I have over 50% of my net worth invested in Real Estate Investment Trusts, or REITs in short.

I invest so heavily in this sector because I think that it offers a historic opportunity to buy real estate at a steep discount to its fair value.

There are many REITs that are today priced at a 50% discount relative to the fair value of their underlying real estate because their share prices have crashed even as their rents kept on growing and their property values remained more or less stable.

I strongly believe that the market has overreacted to fears of rising interest rates, not understanding that REITs use little debt, enjoy long debt maturities, and the growing rents more than make up for the rising interest expense.

So I am very bullish on most REITs.

But even I am objective enough to recognize that not all REITs are attractive. In fact, there are quite a few types of REITs that I expect to do very poorly over the long run, and the goal of this article is to warn you against those REITs:

#1 – Externally Managed REITs

Most REITs are today internally managed.

What this means is that the management is hired as employees of the REIT and their sole focus should be the REIT itself and not some other vehicles.

Moreover, this also means that the managers won’t earn “fees” that are based on the volume of assets under management. Instead, they will earn salaries, which are typically based on key performance indicators. As an example, the compensation of executives at VICI Properties (VICI) depends on two things: (1) their ability to grow their funds from operations (“FFO”) per share by at least 6% per year over a 2-year rolling period; and (2) reaching at least 10% compounded annual total returns for shareholders over a 3-year period.

This does a great job of aligning the interests of the shareholders and managers, and this is why most REITs are today internally managed.

However, there are still many REITs that are externally managed, which essentially means that the management is outsourced to an external asset management company that’s hired to take care of the management.

This leads to much greater conflicts of interest because:

- For one, the manager will typically also manage other vehicles with competing interests. As an example, they may take care of the REIT but also manage 3 different private funds that focus on the same property sector. Which vehicle then gets the best deals?

- For two, the compensation of the manager will typically be a fee that’s based on the volume of assets under management and not the performance of the REIT itself. This will then lead to a “growth at all costs” mentality. The REIT will issue as many shares as it can to buy more assets even if the deals are dilutive just because it would lead to greater compensation for the manager. It will also push the manager to take more debt because higher leverage would lead to more assets and higher fees.

As a result of these conflicts, the performance of externally managed REITs has been a lot worse than that of internally managed REITs.

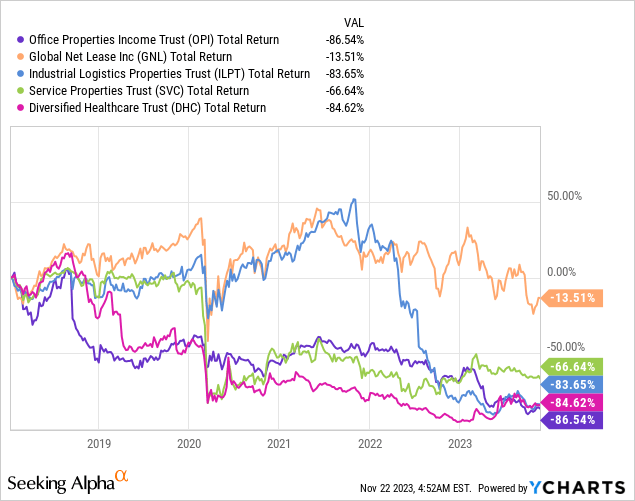

Here are some examples of externally managed REITs that I would avoid at all costs. They always seem to be cheap, but cheap often gets cheaper…

- Office Properties Income Trust (OPI)

- Global Net Lease (GNL)

- Industrial Logistics Properties Trust (ILPT)

- Service Properties Trust (SVC)

- Diversified Healthcare Trust (DHC).

And there are many others.

If a REIT has an external management structure, probably stay away from it. There are a few exceptions, but generally speaking, they are not worth the risk.

#2 – Mortgage REITs

A lot of investors are lured into mortgage REITs, or mREITs, because they offer very high dividend yields.

Just to give you a few examples, AGNC Investment Corp. (AGNC) offers an 16.4% dividend yield, Arbor Realty Trust (ABR) yields 14%, and Annaly Capital Management (NLY) yields 14.6%.

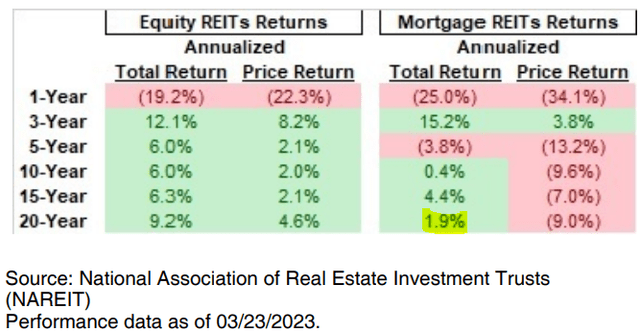

But despite offering these high dividend yields, most mortgage REITs have been very poor investments over the long run. In fact, their track record is amongst the worst in the entire financial market:

NAREIT

They only earned a ~2% total return over the past 20-year period, which shows you that the high dividends were really just a mirage as they came at the cost of declining share prices.

I believe that this is because most mREITs are too heavily dependent on external macro factors that are out of their control. Small changes in interest rates or spreads can have a significant impact on their businesses, and predicting these factors is very challenging.

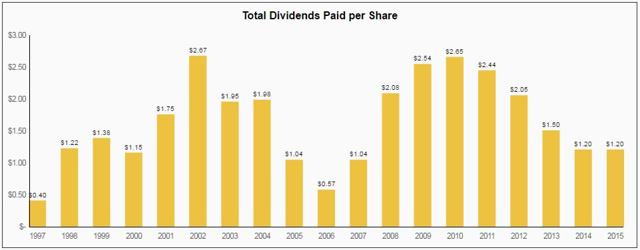

A good chart to illustrate this point is the dividend track record of Annaly Capital Management, which is one of the most popular mREITs:

Annaly Capital Management

You can clearly see that their business model is at the mercy of macro factors that they aren’t able to predict.

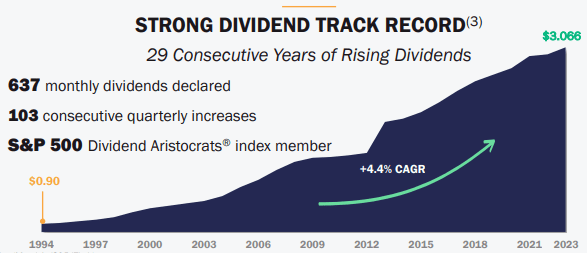

I would much rather invest in a lower-yielding equity REIT like Realty Income (O) that grows slowly but steadily. The risk-to-reward is a lot more compelling in my opinion because the business model of a real landlord is less dependent on these macro factors:

Realty Income

#3 – Certain Specific Property Sectors

This may seem obvious, but not all real estate is created equal and there are many property sectors that I would avoid.

The best example is the office sector.

Office REITs are today heavily discounted and they are attracting a lot of value investors, but I think that if you adjust for the high capex needs, the leverage, some cap rate expansion, and the risk of further declines in occupancy/rents, then today’s prices aren’t that cheap.

I run a small investment boutique and my entire team is fully remote and things are just fine. I don’t expect everyone to go this route, but hybrid is here to stay and it will have a profound and long-lasting impact on the office sector.

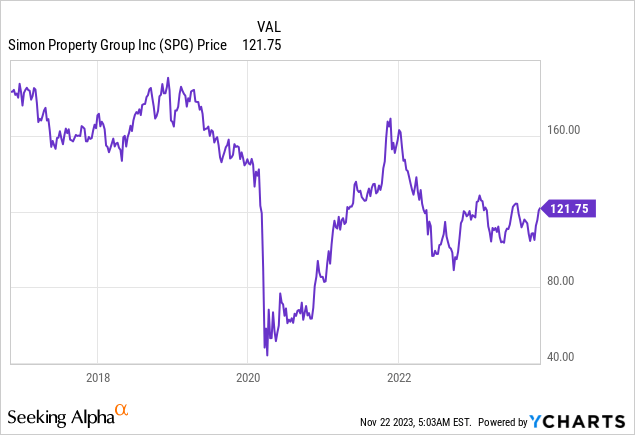

Therefore, I fear that REITs like Boston Properties (BXP) will turn into value traps. Investing today in BXP could be similar to investing in a mall REIT like Simon Property Group (SPG) back in 2017. It seemed cheap back then, but it still ended up turning into a value trap.

But there are other property sectors to avoid as well.

I generally don’t like hotels. They require too much capex, they are too cyclical, and they are facing growing competition from Airbnb (ABNB) and other similar platforms.

I also fear that self-storage is overbuilt in the U.S. The share prices of Public Storage (PSA) and Extra Space Storage (EXR) have come down, but they are still priced at a premium relative to better-performing property sectors.

#4 – Some International Markets

Generally speaking, REITs are well-managed in the U.S. There are, of course, some exceptions, but REITs have existed for many decades, they are scrutinized by countless analysts, regulated by the SEC, and managers are typically well-aligned with shareholders.

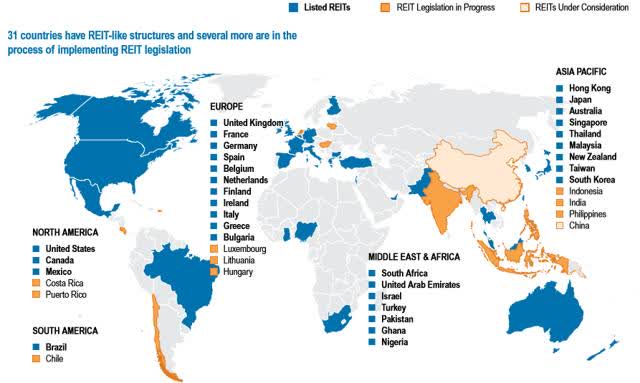

However, the same is not true for many foreign REIT markets.

NAREIT

I am currently in Asia to look for Asian REIT opportunities for our international REIT portfolio, and the main reason why 90%+ of REITs are uninvestable is because their management is poorly aligned with shareholders.

External management structures are still very common and REITs get away with related party transactions that would be unacceptable in the U.S. As an example, there is a common “asset dumping” practice by which a manager will develop properties with a separate entity and then sell them to the REIT at a high price.

Stay away from such situations.

#5 – REIT CEFs

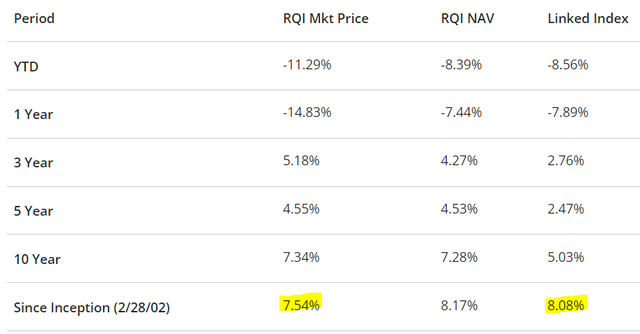

Finally, I am not a big fan of REIT closed-end funds (CEFs). Many investors are attracted by funds like the Cohen&Steers Quality Income Realty Fund (RQI) because it offers a much higher dividend yield than the Vanguard Real Estate Index Fund ETF Shares (VNQ), but here are the issues:

- They use high leverage to create this yield.

- They also invest heavily in preferred shares to bump up the yield, but preferred shares have less upside potential in a future recovery.

- They charge high fees.

- They do “closet indexing” with many of their top holdings being very similar to those of passive benchmarks, reducing the chances of earning alpha.

- Their track records are poor in most cases.

Take the example of Cohen&Steers Quality Income Realty Fund, which is commonly perceived to be the best REIT CEF. It has actually underperformed its passive benchmark since its inception:

Cohen & Steers

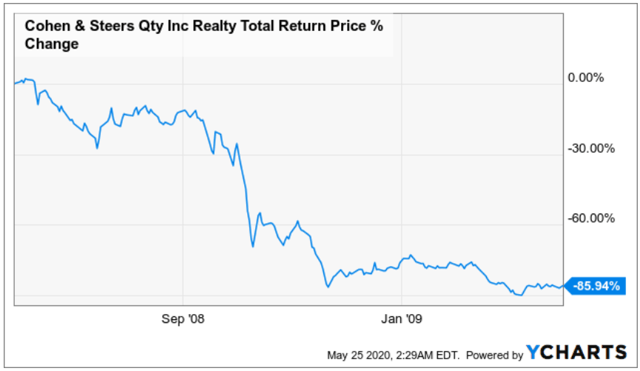

And that’s despite taking much greater risk because it is leveraged. In fact, it almost went bankrupt during the great financial crisis:

YCHARTS

So the risk-to-reward of these CEFs is often very poor. Too much leverage, high fees, and closet-indexing won’t earn you alpha.

If you want to be passive, you better stick to a low-cost ETF in most cases.

Bottom Line

It is not all sunshine and rainbows in the REIT world.

I have the bulk of my net worth invested in REITs, but it is very important to be selective because not all REITs are worth buying.

Some could be exceptionally rewarding while others could turn into real disasters. I am talking from experience, having learned this the hard way at times.

My portfolio today consists of just ~25 REITs in a universe of nearly 1,000 companies worldwide.

Read the full article here