Investment Rundown

Avis Budget Group, Inc. (NASDAQ:CAR) stock has gone down over 17% in the last 12 months and the question arises if CAR will continue to slide in valuation. I do think that this will continue because the rise in interest rates is putting pressure on everyday Americans’ spending power. With less capital available leaves less capital available for car rental companies like CAR to have access to. Besides, the share price has been incredibly volatile for the company and the industry is steadily seeing shifts towards car-sharing services rather than rental. CAR will likely need to invest quite heavily to maintain a strong position here and keep up with competitors. I think the coming quarters will continue to see a rise in long-term debts and that might put pressure on the bottom line as interest expenses rise. CAR is a larger business with TTM revenues of over $12 billion, putting it at a p/s of under 0.6 on an FWD basis. I still think it’s rather risky as the disruption caused by car-sharing services may impact coming results for CAR unless their Zipcar asset grows rapidly and offsets losses in other markets. Because of these uncertainties, I am more comfortable rating CAR a hold for now, and potentially a buy, depending on how the industry evolves. It should be said that investors are still getting quite a lot of value from holding shares as CAR continues to quite aggressively buy back shares right now.

Company Segments

Based in New Jersey, CAR operates in the American car rental industry, maintaining a robust fleet of approximately 19,000 vehicles. The company takes pride in its diverse portfolio of renowned brands, such as Avis Car Rental, Budget Rent a Car, Payless Car Rental, and Zipcar. This extensive array of brands positions CAR as a leading force in the car rental market, catering to a wide range of customer preferences and needs.

CAR continues to have a strong presence in the car rental service industry but it is under a lot of pressure from companies like Ryder System, Inc. (R) and Hertz Global Holdings, Inc. (HTZ). The company saw a spike in the bottom line margins in the last few years but the market and industry are still faced with a lot of uncertainties and risks. CAR does have exposure to this market thanks to its ownership in Zipcar, but needs to in my opinion invest significantly here to gain market share and retain it as well.

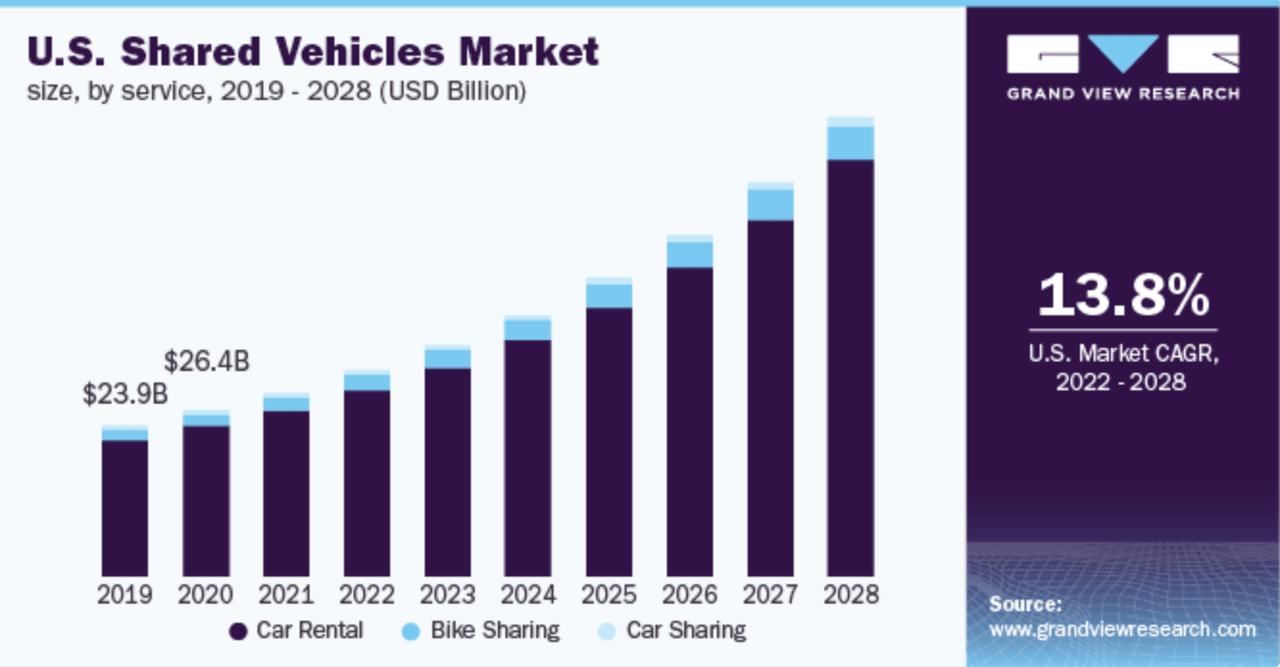

Market Outlook (Grand View Research)

The rental car sector is currently witnessing a significant transformation, largely shaped by the ascendance of car-sharing services. Car sharing represents a departure from the traditional model of car rental, allowing consumers to rent vehicles for shorter durations and from various locations, often sourced from individuals or smaller operators. The market for car sharing in the US alone is expected to grow by around 13.8% annually until 2028, presenting a massive opportunity for companies to enter and take advantage of the growing demand.

Competitors (Berg Insight)

This shift has introduced a new level of convenience for consumers, especially those who do not require a car regularly. Car sharing provides a flexible solution, enabling individuals to access vehicles when needed without the financial commitments associated with outright ownership. This transformative trend not only reflects changing consumer preferences but also has substantial implications for the dynamics of the rental car market. As the industry adapts to these evolving patterns, companies like CAR are navigating through this new terrain to meet the emerging needs of contemporary consumers. There is no lack of companies trying to enter this market and I think it will be tough for CAR to reticent their margins because of the hefty amount of capital likely necessary to maintain a strong position here. It might be a race to the bottom eventually as more companies enter and are trying to undercut each other. I don’t like that scenario and is a key reason why I can’t rate the business a buy right now.

Earnings Highlights

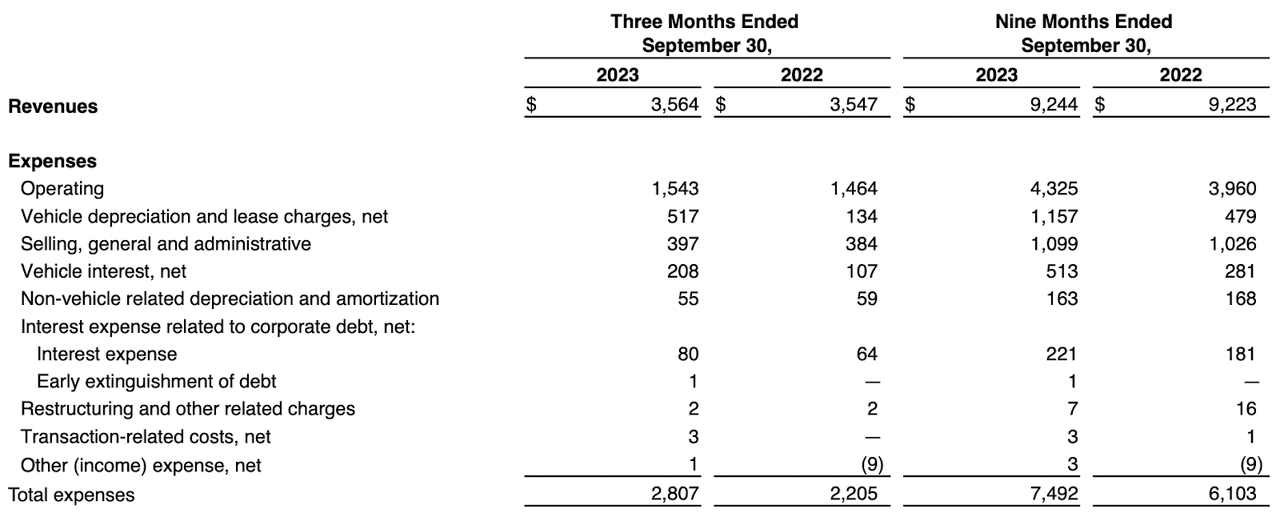

Income (Earnings Report)

The last earnings report from the company showcased a slight increase in the revenues, but no more than 1% even. The higher interest rates in the US and internationally are putting pressure on people’s capabilities to spend and services that CAR are offering become a lower priority for a lot of people. Rates seem to have impacted CAR as well and the bottom line decreased by 39% YoY, which has given way to the high amount of short interest circulating the company currently.

Income Statement (Earnings Report)

A big cause was also the depreciation of vehicles for the company as well as lease charges. This went from $134 million in Q3 of FY2022 up to $517 million in Q3 FY2023. The vehicle interest also increased by $100 million further which resulted in total expenses rising by over $600 million all the whilst the revenue of the company stayed flat.

Looking closer at Zipcar as a brand and asset for the company it’s included in other revenues for the company and last quarter did show a trend appearing where it’s declining. I think the. growth opportunity for Zipcar is there but the current market climate may not support any rapid growth. At the valuation that we will get to below, I still think a hold is reasonable as the risks seem to be accounted for right now in it.

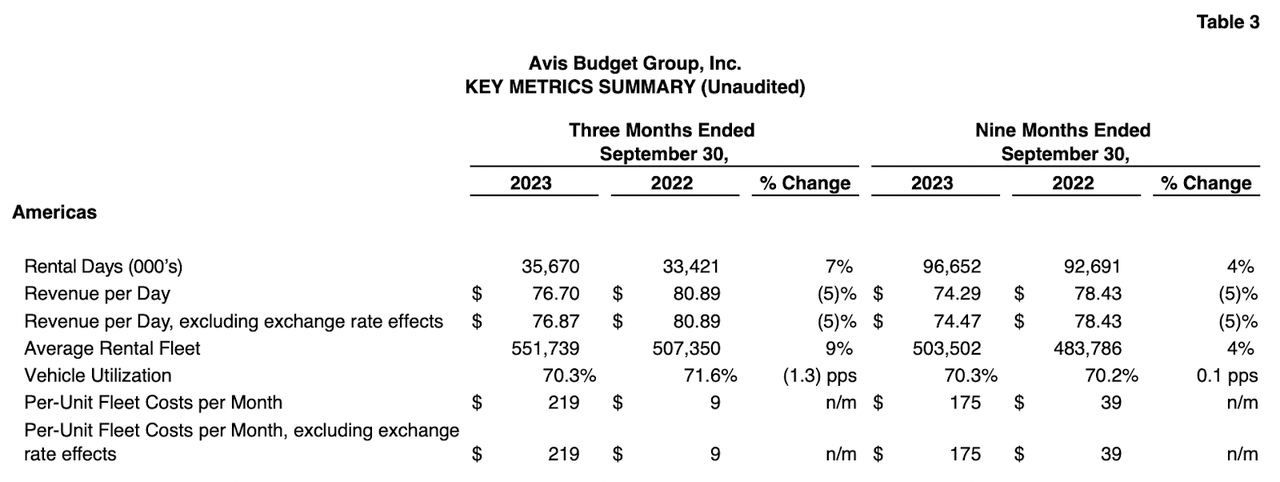

US Segment (Earnings Report)

The Americas continues to be the largest market for the company right now and the rental days here increased by 7% YoY, which was a welcomed positive sign last quarter. Revenue per day decreased though, which shows that the pricing environment might not be that solid for CAR and competition is still stiff. Furthermore, the utilization rate for the company decreased to 70.3%. This has been visible as well in the ROA of the company, which peaked at over 10% in the last quarter of 2022 and now is below 6%. I do think further depreciation here will be visible and that means a lower valuation is justified and a buy rating is hard to make as well.

One of the largest companies and peers to CAR is HTZ. When looking at the valuation of these companies they trade very low on a p/s scale, CAR at 0.56 and HTZ at 0.27. I think a key reason for CAR trading at a slightly higher multiple has to do with their stronger margins in comparison to HTZ. The gross margins are at 41% and over the last 10 years have seen the top line growing at 4.44% CAGR. Moving to HTZ they have gross margins at 25% and have the last decade actually seen its topline retreat and post an average decline of 1.33% during that same period. I think this shows that perhaps CAR may be the superior growth opportunity, but as I have stated before, not at a point where it’s enough convincing to make a buy.

Risks

As an increasing number of companies delve into the car-sharing industry, there emerges a notable risk of a “race to the bottom.” This scenario entails fierce competition where companies attempt to outdo each other by slashing prices to secure a larger market share. This intensified competition may result in thinner profit margins for companies, including CAR, compared to what is currently reflected in their valuation.

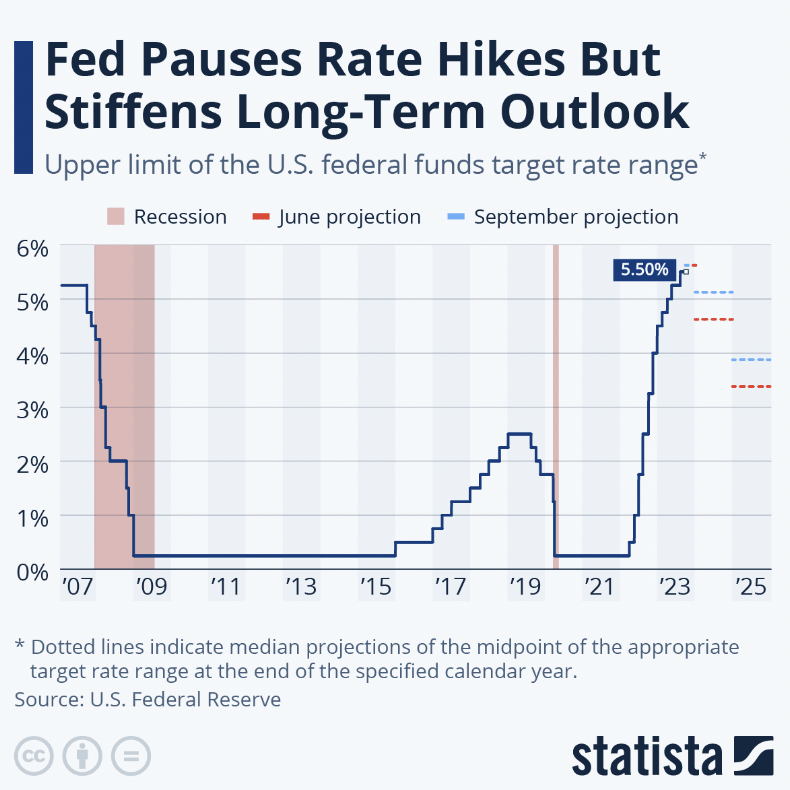

Rate Hikes (Statista)

Moreover, the persistent threat of higher interest rates poses an additional challenge to profitability. If interest rates continue to rise and remain elevated for an extended period, it’s conceivable that CAR’s valuation might experience downward pressure, potentially leading to a reduction in its trading multiple. Higher interest rates often lead to more pressure on the bottom lines as interest expenses grow. The evolving landscape of the car-sharing industry, coupled with economic factors like interest rates, underscores the need for companies to strategize effectively to maintain a competitive edge and financial resilience in the face of these challenges.

Final Words

The car rental industry is quite interesting to follow as in many ways it’s a good reflection of how consumers spending power looks. The demand for CAR has not appreciated very much as the revenues stayed largely flat YoY. Furthermore, the higher interest rates and large depreciation of vehicles and other assets have helped result in a 39% YoY decrease in net incomes as seen in the last earnings report. I think that CAR is also at a point where it needs to allocate a lot of capital to Zipcar to gain market share in the growing car-sharing industry, which is disrupting the more traditional car rental industry. Right now the results are trending the wrong way but I think the risks are baked in with the current company valuation and a hold rating can be justified here.

Read the full article here