Acumen Pharmaceuticals, Inc. (NASDAQ:ABOS) is a clinical-stage biopharmaceutical company that develops innovative treatments for AD, specifically targeting toxic soluble AβOs that accumulate in the brain, producing synapse deterioration, tau hyper-phosphorylation, and inflammation. These factors contribute to neuronal death, leading to cognitive and functional impairments. ABOS’s leading drug candidate, Sabirnetug, is a monoclonal antibody designed to neutralize AβOs to preserve neuronal health. Sabirnetug’s promising Phase 1 results showed its effective engagement with AβOs and significantly reduced brain amyloid plaques. The market potential for treatments indicated for early AD is approximately 7 million patients. Therefore, if successfully developed and commercialized, ABOS would be well-positioned to capture significant market share. Moreover, the company has a healthy cash runway and seems undervalued relative to its peers. Thus, I believe ABOS is a suitable speculative “buy” for investors who understand the inherent biotech risks.

Sabirnetug: Business Overview

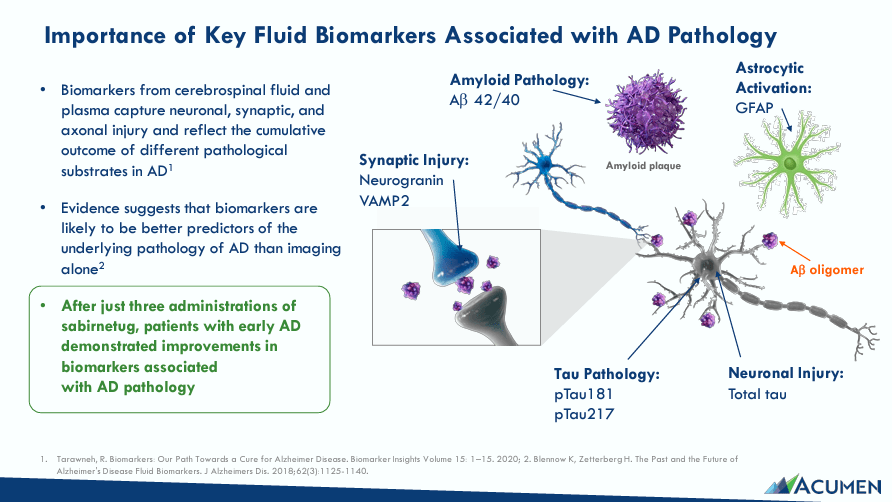

Acumen Pharmaceuticals is a clinical-stage pre-revenues biotech founded in 1996. ABOS officially went public on July 1, 2021, and is currently headquartered in Charlottesville, Virginia. The company develops innovative treatments for Alzheimer’s disease [AD], targeting toxic soluble amyloid-beta oligomers [AβOs], which influence neurodegenerative processes related to AD. AβOs are protein aggregates that accumulate in the brain and are implicated in AD cognitive impairment. Initially, synapses deteriorate, disrupting communication between neurons. AβOs cause tau protein hyper-phosphorylation and are linked to microtubules in neurons. Thus, tau protein hyper-phosphorylation detaches from microtubules and forms tangles in the neurons, leading to neuronal death.

Source: Corporate Presentation. May 2024.

The underlying principle is that AβOs produce inflammation through microglia activation. So, the brain’s immune cells release inflammatory cytokines in response. However, that inflammation further damages neurons and aggravates neurodegeneration. Recent studies show that neutralizing toxic AβOs may slow down or stop these pathological processes, stabilize impaired neurocircuits, and halt cognitive decline.

This is how ABOS’s leading drug candidate works. ABOS’s Sabirnetug (ACU193) is a monoclonal antibody that targets and neutralizes toxic AβOs, preventing them from binding to dendritic spines to preserve neuronal function. Sabirnetug’s intravenous [IV] infusion form is in Phase 2, and a subcutaneous [SC] administration is in Phase 1. Sabirnetug could become the first drug of its kind to initiate clinical trials for early AD, and it recently received the FDA’s Fast Track designation for that indication.

Source: Corporate Presentation. May 2024.

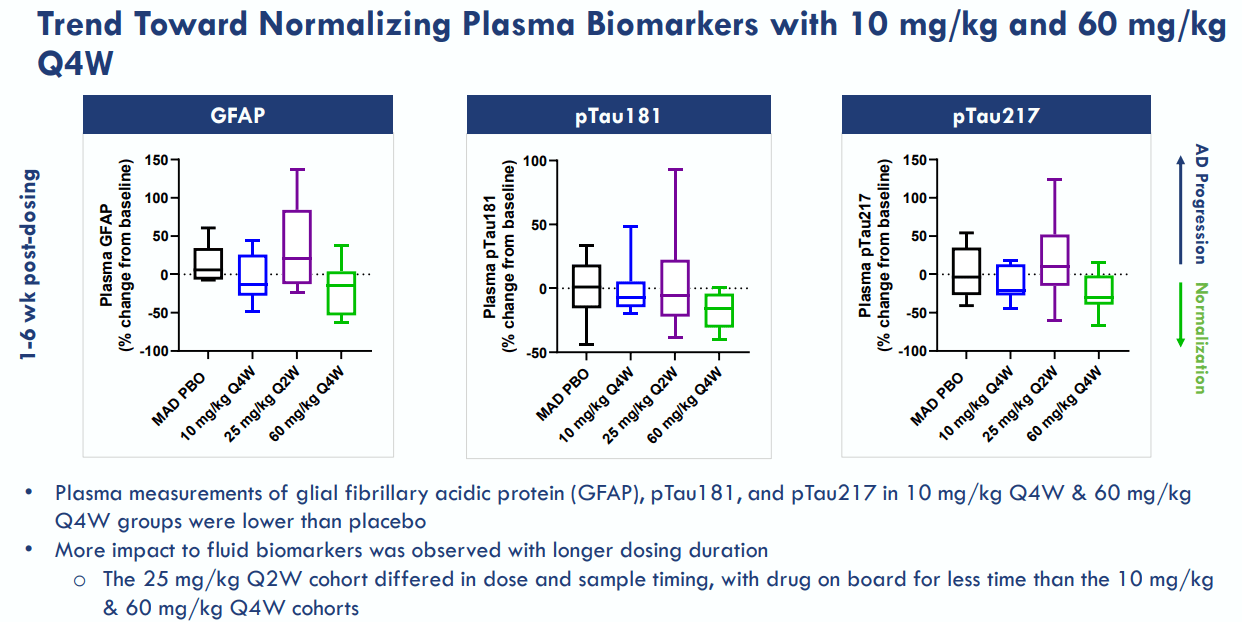

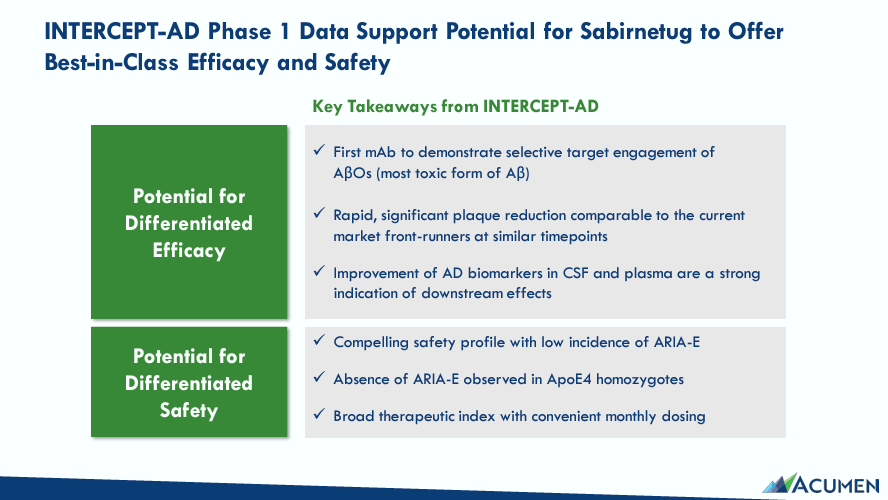

Furthermore, Sabirnetug IV’s Phase 1 trial, INTERCEPT-AD, evaluated the drug’s efficacy and safety profile. INTERCEPT-AD had 62 participants with early AD who received the drug in single-ascending-dose [SAD] of 2, 10, 25, and 60 mg/kg. Later, cohorts received multiple-ascending doses [MAD] of 10, 60, and 25 mg/kg. INTERCEPT-AD’s data corroborated Sabirnetug’s rapid and direct AβOs engagement, leading to decreased brain amyloid plaque load as measured by Positron Emission Tomography [PET]. Interestingly, amyloid plaque reduction after 6-12 weeks compared to baseline in each cohort was statistically significant, with a p-value of 0.01. In theory, these results support Sabirnetug’s action mechanism for AD.

Source: Corporate Presentation. May 2024.

Sabirnetug’s pharmacokinetics [PK] and pharmacodynamics [PD] results from INTERCEPT-AD showed it can bind to brain AβOs. This data potentially further validates its therapeutic mechanism for AD. PK results indicate Sabirnetug is dose-dependent, as the drug’s plasma concentration and cerebrospinal fluid [CSF] increase at higher dosages. Also, increased dosages in targeted engagements indicated a dependable and reproducible effect. Sabirnetug’s administered doses were sufficient to engage and clear AβOs from the brain, indicating effective target interaction in AD patients. This could be a game changer if further corroborated in Phase 2 and 3 trials, paving the way to a potential FDA approval.

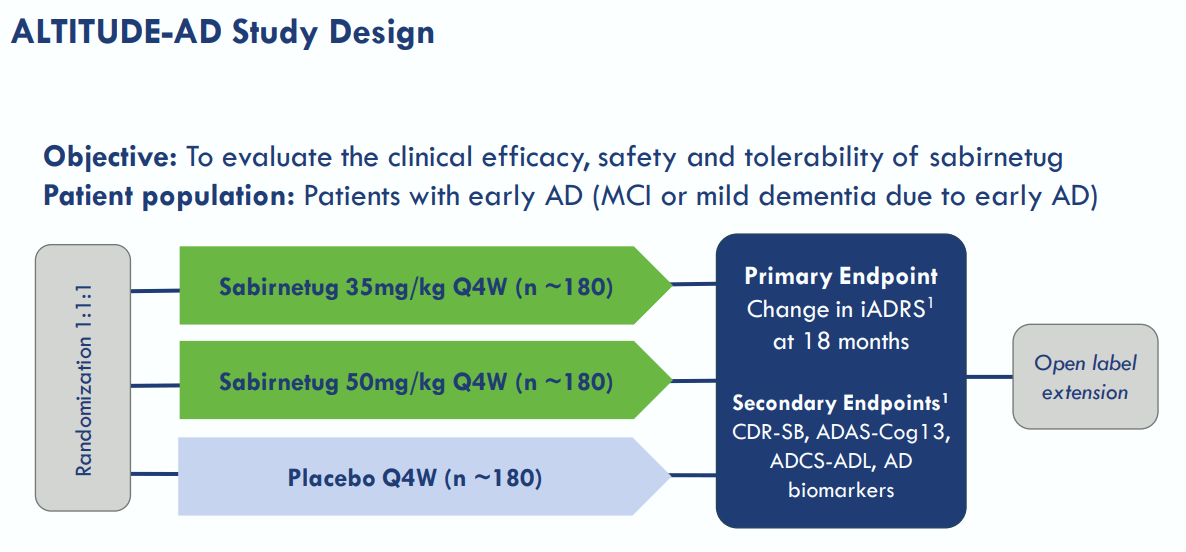

Fast-Tracked: ALTITUDE-AD Phase 2

Today, ABOS is enrolling participants for its new ALTITUDE-AD Phase 2 study, which will evaluate Sabirnetug administered once every four weeks. This trial will measure cognitive and functional deterioration versus placebo. It’s worth highlighting that the first patient dosed in the ALTITUDE-AD trial was reported in May 2024. Also, in April 2024, ABOS signed an agreement with Lonza Group (OTCPK:LZAGY) to manufacture Sabirnetug at its next-generation facility in Portsmouth, New Hampshire. Lonza’s facilities have 2,000-liter disposable single-use bioreactors, vital to Sabirnetug’s production. ABOS can also use Lonza’s network to efficiently scale production from 2,000 liters to up to 20,000 liters, ensuring sufficient production capacity.

Source: Corporate Presentation. May 2024.

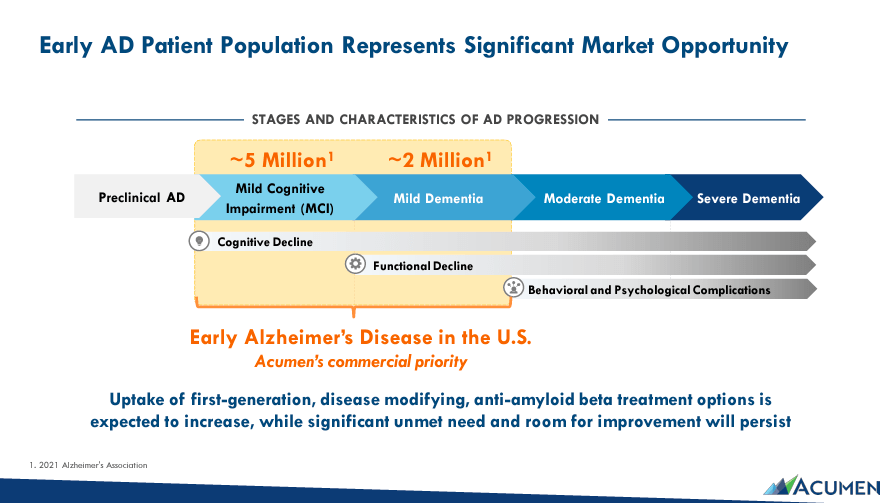

Naturally, ABOS’s market opportunity in early AD in the US is significant. Typically, preclinical AD is mostly asymptomatic. However, it has early underlying pathological processes that gradually degenerate the brain. Eventually, AD reaches its second stage, presenting mild cognitive impairment (MCI), characterized by an observable cognitive decline. However, MCI doesn’t significantly interfere with a patient’s quality of life but can quickly degenerate further from there. Around 5 million individuals are in this second AD stage in the US. After that, AD degenerates into mild dementia, where cognitive decline is pronounced and interferes with daily activities. Approximately 2 million people are in this AD stage in the US.

Unfortunately, AD eventually advances into moderate and severe dementia. These final AD stages include significantly deteriorated cognitive functions like memory, thinking, and reasoning. Patients with advanced AD are affected considerably and have difficulties with daily activities. In that context, ABOS’s strategy is to focus on early AD in the MCI and mild dementia stages. If ABOS can stop early AD from progressing, it could have a meaningful impact, even if it isn’t technically a cure for AD. Therefore, Sabirnetug targets around 7 million US patients, representing a significant opportunity for effective new AD treatments.

Long-Term Bet: Valuation Analysis

From a valuation perspective, ABOS trades at a $209.1 million market cap, making it a microcap biotech company. Its balance sheet holds $46.9 million in cash and equivalents, plus $205.6 million in short-term marketable securities. The total available short-term liquidity is $252.5 million, against $30.2 million in long-term debt maturing in 2026 and 2027. It has $301.0 million in total assets and $38.9 million in total liabilities, leading to a book value of approximately $262.0 million. This means it has a 0.8 P/B, which is evidently cheap. For comparison, the sector’s median P/B is 2.5, implying ABOS is relatively undervalued.

Moreover, I estimate the company’s latest quarterly cash burn was $17.9 million by adding its CFOs and Net CAPEX. This suggests a yearly cash burn rate of $71.6 million. Thus, the cash runway is about 3.5 years, which is quite healthy as it leaves ABOS ample room for maneuvering as needed. However, it’s worth noting that its most advanced research is its Phase 2 ALTITUDE-AD trials, which are still enrolling patients. Also, this study will likely take several years, with an estimated completion date of 2031. Therefore, ABOS would theoretically be several years away from a potential FDA approval.

Source: Corporate Presentation. May 2024.

Nevertheless, ABOS’s ALTITUDE-AD Phase 2 is FDA Fast-Tracked, which I believe means preliminary results could be available within 12-18 months if the study successfully progresses without delays. If ABOS obtains promising Phase 2 data, it could initiate an immediate subsequent Phase 3 trial based on FDA’s feedback. Through its rolling review, it could submit a New Drug Application [NDA] and update it as trial results are received. This could theoretically greatly speed up ABOS’s research and approval prospects, but ultimately, this will take years from today regardless.

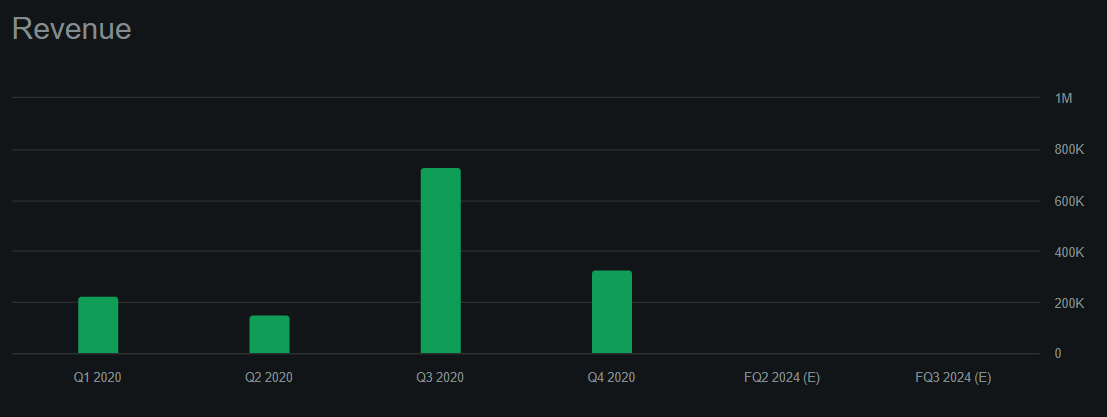

Source: Seeking Alpha.

ABOS remains pre-revenue and will likely stay like that for the foreseeable future. So unless it generates revenues from collaborations or services, it’ll likely have to tap into the capital markets again after a few years. However, depending on how promising its trial data is in its new Phase 2 trial, the stock could be higher by then, mitigating the related dilution impact. Hence, ABOS’s financials and revenue prospects, coupled with the relatively early stages of research, somewhat temper my optimism about the stock. But, given its fast-track designation, I have to lean on the bullish side, which is why I rate it a speculative “buy” for long-term investors.

Investment Caveats: Risk Analysis

Nevertheless, ABOS is inherently a highly speculative investment at this juncture and shouldn’t represent a major portion of your portfolio. ABOS’s research remains in relatively early stages, and according to the Phase 2 study details, it could end by 2031. I assume its fast-track designation could speed up this process, but that largely depends on how effective Sabirnetug is in more rigorous trials across all of its endpoints. After all, it’s not guaranteed that Sabirnetug will be as effective as it appeared in early trials. If subsequent testing reveals disappointing results, it would undoubtedly hit the stock price, leading to considerable shareholder losses. This would be a double-whammy for ABOS because it could imply a higher dilution impact if it needs to raise additional capital after obtaining those results.

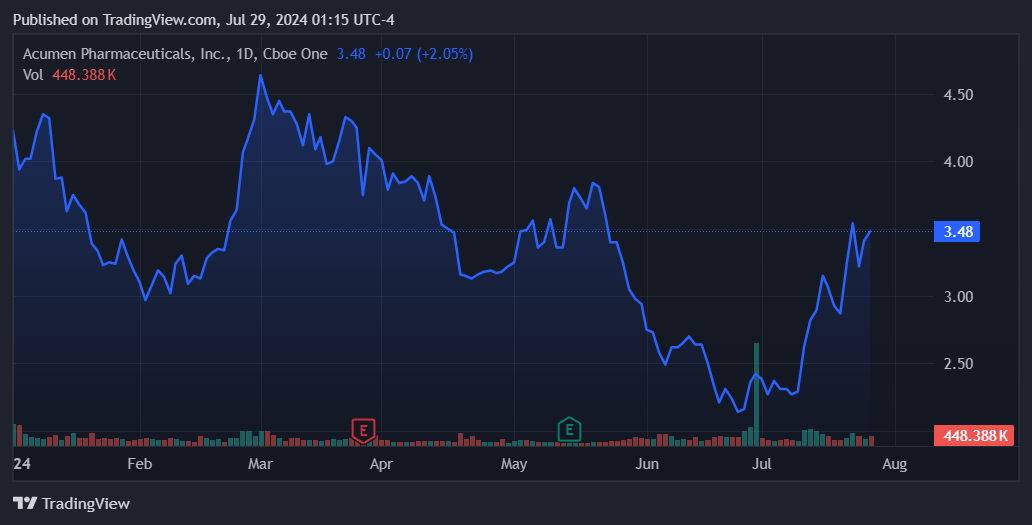

Source: TradingView.

My current cash runway estimate of 3.5 years is reassuring, as I believe the company should be able to report positive updates within 12-18 months. However, investors must look out for the typical red flags of not disclosing results as they come in, which may imply that they might not be as good as initially expected. Moreover, it’s important to remember that AD is a notably tricky multifactorial disease, and it’s possible that Sabirnetug’s mechanism of action doesn’t address all of AD’s causes. So, despite potentially being effective at its clinical endpoints, Sabirnetug might still not be effective against early AD in the long run. Nevertheless, based on the clinical data available today, I believe there’s a reasonable case for Sabirnetug. AD is a huge market, and if Sabirnetug is validated as a viable treatment for early AD, it could unlock enormous shareholder value. Therefore, I think the risks are justified if investors size their investments accordingly.

Speculative Buy: Conclusion

Overall, ABOS is a promising biotech that attempts to halt early AD progression with its leading drug candidate, Sabirnetug. Early clinical trials have shown that Sabirnetug addresses known early indicators of AD, implying that if it targets them, it can halt the disease’s progression. In theory, if Sabirnetug is successful, it could unlock an enormous market and address a critically unmet need despite not being technically a cure for AD. ABOS also seems undervalued relative to peers and should have enough cash to carry out Phase 2 trials for Sabirnetug. In my view, this combination makes ABOS a reasonably good “buy” for investors who understand its highly speculative nature.

Read the full article here