Dear readers/followers,

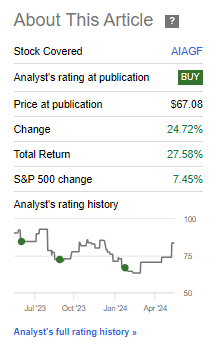

Aurubis (OTCPK:AIAGF) (OTCPK:AIAGY) is a company I have been following and investing in for some time – and that investment, the largest buy I made for it, has finally paid off. In my last article, which you can find here, I doubled down on the company with a “BUY” recommendation and the results since that time speak for themselves. You can also find that article here.

Seeking Alpha Aurubis TSR (Seeking Alpha Aurubis TSR)

This is not me taking a victory lap though. Yes, the company has performed very well. But as you can see in the small picture, I’ve been positive for far longer than that and my performance since that time has not been great. Since my first article, the total RoR is still negative – even if only by 1%.

However, I believe the company has a far better upside than you would expect here – which I have been pointing out. In this article, we’ll look at the latest results, see what the company has done to right its operations, and what we can expect in terms of further reversal as the company “struggles” upward. While my total position is now in the green, I expect far more from the business.

Let me show you why that is.

What upside exists here for Copper and recycling

Despite the struggles in the basic materials and mining space, I still believe Copper is a good space to be in – and copper is much of what Aurubis is. Many of the investments I’ve made are cyclical and are looking at a tough 2024-2025 period, but my timeframe is far longer than this.

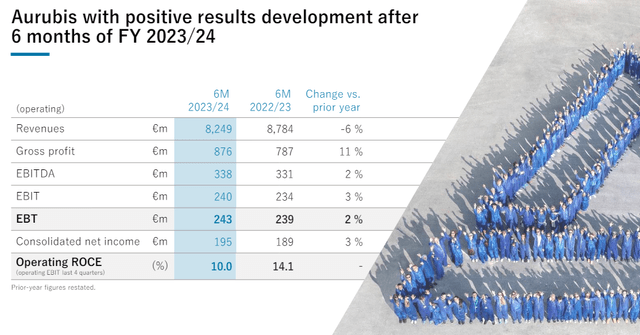

The last report we have is not even a month old at this point, and we’re looking at the first 6 months of the year. Operating EBT rose slightly, net cash flow was down, and operating ROCE was down further – just managing to cling onto double digits at 10.0%, with a confirmed 2023-2024E EBT of upwards of almost €500M for the year.

Despite declines in operating ROCE, this is an overall positive result. The EBT was due to better pricing for both concentrates and copper premiums, as well as a non-trivial increase in wire demand, and lower overall energy costs. The lower energy costs are something I’ve seen reported from utility companies, where it has been a negative. It goes to show you that when you invest broadly, as I do, one company’s downside is another company’s upside. As long as energy costs stay down, Aurubis will have a certain tailwind here given the sheer energy consumption of its operations.

Aurubis IR (Aurubis IR)

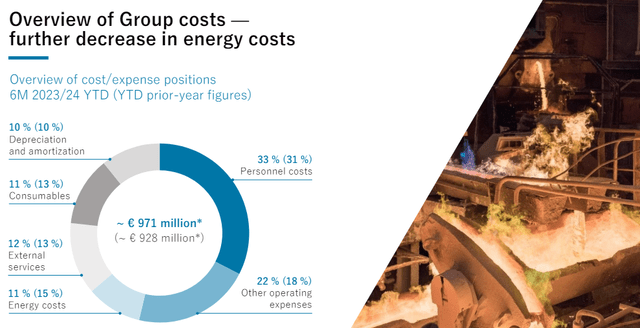

So, we have a good reason for the company’s recovery in terms of share price – the underlying operations have recovered as well. Improvements in market conditions also include the company’s secondary output, sulfuric acid. The company managed improvements in gross margins as well, and the decrease in energy costs really becomes clear once you look at a breakdown of the cost situation. Energy costs are down, yes – while costs for personnel and “other” went up quite a bit.

Aurubis IR (Aurubis IR)

I have done some digging as to what exactly the 4% increase in other OpEx represents, but as of yet have not been able to find a good answer for this. The decrease in energy costs has a few reasons, but most of all it’s the decreased pricing for both electricity and Natgas, as well as a more active hedging management which has resulted in some significant upsides here.

Aurubis, like many German businesses, also remains low-leverage and with a very sound balance sheet. The company now records an equity ratio of upwards of 54.2%, and a debt coverage of 0.2x – meaning net financial liabilities tolling 4-quarter EBITDA, meaning very low leverage indeed.

The company now operates in two segments – recycling and smelting & products. The first of those saw a decline in most sub-segments, with a significant ROCE decline. Recycling is unfortunately the reason why results are down, because while Custom Smelting & products saw some decline, EBIT and EBT were up, and ROCE was still close to 15%.

For the full year, the company’s forecasts remain mixed, and as a result of this we should expect volatility to continue. To make this clear, I do not expect material improvements in valuation this year, even if I am one of the only ones to expect further pressure for earnings. Between a reduced but sufficient concentrate supply forecasts, a subdued recycling input due to increased Asian competition (though most smelters are currently supplied for 2024), a less favorable expected revenue situation for Sulfuric Acid, and wire rod to remain one of the only product categories with solid demand, the potential for the company here is volatile. On a group level, ROCE is set to come in below the company’s target range of 15%, at 10-14%, due mostly to negative trends in recycling which could see ROCE margins down to 5%.

The current group guidance does imply the potential for a higher EPS for 2024E, but this is only compared to the dismal 2023A EPS we saw, which was a 37% decline from 2022.

The reason I remain so positive about Aurubis is the long-term trend. I believe we’re in a situation where recycled metals and the companies that supply them and have specialized expertise in exactly these areas, are going to see increased business volume.

The current forecasts would agree with this, because over the next 3 years, Aurubis is expected to grow earnings on an adjusted basis by almost 10% per year (Paywalled F.A.S.T Graphs Source)

This is not a huge company. Aurubis has a current market cap of just above €3B, but the combination of extremely low debt – less than 5% of LT debt/capital – and the growth potential here, alongside the solid fundamentals and the operational history and expertise, gives me a high conviction for a longer-term upside for the company.

There’s no denying, however, that there is a lot of volatility to this play. The company does not always beat or hit its estimates, it misses them more than 25% of the time, and with more than 10-20% depending on the timeframe you look at. Investing in Aurubis is therefore a play that requires you to be comfortable taking the risks in order to get a decent payout.

How “decent” a payout are we talking about, and in what timeframe?

Things to like about the valuation of the stock, and the upside at less than 10x P/E.

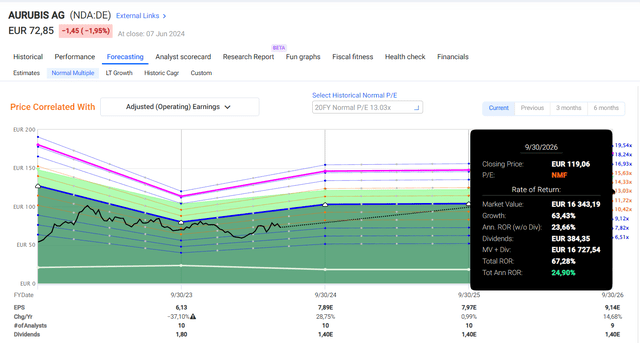

This company is still really trading at below 10x P/E, despite outperforming the S&P500 with a 20%+ RoR since my last article. It’s also still trading below this level despite what I would consider a compelling upside in terms of 2024-2026E results.

Current forecasts have this company at a very front-loaded pace of earnings improvements, including a 28.7% EPS growth this fiscal, and then about 7% per year for 2025 and 2026E. If this materializes, and if we assign the company its historical average of, let’s say the 13x 20-year average, then the results would look like this.

Aurubis Upside F.A.S.T graphs (Aurubis Upside F.A.S.T graphs)

And if you bought when I did, we’re talking triple-digit levels of potential return. Even without that, almost 25% per year is still very good, even if the dividend yield of less than 2% isn’t exactly enticing here.

Aurubis is a complex investment and I do not expect everyone to be “all over it” here. in fact, my own position in relation to my total portfolio is still “in progress”, at less than 0.5% of total. My last PT in my previous article was €80/share – and we’re now at €72.8. I’m not changing that PT here because I do not believe or see that we’ve gotten any improvement in clarity or forecasts – but I do say that the company is indeed worth that €80/share, representing a low normalized 10x P/E for this company that’s set to grow at double digits.

S&P Global gives this company, at this time, a range starting at €61/share and going up to €110/share, with an average of €82/share. Out of 9 analysts, 5 are either at a “BUY” or similar positive rating, and the expectations are for Aurubis, over the next years, to manage a considerable overall increase in company EBITDA, with 2023, the year that we just left behind, acting as a bottom or a trough for the trends. This has been the case for the past two forecasts, with only slightly shifting PTs as analysts impair the company for a variety of scenarios. I do personally see the downtrend potential for Aurubis – we could in fact see something like a €50-€55/share – at which point I would obviously add significantly to my position.

Risks and concerns?

Aside from macro, I don’t see a whole lot. The company’s low leverage makes fundamental risks rather small. The company’s contract book goes up and it goes down. The main reason for the current downturn we’re seeing is the standstill in Hamburg, and this will obviously ramp up again.

There’s the possibility that the current situation with Chinese Smelters (specifically purchasing concentrates, like Aurubis) and some international mining companies are setting prices specifically for the concentrate market (which Aurubis is in), and where there is a question if the benchmark may go so far as being abolished and Aurubis would enter into a very different business situation with its customers and suppliers. Currently, Aurubis is buying concentrate from over 40 large mines across the entire world. There is the potential for change in how these prices and how this sourcing is being done – but that is something that will have to be kept an eye upon. If it happens, Aurubis is far from the only company that will be impacted. For now, it’s a remote risk, but I considered it worth mentioning at least.

Thesis

- Aurubis is a market-leading German metallurgy company in the segment of copper, other non-ferrous metals, and precious metals, as well as the byproduct of Sulfuric Acid. The company has one of the most extensive expertise on the planet for this particular field, and it deserves more than the attention it’s getting here at this time.

- As of the latest quarterly report, some of the expectations for 2024E are somewhat more crystallized, and what I would consider clearer than before. This enables us to act with more confidence and also maintain our PT and positive stance for this company.

- I say that Aurubis remains a “BUY” at around €80/share or below for the common. I have looked at options plays available for this company, but for the time being, would not consider this to be relevant due to low premiums.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

There are still enough positives here, and I would now also argue the company is getting closer and closer to “cheap”.

This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here