My Thesis

As an investor whose primary focus is the quality of the business, AutoZone (NYSE:AZO) impresses me. It offers excellent service, predictability, and impressive figures in terms of ROC and margins, and it’s additionally engaged in share buybacks, often referred to as share cannibalization. AutoZone has demonstrated a proven formula for outperforming the market over the past decades, even when top-line growth is not particularly high. Furthermore, in my view, it is trading at a fairly reasonable price.

However, there are evident risks, such as the growth of electric vehicles and increased competition, which we should consider in our research.

The Business

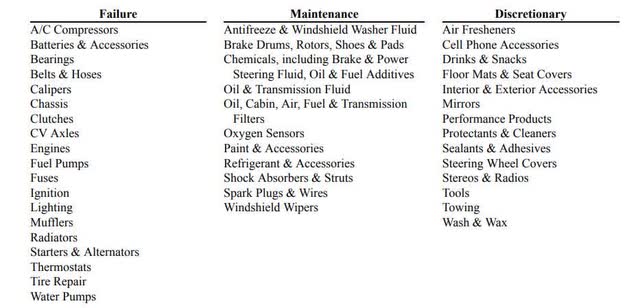

AutoZone is a specialty retailer of car and truck parts, offering a broad range of products. The majority (84%) of their offerings fall into the ‘Failure or Maintenance’ category, with the remainder falling into the ‘Discretionary’ category.

‘Failure’ products are those you need when your vehicle has an immediate problem, and you require them urgently. AutoZone keeps a high level of inventory to support these situations since these products have a long shelf life.

‘Maintenance’ items are products you purchase to keep your vehicle running smoothly and extend its lifespan. On the other hand, ‘Discretionary’ items are accessories for your vehicle, not necessarily essential.

Products (AZO annual report)

Beyond the quality of service, what shields AutoZone’s business from the disruption of e-commerce is the immediate necessity for their products. If your car has a problem, and you need to get to work, waiting for a product to be delivered isn’t an option. You’re more likely to buy it immediately, and the expertise of AutoZone staff helps you make informed choices, preventing you from making mistakes when selecting the right product.

Service plays a crucial role in this retail business. Since most people are not car enthusiasts, the expertise of AutoZone workers and their catalog help customers choose the right product for their specific needs.

AutoZone divides its business into two markets: the DIY business, which accounts for 71% of its revenue. This is the more mature segment, primarily serving car enthusiasts and those with the knowledge to ‘do it themselves.’

The commercial business, on the other hand, involves selling to local garages through their website or their larger ‘hubs,’ which are bigger than the average store. Currently, the commercial business is experiencing faster growth, and AutoZone’s management is closely monitoring its expansion, surpassing market growth.

AutoZone is the leading player in this robust market, boasting approximately a 14% market share, while its significant competitors, O’Reilly with 9% and Advanced Auto Parts with 6%, are nipping at its heels. The remaining market share is held by local players. There’s ample room for AutoZone to capture more of this market, and we haven’t even mentioned their international expansion efforts yet.

The Industry

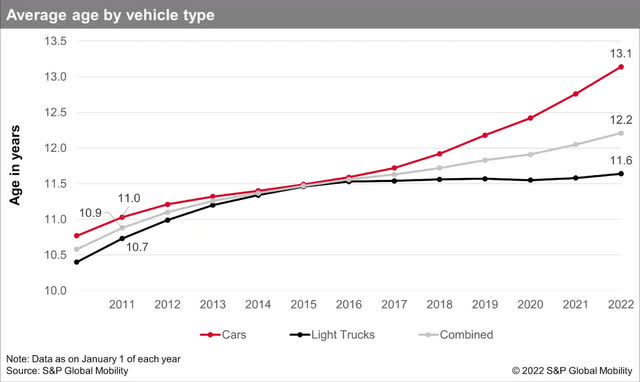

The industry is quite predictable. There’s a consensus among car companies regarding offering a seven-year warranty on vehicles. This predictability allows you to anticipate future demand. In the industry, there’s a concept known as the ‘sweet spot,’ which refers to the period after the warranty has expired but before the vehicle is taken off the road. This typically falls within the 8-12 year range, but with the aging of active cars in recent years, this ‘sweet spot’ has extended.

A notable example of this was during the recovery from the 2008 recession when people had more confidence in driving, resulting in increased vehicle usage and subsequently, more repairs. This led to higher growth rates in the industry.

The Sweet Spot (CNBC)

Several factors contribute to the growth of the industry: increasing car sales, greater distances traveled by vehicles, and the aging of cars. While the industry’s growth rate may not be awe-inspiring, it is indeed expanding. AutoZone compensates for this by capturing more market share, expanding globally, enhancing margins, and consistently executing aggressive share buybacks.

Age of a vehicle (S&P Global)

What I appreciate about this industry is its essential nature. People require car parts to keep their vehicles running, and this need is continuous. Furthermore, the industry is relatively predictable, and there is still significant potential for further growth.

Global Expansion

While the U.S. market is relatively mature with around 7,140 stores, it continues to grow. AutoZone has expanded its operations into two additional countries: Mexico and Brazil. In Mexico, AZO has established a substantial presence, boasting over 700 stores. Management has noted that it achieves an even higher return on invested capital there than in the U.S.

Brazil is a relatively new market for AZO, with just over 100 stores. Both countries are vast markets where people tend to drive more. They feature growing populations and high GDP growth, factors that will contribute to increased vehicle sales and greater distances traveled by cars in both regions.

AZO Growth

AutoZone has successfully increased its top-line revenue by 9% over the last five years, indicating significant market share expansion. This growth is quite robust, although analysts anticipate a more moderate environment in the coming years, projecting a 5.2% CAGR for the next three years.

In addition to international expansion, AutoZone is growing by consistently opening new stores. Their store count has been increasing by 3% per year, adding just over 200 stores each year according to the last quarter’s report.

Furthermore, same-store sales growth has been around 4% per year, with international stores experiencing even more rapid growth in same-store sales. In the last quarter, international same-store sales grew at a rate of 34%, while domestic same-store sales only grew by 1.4%.

Considering just these two factors, we see about 7% growth in the top-line revenue. We will later discuss margin growth and share buybacks, which also contribute to earnings per share growth.

If we exclude the primary threat of electric vehicles, which we will delve into later, I don’t see many factors that could hinder this growth.

Profitability

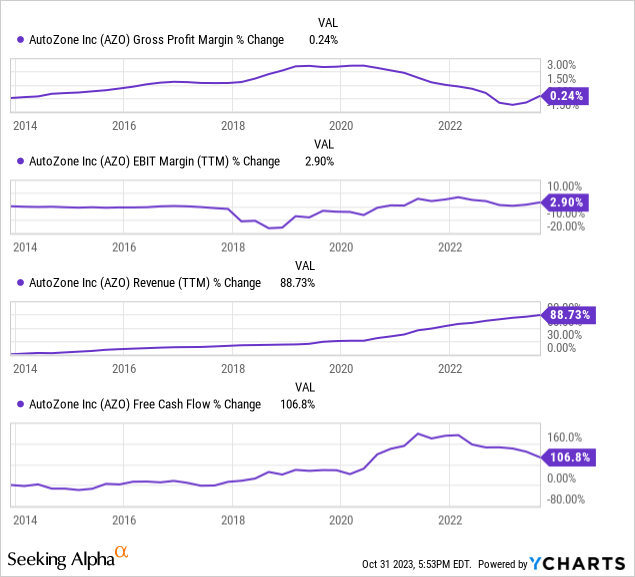

AutoZone boasts excellent margins for a retailer. These robust margins not only enhance business resilience but also lead to high returns on capital. It’s important to note that, while they have strong margins, there hasn’t been significant growth in this area. Over the past decade, the margin increase has been relatively insignificant, as evidenced by the growth in free cash flow, which is only slightly higher than the revenue growth.

Perhaps in the future, with the higher returns on capital in Mexico, we could see margin growth.

I believe that, in addition to top-line growth, the spread between a business’s WACC and its returns on capital, as measured by ROCE and ROIC, are critical factors for long-term business success. A recent study has shown that high and growing ROIC is indicative of strong stock performance. AutoZone boasts an impressive 50% ROCE and a 35% ROIC, both of which are not only stable but also remarkably high. This is the type of company that piques my interest.

Furthermore, I appreciate the stable margins, which suggest that AutoZone is not highly sensitive to inflationary pressures and may even be resilient in the face of such pressures.

Eating Its Own Shares

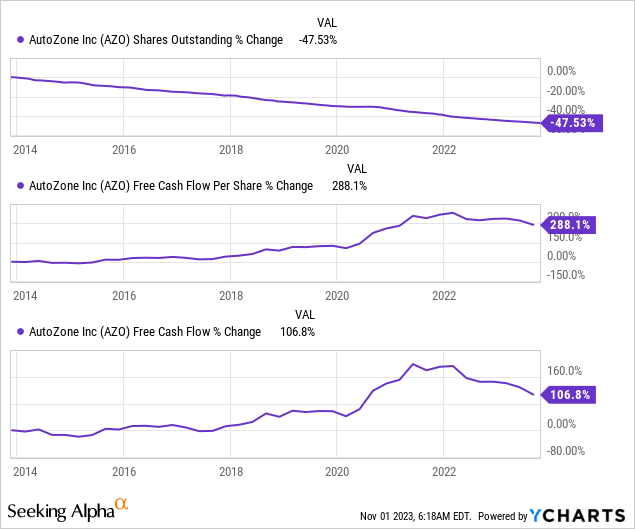

AutoZone operates in a relatively mature, yet still growing industry. The company hasn’t been able to significantly expand its profit margins. Therefore, we can anticipate that free cash flow will grow at a rate similar to revenue growth in the long run. The third avenue for growing FCF per share, in addition to revenue and FCF growth, is through strategic buybacks. Given that AutoZone has often not been a highly-priced stock, the management has been able to execute an effective and consistent buyback program, reducing the share count and boosting FCF per share growth.

Over the last decade, AZO has reduced its shares outstanding by 47%, and since its inception, by a remarkable 85%. The result has been a very high FCF per share growth, significantly exceeding the FCF growth of the overall business.

This is a critical component of the fundamental formula that AutoZone relies on to outperform: expanding store count, boosting same-store sales, and utilizing the free cash flow to repurchase its stock. You’re likely aware of the current results, but the main question is whether this trend will persist.

Solvency

AutoZone maintains a reasonably solid financial position, although it falls short of the robustness I’d prefer to see. It carries $7.5 billion in net debt, while its highest annual free cash flow reached $2.4 billion (2021). Although I don’t perceive a significant threat in this regard, especially given the excellent returns they’re achieving on this debt, I do prefer investing in companies capable of repaying their debt in less than three years’ worth of FCF. Their interest coverage is healthy, standing at 13 times, and their current ratio is slightly below 1, at 0.8. The Altman Z-Score reveals minor concerns, assigning it a score of 2.7, which is just below the ideal threshold of three.

AutoZone is a relatively predictable business with a strong brand and a source of recurring revenue, so I don’t believe this financial position will significantly impede its buyback program in the long term.

CEO Change

While AutoZone is a stable and predictable business, the impending change in CEO carries a degree of risk. Bill Rhodes has held the position of CEO at AZO since 2005, and he is a highly respected figure who has guided the company to outstanding results, reflected in the stock price. Any significant change in leadership after a long CEO tenure is always a cause for concern, as we’ve witnessed in recent times with companies like Disney and Dollar General.

I appreciate the previous compensation plan that was based on ROIC performance, and I hope this approach continues.

The new CEO, Philip B. Daniele, has a notable point in his favor – he has been with the company since before 2005, indicating a deep familiarity with the company’s culture and business strategy. He’s not new to this game. It’s also encouraging to see Bill Rhodes transition into the role of Executive Chairman, suggesting his continued involvement in the business.

EVs

Perhaps the most significant risk for AutoZone’s business is the transition to electric vehicles. EVs have fewer spare parts compared to internal combustion vehicles and generally require less maintenance and repair, directly impacting AutoZone’s business. As of October 12th, EVs accounted for 7.9% of the car industry, which, while still relatively low, is steadily growing. This marked a record high and a 50% growth over the past year.

This represents a substantial risk to AutoZone’s business. However, I believe two factors may work in AZO’s favor. First, this risk has been evident for a while now, giving the management time to prepare and make necessary changes. Second, as EV innovation advances, more technologies and, consequently, more parts will be needed for these vehicles. In the future, as EVs capture a larger share of car sales, they may become even more complex than internal combustion vehicles.

While this is indeed a risk, it appears to be more of a long-term concern.

Valuation

I prefer to invest in companies when their stock prices are trading below their historical averages. This provides room for multiple expansion. However, this is not the current situation with AutoZone.

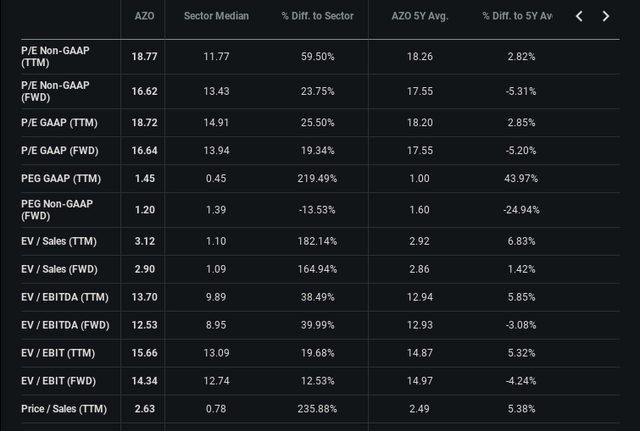

multiples (seeking alpha)

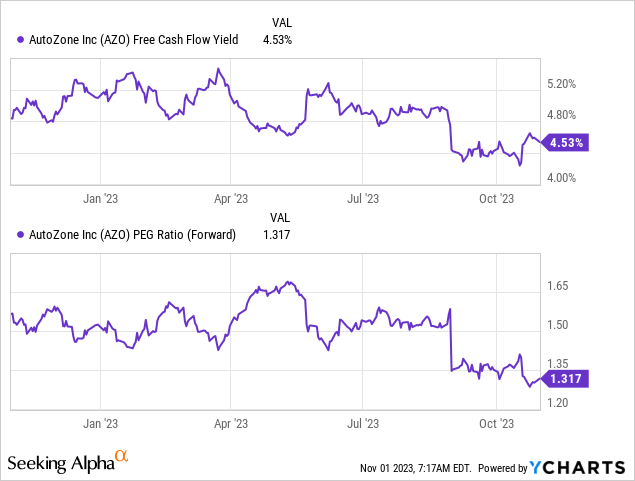

I like to invest in companies with a close-to-5% free cash flow yield, and AutoZone meets this criterion. Additionally, I prefer a reasonable forward PEG ratio, ideally below 1.2.

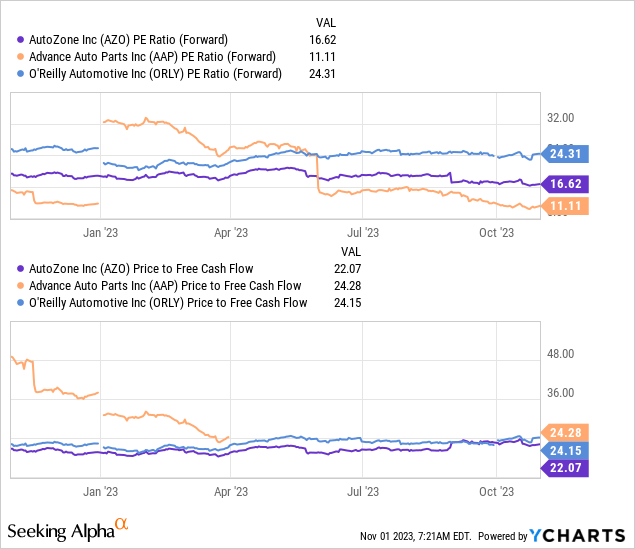

Let’s compare AutoZone to its peers, such as O’Reilly (ORLY), its main competitor. While some may argue that AZO’s lower trading price indicates it’s a cheap investment, I’m cautious about relying solely on relative valuation. Each company has its unique attributes, quality, and growth rates, and I wouldn’t make an investment decision based solely on this factor.

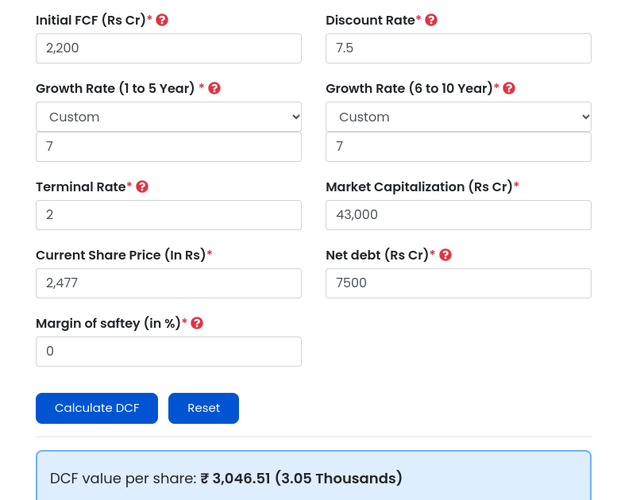

Let’s make a sober DCF analysis; the FCF I’ll input is the average FCF margin of 12%, divided by the next year’s revenue estimate, which gives us $2.2 billion of FCF. For the sake of conservatism, I won’t include the buyback effect in the growth rate. Assuming 3% store count growth, plus 4% same-store sales growth, we can expect 7% FCF growth, without margin expansion that wasn’t visible in the past. The WACC is 7.5%, and the terminal rate is 2%. The intrinsic value based upon these inputs suggests a share price of $3,046, a 24% undervaluation. Notice that this is without considering buybacks at all. If we assume a 4% decrease in the share count per year, resulting in an 11% FCF per share growth, the stock seems more than 70% undervalued. This is a cheap stock.

DCF (finology)

However, these growth rates do not include the EV risk. Extensive EV sales will probably hurt AZO’s performance unless the management takes active measures to provide suitable products for EV owners.

Risks

The most conspicuous risk is the EV risk. I would like to see AutoZone management proactively address this risk and present a plan to mitigate the potential impact on future sales.

There’s also the risk associated with the change in management. While we don’t yet know the new CEO’s plans, I don’t perceive this as a risk that would deter me from this excellent company.

Another potential risk lies in global expansion. It’s possible that store counts in Brazil and Mexico might not meet expectations, which could affect overall growth.

The performance of the commercial segment sales is pivotal for the industry’s growth. I would prefer to see it continue its historical growth in this segment.

Additionally, there’s the risk of aggressive competition from other major retailers, such as Costco or Walmart. The high margins in this segment are likely to attract new competition.

Solvency risk, in my view, is minor, although it’s discernible and could potentially impact future buyback initiatives.

Conclusion

I see a high-quality business here, with promising future growth prospects, predictability, high and stable returns on capital, and, most importantly, a very reasonable price.

There are risks, but I believe that the price compensates for them. I rate AZO as a BUY, primarily due to the EV risk; otherwise, it would be a strong buy.

I’d be interested in hearing your thoughts on this straightforward and understandable business.

Read the full article here