Investment Thesis

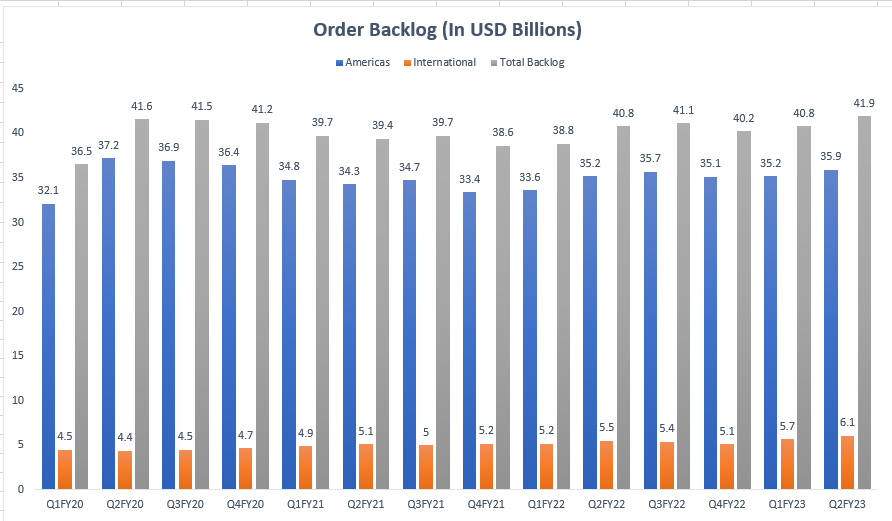

AECOM (NYSE:ACM) is well-positioned to sustain its impressive revenue and margin growth in the foreseeable future. The company’s revenue growth is expected to be boosted by several factors. Firstly, it benefits from a robust backlog of projects, totaling $41.9 billion as of the end of Q2 FY23. Additionally, AECOM is experiencing an increased rate of project wins, and the composition of its backlog is improving due to a rise in higher-value long-term projects worth $25 million or more. Furthermore, the company is poised to capitalize on multi-year demand trends driven by ongoing global investments in infrastructure, sustainability, resilience, and long-term transitions in the supply chain and energy sectors. Notable initiatives contributing to this demand include the Infrastructure Investment and Job Act (IIJA), the Inflation Reduction Act (IRA), and various other infrastructure investment programs worldwide.

The company’s margins are expected to benefit from effective project execution and a higher proportion of higher-margin projects in the backlog. Additionally, AECOM anticipates achieving efficiency gains, which should further enhance its margins. AECOM’s valuation is also reasonable and the company trades at a significant discount compared to its peer, Tetra Tech (TTEK). Considering the favorable prospects for revenue growth and margin expansion, and a reasonable valuation, AECOM’s stock provides an attractive investment opportunity.

Revenue Analysis and Outlook

In my previous article in February, I shared a positive outlook on AECOM’s revenue growth prospects, driven by strong demand and increased infrastructure investment initiatives such as the IIJA and IRA. Since then, the company has released its earnings report for the second quarter of fiscal 2023, which reaffirmed these positive dynamics.

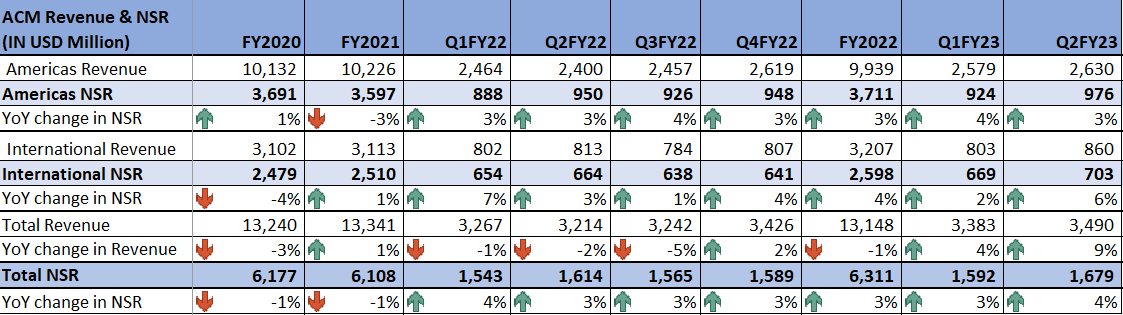

During the second quarter of fiscal 2023, AECOM experienced an acceleration in government funding, which further bolstered the demand in the end market. The company’s revenue growth was also supported by effective backlog execution and a high rate of project wins in the design business. As a result, there was a 9% year-over-year increase in revenue, reaching $3.4 billion. Net Service Revenue (NSR) also exhibited growth, rising by 7% year-over-year on a constant currency basis. The NSR growth primarily reflects an 8% year-over-year increase in the design business, which accounts for 90% of the total NSR. Total NSR, including the impact of currency headwind, was up ~4% YoY.

Despite the company beating sell-side estimates in the quarter, if we look at the stock’s performance it has seen a mid-single-digit decrease since posting its all-time high in mid-February. The reason behind this underperformance is likely investors’ worry about the slowing commercial Real estate market where AECOM has some exposure. I believe this fear is unwarranted as accelerating Federal spending should more than offset any slowdown in CRE markets. In the last quarter, the company reported a solid book-to-bill ratio of 1.5x in the design business which indicates a good demand environment.

AECOM’s Historical Revenue and NSR (Company Data, GS Analytics Research)

Looking ahead, AECOM is well-positioned to maintain its strong revenue growth due to several factors, including a robust backlog, favorable secular demand trends, and federal funding support.

A company’s backlog is a good indicator of its future revenue growth, and AECOM has a healthy level of backlog that supports its future performance. In the second quarter of fiscal 2023, the company’s backlog increased by 3% year-over-year, reaching $41.9 billion, with growth observed in both its Americas and International business segments. Notably, the design business, which accounts for approximately 90% of the total net service revenue, experienced a 10.5% year-over-year growth in its backlog, or 12% year-over-year on a constant currency basis, reaching approximately $20.9 billion. Moreover, the company has been successful in winning more than half of every dollar it bids, with an even higher success rate of over 70% on large global bids in the first half of the year. This success has resulted in a transformation in the composition of the backlog, with long-term projects valued at $25 million or more, now comprising 30% of the backlog, more than double the level from just a few years ago. These robust backlog levels and increased win rates for large projects provide a solid foundation for sustained revenue growth in the future.

AECOM’s Order Backlog (Company Data, GS Analytics Research)

Furthermore, AECOM’s end markets are poised for continued growth, supported by secular demand trends in global infrastructure investment, sustainability and resilience, and long-term transitions in supply chains and energy.

Governments worldwide, particularly in developed countries like the U.S., have intensified their focus on addressing aging and overloaded infrastructure. This has led to increased infrastructure stimulus programs aimed at modernizing and upgrading infrastructure systems to ensure safety and efficiency. AECOM has already witnessed the acceleration of government funding flow, including initiatives such as the IIJA, IRA, and the CHIPs and Science Act. These funding initiatives have expanded the pipeline of opportunities and supported backlog growth, and the company anticipates these investments to continue increasing for the next few years, providing a favorable medium-term outlook for demand.

The demand for infrastructure projects has also been driven by the urgent need to address the adverse effects of climate change. There is a growing emphasis on climate resiliency and sustainability projects globally, aimed at mitigating the impact of climate change and ensuring the long-term viability of infrastructure. Moreover, there is an increasing emphasis on energy transition and sustainability, with rising demand for renewable sources of power generation and environmental protection measures. The reshoring of manufacturing in the United States, driven by supply chain challenges post-COVID, has further increased demand across various end markets.

These demand trends have translated into significant project wins for AECOM in recent quarters. For instance, the company secured contracts for PFAS remedial investigation and feasibility studies for the U.S. Army National Guard, and management expects additional opportunities arising from IIJA funding for emerging contaminants like PFAS. The management recently shared their estimates on PFAS market size in an investor presentation where they characterized it as a multi-billion dollar opportunity. AECOM was also chosen to provide technical and program management services for a large wastewater treatment program in California, reflecting the growing demand for climate resiliency and sustainable solutions. Additionally, the company was selected by the US Department of Energy’s Office of Clean Energy and Demonstrations to leverage its expertise in securing competitive grants for new clean energy solutions under the IIJA. The company’s contract with the city of Rialto to develop a comprehensive microgrid solution for a wastewater treatment plant and the major bridge replacement project on an Eastern U.S. railway line, where IIJA funding played a crucial role, further demonstrates the company’s strong position to benefit from government funding.

Considering these demand trends and the related government funding, AECOM is well-positioned to achieve backlog growth in the coming years, supporting its revenue growth. Additionally, the company has strategically reduced its exposure in the commercial real estate market over the past five years and diversified into markets such as logistics, freight, distribution, aviation, and energy and water utilities. This diversification strategy helps offset the potential slowdown in commercial real estate markets and contributes to overall revenue growth. Consequently, I maintain a positive outlook on AECOM’s revenue growth prospects moving forward.

Margin Analysis and Outlook

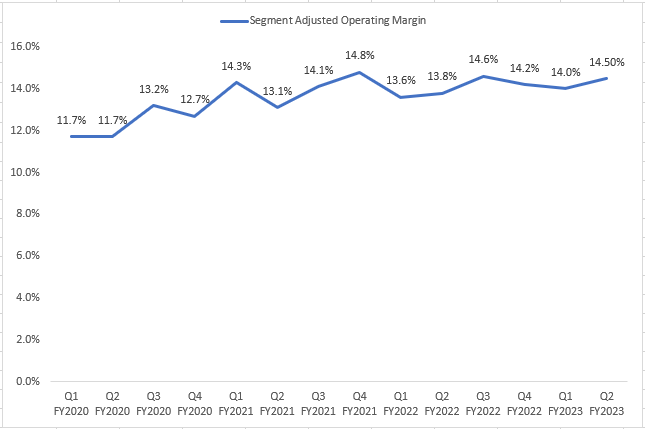

In the second quarter of fiscal 2023, the segment-adjusted operating margin improved by 60 basis points year-over-year to reach 14.5%. This improvement was driven by efficiency gains, successful execution of backlog orders, and a favorable composition of high-margin projects in backlog. The margin expansion was further supported by growth in both the Americas and International segments. Specifically, in the Americas segment, the adjusted operating margin increased by 100 basis points year-over-year to reach 18.7%. Similarly, in the international segment, the adjusted operating margin increased by 30 basis points year-over-year to reach 8.6%.

AECOM’s Historical Segment Adjusted Operating Margin (Company Data, GS Analytics Research)

Looking ahead, I expect the company to see continued margin expansion. AECOM has demonstrated discipline in selecting projects for its backlog, prioritizing those with higher margins and lower risk. According to management, this strategic approach has led to a 30% to 40% increase in margins within the backlog over the past three years, and the company is witnessing continued improvement in the trajectory of high-margin backlog growth. Management has also expressed confidence in achieving double-digit margins in the international business in the next fiscal year, despite foreign exchange headwinds. This is attributed to securing large project wins with better margin profiles than before. These developments are expected to contribute to overall margin growth going forward.

Additionally, the company is actively working on enhancing operational efficiency. Investments in digital tools enable existing professionals to focus on high-value tasks, resulting in increased capacity and improved efficiency. This focus on efficiency is anticipated to further support margin expansion in the future. Considering these factors, I maintain an optimistic outlook on the company’s margin growth prospects.

Valuation and Conclusion

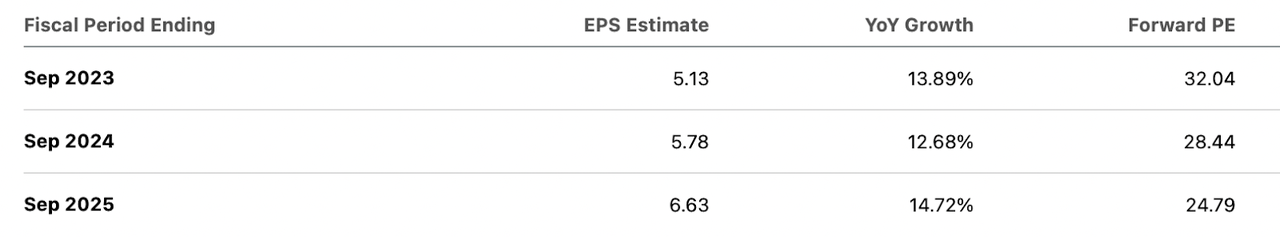

ACM is currently trading at a price-to-earnings (P/E) multiple of 22.73x the FY23 consensus EPS estimate of $3.75 and 19.34x the FY24 consensus estimate of $4.40. In comparison, its peer Tetra Tech is trading at a P/E of 32.04x the FY23 consensus estimate of $5.13 and 28.44x FY24 P/E of $5.78. While the EPS growth rate for ACM is lower than TTEK in the current year, for the next two years ACM is expected to grow its EPS at a faster pace. This suggests that ACM is relatively cheaper in terms of valuation.

ACM Consensus EPS Estimates, Growth Rate and Valuations (Seeking Alpha) TTEK Consensus EPS Estimates, Growth Rate and P/E (Seeking Alpha )

ACM has promising long-term growth prospects, driven by factors such as a healthy backlog, improved win rates, favorable backlog composition with large and high-margin projects, ongoing demand trends, and potential federal infrastructure funding. Furthermore, the company’s efforts to enhance backlog composition and improve efficiency are expected to support margin expansion.

Considering these factors, I believe ACM presents a good buying opportunity and has the potential to outperform the market.

Read the full article here