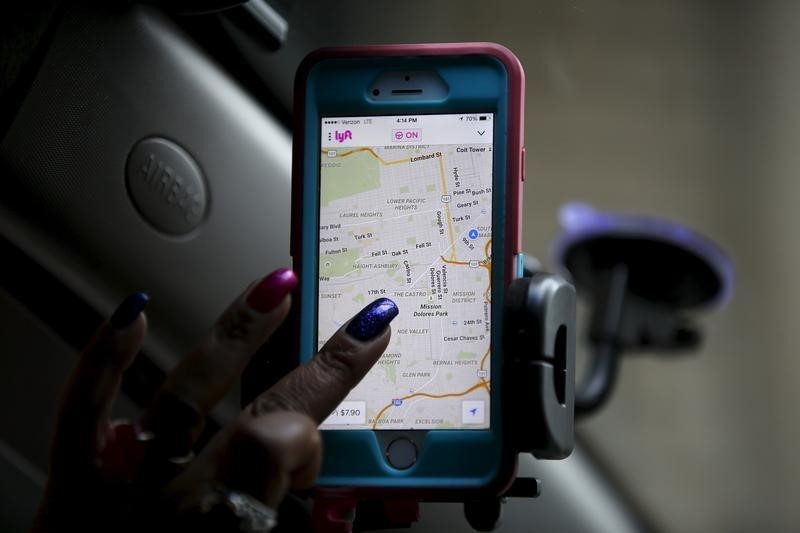

© Reuters.

Institutional investors, who hold a substantial 74% stake in Lyft (NASDAQ:), have been significantly influencing the company’s stock price. The recent market cap drop of $282 million has compounded a one-year shareholder loss of 37%, which could potentially trigger selling pressure from these institutions, adversely affecting individual investors.

Lyft’s stock has been under close watch due to the considerable influence of these institutions. Their analysts’ faith in the company is evident through their sizable investment. Nevertheless, a simultaneous selling action by two large institutions could precipitate a sharp price drop.

The board of Lyft is urged to pay close attention to these institutions’ preferences, given their control over more than half of the issued stock. FMR LLC stands as the largest shareholder with a 14% stake, while the second and third largest shareholders hold about 8.1% and 7.9% respectively.

Contrastingly, hedge funds hold only a minor share in Lyft, further emphasizing the significant role institutional investors play in shaping the company’s stock performance. Today’s developments underscore the importance of these large shareholders and their potential impact on the ride-hailing company’s future trajectory.

InvestingPro Insights

Looking at real-time data from InvestingPro, Lyft’s market cap stands at $3.58 billion. Despite a negative P/E ratio of -2.63, indicating the company is not profitable, analysts predict that the company will turn a profit this year, as per InvestingPro Tips. Moreover, the company holds more cash than debt on its balance sheet, which could provide a buffer against potential financial challenges.

However, the ride-hailing service’s stock price movements have been quite volatile, with a significant drop over the last three months. This could be a potential concern for institutional investors who hold a substantial stake in the company.

For more in-depth insights and additional tips, consider exploring the InvestingPro product which includes 13 more valuable tips about Lyft. These tips could provide a more comprehensive understanding of Lyft’s financial health and future prospects.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

Read the full article here