Summary

In my previous coverage (in May’23), I recommended a buy rating as I saw a path for AGCO (NYSE:AGCO) earnings and revenue to continue growing, supported by the strong industry tailwind. I also believed that management FY23 revised sales guidance was management signaling higher volume. Since my last update, the stock performed as expected initially, with the share price inching upwards to $140. The reduction in share price since $140 to the current $120 were, I believe, largely due to the market being concern that the cycle has peaked. This post is to provide an update on my thoughts on the business and stock. I reiterate my buy rating for AGCO as order books remain very healthy, providing strong visibility for the near-term outlook.

Investment thesis

AGCO reported on October 31st 3Q net sales growth of 11% to $3.5 billion, in which NA (North America) sales grew 3%, SA (South America) grew 26%, and EME (Europe/Middle East) grew 14%. Consolidated EBIT margin increased to 12.6% at $436 million, which led to an increase in adjusted EPS to $3.97, beating consensus estimate of $3.32. With the better-than-expected 3Q results, management raised 2023 adjusted EPS guidance to $15.75, a 3.2% increase vs. the prior guide. The revised earnings guidance is driven by an unchanged FY23 net sales guide of $14.7 billion, or 16% growth, and EBIT of $1.8 billion. The 2023 guidance implies 4Q net sales to increase by 5% to $4.1 billion, EBIT to come in at $457 million at a margin of 11.2%, and EPS of $3.99.

In my view, AGCO 3Q23 results were strong when I consider the macro situation. That said, growth has certainly slowed down from the 20+% saw in the past 2 quarters, which I believed might have added to the negative sentiment as growth has decelerated quite significantly. However, note that the past few quarters (FY21 and FY22) were abnormal years, and it is unlikely for AGCO to grow at 20+% for a prolonged period of time. Beyond FY23, AGCO should continue to see growth normalization, and long-term growth will continue to be supported industry tailwinds.

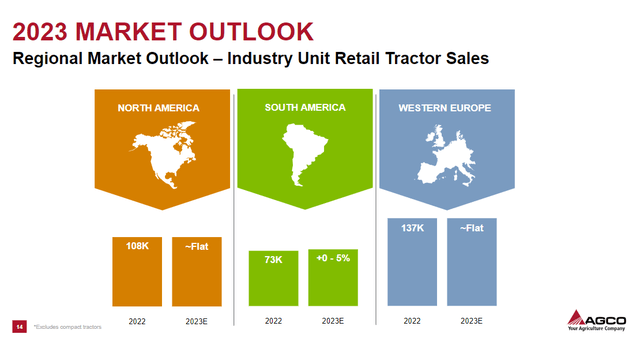

4Q22 earnings results ppt

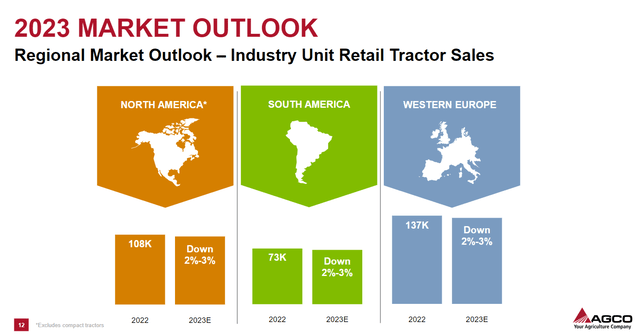

3Q23 earnings results ppt

Despite the strong result, the stock did not react in a major positive way. I believe the reason was due to the weakened market outlook. In the 4Q22 earnings presentation, management outlook for FY23 was flattish with potential growth in SA. This outlook lasted for the past 2 quarters until 3Q23, when management revised their outlook for a decline across all regions. In my opinion, this is a massive change in sentiment that might have spooked several investors. I would not go into the exact details for each reason, as readers can find them in the latest earnings call. At a high level, demand for small tractors in North America is low, in large part because of high interest rates and sluggish economic growth. The outlook is bleak in Western Europe because of the negative effect that rising input prices and the ongoing conflict in Ukraine have had on farmer morale. In South America, retail sales dropped as a result of the end of a loan subsidy program in Brazil.

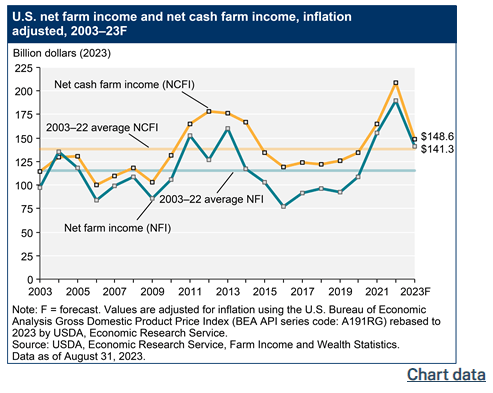

I believe the situation is not as dire as it seems. First of all, we are not at the peak of the cycle yet. In the call, management mentioned that we are still in mid-cycle. While lower crop prices are impacting farmer sentiment, note that profitability is their key metric and not revenue for the farmers. Input costs have come down since their peak, which suggests that profitability is not as heavily impacted as it seems. On the contrary, data from the USDA suggests that farmers’ incomes are expected to remain above average. The pushback here is the profits have fallen sharply from last year. I see this as part of the profit cycle (refer to chart below), only that it is elevated due to the abnormal last year stemmed from the Russia/Ukraine war which drove commodity prices to extreme levels.

“And third, input costs such as fuel and fertilizer are down from their peaks last year. We expect farm income to be down modestly in 2023 from the record levels of 2022.” 3Q23 earnings results call

USDA

The AGCO order book is a clear indication of the farmers’ willingness to invest. I think the AGCO has a pretty visible near-term outlook as number of orders is a key part of the growth equation.

- In North America, AGCO’s order backlog for both large and small agriculture is about seven months, and FY24 orders for planters, tractors, and application equipment are completely booked.

- In Europe, AGCO has around 6 months of coverage

- In SA, order books remain very strong, with orders filled through year-end. Note that AGCO continues to limit orders to one quarter in advance in the region, which means underlying demand could be stronger than what the backlog suggests (i.e., the order book is intentionally limited).

Dealer inventories are leveling off across regions, a positive sign for AGCO’s business as a whole. As farmers in South America regain faith in the availability of their crops, stockpiles are returning to normal. In North America, suppliers have enough stock to last for 6 months, but in Europe, they only have enough for 4. Used equipment prices for items like NA 175-300HP tractors continue to be high, which is indicative of a thriving market. Aside dealer inventories, pricing is also showing positive signs of normalization, as management’s full-year guidance of an 8% price tailwind implies 4Q pricing to be roughly 2%. This is a significant slowdown from the 9% pricing growth seen in 3Q23. At 2%, it falls within the normal range of 2–3%. While some investors might say that lowered pricing growth is bad, I think it is net positive as it reduces the urge to oversupply the market (high prices attract more supply) and also farmers will be able to better afford machines/investments.

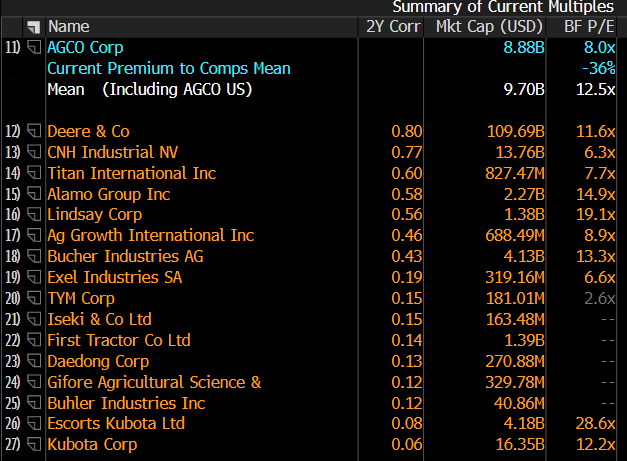

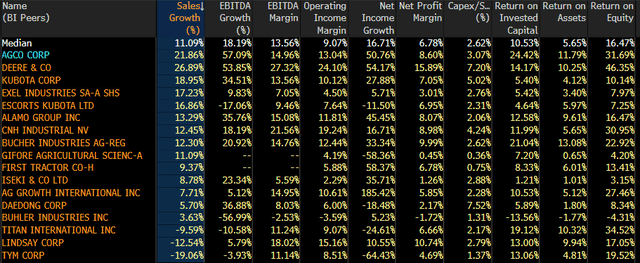

Valuation

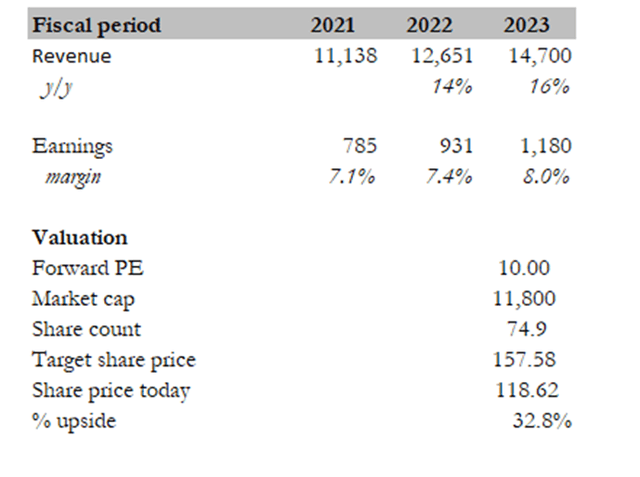

Own calculation

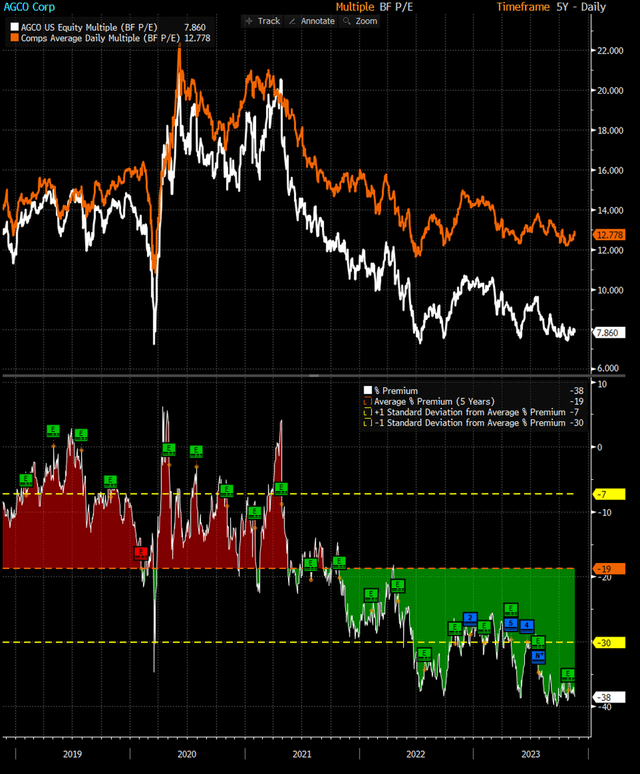

My target price for AGCO, based on my model, is ~$160. My model assumptions are that AGCO will meet its FY23 guidance given the strong order book outlook and favorable conditions. Previously, I wrote that AGCO was trading at 9x forward PE, which granted investors a good margin of safety. This logic still stands today as the valuation has dropped by 1x to 8x forward PE. With the visibility in bookings, operating metrics outperformance vs peers, and dealers’ inventories easing, I expect valuation to move upwards towards peers level. Hence, I expect the main upside for the stock to come from valuation improving to the peer’s level. AGCO current forward earnings multiple is 4x below peers and near its all-time low over its own trading history. I believe the discount is unwarranted. I expect AGCO multiples to improve to 10x PE, the midpoint of AGCO current multiples and peers’ average, in the near-term, and possibly reaching peers’ level over time (which AGCO used to trade in line pre-covid). I note that 10x is 1 standard deviation below the AGCO historical average.

Bloomberg

Bloomberg

Bloomberg

Risk

The bear case for AGCO is that in the near term, weak farmer sentiment, stemming from concern that crop prices will fall further, may continue to limit growth (albeit my positive view that farmers are still profitable). A severe slowdown in the broader European economy may further weigh on farmer sentiment and equipment purchases in the region. Both of which will impact demand for AGCO machines. At the macro level, conflict across the world is a risk. Over the past 24 months, there have been increasing conflicts between countries across the world, each with increasing intensity (Ukraine vs Russia, China vs Taiwan, Israel vs Hamas). The indirect result from more conflicts is higher commodity price, which hurts AGCO as farmers profitability get decimated.

Given these risks, the investment opportunity exists as I believe the stock valuation has already priced in these risks.

Conclusion

My buy recommendation for AGCO remains the same due to its robust order book visibility. Despite a subdued stock reaction post-earnings, AGCO’s 3Q results were great, with improved EPS guidance for 2023. While sales outlook across region have dampened, I believe the current situation isn’t as dire as perceived, considering we’re still in a mid-cycle phase. AGCO’s order backlog in all regions indicates sustained farmer interest, mitigating concerns over short-term sentiment fluctuations. Notably, improving dealer inventories and normalized pricing trends signify a healthy market.

Read the full article here