Amid a broad market rally over the past few weeks, investors are now wondering: is it too late to get a jump on stocks again? In my view, the answer is no: but the key to beating the markets through next year will be to double down on high-quality small cap stocks that have little correlation to how the large-cap players in the S&P 500 are moving.

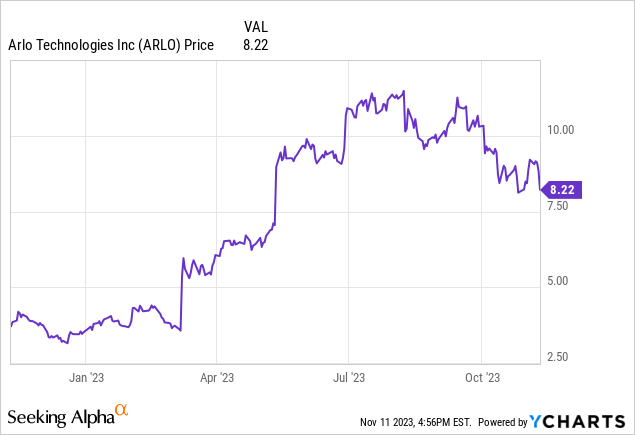

Arlo Technologies (NYSE:ARLO) is a stock that has performed tremendously this year, up more than 2x year to date (though like many small cap peers, the stock is down considerably from mid-summer highs before interest rate fears started to pummel valuation multiples down). And in my view, there’s plenty of upside left to go here.

I wrote a bullish opinion on Arlo last month when the stock was trading closer to $10 per share. Since then, the stock has tumbled ~15% alongside what I interpreted to be a strong (albeit not perfect) Q3 earnings print. Amid this dip, I’m renewing my bullish call on Arlo and am encouraging investors to buy Arlo on the dip.

Before we get into the details of Arlo’s rather mixed Q3 results, here’s a reminder of what I view to be the long-term bull case on Arlo:

- Highly rated product and brand. Arlo has been highly reviewed by major tech publications like CNET and PCMag and is considered one of the top home smart cameras. In addition to this, Arlo is one of the most prominent security companies to promote DIY installation, vs. other cameras that require expensive technicians for installation.

- Building a subscription base. Arlo is moving away from being a pure hardware products company. Paid subscriber accounts, now above 2 million customers, are growing at a >50% y/y clip. Arlo also notes that ~65% of new hardware customers sign up for Arlo Secure within six months.

- Favorable unit economics. The company touts an LTV to CAC ratio of 7x, justifying its recent push to reduce hardware prices and get more paid subscribers in the door.

- Large addressable market. Arlo estimates the market for home security to currently stand at $53 billion, and it also expects this opportunity to grow to $78 billion by 2025. With less than ~$500 million in annual revenue, Arlo has plenty of room to expand and innovate in this space. Given as well that there is no clear leader in the home security camera market, Arlo has a chance to take the crown.

- Profitability. Unlike many small-caps of its size, Arlo has hit pro forma operating profitability, or hovered very close to it, for over a year.

Stay long here and use the post-earnings weakness as an opportunity to buy.

Mixed Q3 reflects top-line strength amid gross margin volatility

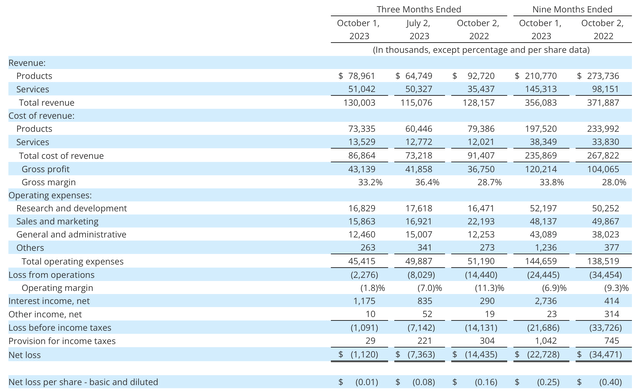

Let’s now go through Arlo’s most recent Q3 earnings in greater detail. The Q3 earnings summary is shown below:

Arlo Q3 results (Arlo Q3 earnings release)

Arlo’s revenue grew 1% y/y to $130.0 million, ahead of Wall Street’s expectations of $126.8 million (-1% y/y) and accelerating four points ahead of Q2’s -3% y/y growth pace. Underneath the top line, products revenue declined -15% y/y (versus a -25% y/y decline in Q2) while services grew 44% y/y, slightly decelerating from 53% y/y growth in Q2 but still growing sequentially at a 1% pace.

Hardware strength, meanwhile, was driven by the launch of the second generation of Arlo’s Essential camera, which starts at $99.99. Management billed this as the most significant launch in the company’s history. Per CEO Matthew McRae’s remarks on the Q3 earnings call on the Essential launch:

The team worked tirelessly over the last 12 months to develop our new Essential 2 platform, which includes significant user experience enhancements, video quality upgrades, battery life improvement and new features all at a substantially lower price.

In fact, a significant portion of the innovation cycle came from the close hardware integration and resulting cost reductions with our supply partners that enabled Arlo to target lower-priced segments with a superior product and user experience.

The launch of Essential 2, also demonstrates our operational excellence across our supply chain capabilities. This is the largest product launch in Arlo’s history. We ramped, our production to 800,000 units across more than 40 SKUs in less than eight weeks in order to support a robust holiday sales plan in collaboration with our channel partners.”

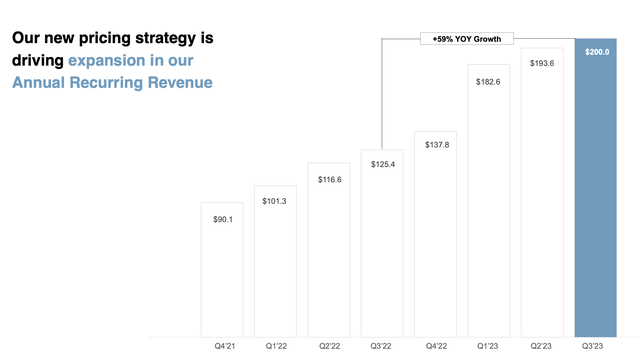

Investors weren’t convinced, however, that this quarter’s relative strength in hardware revenue is sustainable (as it may include buildup in channel inventory for the new product that will unwind in future quarters). One sticking point was the flatter growth rates in ARR, still up 59% y/y but adding only $6.4 million in net-new ARR within the quarter, versus an $11 million add in Q2.

Arlo ARR growth (Arlo Q3 earnings release)

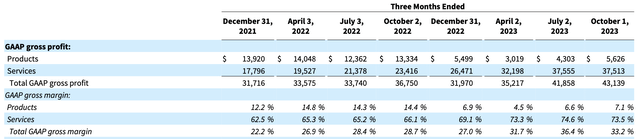

The second core concern here: sequentially, the higher mix of hardware revenue associated with the Essential 2 launch was a quarter-over-quarter headwind to gross margins, which hit 33.2% this quarter – again, still up 450bps y/y, but down 320bps sequentially.

Arlo gross margin trends (Arlo Q3 earnings release)

The company had seen a steady march upward in gross margins this year as Arlo leaned in on its hardware price discounts to encourage subscription signups, which in turn led to favorable revenue mix and margin strength. That narrative took a breather this quarter, alongside a slight 110bps sequential reduction in services margins themselves.

That being said – we shouldn’t count only the negative tea leaves. Excitement for the Essential 2 product launch, especially ahead of Black Friday and Christmas, may spark a delayed uptick in subscription sign-ups after the holiday season. The company also launched a new lower-cost $10/month subscription that combines both hardware and software offerings, including professional monitoring. In other words, the ARR base is still growing – and we may need to wait until after the holiday quarter to see the benefits of this launch.

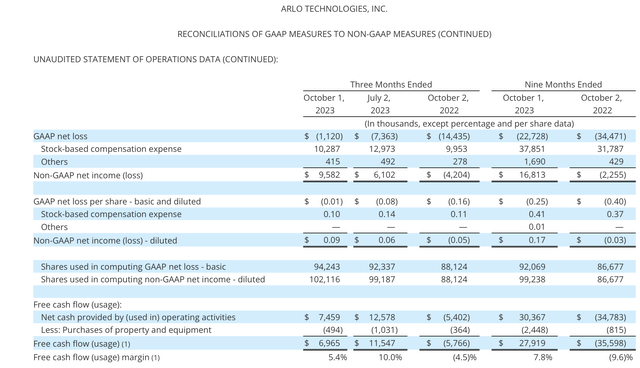

Free cash flow is another positive: year to date, the company has generated $27.9 million of positive FCF, representing a strong 8% FCF margin – versus a -10% cash burn margin in the year-ago period.

Arlo FCF (Arlo gross margin trends)

On top of $126 million of balance sheet cash (which is roughly three quarters’ worth of opex for the company) and no debt, Arlo is in quite a strong liquidity position.

Key takeaways

Arlo is certainly a “show me” story after the Essential 2 launch and ahead of the holiday season, but we shouldn’t write off the company as a failure especially after a sharp stock decline. I continue to encourage taking a small position in this stock and waiting for post-holiday performance to drive renewed optimism here.

Read the full article here