Berkshire Hathaway Inc. (NYSE:BRK.A) (NYSE:BRK.B) investors are likely at a crossroads as they assess whether Warren Buffett anticipates a recession or not seeing attractive value in Berkshire shares.

The leading conglomerate reported its third-quarter or FQ3 earnings results over the weekend. The highlight of the earnings report was a significant 41% surge in operating earnings to $10.76B, benefiting from the impressive performance in its insurance business. Accordingly, Berkshire’s insurance underwriting business delivered operating earnings of $2.42B, up markedly from a loss of -$1.07B in the previous year. Despite that, weaknesses in Berkshire’s energy, utilities, and railroad business offset part of the gains. Still, it was a massive quarter for Berkshire investors, demonstrating the well-diversified resilience of the company’s business model.

However, Warren Buffett tempered his enthusiasm for stock repurchases in Q3, deploying $1.1B. In addition, an estimated $800M was also repurchased in October “up to the 24th of the month.” As such, it suggests Buffett timed his repurchases with aplomb, as BRK.B bottomed out in late October.

Notwithstanding Berkshire’s repurchases, the $1.1B buyback cadence was more than 20% below Q2’s $1.4B metric. It was also substantially below the $4.4B buyback initiated in the first quarter of 2023. As such, Buffett didn’t seem convinced about buying back its stock aggressively, even though its cash and short-term investments pile swelled to $157B in Q3.

I believe Buffett’s caution is astute. I updated Berkshire investors in my previous article that Berkshire shares weren’t attractive following the surge toward its September highs. That caution has panned out, as BRK has underperformed the S&P 500 (SP500) since my previous update. In addition, buyers didn’t seem keen to carry on the recovery from last week’s bottom as BRK.B fell from last week’s highs. In other words, I believe investors bought into Berkshire shares ahead of its earnings release, anticipating a more robust buyback cadence, but were likely left disappointed.

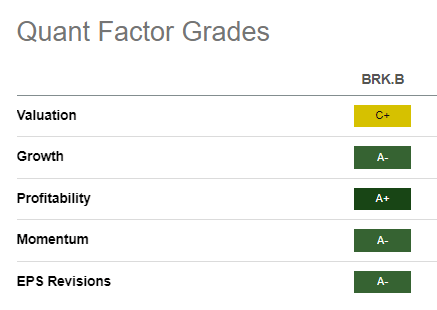

BRK.B Quant Grades (Seeking Alpha)

BRK.B garners highly attractive factor ratings from Seeking Alpha’s Quant, corroborating its wide-moat business model. As such, I believe BRK.B is a stock that should be held and bought on steep pullbacks if they occur. Its “C+” valuation grade suggests Berkshire stock isn’t expensive. Notably, its forward operating earnings per share multiple of 19x is below its 10Y average of 20.5x.

Notwithstanding the positive Quant metrics, I assessed that investors must continue to be cautious, as the market is likely rotating toward well-battered sectors that could see BRK.B underperform in the near- to medium-term. Given BRK.B’s seemingly fair valuation, investors must remain patient and wait for a steeper pullback that could see Buffett deploying his record cash pile more aggressively.

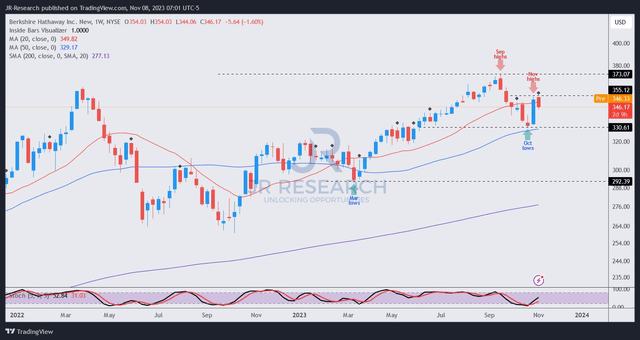

BRK.B price chart (weekly) (TradingView)

BRK.B dip-buyers staged a remarkable rally last week, in line with the broad market recovery. It was also an astute bear trap (false downside breakdown), as BRK.B bottomed out in late October at the $330 level after falling toward lows last seen in late June.

Notably, Buffett’s more aggressive deployment of funds in October suggests that level could attract Berkshire again if we potentially re-test those levels. Hence, I urge investors to pay close attention to that support zone.

For now, BRK.B’s upward recovery seems to have failed at a pivotal juncture. The market structure suggests a possible October 2023 lows re-test is increasingly likely, paving the way for patient investors to add based on a more attractive risk/reward profile. Berkshire investors should heed Buffett’s patience as we anticipate the next steep pullback.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here