Belpointe PREP, LLC (NYSE:OZ) is currently trading at a discount to its NAV despite its good growth prospects and conservative balance sheet, reflecting in part its considerable dilution risk.

Business Overview

Belpointe PREP is based in Delaware and was founded in 2020, having nowadays a market value of about $250 million, being therefore a small-cap company by this measure. It’s a limited liability company (LLC), and its goal is to operate in a manner that can quality as a partnership for U.S. federal income tax purposes.

Its business goal is to identify and manage commercial real estate within qualified opportunity zones, which should represent at least some 90% of its assets. Belpointe PREP has been considered a qualified opportunity fund since its first taxable year (2020), making some of its investors eligible for favorable capital gains tax treatment in their investments, being a distinctive feature of its investment profile compared to other Real Estate Investment Trusts (REITs).

Belpointe PREP is externally managed by Belpointe PREP Manager, LLC, which is an affiliate of its sponsor, Belpointe LLC. This means that its external manager is responsible for managing daily operations, and implementing Belpointe PREP’s investment objectives and strategy, thus the company does not have any employees and no intention of having employees.

Its manager has a team of investment and asset management professionals, which are part of Belpointe Asset Management, LLC, a private asset management company with offices in Greenwich and Reno.

Belpointe Asset Management operates a family office, making investments across several asset classes, and providing wealth management, legal, and real estate services to its clients. At the end of 2022, its assets under management were above $3 billion in public securities, being a relatively small asset manager by this measure.

Regarding its main goals, Belpointe PREP aims to preserve and return its capital contribution, expecting to pay attractive and recurring cash distribution to its investors.

Its initial investments consist of properties based on qualified opportunity zones, which is an economically distressed community where new investments may be eligible for preferential tax treatment. This program was created in 2017 to encourage new long-term investments in low income urban and rural communities across the U.S., and there are nowadays about 8,700 qualified opportunity zones across the country.

Belpointe PREP’s assets are focused on multifamily housing, student houses, senior living, healthcare, industrial, self-storage, office, beyond others. This means that Belpointe PREP will seek to buy and manage properties which may be attractively valued or have good redevelopment prospects, aiming to create value for investors over the long-term without being specialized in a single, or a few, real estate segments.

By geography, Belpointe PREP wants to invest across the U.S., not having therefore any region or state specifically targeted for investments, being open to invest where the opportunity arises.

By its investment guidelines mandate, its external manager has enough autonomy to decide and execute acquisitions and divestments, including the reinvestment of capital gains, if they are within the fund’s strategy and investment criteria. Investors should note that Belpointe PREP’s current focus and structure as an opportunity zone fund may cease at any time, which means its investment strategy may change in the future if it considers to be better investment opportunities outside of qualified opportunity zones.

Regarding its current investment portfolio, Belpointe PREP owned at the end of 2022, several assets in Florida, Connecticut, and Tennessee. These assets consist of a mix of undeveloped land, expected to be used for building residential units or mixed-use development, office, retail stores, and industrial buildings. The vast majority of its assets are for redevelopment, aiming to build new apartment buildings or residential communities, due to good demand for these types of properties in these locations.

Given that Belpointe PREP is externally managed, its role is mainly as a passive investor, while the management of each asset is done by its manager or sponsor, or a combination of both.

Financial Overview

Regarding its financial profile, Belpointe PREP has acquired assets in recent years, mainly for redevelopment purposes, and therefore has not generated much revenue or cash flows. Belpointe PREP has raised equity to buy its assets, but also intends to use leverage to provide more funds available for investment.

Indeed, for instance, the fund bought a property in Sarasota, Florida for some $20.7 million, which was partially funded by a secured loan from First Foundation Bank of $10.8 million. While this loan was fully repaid in 2022, this is an example of how Belpointe PREP can use borrowings to leverage its investment portfolio, aiming to generate higher returns for its unitholders and investors.

Belpointe PREP wants to use leverage in a conservative perspective, not putting into question its business sustainability. Its target at the property-level, is to use debt in the range of 50-70% of the greater of the cost of the fair market value of its assets, most likely in the form of mortgage loans at the property-level or line of credit at the company level.

Since its IPO in 2020, Belpointe PREP has raised some $226 million from equity issuance, which has used to fund its loans receivables in an amount of about $35 million, and more than $29 million was used to purchase properties and land.

However, most of its assets do not generate any meaningful revenue or cash flows, explaining why its revenue was only $1.4 million in 2022, being totally generated by rental income. This was not enough to cover property and general expenses, plus depreciation, leading to an operating loss of about $8 million in the year, while in the previous year its loss was about $3 million. At the end of 2022, Belpointe PREP had about $145 million in cash, as the company has used some of its capital raised to make acquisitions and construction works.

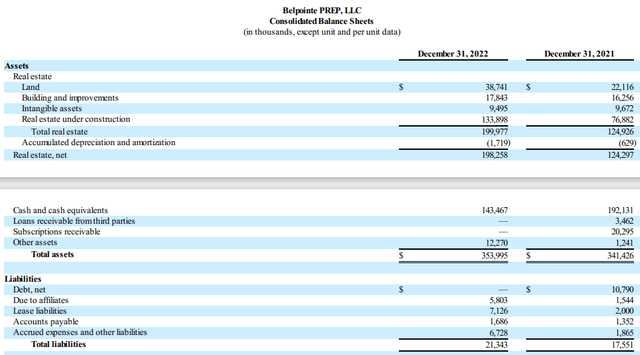

At the end of 2022, Belpointe PREP’s assets amounted to more than $354 million, while it only had some $21 million of liabilities, as shown in the next table, having therefore a quite low leverage position and can easily increase its borrowings over the next few years to develop its investment portfolio.

Balance sheet (Belpointe PREP)

While Belpointe PREP’s current portfolio is not generating much rental income and cash flows, it has enough financial resources to invest in its current properties and is expected to gradually increase its organic revenues and cash flows.

Moreover, Belpointe PREP has announced back in May a new $750 million offering of its Class A units, to raise additional capital to fund its current and potential investments. So far, the company has decided not to raise new capital, but may pursue further raisings in the future to finance the growth of its investment portfolio, which should have a short-term negative impact on its share price due to dilution, but should be positive over the long term if the company is able to generate value as expected from its redevelopment projects.

Conclusion

Belpointe PRERP offers a unique investment proposition by being the only publicly traded opportunity fund, aiming to invest in several segments of the real estate sector to create value for unitholders over the long term.

While the company’s track record is quite short and currently it does not have much income-generating assets, it has good growth prospects if it can successfully develop its projects. This means execution risk is considerable, plus funding conditions are also tough for the company with banking partners, explaining in my opinion why its share price is currently at some discount to its net asset value.

Indeed, its last NAV disclosed at the end of last June was $98.58 per unit, which means is currently trading at 0.68x NAV. Despite this discount, I think investors should wait for the company to start generating meaningful revenue and cash flows that can, at least in part, organically finance its growth projects, or the risk of dilution is quite significant and a lower NAV is likely ahead.

Read the full article here