Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the second week of November.

Market Action

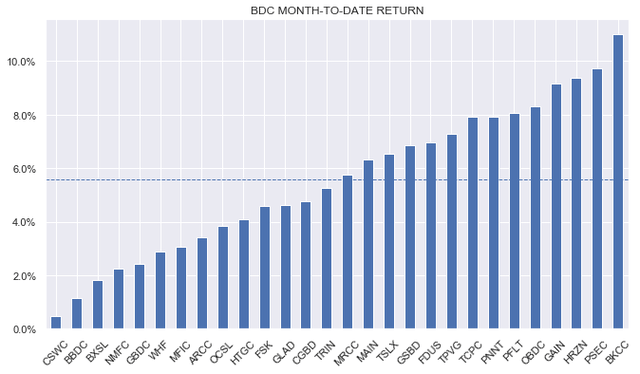

BDCs were flat on the week as markets consolidated after a sharp run-up over the previous couple of weeks. Month-to-date, all BDCs in our coverage are in the green.

Systematic Income

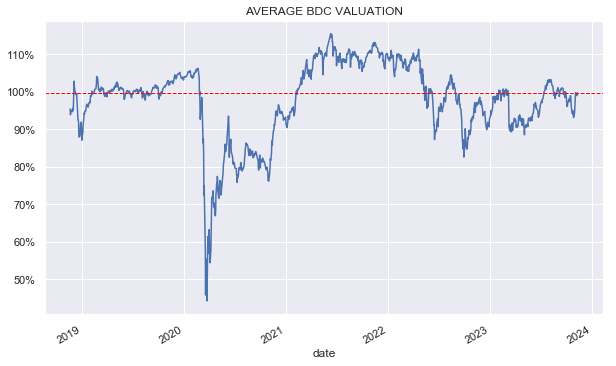

Valuations remain near 100% after briefly dipping towards the low 90s area – when we managed to squeeze in an upsize to our BDC position. BDC earnings have been coming in very strong so this is likely to support the sector over the coming weeks.

Systematic Income

Market Themes

MidCap Financial Investment Corp. (MFIC) announced a merger agreement with two Apollo loan CEFs (AIF) and (AFT). MFIC is a former Apollo BDC (AINV) so there is a connection there. As a sweetener for the proposed merger, the two CEFs get an additional $0.25 (a bit less than 2% of NAV) on closing.

We do see quite a few BDC mergers (FCRD, BKCC etc) and CEF mergers (too many to count) however we don’t see a lot of BDC / CEF mergers. On the face of it maybe we should since BDCs hold “loans” as do “loan” CEFs like AIF and AFT.

However, while both can hold loans, the loans themselves are very different between the two types of vehicles. BDCs hold private loans that they themselves typically negotiate with companies that they tend to have a close relationship with. There are very few exceptions such as OCSL which likes to punt in the public loan market but even there the size of its public loan position is very small.

CEFs, on the other hand, hold public i.e. bank loans that they acquire in the secondary market. Again, there are a handful of exceptions such as the Barings CEFs which are really more BDCs at heart than CEFs.

The two different types of loans have important knock-on effects. If MFIC acquires the portfolios of AIF and AFT much of the value of the BDC wrapper disappears for those assets. Public loans have to be marked-to-market – they have much more volatile valuations than private loans. This is why loan CEFs have much lower leverage levels than BDCs.

The ability of MFIC to “manage” its NAV as other BDCs do will also be significantly reduced. BDC are less at risk for a forced deleveraging than the lower-leveraged CEFs because of their ability to mark-to-model rather than mark-to-market. This, naturally, keeps BDC NAVs much more stable than loan CEF NAVs. An increase in public loans within the portfolio may cause MFIC to dial its leverage down in response to the higher volatility of its assets, losing much of the BDC wrapper benefit.

Two, MFIC will not have a relationship with the companies whose loans it acquires from the funds so there will be nothing for it to do to manage them (e.g. convert to PIK, offer management assistance and cross-selling opportunities etc) if they deteriorate except to sell them. Unlike in private lending, public loans are usually held by many investors, making it very difficult to coordinate assistance to the borrower.

So, what is going on? The simplest answer here is that this seems to be a grab for assets. MFIC trades below the NAV which makes it difficult to grow its asset base via at-the-market share sales and public offerings. Another key benefit is fees. MFIC has a fee that’s twice that of the CEFs so, all of a sudden, you double your fees on the same assets – magic!

Ultimately, we suspect MFIC will unwind all of the AIF/AFT portfolios and plow the money into new private lending. This will allow it to grow its total asset base above and beyond the assets held by the two funds as MFIC operates at a higher level of leverage.

MFIC said that the combined company will have greater scale and diversification – the scale point is fair enough however the diversification point is not obvious. MFIC and AIF have about the same number of positions however the largest MFIC positions are “chunkier”. Plus, because of its higher leverage, each position is a higher proportion of the NAV than in AIF. This is not to mention the 8% Aviation legacy portfolio. For an MFIC shareholder, there will be additional diversification however for an AIF shareholder there will arguably be less diversification.

It remains to be seen whether the merger will close. As a holder of the CEFs, it’s not at all obvious that this merger makes sense as it decreases the pool of loan CEFs and provides no valuation upside for the CEF holders given the sizable MFIC discount.

Market Commentary

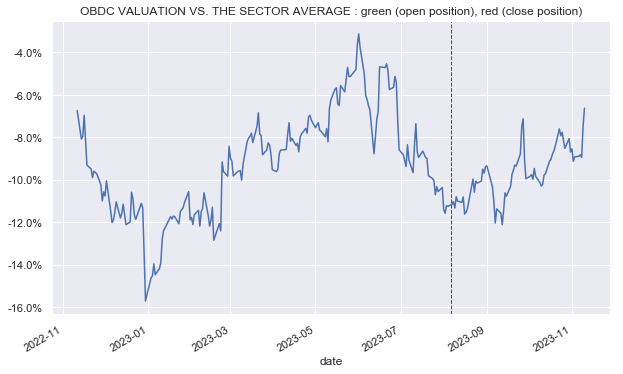

Blue Own Capital Corp (OBDC) delivered good results with a 3.6% total NAV return. Both net interest income and the NAV rose marginally. Non-accruals remained the same.

The stock remains attractive in the sector. In the past year it has outperformed the broader sector with a return double of the median BDC however it continues to trade at a substantial discount to the sector.

This discount has continued to narrow since our initial allocation to the stock when it was trading at more than a 10% wider discount. This convergence should continue over the medium term.

Systematic Income

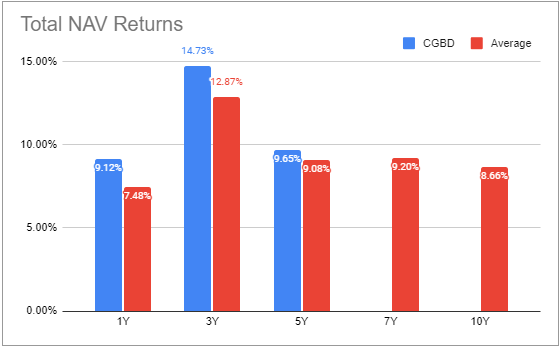

Carlyle Secured Lending (CGBD) reported good Q3 numbers for a total NAV return of 3.5% over the quarter. Net income was fairly flat – as net new investments remained negative and a high level of floating-rate liabilities was a headwind. Non-accruals held steady.

Overall, the company continues to do very well but trades well below the sector average valuation. If its outperformance continues we should see continued improvement in its valuation.

Systematic Income BDC Tool

Read the full article here