We previously covered AT&T (NYSE:T) in August 2023, discussing the massive pessimism embedded in its prospects, attributed to the sluggish stock movement despite the bottom line and Free Cash Flow [FCF] beats in FQ2’23.

While we had been confident about the management’s capability to achieve their long-term net debt to EBITDA ratio of 2.5x, we had also rated the stock as a Hold then, since we had not been sure if the support levels might hold.

In this article, we will be discussing T’s mixed prospects after its recent FQ3’23 earnings call, with the raised FCF guidance and subsequent pop in stock prices unlikely to make up for the capital losses observed in its stock decline since March 2020.

We will also be focusing on the market sentiments surrounding this fallen angel, with us preferring to rate the stock as a speculative buy, only for income investors looking to buy and drip indefinitely.

The T Investment Thesis Remains Speculative

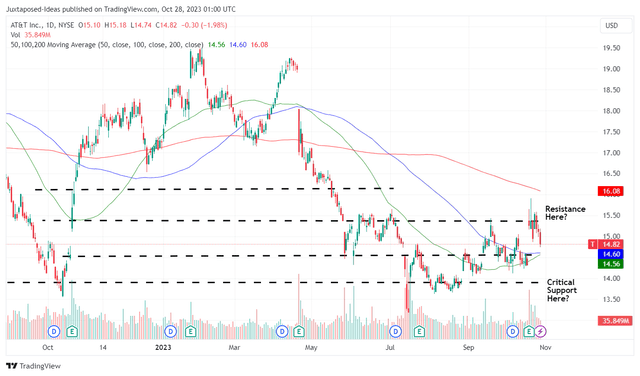

T 1Y Stock Price

Trading View

For now, the T stock has popped by over +5% after the recent FQ3’23 earnings call, thanks to its robust YTD FCF generation of $10.4B (+30% YoY) and raised FY2023 FCF generation by +$0.5B to $16.5B (+1.9% YoY).

Based on the detailed charts provided by a SA News Editor here, it is apparent that the management continues to execute well, as net adds grow across different segments, consequently contributing to the expansion in its top-line.

T’s income investment thesis has played out well indeed, with the raised FCF guidance suggesting its safer forward dividend payouts, no matter the state of the telecom’s balance sheet and stock performance.

With many pensioners, including those whom previously worked at the telecom, relying on its dividends as part of their retirement portfolios, we are not surprised that the stock remains a popular choice for many income investors.

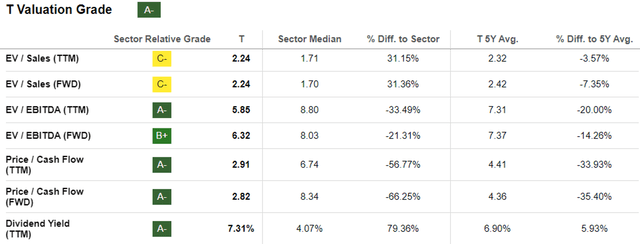

T Valuations

Seeking Alpha

Perhaps this is why the T stock’s FWD EV/ Sales valuation of 2.24x and FWD EV/ EBITDA of 6.32x have normalized nearer to its 3Y pre-pandemic means of 2.25x/ 6.86x, though still impacted compared to the sector medians of 1.70x/ 8.03x, respectively.

Then again, investors must also note that market sentiments surrounding its cash flow remains pessimistic despite the moderately raised FCF guidance, based on its FWD Price/ Cash Flow valuation of 2.82x, compared to its 5Y averages of 4.36x and sector median of 8.34x.

Long-term T shareholders may very well understand Mr. Market’s pessimism, due to the telecom’s immense long-term debts of $126.7B (-0.7% QoQ/ +2.2% YoY) and consequently higher annualized interest expenses of $6.64B (+3.7% QoQ/ +16.9% YoY) in the latest quarter.

It is unsurprising that the combination of the elevated interest rate headwind and intensified FY2023 5G capex of $24B (+23.2% YoY) has resulted in its impacted FCF profitability.

For example, based on the T management’s guidance, we are only looking at an underwhelming FCF margins of approximately 13.6% (+0.2 points YoY), compared to its FY2019 levels of 16% (+2.9 points YoY).

This is assuming that its FQ4’23 revenue is in-line to its FQ3’23 levels of $30.35B, resulting in an estimated FY2023 overall revenues of $120.74B (inline YoY).

Nonetheless, it appears that the T stock is trading near its fair value of $15.87, based on its FWD Price/ Cash Flow valuation of 2.82x.

This is based on the management’s FY2023 cash from operation guidance of $40.5B (+26.4% YoY) and its 7.18B of share count at the latest quarter, resulting at an estimated cash from operation per share of $5.63 (+32.1% YoY).

The T Stock Is A Buy, But With One Particular Caveat

On the one hand, we maintain our conviction that T is likely to remain a battleground stock, since its dividends have been insufficient to cover the capital losses observed in its stock decline thus far, especially given the previous cut in Q1’22.

On the other hand, we can also understand why some analysts and readers continue to champion the T stock, since they may have chosen to perceive it as a stock to buy and DRIP indefinitely, thanks to the relatively attractive dividend yields.

With losses only realized if the stock is traded or sold, long-term investors would have simply enjoyed a consistent dividend payout every quarterly, no matter the noise in the stock market.

We suppose that there is no harm in viewing the T stock in this manner, since no one can deny the fact that connectivity is an essential commodity no matter the uncertain macroeconomic outlook.

This is especially due to the proliferation of social media, the pandemic-induced remote work trend, increased demand for IoT and Generative AI, amongst others, with many of the current readers likely being customers of T, or Verizon (VZ), or T-Mobile (TMUS), at one point of their life.

With the T stock consistently bouncing of the critical support of $13s/ $14s since the October 2022 bottom, it appears that investors may be rest assured that this floor may hold over the next few quarters of uncertain macroeconomic outlook.

In addition, the management has already guided a step-down in its capital expenditure moving forward, with its FCF generation likely to improve from current levels:

Our cost takeout efforts the last couple of years have shown that we are committed to creating a really efficient cost structure. So all those things will help drive EBITDA growth and you couple that with a step-down in CapEx from the elevated levels we’ve been at in ‘22 and ‘23. Those are going to be the big growth drivers to drive both free cash flow growth next year. (Seeking Alpha)

While the T management does not offer a forward guidance beyond the FQ4’23 quarter, we believe that the telecom’s capex may moderate nearer to its pre-5G capex levels of approximately $19.5B.

Assuming that its cash from operation remains at current levels of ~$40.5B, we may see its FCF normalize to nearly $21B, near to its pre-pandemic levels indeed.

Market analysts also expect 6G to be introduced only by 2030, implying that the telecom’s capex is likely to remain muted over the next few years, allowing the T management to sustain its dividends while deleveraging at the same time.

These projections point to a promising reversal of its profitability, likely to put a floor to its stock prices as well, depending on when the Fed pivots and the telecom’s interest rate headwinds moderate.

As a result of its expanded forward dividend yield of 7.34% (compared to the 5Y average of 6.72% and the sector median of 3.76%), we are upgrading the T stock as a Buy, preferably at its support levels of $13s/ $14s for an improved margin of safety.

Naturally, the T stock is only for income seeking investors with higher risk tolerance, whom are looking to buy-and-drip indefinitely. Even then, they should be aware that the lead-lined issues are still unresolved, with T likely to bear the brunt of the $60B rectification efforts.

As a result, investors may want to brace for more volatility until the legal headwinds have passed.

Read the full article here