Introduction

I reaffirm my Buy rating on Koninklijke Ahold Delhaize N.V. shares (OTCQX:ADRNY) following the company’s Q3 results, which beat expectations despite the company facing significant headwinds. However, despite some margin weakness and a slowdown in top-line growth, my bullish thesis remains unchanged. I continue to view Ahold as an excellent defensive opportunity, offering resilience in a potential downturn and consistent sales and EPS growth.

For those unfamiliar with the company, the following information might be useful:

Koninklijke Ahold Delhaize N.V. is a global corporation that operates various supermarket chains, online grocery platforms, liquor stores, and the well-known European e-commerce company Bol.com, offering an alternative to Amazon.com. With a diverse portfolio of 21 brands, the company has established its presence in over 11 countries across Europe and the United States. In terms of revenue, approximately 60% is generated from the U.S., while the remaining 40% originates from Europe, primarily from The Netherlands and Belgium.

Ahold Delhaize food brands (Ahold Delhaize)

It has been a while since I last covered Ahold. My last coverage of the shares on Seeking Alpha was back in May, right after the Q1 result, when I rated the shares a Buy. This was what I concluded back then:

Overall, there were not many surprises in the earnings report, which for a defensive holding like Ahold is exactly how you want these reports to be. As a result, my investment thesis from before and, as explained in the introduction of this article has not changed, and I remain bullish on the shares. The company is in a great position to deliver consistent growth over the next several years. This, combined with share buybacks and steady dividends, should ensure decent shareholder returns.

However, while I remained bullish on the shares from a long-term growth perspective, these have significantly underperformed global indices since, as previous tailwinds turned into headwinds, and the company is struggling with the persistently high inflation and rising rates impacting consumer spending health.

These struggles were clearly reflected in the Q3 results presented by the company earlier this week, and shares declined 6.5% in the following trading session in response, meaning these are now down 16% since May, which, considering this is a very defensive holding, is significant. Furthermore, shares declined heavily following the Q3 results despite Ahold actually beating analysts’ expectations with revenue in line, higher margins, and an upgraded FY23 FCF outlook. The company also increased the dividend by 6.5%, which still could not satisfy investors.

Ahold is facing FX headwinds and weakening consumer spending power but still performs relatively well

Ahold reported Q3 net sales of €21.9 billion, down 2.1% YoY. This is a significant slowdown from the 9.4% growth reported in Q1 and 2.9% growth in Q2. However, this is essentially the result of the currency tailwind that has boosted Ahold’s results over the last year, with the company deriving the majority of its revenues from the US, turning into a headwind with the Euro strengthening compared to a year ago. Excluding this currency impact, revenue was up 2.9% YoY.

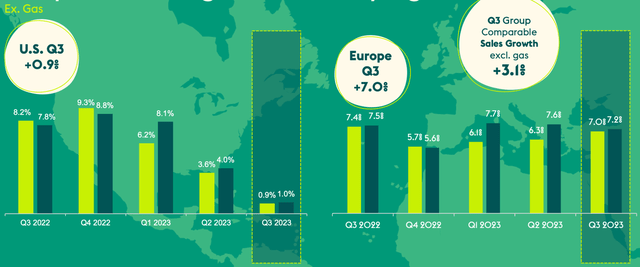

This was driven by Q3 comparable store sales growth of 3.1%, driven by 0.9% growth in the US and 7% in Europe. The US comparable store sales growth, the main driver of growth over the last two years, has slowed down significantly over recent quarters. Meanwhile, comparable store sales growth in Europe remains much more resilient, even amid quite some pressure on consumer spending power.

U.S. and Europe growth rates YoY (Ahold Delhaize)

US net sales came in at €13.6 billion, meaning it still accounts for 62% of group revenue. Even as growth in the US slows, the potential for Ahold in this market remains meaningful, and the company’s underlying operational performance is solid. Efforts in building out its omnichannel model in the country are paying off, highlighted by 19% YoY growth in online traffic in Q3 and the number of omnichannel customers, which are the most profitable ones, growing 8% YoY. As a result, Food Lion has now grown sales for 44 consecutive quarters, and Ahold has gained market share in 28 of the last 30 quarters with its entire US operations.

European net sales were €8.3 billion. The strong relative YoY performance of the European segment was supported by a strong performance in the company’s Benelux alternative to Amazon (AMZN) – Bol – which reported GMV of €1.4 billion, up 10.5% YoY, driven by 48% growth in advertising revenue. This brought the group’s total online sales to €2.8 billion, up 6.4% YoY in constant currency.

Ahold also, last month, announced the acquisition of local Romanian supermarket chain Profi for €1.8 billion or 7x EBITDA. This should not impact the capital allocation strategy and will most likely increase the debt position to 2.2x EBITDA from 2x.

Meanwhile, this acquisition will more than double the size of Ahold’s existing Romanian business, which operates under the Mega Image brand and has 969 stores. The Profi acquisition adds another 1654 stores to this total and gives the company greater exposure throughout the country. The acquisition adds €2.5 billion in net sales going by the last twelve months.

I must say I am quite happy with this acquisition. I don’t believe the price Ahold is paying is that high. Meanwhile, it adds significantly to the company’s footprint in Romania, a highly interesting market due to the growing wealth in the country. The acquisition is expected to be sales growth and EBIT margin accretive post synergies and EPS accretive to Ahold Delhaize as a group in the first year after closing.

Overall, I believe growing exposure in Romania is a good move and could boost revenue growth in the medium term. Furthermore, the business currently reports an EBIT margin above that of Ahold’s European business, making it a great addition in terms of profitability.

Ahold is facing weakening margins in the US, impacting the bottom line performance

Moving to the bottom line, we can see that this is where Ahold is struggling more today, in part due to the currency headwind impact on the top-line results but also due to one-off impacts and higher operating costs.

Still, the company reported an operating margin of 4.1%, which beat analysts’ expectations by 20 basis points. The underlying operating margin was 3.8%, down 60 basis points YoY, driven by one-off insurance-related adjustments and higher operating costs in the US as a result of wage inflation.

The US underlying operating margin was down 80 basis points YoY but still was quite strong at 4.2%. Furthermore, the modest margin pressure we are seeing for this region is expected to be transitory and should pass in a few quarters’ time. Therefore, the long-term outlook here remains unchanged, and apart from being a top-line growth driver for Ahold, the US operations should also continue to boost the bottom-line performance.

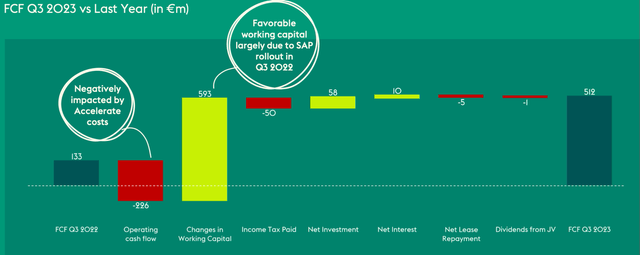

Europe’s underlying operating margin was 3.5% and flat YoY. Strong cost control offset the impact of the Belgian transformation and energy and wage inflation in many of its markets. Still, the slight margin weakness as a result of higher costs and FX headwinds drove EPS down 17.1% YoY to €0.58. Q3 free cash flow was €512 million, up from €133 million one year ago.

FCF YoY changes (Ahold Delhaize)

With current headwinds expected to be transitory and US margins expected to rebound in a few quarters’ time, management remains committed to its goal of consistently achieving an underlying operating margin of at least 4%. Driven by the belief that margins should recover quickly and the very strong FCF reported in Q3, management also announced a new share buyback program amounting to €1 billion to start at the beginning of 2024.

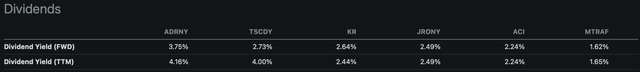

Furthermore, following the 16% share price drop, the dividend yield has increased back toward the 4% mark, making it one of the best-yielding shares among peers. Management continues to target a 40-50% payout range and currently sits comfortably within that range at around 40%, making the dividend very safe and sustainable. This adds to the attractiveness of the shares.

Dividend comparison (Seeking Alpha)

Outlook & valuation – Is Ahold a buy, sell, or hold?

Following the Q3 results, management largely maintained its FY23 outlook. However, it did upgrade its FCF expectations and now expects to report free cash flow in a range of €2.2 billion to €2.4 billion (from a range from €2.0 billion to €2.2 billion) but expects underlying EPS to come in slightly worse at below 2022 levels, whereas this was previously expected to be in line. The operating margin is still expected to be above 4%.

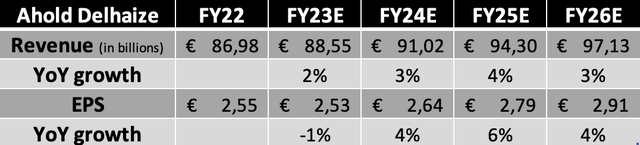

Following the Q2 and Q3 results, business developments, and revised FY23 guidance, I slightly lowered my FY23 and FY24 expectations based on persisting currency headwinds in Q4 and the first half of FY24. Furthermore, US margins will most likely remain suppressed through the first half of FY24. Still, I remain bullish on the company’s long-term prospects and believe it should be able to drive solid sales growth through the end of the decade. I now expect the following financial results through FY26.

Financial projections (By author)

Based on these estimates, shares now trade at a forward P/E of 10.6x, which is a 13.6% discount to the 5-year average but still a slight premium to the peer average. However, considering the company’s strong market positions in both the US and Europe, its strong financial profile, and superior dividend yield, I believe the premium is more than justified.

I would argue that a 12x multiple, which is still a discount to historical averages, would be fair for this business, even when factoring in the risk of a recession and continued weakness. Based on a 12x P/E multiple and my FY24 EPS projection, I calculate a price target of €32 per share, leaving investors with 19% upside potential over the next 14 months or close to 23% when factoring in the dividend.

Therefore, I believe that Ahold shares today, following two quarters of solid financial results and a 16% drop in the share price, offer an excellent opportunity to investors. I believe Ahold remains an excellent defensive opportunity, offering resilience in a potential downturn and consistent sales and EPS growth. Based on my FY26 EPS projection, I believe investors can expect annual returns exceeding 8% or double-digit returns when including dividends.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here