On our last coverage of Altria Group, Inc. (NYSE:MO) we pointed out the bull case was being undermined by a bunch of quitters. Investors were too drunk on the dividend hike to care, and the stock glided higher.

Seeking Alpha

Q1-2024 results came out and gave everyone another opportunity to focus on the facts. Will you take it? Let’s find out.

Q1-2024

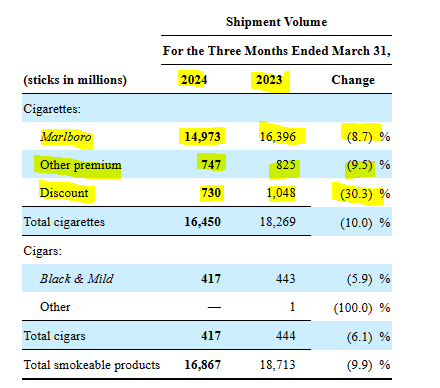

The stick figures that mattered, once again came in looking like what Altria product consumers look like after 30 years. The declines would be funny if they were not predictable. Marlboro dropped by about 8.7% and the “other premium” category almost made it to double digits. Discount segment once again took the crown for the hosting the category of people gaining health consciousness at the fastest pace.

Altria Q1-2024 10-Q

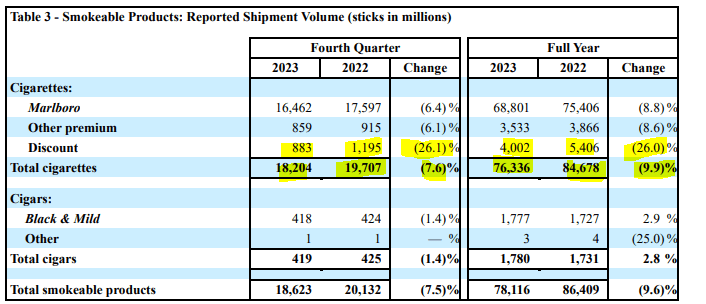

30.3% annual decline? That is mind-blowing. This decline rate actually accelerated from Q4-2023 where it was already looking ominous.

Altria 2023 10-K

Let’s drop the year-over-year charade for just one second. Discount segment declined by 17.5% in one quarter. Yes, we get that it is small out of the total. But we believe this is a preview of what is coming on top in the premium segment as well. It is possible that no one bothers to look past the numbers shown in the presentation.

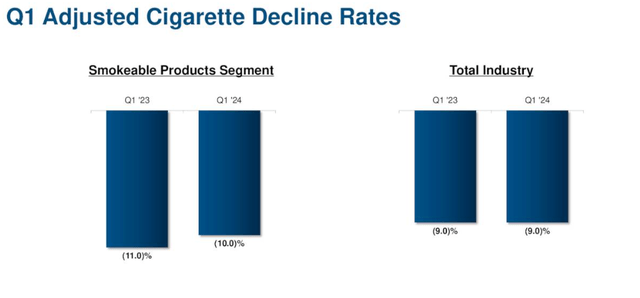

Altria Q1-2024 Presentation

But even that 10% decline rate should merit attention.

How did Altria handle all of these declines? With a smile. Well, with a smile and another big price hike.

Effective January 14, 2024, PM USA increased the list price of Marlboro (excluding Mainline Menthol and 72s Menthol), L&M and Basic by $0.15 per pack. PM USA also increased the list price of all its other cigarette brands by $0.20 per pack.

In addition:

▪Effective April 14, 2024, PM USA increased the list price of Marlboro (excluding Mainline Menthol and 72s Menthol), L&M and Basic by $0.20 per pack. PM USA also increased the list price of all its other cigarette brands by $0.25 per pack.

▪Effective April 21, 2024, Middleton increased various list prices across substantially all of its cigar brands resulting in a weighted-average increase of approximately $0.16 per five-pack.

Source: Altria Q1-2024 10-Q

These hikes are part of every quarter of MO’s strategy. Basically everyone in charge comes back every couple of months and then come to the conclusion that pretty much all they can do at this point is keep hiking prices and hope the theory that cigarette prices are low in US holds. But as we are seeing, that theory, is not working. Declines are accelerating and feedback loop from prices is the key factor. This is a one-way ticket as well. The ones that quit are not coming back if Altria lowers prices. But the most interesting aspect of these price hikes is that they are not working to keep revenues stable.

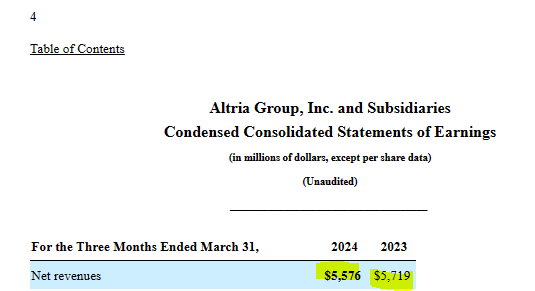

Altria Q1-2024 10-Q

Imagine that. People are quitting so quickly that even such large scale hikes cannot keep revenues constant.

Federal, state and local cigarette excise taxes have increased substantially over the past two decades, far outpacing the rate of inflation. Between the end of 1998 and April 22, 2024, the weighted-average state cigarette excise tax increased from $0.36 to $1.90 per pack. Only one state, New York, enacted new legislation increasing excise taxes in 2023. As of April 22, 2024, no states have enacted excise tax increases in 2024. However, various increases are under consideration or have been proposed.

Source: Altria Q1-2024 10-Q

We have also not witnessed excise tax hikes recently. In the next recession, they will be coming fast and furious.

Verdict & Why We Prefer Another Name

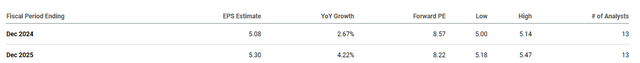

The recent additional declines in cigarette sticks sold and the modest price appreciation have made Altria expensive. Sure, the investors get excited over the dividends but any new incoming investor has to know that this decline will have repercussions. It is a matter of time until we see a reverse network effect as more and more smokers find themselves as the one only one running to take a smoke break. Wall Street remains asleep on this risk with everyone forecasting an increase in earnings per share.

Seeking Alpha

We see this as too dangerous a bet to make at least at the US level where declines trend are accelerating. We are keeping our “buy-under” price for Altria at $32.50 and will likely reduce it further if declines stay at current trends for another year.

We want to briefly touch upon our thesis as to why we prefer British American Tobacco p.l.c. (BTI) relative to MO. As a cigarette maker, BTI also has a tough slog with a declining market. But there are two key differences. The first being that BTI’s decline rates are far gentler. BTI’s global base shows modest declines and you can see this in their 2024 outlook. Pricing should allow them to offset this easily.

2024 Outlook – Global tobacco industry volume expected to be down 3% mainly due to the U.S. and Indonesia.

Low-single figure organic revenue growth and continued progress towards our 2025 £5 billion New Category revenue ambition

Source: BTI Annual Presentation (emphasis ours)

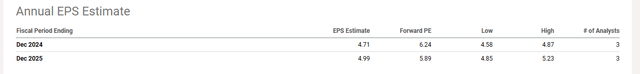

The second reason is that BTI is actually priced the way Altria should be priced. At a P/E ratio of 6.

Seeking Alpha

We like BTI here and think it could progress to $35 over the next year rewarding investors with a solid total return including its 10% dividend yield.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here