3D Systems (NYSE:DDD) is a leading additive manufacturing vendor, providing solutions across printers, materials, software and services. Most segments of additive manufacturing have had poor economics in the past though, and this is something that 3D Systems hopes to address by merging with Stratasys (SSYS). Increased scale, along with industry consolidation, could improve 3D Systems’ financial performance, but competition from more focused companies will continue to be fierce.

Market

Additive manufacturing is a type of manufacturing where products are made by progressively depositing layers of a printing material. This process enables:

- Design flexibility

- Mass customization

- Greater complexity

- Low volume parts

- Faster product cycles

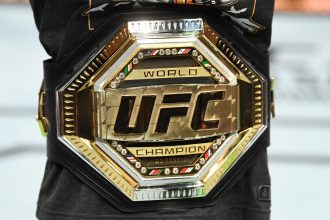

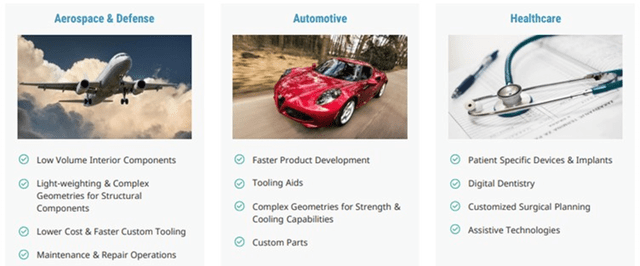

Because of these properties, additive manufacturing has primarily been used for prototyping, but manufacturers are now beginning to create more complex products and customized products. While additive manufacturing will continue to be a niche solution, adoption is increasing in areas like aerospace, automotive and healthcare.

Figure 1: Example Additive Manufacturing End Markets (source: 3D Systems)

3D Systems estimates that its serviceable market is in excess of $6 billion. It is hard to know what to make of this though. Proponents have long pointed toward the size and growth of the additive manufacturing market, and yet few companies have been able to capitalize on the opportunity.

3D Systems’ future is more dependent on achieving profitability than growth though, and this is evidenced by the company divesting assets that have been deemed less attractive.

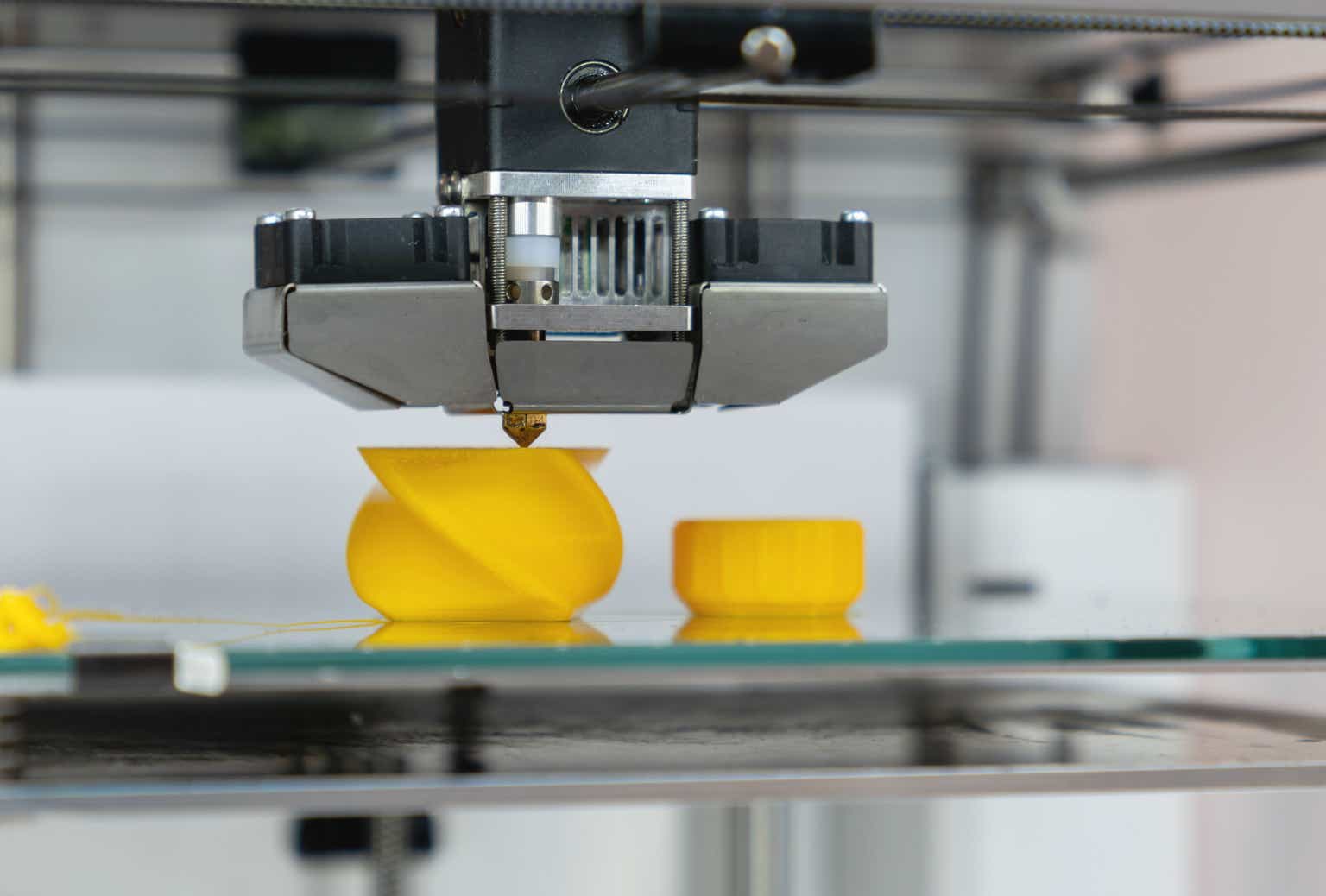

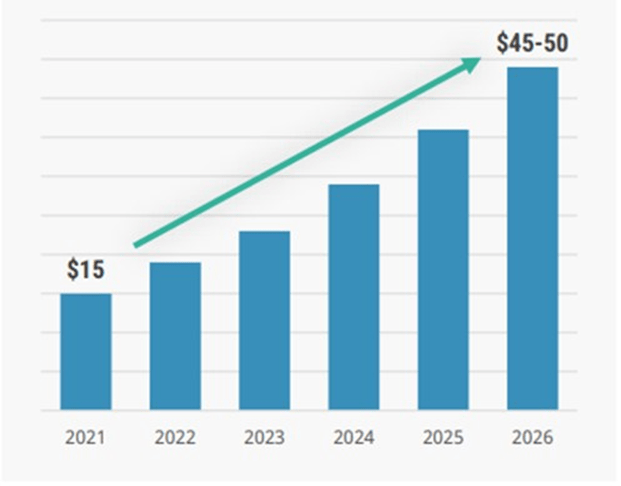

Figure 2: 3D Printing Market Size – billion USD (source: 3D Systems)

Dental orthodontics is one of 3D Systems’ most important end markets, particularly clear dental aligners. This is a large drag on the business at the moment as demand has been impacted by reduced consumer discretionary spending. Customers have also been trying to reduce inventory levels, which has contributed to headwinds. 3D Systems believes that the market is stabilizing, but is yet to return to growth.

Orthopedics is another important market for 3D Systems, and this market continues to be robust. 3D Systems is a leader in craniomaxillofacial and spinal orthopedic applications, and has been expanding into additional indications. Improved hardware and material systems are driving the expansion of use cases, with vertical integration potentially helping in this regard. Software is also becoming more advanced, with AI being used to optimize workflows. 3D Systems believes that the speed and economics of this entire orthopedic workflow has now improved to the point that large-scale adoption is possible.

Healthcare should be a highly profitable market for 3D Systems as regulatory approvals are a potential barrier to entry and cost is a secondary concern to quality. Materialise (MTLS) has a highly profitable and growing healthcare business that demonstrates the attractiveness of this market.

3D Systems is seeing strong demand within its Industrial Solutions group, driven by end markets like automotive, electronics, military aviation and aerospace. Automotive may become a headwind later in the year though, as there is evidence that end market demand is beginning to soften and that some OEMs are starting to have inventory problems.

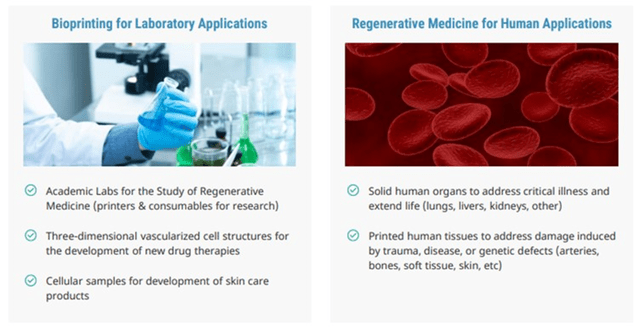

Regenerative Medicine

3D Systems is also hoping to employ its technology within regenerative medicine. Additive manufacturing can be used for both human organ transplants and non-organ human tissue scaffolds for use in transplants and surgical reconstruction applications. Progress in this market could open up new growth markets for 3D printed, vascularized soft-tissue scaffolds.

The supply of donated organs is insufficient to meet the needs of patients seeking transplantation and this is something that 3D Systems hopes to address. The company has so far been focused on developing the capability to print scaffolds for human lungs. Based upon the progress made toward this goal, the program has been expanded to include two additional human organs.

3D Systems is working in partnership with United Therapeutics on its human lung program. Together they have developed lung scaffolds that represent the most complex objects ever printed and have demonstrated gas exchange in animal models. United Therapeutics expects human clinical trials of 3D-printed, cellularized lungs in the next five years.

Bio-printing can also be used to manufacture vascularized “organs-on-chips” that can be used in drug development. These chips could be used to help test new drugs, accelerating drug development as well as reducing costs and the need for animal testing.

3D Systems formed Systemic Bio to pursue the organ-on-a-chip opportunity. Systemic Bio is a start-up fully owned by 3D Systems which is developing organ-on-a-chip technology called h-VIOS for use in drug discovery and development by the pharmaceutical industry. Systemic Bio will partner with industry players to develop h-VIOS chips that are tailored to specific organ and disease functions. Systemic Bio has already signed a contract with a pharmaceutical company for application of its h-VIOS chip technology in a bioprinted vascularized tumor model for oncology drug discovery.

3D Systems acquired Volumetric in 2021 to support its regenerative medicine business. Volumetric is a biotech company with expertise in tissue engineering. The acquisition was expected to accelerate the commercialization of vascularized human tissues and bioprinted constructs for non-organ applications within the body.

Figure 3: Additive Manufacturing in Regenerative Medicine (source: 3D Systems)

3D Systems

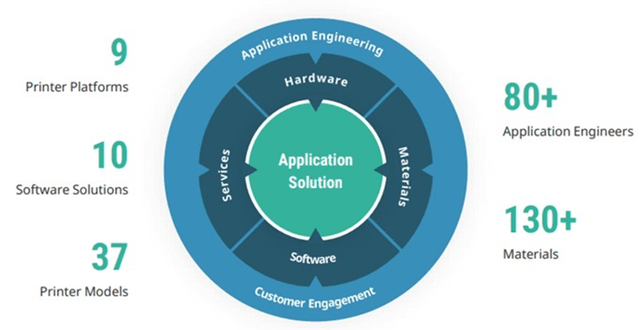

3D Systems is a leader in additive manufacturing. The company provides a broad range of 3D printers (for plastics and metal), materials, software and services. The company is focused on high value end market markets that are grouped into two segments:

- Healthcare Solutions (which includes dental, medical devices, personalized health services and regenerative medicine)

- Industrial Solutions (which includes aerospace, defense, transportation and general manufacturing).

Beginning in 2020, 3D Systems commenced a strategic reorganization involving both the divestiture of assets and acquisition of new businesses. These divestitures appear to have been targeted at creating a more focused company that is exposed to growth markets with barriers to entry. Divestitures were completed in 2021 and included:

- Cimatron – integrated CAD/CAM software and CNC programming software

- Simbionix – surgical simulators

- 3D Systems’ On Demand Manufacturing business

The total proceeds from these divestitures was approximately $450 million.

Figure 4: 3D Systems Reorganization (source: 3D Systems)

3D Systems offers a range of 3D printing technologies, including:

- Stereolithography (SLA)

- Selective Laser Sintering

- Direct Metal Printing

- MultiJet Printing

- ColorJet Printing

- Polymer extrusion

- Extrusion and SLA based bioprinting

These printers utilize a wide range of materials, most of which are proprietary, including:

- Plastic

- Nylon

- Metal

- Composite

- Elastomeric

- Wax

- Polymeric dental materials

- Biocompatible materials

Figure 5: 3D Systems Product Portfolio (source: 3D Systems)

3D Systems also provides a range of design tools, including software, scanners and haptic devices. Software functionality includes design, simulation, process management and manufacturing execution.

3D Systems acquired Oqton in 2021 to support its software business. Oqton has a Manufacturing Operating System that moves 3D Systems’ in the direction of orchestrating tens or hundreds of printers in large scale manufacturing operations. 3D Systems now offers a cloud-based Manufacturing Operating System platform that helps customers to automate digital manufacturing workflows and scale their operations. 3D Systems is still working on integrating its legacy software applications with Oqton’s MOS. This product appears to be gaining some traction in the market, with several hundred dental labs adopting Oqton’s MOS in the first 18 months of its availability. With the addition of Oqton, 3D Systems believes that it will be generating in excess of $100 million of revenue from software by the end of 2025.

Despite already having one of the broadest product portfolios in the industry, 3D Systems continues to add to its portfolio through acquisitions. Recent acquisitions include:

- 3D Systems plans on acquiring Wematter to enhance its SLS offering. Wematter’s line of enterprise SLS printers are a turnkey solution for smaller production environments, which could enable adoption amongst a broader population of customers.

- 3D Systems acquired Titan Robotics for its pellet extrusion technology, which can lower material costs. The Titan platform has now been integrated into 3D Systems’ existing portfolio and is in full production. This acquisition complements 3D Systems’ polymer technology portfolio

- 3D Systems acquired Kumovis for its extrusion technology for high-performance medical and aerospace grade polymers. High-performance polymers such as PEEK (polyether ether ketone) are often preferred for human implants and surgical instrumentation applications. This acquisition expands 3D Systems’ healthcare applications portfolio, particularly in the area of personalized healthcare applications.

- 3D Systems acquired DP Polar for its high-speed rotary printing platform. DP Polar’s printing process works on a polar coordinate system rather than a cartesian system, eliminating the start/stop operations of most printing platforms. These units are specifically designed for high-speed printing of high-volume high-mix polymer components. 3D Systems’ expects the first of these units to be installed in late summer with more to follow in the fall.

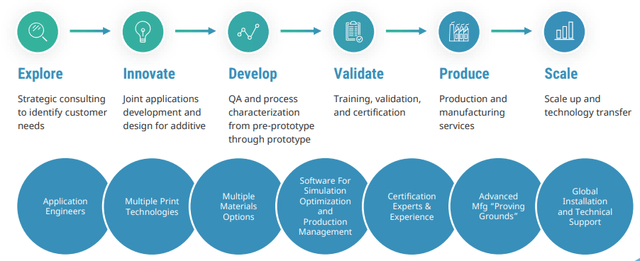

3D Systems’ Applications Innovation Group combines the company’s products with professional and technical services in order to solve a customer’s product need. In cases where customers do not have additive manufacturing expertise this is likely to be a valuable service and may benefit from 3D Systems’ vertical integration.

The relationships developed by AIG may also help to drive business to 3D Systems’ Advanced Manufacturing Solutions business. 3D Systems’ can scale production for customers and can help customers to launch their own scaled production facilities.

Figure 6: Applications Innovation Group Workflow (source: 3D Systems)

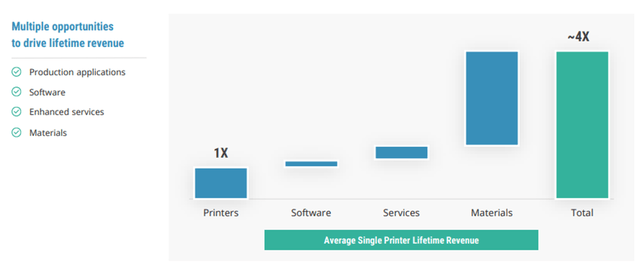

3D Systems’ pursuit of a broad product portfolio and vertical integration seems to be based around a desire to capture as much value as possible. The company estimates that an integrated solution can increase a customers’ lifetime value by 4x versus selling a printer alone.

This logic is questionable though. There may be benefits in integrating printers and software or printers and material, but the competencies necessary to remain on the cutting edge across printers, software, services and material are very different. It is difficult to see how the company can compete across these areas without greater scale, particularly as 3D Systems’ doesn’t have a cash cow it can milk to drive investment.

Figure 7: Average Single Printer Lifetime Revenue (source: 3D Systems)

Stratasys Merger

In recent months 3D Systems has been trying to initiate a friendly merger with Stratasys. Stratasys is refusing to engage with 3D Systems though. 3D Systems recently submitted an enhanced proposal worth roughly $20.8 per share in stock and cash. This doesn’t represent any significant premium to what Stratasys’ stock has generally traded at over the past 5-10 years though.

Prior to the 3D Systems offer, Stratasys announced a plan to merge with Desktop Metal (DM) in a $1.8 billion all stock transaction. Nano Dimension (NNDM) has also been trying to increase its ownership stake in Stratasys. Nano Dimension’s roughly $20 per share all cash offer is probably viewed more favorably than the 3D Systems offer, even though it was deemed insufficient.

Given Stratasys’ apparent enthusiasm for the Desktop Metal deal it is hard to see 3D Systems’ advances being entertained unless they sweeten the deal significantly. If nothing else, Stratasys may just choose to sit back and wait for an offer the is more in line with what management thinks the company is worth.

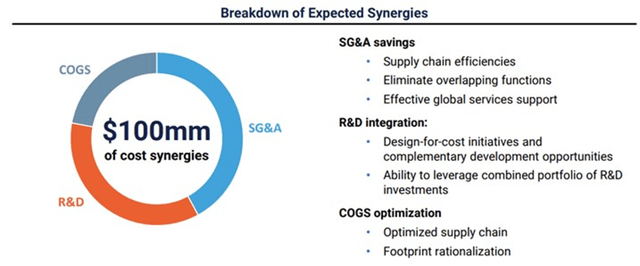

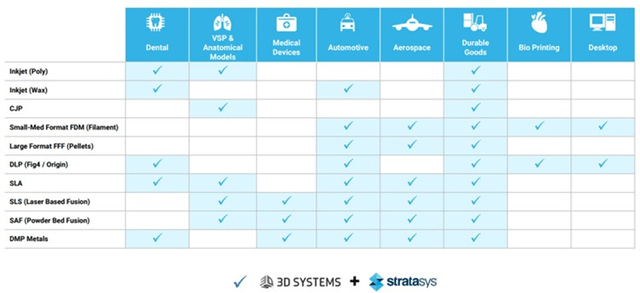

The strategic logic of the proposed merger between 3D Systems and Stratasys seems to be based around cost synergies and creating sufficient scale to achieve profitability. 3D Systems also believes that the two companies have complimentary product portfolios with limited overlap.

Figure 8: Potential Cost Synergies (source: 3D Systems) Figure 9: Combined Company Technology Portfolio (source: 3D Systems)

Given the timing of the merger offer and 3D Systems’ poor financial performance, it is hard not to feel that there is a defensive aspect to the proposed offer. Stratasys questions the competitive positioning of 3D Systems’ dental and metal businesses. A large part of Stratasys’ reasoning for rejecting the advances of 3D Systems is because of perceived weaknesses in the company’s product portfolio.

Financial Analysis

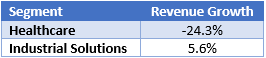

Revenue declined by approximately 9% YoY in the first quarter, driven primarily by weakness in 3D Systems’ dental business. Revenue from non-dental markets increased 12% YoY on a constant currency basis.

3D Systems’ non-dental healthcare business grew by more than 22% on a constant currency basis in the first quarter. Continued double-digit growth is expected in this business driven by strength in the orthopedic and CMF markets.

The Industrial Solutions segment is currently being negatively impacted by FX rates, but autos and electronics have been areas of strength.

Table 1: Revenue Growth by Segment (source: Created by author using data from 3D Systems)

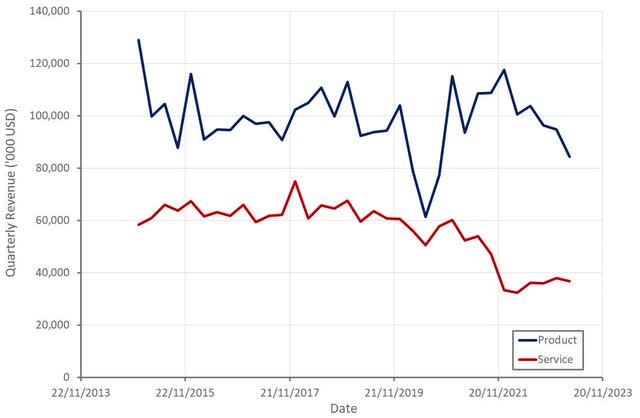

While 3D Systems is currently facing macro headwinds and divested assets in 2021, it is concerning that the company hasn’t been able to scale over the past decade.

Figure 10: 3D Systems Revenue (source: 3D Systems Revenue)

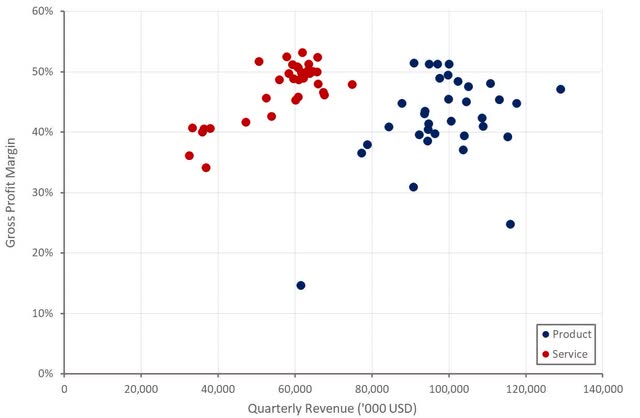

3D Systems’ gross profit margins are reasonable and have shown some improvement with scale (particularly for services). Product gross margins have a history of being quite volatile though, which is indicative of the competitive nature of the market.

Figure 11: 3D Systems Gross Profit Margins (source: 3D Systems Gross Profit Margins)

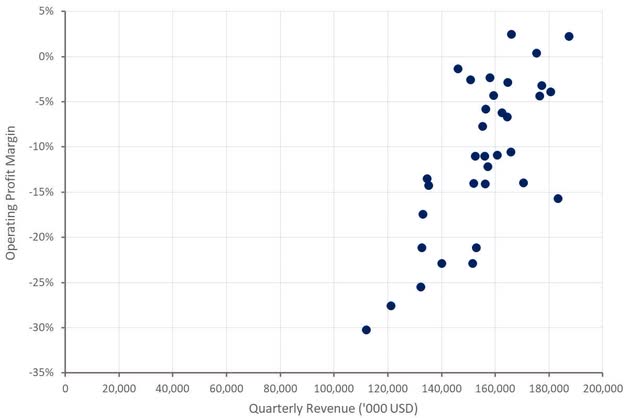

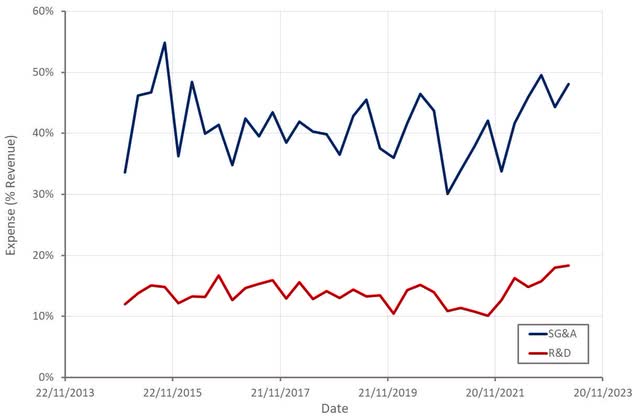

3D Systems’ profitably problems appear to stem more from operating expenses than gross profit margins though. The company has demonstrated there is significant leverage in its business but has never been able to reach a scale where it is consistently profitable.

Figure 12: 3D Systems Operating Profit Margins (source: Created by author using data from 3D Systems)

3D Systems is currently undergoing a restructuring which aims to reduce costs by streamlining the organization and focusing on high potential products. These efforts include a 6% headcount reduction across all functions of the company. The restructuring is expected to reduce operating expenses by $6.5-$9.5 million in 2023 and provide annualized savings of $14.5-$18 million beginning in 2024.

Figure 13: 3D Systems Operating Expenses (source: Created by author using data from 3D Systems)

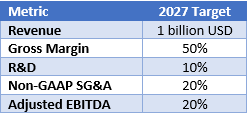

3D Systems’ is targeting $1 billion revenue in 2027 at a 20% adjusted EBITDA margin. These are not unreasonable targets if the company’s more focused approach yields results, but there is a significant risk that growth continues to be weak and 3D Systems remains sub-scale.

Table 2: 3D Systems 2027 Financial Targets (source: Created by author using data from 3D Systems)

Valuation

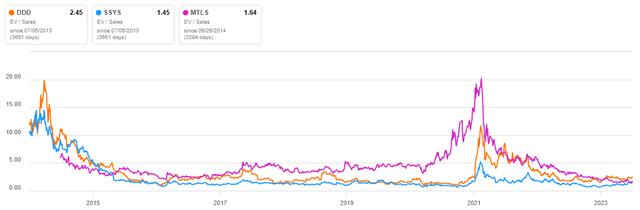

In the past, 3D Systems has generally traded at a discount to Materialise and in line with Stratasys. While 3D Systems’ valuation is still fairly modest, the company is now trading at a premium to peers, which is not warranted by the company’s fundamentals. The market obviously likes 3D Systems’ more focused approach, but this is yet to lead to an improvement in financial performance. There may also be growing excitement around 3D Systems’ bioprinting capabilities, although this business is still speculative. Even if regenerative medicine ends up being successful, it will take years for 3D Systems to realize value.

The Stratasys merger currently looks unlikely to occur, and without this it is difficult to see 3D Systems achieving profitability in the near term. In addition, there is a risk that if Stratasys combines with Desktop Metal, 3D Systems’ business will be negatively impacted.

Figure 14: 3D Systems Relative Valuation (source: Seeking Alpha)

Read the full article here