the strike and are hopeful that the WGA will work toward the same resolution.”

Production delays and cancellations have already been announced across major motion pictures studios, including the three new Avatar films, new Marvel Avengers movies, as well as television series including The White Lotus, Grey’s Anatomy, and more. With Paramount’s Mission Impossible: Dead Reckoning Part 2 also delayed, the company is embracing the power of its content licensing strategy to 3rd-party linear and streaming platforms and its strong position in the ads space to yield economic value, according to reports.

The dual strikes may continue into the fall and consequently affect fall lineups and release schedules. Here’s a segment breakdown of what tv and film companies are doing to remain nimble.

Studios Segment: Warner Bros. Discovery and Paramount Pictures

A couple of legacy studios are exploring alternative strategies as they seek to remain nimble amid ongoing Hollywood strikes.

Warner Bros. Discovery

Warner Bros. Discovery’s studios segment, which comprises of content, distribution, and advertising revenues, reported a 25% decrease in content revenue. TV revenue also declined primarily due to the timing of production—which was partially strike-driven— as well as fewer CW series and fewer series sold to its owned platforms. Home entertainment and theatrical revenues also took a hit as well due to the stronger performance of the company’s film slate last year, including The Batman, according to the company’s latest earnings report.

Inconsistent box office performance led to an overall 24% revenue decrease to $2.58 billion compared to the prior year quarter.

“This may have implications for the timing and performance of the remainder of the film slate, as well as our ability to produce and deliver content. And while we are hoping for a fast resolution, our modeling assumes a return-to-work date in early September. Should the strikes run through the end of the year, I would expect several hundred million dollars of incremental upside to our free cash flow guidance and some incremental downside for adjusted EBITDA”, Warner Bros. Discovery chief financial officer, Gunnar Wiedenfels, said.

As one of the largest producers and sellers of content worldwide, Warner Bros. Discovery’s mitigation plan to the strikes’ disruption is seemingly simple. “We need to have content everywhere and we need to create an ecosystem that works for everyone”, David Zaslav, president and chief executive officer, said.

With $1.7 billion in free cash flow generated in Q2 2023, likely due to savings on production costs amid ongoing strikes, the company sees an opportunity in exploring international markets and will be pivoting its focus on building a strong, sustainable direct-to-consumer strategy focused on profitable growth, rather than “chasing subscribers at any cost”.

In response to inconsistent studios’ performance with box office results underperforming expectations, Warner Bros. Discovery will be tapping into its underutilized IP to create tentpole films along with leveraging its extensive film and TV assets to license some of its library content to subscription video on demand (SVOD) platforms.

“Release dates and performance expectations are naturally fluid given the ongoing strikes and we will evaluate our options and update the market accordingly. But it is possible we will see greater variability against our forecast”, CFO Gunnar Wiedenfels said.

Paramount Pictures

Paramount’s filmed entertainment segment, which includes Paramount Pictures and Nickelodeon Studio, also saw a revenue decline of 39%, though not strike-driven, but instead driven by lower theatrical revenues due to the release of Top Gun: Maverick in the prior-year period, according to the company’s earnings results.

Boasting its best-in-class content, distribution, and monetization strategies, Paramount has been able to leverage its popular IP through a franchise-focused strategy to attain ubiquitous distribution to reach a wide addressable audience, all while monetizing across streaming, linear, and theatrical platforms.

“With respect to our film slate, the good news is we have a significant number of films, of which production is complete. That includes Killers of the Flower Moon, Bob Marley, John Krasinski’s If, as well as A Quiet Place: Day One, and Dear Santa with Jack Black. Strikes do present some marketing challenges, something we’re working to assess with respect to our lease strategy. But again, we’re well stocked”, said Naveen K. Chopra, executive vice president and chief financial officer of Paramount Global.

Not to mention, Paramount is anticipating its pipeline of theatrical movies such as Teenage Mutant Ninja Turtles and PAW Patrol to hit Paramount+ later this year.

“From a content perspective, we’re in pretty good shape”, CFO Naveen Chopra also said.

Direct to Consumer (DTC) Segment: Paramount+, Max, Showtime, HBO, And More

Production companies are also leveraging global multi-platform content capabilities to drive revenue across the DTC segment, which is uniquely positioned to withstand some impacts of the Hollywood strikes due to the availability of global content across multiple subscription and on-demand platforms.

Warner Bros. Discovery

Although Warner Bros. Discovery saw a 1.8 million decrease in global subscribers since the end of Q1 2023 , DTC revenues increased 14% to $2.73 billion compared to the prior year quarter across HBO, Max, and Discovery+, collectively.

Distribution revenue increased 2%, along with a 25% increase in advertising revenue, as well as a significant, though not meaningful, growth in content revenue driven by the timing of certain library licensing deals, according to the company’s Q2 2023 earnings report.

With a total of 95.8 million global DTC subscribers, the company’s streaming business is progressing towards profitability, according to the Hollywood Reporter.

The U.S. launch of Max in May of this year contributed to growth across the DTC revenue stream. Platform engagement was up more than 20%, as Warner Bros. Discovery’s strategy to broaden Max’s content menu is generating positive outcomes. More recently, Max also rolled out a top ten movies and TV show lists in line with Netflix, Prime Video, and Apple TV+ that will base rankings on unique views of at least two minutes. International rollouts will also begin in the fourth quarter, starting with Latin America.

“The platform is really terrific. It’s able to support all of our entertainment and non-fiction content. It’s a platform that will roll out next year and later this year around the world. We need to work through the transition of getting people on Max and that’s worked really quite well and now we got to focus on how do we grow it”, CEO David Zaslav, said during Goldman Sach’s Communacopia & Technology Conference.

Even more recently, Warner Bros. Discovery announced plans to offer live sports at no additional cost on its Max streaming service for a limited period of time later this year, according to Bloomberg. That, along with the anticipated launch of CNN Max soon, allows the company to leverage strong linear assets to bring live sports and live news into the mix to reduce subscriber churn and keep viewership up amid ongoing strikes.

“Leader in news, leader in entertainment where we own all of our IP and leader in sports domestically and around the world where we have a lot of great content. And all of that we could bring to bear, and we just need to figure out exactly how to offer it to create value for the consumer and sustainable growth for shareholders”, David Zaslav also said at the Goldman Sach’s Communacopia & Technology Conference.

Paramount+

Likewise, Paramount continues to make progress to drive scale and profitability on its streaming platform, Paramount +.

The company’s Q2 2023 results revealed that strong revenue growth in its DTC segment was catapulted by an increase in subscriber growth and increased platform engagement, with the segment on steady track to bolster strong earnings improvement in 2024.

Revenue increased 40% YoY, while Paramount+ subscription revenue grew 47% to over $1.2 billion, driven by subscriber growth. Advertising revenue also increased 21%, along with subscriber counts reaching an upwards of 61 million, with the addition of 0.7 million subscribers in the recent quarter.

“We actually feel pretty good about our slate. Our back-half plan does include a number of formats that are either unaffected by the strike or things that were already in the can. That include shows like Special Ops: Lioness, which is now on the service, the next season of Billions as well as our next Taylor Sheridan original, Lawmen. We also have a Mean Girls musical. We’ll continue, obviously, to get the benefit of NFL Football, the SCC and Big Ten, all 3 of which will be in full swing during the fall”, said executive vice president and CFO, Naveen Chopra.

Some of Paramount+ originals that were supposed to come to the streaming platform in Q4 2023 were moved into 2024 due to “strike-related production delays”. However, CFO Naveen Chopra believes that it is too early to provide estimations into anticipated impacts as result of the ongoing strikes. The company reportedly has 85 international scripted and unscripted Paramount+ originals already produced, in production or greenlit, as well as more than 20 local versions of global unscripted formats slated to debut through 2024.

“We feel pretty good about our distribution plan and the slate in general”, CFO Naveen Chopra reiterated during the earnings call.

Linear TV And Networks Segment: CBS, CNN, And More

Recent reports have also indicated that companies with exposure to the linear TV and networks business will face challenges if strikes continue into the fall season. The TV advertising business may subsequently become impacted as well.

Warner Bros. Discovery

While content revenue increased 18%, driven mostly by the timing of inter-segment content licensing to DTC, advertising revenue decreased 13% due to NCAA Final 4 and championship games being missing from its networks’ sports lineup, in addition to a decline in audience levels, as well as in the domestic general entertainment, news networks, and soft advertising markets. Distribution revenue also decreased by 1%.

Still, although the networks segment was impacted by macroeconomic headwinds and sports timing, Warner Bros. Discovery believes that one of its biggest strengths and differentiators is its ability to take one its properties or titles and spread it across its global platforms.

A great example of this was seen with the Barbie Dreamhouse Challenge on HGTV, a 4-part series, which premiered in the U.S. to 4 million viewers. Food Networks’ Barbie-themed Summer Baking Championship was then broadcast across 146 countries. A sneak peek of the film was also broadcast during the NBA Eastern Conference finals on Turner Sports.

Additionally, the new appointment of Mark Thompson as chairman and CEO of CNN Worldwide, means that Warner Bros. Discovery will also be shifting some of its focus into making the live news product a long-term global linear asset available on every platform.

Paramount

On the other hand, anticipated disruption due to the dual strikes have led broadcast networks such as CBS, to adjust their fall lineups, while actors are halting all promotions for their projects.

CBS is by far one of Paramount’s strongest assets. As the #1 broadcast network in all of television for the 15th straight season, CBS content accounts for nearly half of total minutes viewed on Paramount+.

In addition to that, Paramount’s global content licensing power contributed to over $600 million of licensing revenue of CBS-produced content. Not to mention, Paramount’s TV media segment revenue performance is outpacing audience trends, according to the earnings release.

Paramount’s ability to leverage multiple platforms and revenue streams in addition to its strategic approach to content licensing is a factor in Paramount’s agility amid ongoing strikes. With a reported Q2 2023 revenue of $5.2 billion in its TV media segment, licensing and other revenue rose 17% in the quarter, although advertising revenue decreased 10%.

“On top of a strong sports lineup, new additions to the CBS schedule include Paramount Network hits like Yellowstone and Paramount+ favorites like SEAL Team, as well as pairing the British hit comedy Ghosts with CBS’ own popular version of the show, to name a few. The slate illustrates the strength of our global multi-platform asset base and strategy, and it’s one of the ways we’re staying nimble”, said Robert Marc Bakish, president, CEO, and director of Paramount Global.

Read the full article here