Price cuts and mortgage-rate buydowns pull sales from previously owned homes.

Homebuilders have cut prices, they’ve built at lower price points, they’ve offered mortgage-rate buydowns and incentives, encouraged to do so last year by plunging sales, a huge wave of cancellations, and an inventory pileup.

Dropping input costs and unsnarling supply chains have kept their margins halfway intact. And buyers have come – shifting from buying previously owned homes, where sales have plunged by 20% year-over-year, to buying new homes.

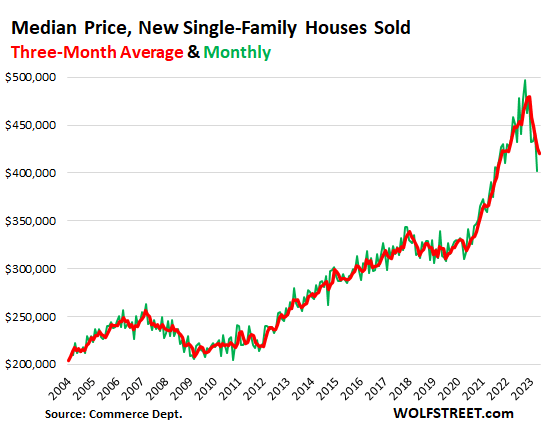

The median price of new single-family houses sold in May fell by 7.6% from a year ago, and by 16% from the peak in October, to $416,300, back where it had been in September 2021, according to data from the Census Bureau today. But these prices do not include the mortgage-rate buydowns and other incentives.

Median-price data jumps up and down a lot (green line). The three-month average (red line), which reduces some of the noise to show the trends, fell 6.3% from a year ago, and by 12% from the peak, to $420,200, the lowest since November 2021:

The average price of new single-family houses dropped by 6.6% year-over-year to $487,300, down 14% from the peak last July.

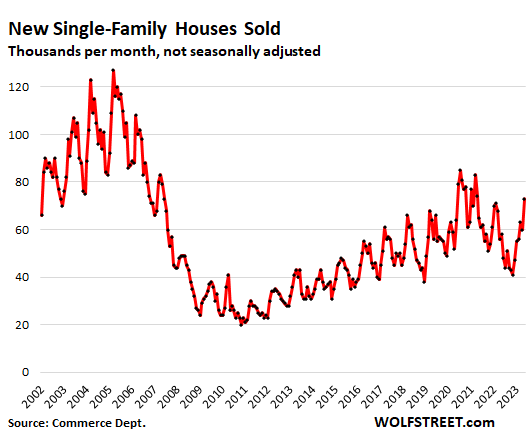

The seasonally adjusted annual rate of sales of new houses jumped 20% year-over year to 763,000 houses, and was up 23% from 2019.

Actual sales – not seasonally adjusted, and not annual rate of sales – jumped by 25.9% year-over-year to 73,000 houses in May, the highest since the pandemic bubble in the spring of 2021. Compared to May 2019, sales were up 30%.

These “sales” are sales orders, not closed sales. Cancellations are not subtracted. Many of the sales orders in late 2021 and early 2022, which show up in this chart, were then cancelled in late 2022, amid a huge wave of cancellations as surging mortgage rates made buyers unwilling or unable to stick to those deals at those prices.

Since then, lower prices and mortgage-rate buydowns have stimulated sales, but sales remain well below the booms during the pandemic and during Housing Bubble 1 from 2001 through 2006. So this isn’t exactly something to write home about, but they have come up a lot from the lows late last year and are above the sales levels in the years just before the pandemic:

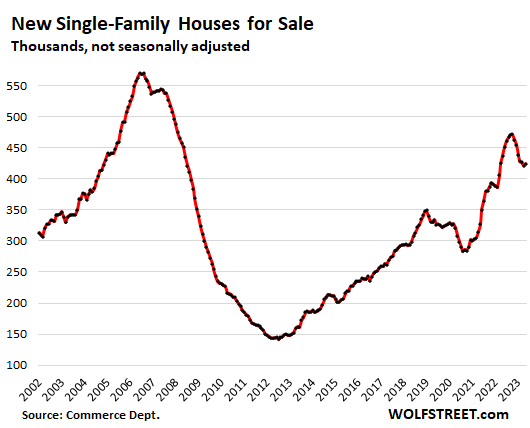

Inventory for sale in all stages of construction rose to 424,000 houses in May from April, the first month-to-month increase, after six months of declines, since the inventory pileup late last year.

Compared to May 2022, inventory for sale was down 3%, as the lower prices and mortgage-rate buydowns have been successful in working down part of the inventory pileup, but the current surge in housing starts is adding more inventory. And that’s a good thing:

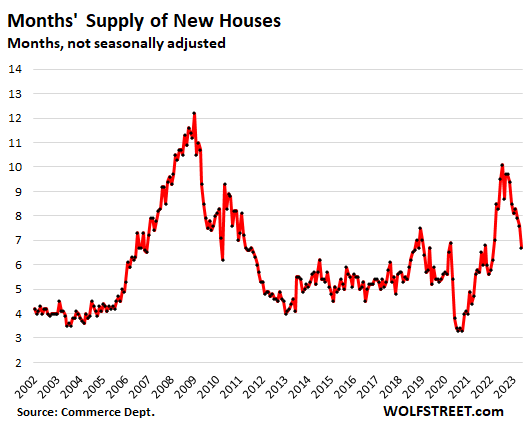

Supply has fallen from an astronomical 10-month supply last July, to 6.7 months in May.

Elbowing in on sales of previously owned homes. Homebuilders are the pros. They’re going to have to build and sell houses no matter what the market is. And they responded to the market and offered deals – while homeowners are sitting on their hands, trying to outwait this market. And benefitting from this disconnect, homebuilders have pulled in buyers that would have otherwise bought a previously owned home.

And so it makes sense that construction starts of single-family houses jumped in May for the fourth month in a row, after a big drop in the second half last year as unsold inventory was piling up. While still below the peaks during the pandemic bubble, starts of single-family houses in May were 18% higher than in May 2019.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here