Intro

Neurodegenerative disease-focused BioVie (NASDAQ:BIVI) recently presented a set of blinded data which, if taken at face value, suggest that its lead asset NE3107 may have robust (and potentially unprecedented) cognitive and biomarker efficacy in Alzheimer’s disease.

On October 25th, the company presented blinded data from its Phase 3 trial of NE3107 in patients with mild-to-moderate Alzheimer’s disease at the CTAD Alzheimer’s Congress in Boston. While a bit unorthodox to present blinded data, CEO Cuong Do has commented that the company originally planned to present the full unblinded data at CTAD, but did not have enough time to verify and lock the database after trial completion in late September.

After no initial reaction from the market, BioVie held a webcast on November 1st to present the data and take questions from investors. Interestingly, the presentation included a full graphical plot of the blinded data points on a number of cognitive and biomarker/imaging endpoints.

On the webcast and in other media appearances, CEO Cuong Do has not been shy about characterizing the data as showing a “beautiful pattern of scattering” into two groups of patients—one which got better and one which got worse—suggesting strong underlying efficacy. While we don’t exactly agree with this characterization, the blinded results do appear to show significant positive signs, primarily in the form of a consistent skewing of the blinded data towards cognitive improvement on multiple endpoints. The stock traded up more than 40% as investors began to take notice.

We, like many others, have discounted BioVie to some degree because of the checkered history of its former Chairman and current largest shareholder, Terren Peizer, who was charged with alleged securities fraud related to healthcare company Ontrak (OTRK) in March. Adding an additional wrinkle to the story, BioVie announced on November 8th via its 10-Q (page 25) that it had discovered 6 of its third-party 31 clinical sites had potentially engaged in clinical misconduct. The stock traded down aggressively but has since recovered and started to show momentum starting the back half of last week.

At ~$160 million of market capitalization, we think the market is significantly undervaluing BioVie’s probability of reporting a positive result when it unblinds its Phase 3 data in late November/early December. If the unblinded data confirm the positive appearance of the blinded data, BioVie could separate itself as perhaps the only biotech with real proof of efficacy that can actually reverse the symptoms of Alzheimer’s disease (rather than just marginally slowing cognitive decline). In which case, we think BioVie would have to trade up to at least in line with the larger small-cap neurodegenerative biotechs like Anavex Life Sciences (AVXL) ($513 million market cap) and Cassava Sciences (SAVA) ($948 million).

While we hope to point out areas of BioVie’s story that we think either warrant skepticism or are being overlooked by other investors/authors, the blinded data has continued to look more encouraging the deeper we dive. At this point, BioVie is very worthy of watching over the next few weeks, especially for those that follow the neurodegenerative space, and, in our view, is worthy of a speculative position due to its asymmetric risk/reward profile going into the unblinded data readout.

NE3107 and Company Overview

By way of a short history, BioVie acquired the rights to NE3107 (previously HE3286) in June 2021 from Neurmedix, a biotech company substantially owned by Terren Peizer, in exchange for 8.3 million shares of BioVie (~$120 million value at the time). The molecule had previously been investigated by Harbor Therapeutics primarily in metabolic disorders.

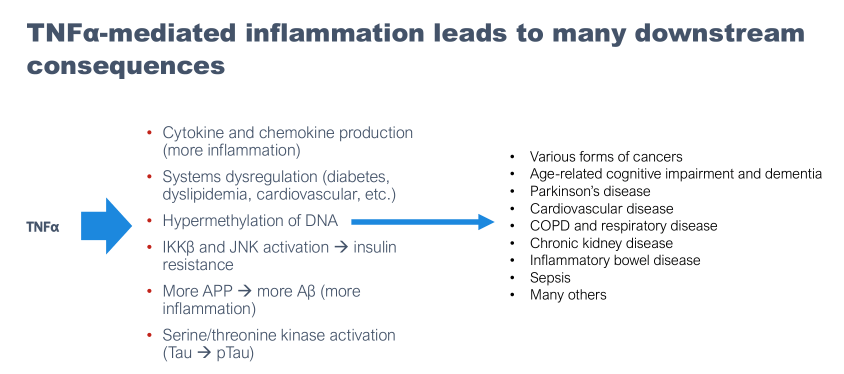

NE3107 is a chemical derivative of the mammalian sterol βAET, which is a metabolite of DHEA (an endogenous androgen hormone). NE3107’s primary biological mechanisms are anti-inflammatory, primarily mediated via the inhibition of ERK and NF-kB (and consequent inhibition of primary inflammatory mediator TNF-alpha), and insulin-sensitizing. Much of the mechanistic findings surrounding NE3107 as it pertains to its potential in Alzheimer’s disease are summarized in Reading et al., 2021. In short, BioVie is advancing NE3107 as a metabolic and inflammation-focused approach to Alzheimer’s disease.

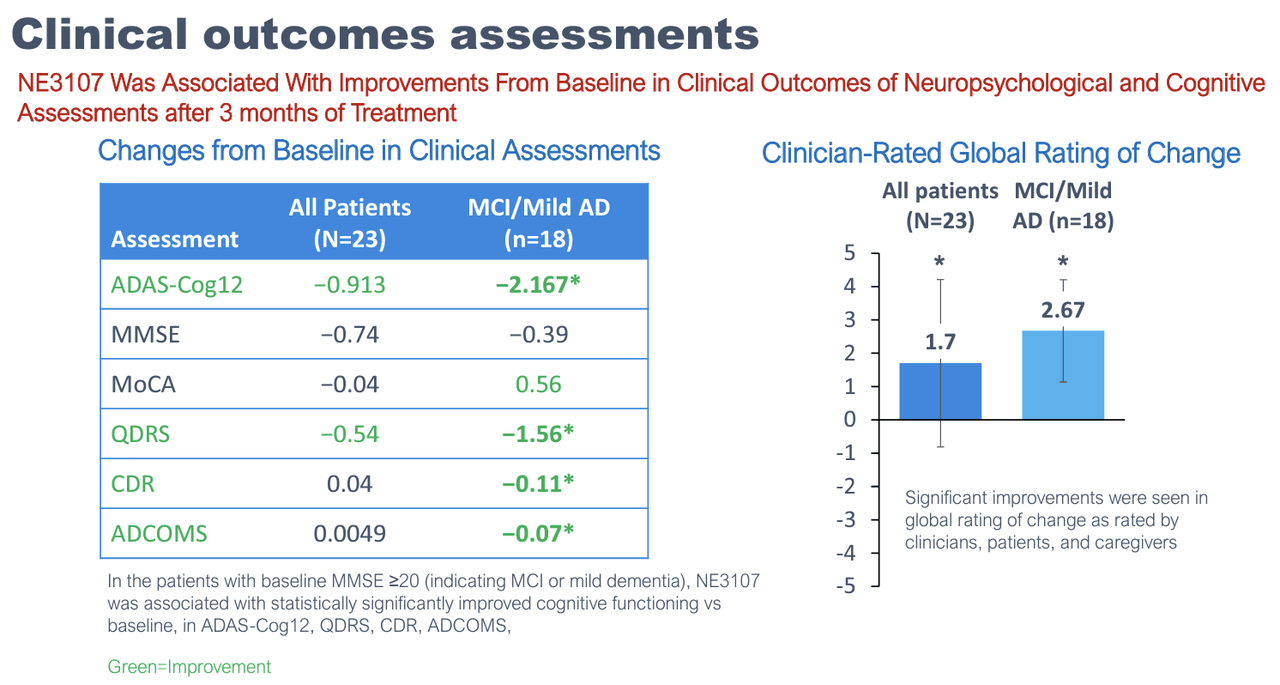

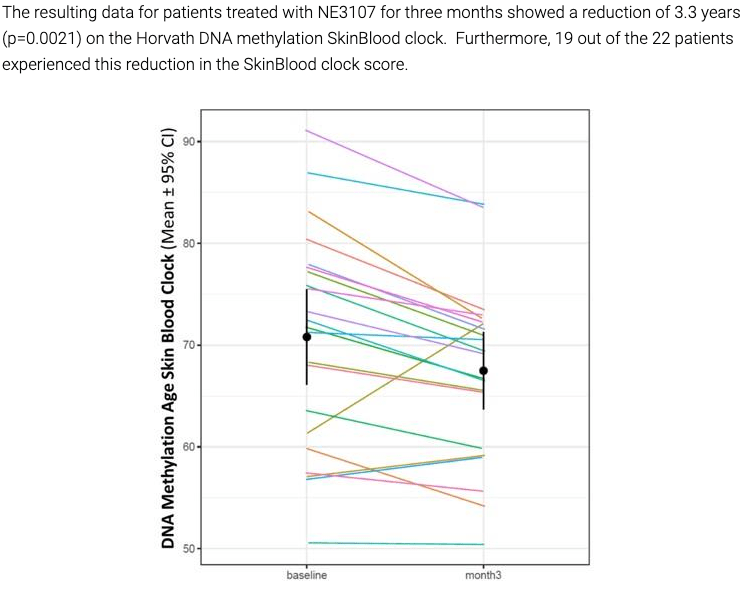

Prior to the recently reported Phase 3 blinded data, there was limited in-human data on NE3107 in neurodegenerative diseases. In Alzheimer’s, BioVie’s largest set of in-human data was a three-month open-label study that enrolled only 23 patients. The company reported the results in December 2022.

BioVie Company Presentation

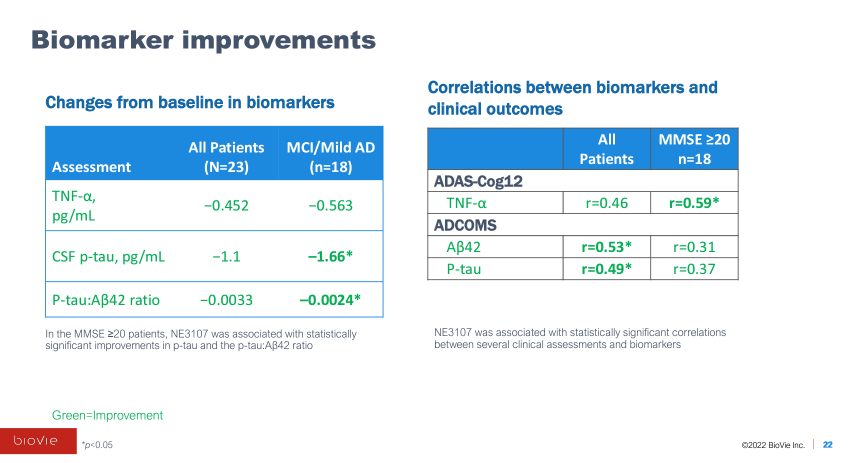

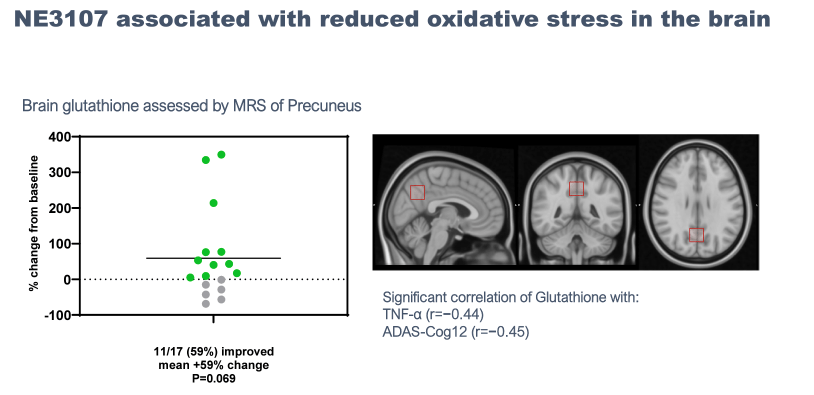

While the results are mostly uninterpretable due to the small sample size, they showed some very preliminary signs of encouragement, mostly in earlier-stage mild AD and mild cognitive impairment, or MCI, patients. The study also reported various exploratory endpoints that showed signs of improvement, including TNF-alpha levels, functional MRI, brain glutathione levels, and, most interestingly, DNA methylation.

BioVie Company Presentation

BioVie Company Presentation

BioVie Company Presentation

In the same month of December 2022, the company also reported data from a small Parkinson’s trial. The main takeaway from the data was that about one-third of treated patients did not experience the normal return to the “OFF” state (significant Parkinson’s symptoms) upon waking up in the morning (i.e. they remained in an “ON” state).

In March 2023, the company held a “BioVie Day” where the company went over the results of both trials and emphasized its belief that NE3107’s interruption of inflammatory TNF-alpha via ERK/NF-kB and improved insulin sensitivity/glucose metabolism were key to its limited, though encouraging, early data in Alzheimer’s and Parkinson’s.

BioVie Company Presentation

Blinded Data

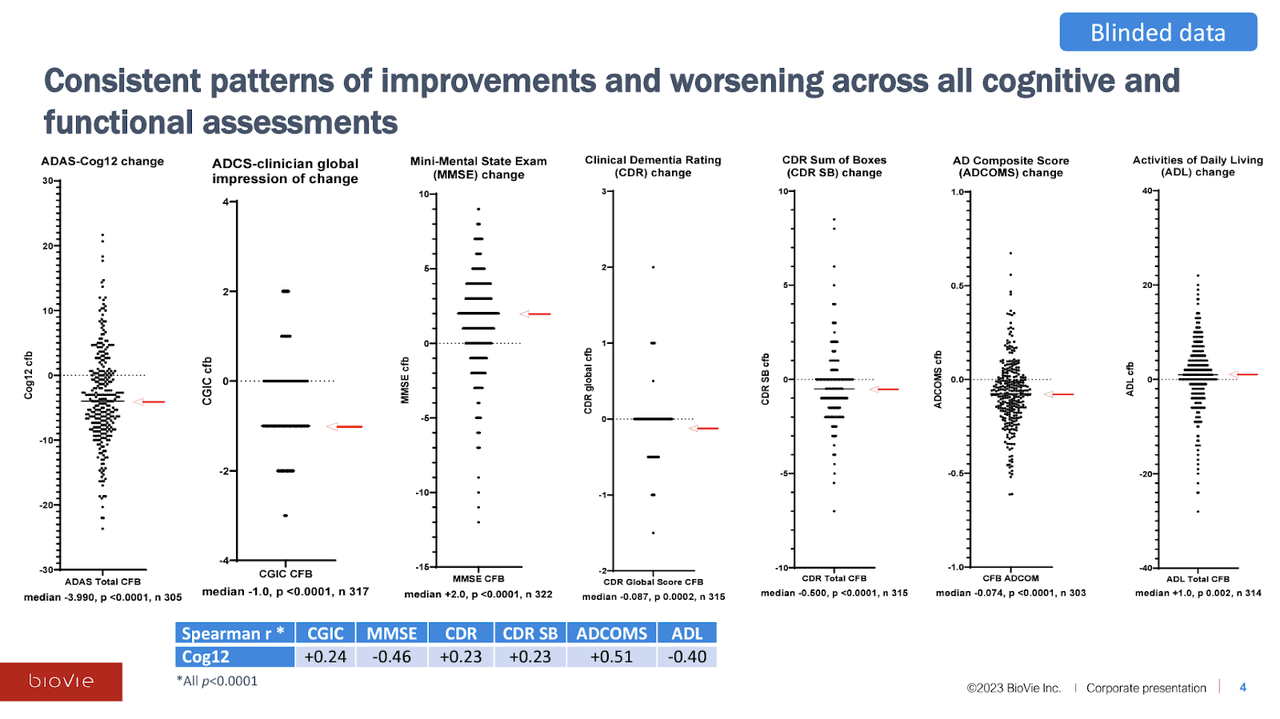

The blinded data presented by BioVie at CTAD include ~320 of the 436 total mild-to-moderate Alzheimer’s patients that were enrolled in the Phase 3 study, split 1:1 between placebo and 20 mg of NE3107. We believe the incomplete data set (~75% of total trial participants) was a function of what data was cleaned and presentable at the time of CTAD. The investor webinar discussing the data was held on November 1st. Here are the data from the major cognitive endpoints:

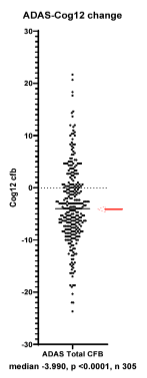

BioVie Blinded Data Presentation

On all of the cognitive assessments—which include all of the most commonly used Alzheimer’s endpoints (i.e. ADAS-Cog, CDR-SB, MMSE)—NE3107 reported a median (and average) improvement in cognitive function (which means higher scores for certain cognitive assessments, and lower scores for others). Interestingly, the company also stated that the distributions were roughly the same across disease severity (mild/moderate AD, MCI), genetic predisposition (APOE4), gender, and age. The trial dropout rate due to adverse events (AEs) was only 2.3%.

Not only does the data skew towards cognitive improvement, but the effect sizes are large. On the gold-standard ADAS-Cog12 test, for example, the mean of the blinded data was a 3.99-point improvement. For reference, Alzheimer’s patients are expected to decline about 2-5 points per year on this measure (Lansdall, et al., 2022, Zhang, et al., 2020), and a 3-4 point improvement is considered to be clinically meaningful (Schrag, et al., 2011).

The median ~4 point improvement on ADAS-Cog for the blinded data suggest substantial and clinically meaningful treatment effects for NE3107 and, as discussed below, we think the positive skew of the blinded data is likely too large to be explained predominantly by placebo effects.

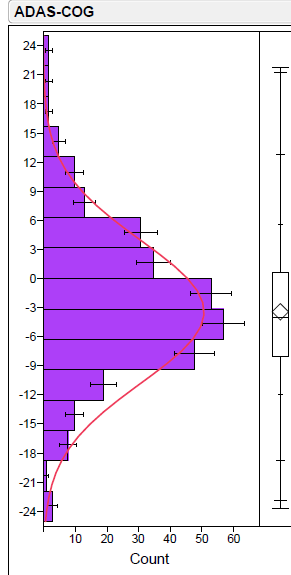

“Clumping” and Bimodal Distribution

Firstly, let’s address the issue of the dispersion of the unblinded data. Recall that CEO Cuong Do referred to “beautiful scattering” of the blinded data, suggesting a divergence of the data into two groups, i.e., a bimodal distribution. You can judge for yourself, but it does not appear from the plots presented by BioVie that this characterization is accurate. The data appear to generally follow a normal distribution, with one primary “clump” of data points. Without the actual data points, however, it is hard to tell for sure.

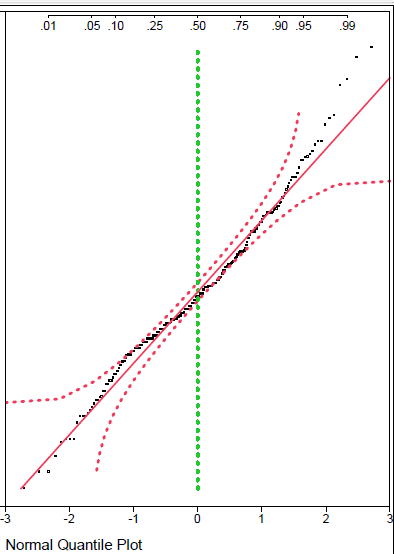

Jesse Brodkin, an active biotech analyst and statistician on Twitter, posted a thread of statistical analyses of the unblinded ADAS-Cog data by manually estimating the individual data points, concluding that the data essentially adhered to a normal distribution.

Jesse Brodkin Twitter

Jesse Brodkin Twitter

While Jesse seems to lean towards skepticism by disposition (probably healthy in biotech investing), we think it is safe to say that there is no clear evidence of data separation into two groups. This fact appears to be overlooked by many following BioVie who may simply be taking Cuong Do’s characterization of the data at face value.

Ultimately, we don’t think it is particularly important whether the data is showing the emergence of a bimodal distribution. The important aspect of BioVie’s blinded data is the substantial skew toward cognitive improvement seen across each of the cognitive assessments. NE3107-treated patients can (and, we argue, are likely to) significantly separate from placebo patients in terms of cognitive improvement, regardless of whether or not the data is splitting clearly into two groups.

Placebo and Expected Decline

Corresponding with the positive skew, we can see that about 60-70% of patients in the blinded data appear to have seen an absolute improvement in cognition from baseline as measured by ADAS-Cog12. Given that only ~50% of patients are on active treatment (which ideally would be the only patients showing improvement), the blinded data suggests a significant placebo effect in some patients in the trial.

While strong placebo effects resulting in actual cognitive improvement are not considered to be common in AD trials, especially over longer periods of time, a shorter six-month study could conceivably be subject to a “learning” effect, meaning patients can remember parts of the test they took six months prior.

E. Roudasev covers the placebo topic well in her article and essentially concludes that Alzheimer’s patients on placebo decline as expected over time within a 90% prediction interval (i.e. Alzheimer’s patients don’t really have a meaningful placebo response, especially over longer periods of time).

As mentioned, without treatment, Alzheimer’s patients are expected to decline between 2-5 points per year on the ADAS-Cog scale (Lansdall, et al., 2022), with some meta analyses finding 5+ point average annual declines (Zhang, et al., 2020). E. Roudasev estimates ~2.5 points of worsening would be expected over the six-month duration of BioVie’s study.

For additional context, we analyze the placebo groups of a handful of recent Alzheimer’s trials:

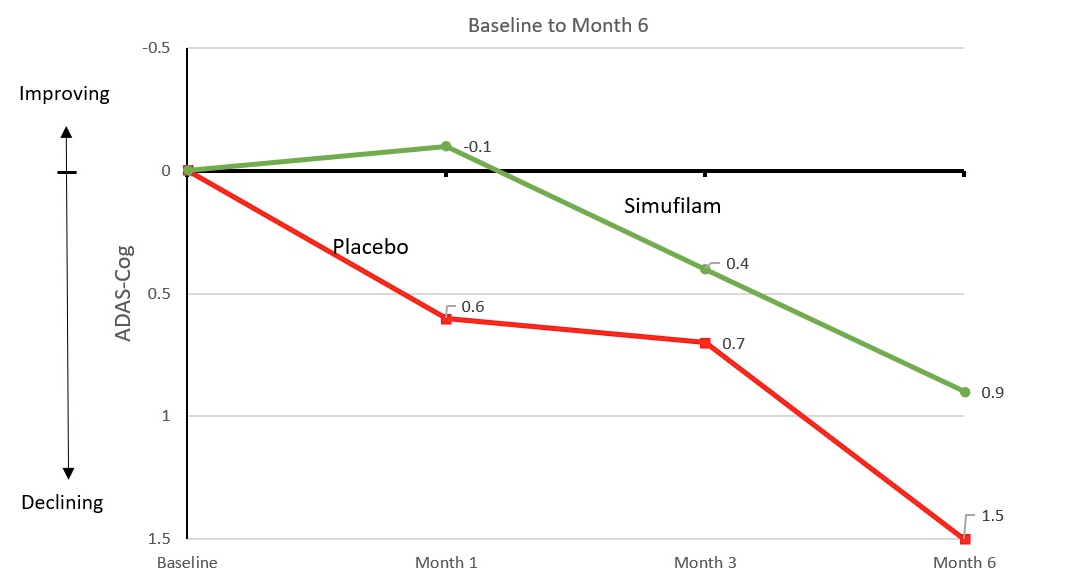

Anavex Life Sciences’ Phase 2b/3 trial of blarcamesine reported a worsening of the placebo by about 3.5 points on ADAS-Cog over 48 weeks (link).

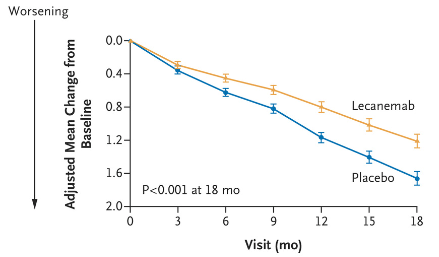

Biogen’s Phase 3 lecanemab (Leqembi) used CDR-SB as its primary endpoint, on which placebo declined 0.6 points (link). On ADAS-Cog14, a larger version of the ADAS-Cog scale with a possible total score of 90 points (versus 70 for ADAS-Cog12), the placebo group declined about 1 point at six months of treatment.

Lecanemab Phase 3 Data

Lecanemab Phase 3 Data

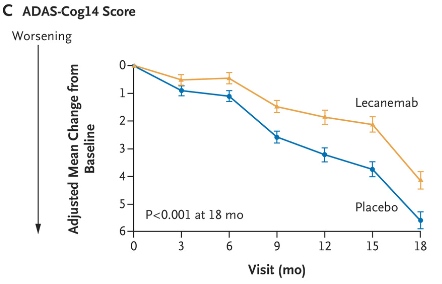

Donanemab’s (Eli Lilly) Phase 2 study reported a mild placebo effect of less than 1 point of worsening on ADAS-Cog13 at six weeks. CDR-SB worsened by a bit less than 0.5 points.

Donanemab Phase 3 Data

Cassava Sciences’ reported a decline of 1.5 points on ADAS-Cog over six months in its CMS trial.

Cassava Press Release

In short, it is unusual for Alzheimer’s placebo groups to see an improvement in cognition on an absolute basis, with most recent studies reporting at least a 1-point average decline in ADAS-Cog at six months.

Additionally, the inclusion criteria for BioVie’s Phase 3 study included an MMSE score of 14-24, which allows for the enrollment of patients with more advanced disease than many other Alzheimer’s trials. An MMSE below 20 is usually considered “moderate” Alzheimer’s dementia, while many trials, namely for the anti-amyloid mAbs, are conducted in “mild” Alzheimer’s patients (MMSE above 20 or 22). More advanced patients are expected to decline more rapidly than early patients, with studies finding that mild AD patients expected to decline about 2-3 points on ADAS-Cog per year, while moderate AD patients are expected to decline about 5 points per year (Padhorna et al., 2016, Wattmo, et al., 2016). BioVie’s baseline data showed an average MMSE of 20 for enrolled patients (i.e. in between mild and moderate Alzheimer’s), making it even more unlikely that patients could have a strong placebo response.

Considering all of the data and analyses above, we would have expected at least a 1 point of worsening on ADAS-Cog12 at six months for the placebo group in BioVie’s Phase 3 trial. It appears from the distribution of BioVie’s blinded data, however, that Phase 3’s placebo group is likely to report a stronger-than-average response. If the unblinded data confirms the positive interpretation of the blinded data (i.e. most of the patients showing worse cognitive improvement than the median are placebo patients), the placebo group will likely read out at roughly no change from baseline, or perhaps a slight improvement of less than 1 point on ADAS-Cog.

Strong Effect Size

While the placebo effect in BioVie’s Phase 3 may be more pronounced than in other trials, the magnitude of the positive skew toward cognitive improvement in the blinded data appears to indicate underlying efficacy for NE3107. Taking a look again at the ADAS-Cog data:

BioVie Blinded Data Presentation

By definition, roughly half of the patients in BioVie’s Phase 3 improved more than the 4-point median on ADAS-Cog12 (we expect the median to hold roughly stable when the additional ~100 patients are included in the data unblinding). It even appears that ~30%+ of patients had a 6+ point improvement on ADAS-Cog12. As discussed, it should be highly unlikely for placebo patients with an average MMSE of 20 (i.e. on the brink of moderate AD) to achieve a 4- or 6-point improvement on ADAS-cog.

Thus, we think that the (probably large) majority of the patients below (better than) the 4-point median is likely on active NE3107 treatment. Assuming that even just a moderate majority of the patients below (better than) the 4-point median are in the active NE3107 arm, the mean improvement for the NE3107 group when the data is unblinded could be something like 5+ points for the NE3107 group on ADAS-Cog, which in a 400+ patient study would likely deliver strong statistical significance (versus a placebo group average around 1 point of improvement, for example).

Recall that a 3-4 point improvement on ADAS-Cog is considered clinically meaningful, meaning it noticeably improves the patient’s life (Schrag, et al., 2011). Even Donepezil (Aricept)—the acetylcholinesterase inhibitor and most commonly used symptomatic treatment of Alzheimer’s disease cognitive impairment—reported improvements in ADAS-Cog of 3+ points in only 20% of patients in one study of 97 patients. In another study of 153 patients, donepezil showed 4+ point improvement in ADAS-Cog in 37% of patients after 12 weeks of treatment.

NE3107’s blinded data shows signs of actually improving cognition in Alzheimer’s patients in a market environment that currently revolves around slowing of disease progression. For example, Anavex’s blarcamesine reported ~45% slowing of decline on ADAS-Cog, while lecanemab and donanemab have reported between 25-35% slowing of decline, all of which have been interpreted as successes by the market.

There is no study that we are aware of that has shown robust absolute cognition improvements in a large clinical trial that is believed to be disease-modifying (Aricept is a symptomatic treatment), giving BioVie the chance to change the dynamic of the neurodegenerative space. A 4-5 point improvement for NE3107-treated patients on ADAS-Cog would represent a step-change in the treatment landscape and a significant source of hope for Alzheimer’s patients.

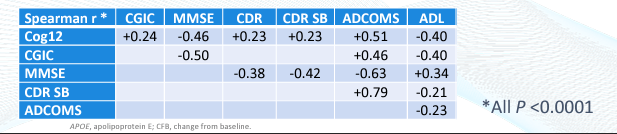

Correlation

In addition to the cognitive endpoints, BioVie’s CTAD presentation provided a correlation analysis (Pearson’s correlation coefficient (r)) between each of the six cognitive endpoints.

While we think that CEO Cuong Do’s characterization of the correlation data as showing a “strong correlation” is a bit exaggerated—a strong correlation is considered r > 0.6—the consistent directional and moderate strength correlations across each cognitive endpoint are definitely supportive of the data.

BioVie CTAD Presentation

We think this correlation data is a nice element of assurance that there is not extremely anomalous intra-patient data, i.e., a patient reporting improvements on one cognitive measure but worsening on another.

Conclusion

While we think some of BioVie’s supporters are overlooking potentially inaccurate claims by management regarding a clear separation of the blinded data into two groups, we think the positive interpretation of the blinded data as a whole is justified, primarily substantiated by the large effect sizes and significant skew towards cognitive improvement across the various endpoints.

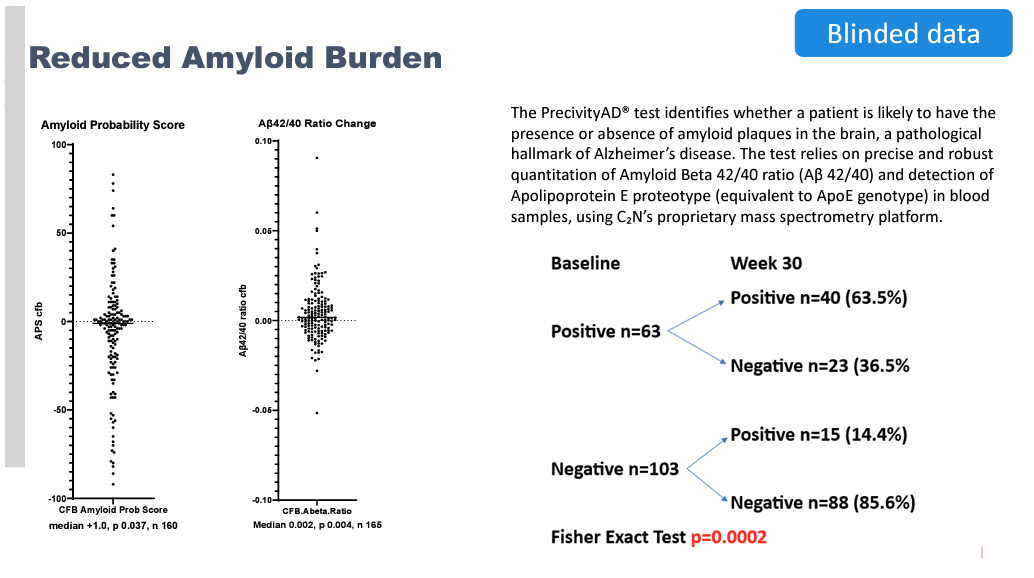

Biomarker Data

Interestingly, BioVie also reported results from a subgroup of ~160 patients who were tested with PrecivityAD, a blood test that is FDA-approved to diagnose probable Alzheimer’s by measuring and calculating the ratio of Ab42 to Ab40 (found to be lower in AD patients; increasing ratio is considered indicative of improvement in amyloid status).

In a continuation of the strangely-good-looking data reported by BioVie, the PrecivityAD results reported that of the 38% of patients who tested positive for amyloid at the beginning of the study, 36% actually tested as amyloid negative after six months, suggesting significant reduction or clearance of amyloid burden.

BioVie CTAD Presentation

This result is especially surprising given that NE3107 is not designed to remove amyloid. The hypothetical explanation given by management for how these patients could achieve amyloid negativity is that NE3017’s mechanism of blocking TNF-alpha leads to reduced production of APP (precursor protein to amyloid beta) as well as inflammation, which gives native glial cells and other maintenance mechanisms in the brain the opportunity to clear accumulated amyloid on their own. While there doesn’t appear to be ample evidence supporting the mechanistic link between TNF-alpha, APP, and glial clearance of amyloid plaques, we understand management is taking a guess at poorly understood mechanisms.

We do not know exactly what to make of this data. We think six months is a very short timeframe for amyloid-positive patients to become amyloid-negative, especially via endogenous protein clearance mechanisms. For context, Biogen’s lecanemab (Leqembi) reported complete clearance of amyloid in 68% of patients after 18 months of treatment. Assuming the reduction was linear (which it likely was not), 23% of patients would have achieved complete amyloid clearance at 6 months.

Some BioVie followers, including E. Roudasev, have made the logical connection that, assuming an even split between placebo and active group patients among the 63 patients who were amyloid-positive at baseline, it appears that 73% of NE3107 patients were relieved of their amyloid burden within six months (23 of the assumed 31.5 treatment arm patients).

This calculation assumes that only patients in the active NE3107-treated arm achieved amyloid-negative status at six months, and none of the placebo patients. While this is a reasonable assumption given that there is no reason to believe that a patient receiving a placebo should be able to achieve amyloid clearance, it seems incredible to say that NE3107 can clear amyloid in 73% of patients after just 6 months of treatment, especially when mAbs specifically designed to clear amyloid take 18 months to achieve comparable numbers.

We will note that the anti-amyloid mAb (e.g. lecanemab, donanemab) studies use PET imaging to determine amyloid status, while PrecivityAD is a blood test, and that complete amyloid clearance is not identical to amyloid-negative status as measured by PrecivityAD. Still, PrecivityAD is well studied for the measurement of amyloid status and is considered a viable diagnostic alternative to expensive PET imaging studies. More info on PrecivityAD here.

Adding to the encouraging interpretation of the PrecivityAD data, we can see that 14% of the patients who were amyloid-negative at baseline became amyloid positive at six months, suggesting normal disease progression in some patients.

On the flip side, one strange aspect of the data that we haven’t seen discussed by BioVie management or supporters is that roughly two-thirds of patients in Phase 3 were amyloid-negative at baseline, which is strange for an AD trial with an average MMSE of 20.

In our opinion, it is difficult to know how to respond to the PrecivityAD data, especially when paired with the cognitive data. The combination seems to defy much of what investors have been conditioned to expect from neurodegenerative biotech data.

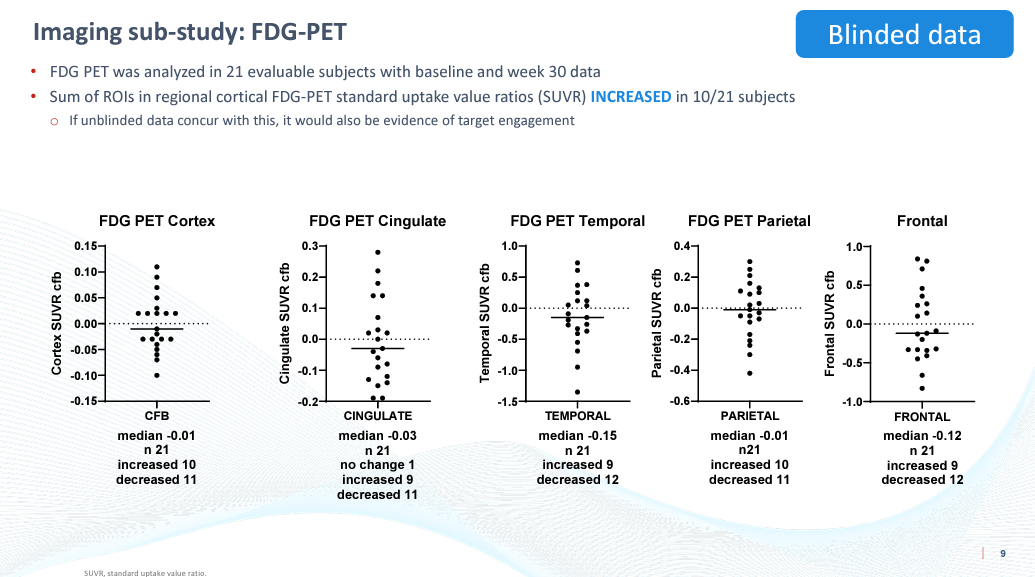

FDG-PET

The company also reported data from an even smaller subset of patients (n=21) measuring FDG-PET in different brain regions. FDG-PET is used to measure glucose uptake and utilization by cells and is generally decreased in the brain regions affected by Alzheimer’s as a result of hypometabolism.

BioVie CTAD Presentation

CEO Cuong Do seems to have inadvertently skipped over this data for the most part in the webcast. While it may be impressive that some patients saw an improvement in glucose utilization, the median was a worsening in each brain region tested. This data, in our view, does not corroborate anything about the imaging data or the cognitive data.

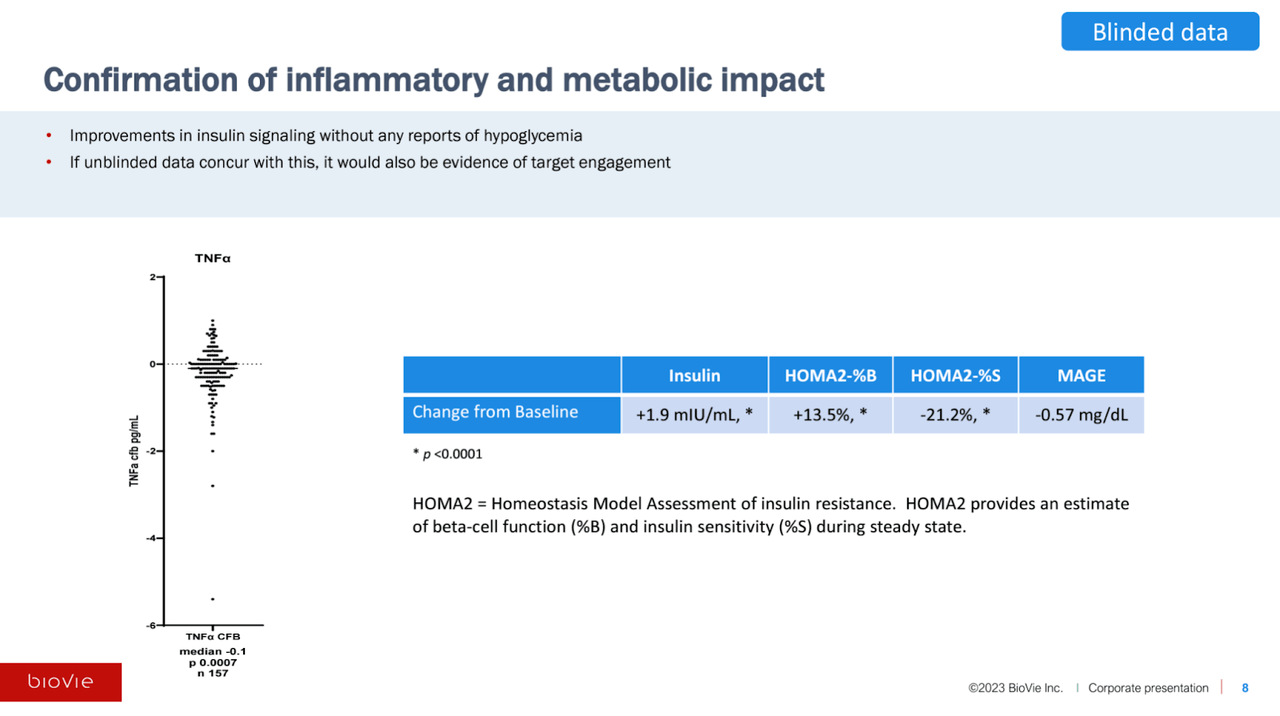

Metabolic/Inflammatory Data

The company also measured TNF-alpha and a number of metabolic metrics in a sub-study of 157 patients. The TNF-alpha data (left side) appears to skew rather clearly towards a reduction. As stated by Cuong Do, the only way that a placebo patient should be able to decrease their TNF-alpha over six months is to significantly overhaul their diet, lifestyle, etc.

BioVie CTAD Presentation

If the unblinded data shows significant separation between NE3107 and placebo on TNF-alpha and the various metabolic measures, especially if they correlate with cognitive improvement, BioVie’s purported mechanism for NE3107 will be largely substantiated in our view.

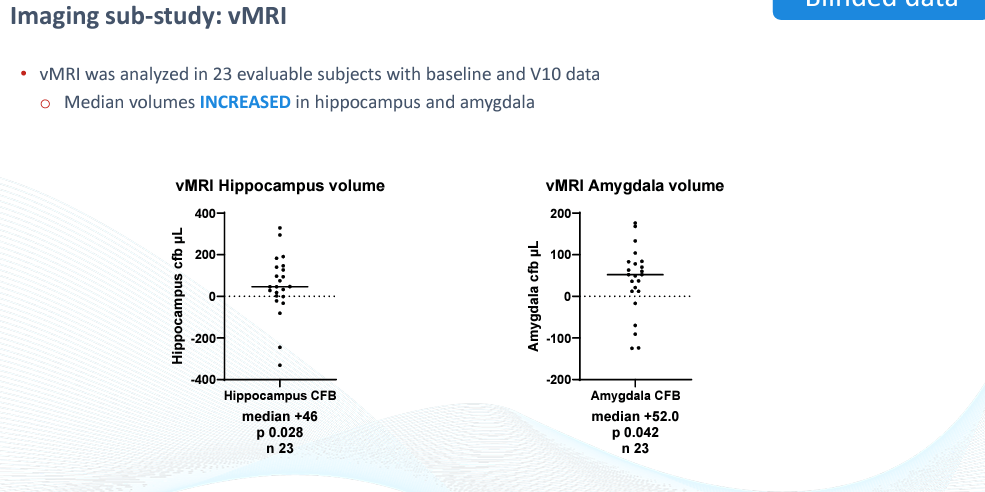

vMRI

The company also reported volumetric MRI (VMRI) data from another subset of 23 patients which reported increased hippocampus and amygdala volume, two areas of the brain known to atrophy in Alzheimer’s. Both brain regions reached statistical significance from baseline (though narrowly in the case of the amygdala).

BioVie CTAD Presentation

This data is yet another incrementally supportive data point for the blinded data. It will be interesting to see the unblinded data corroborate these results (i.e. the data points above the median line turn out to be the treatment group).

Conclusion

The biomarker/imaging data adds to the body of (blinded) evidence that NE3107 has likely activity in Alzheimer’s disease. While we remain cautious on account of a few mildly peculiar details in the data (e.g. two-thirds of patients were amyloid-negative at baseline), the preponderance of evidence appears to indicate NE3017’s underlying effect.

Other Remarks on the Blinded Data Presentation

We appreciate the transparent and coherent presentation of the blinded data by CEO Cuong Do and the BioVie team on the November 1st webinar, even if we think some of the interpretations and characterizations of the blinded data by management were exaggerated. It appears that the company tries to share as much information as possible.

Some other notable comments that were made on the call:

-

CEO Cuong Do stated that BioVie is currently working with the FDA to determine which of the many cognitive endpoints being measured in the study should act as the primary endpoint. It is a bit unusual for this to still be up in the air and is interesting considering CDR-SB is listed as the primary endpoint on CTG Labs – NCBI. CEO Cuong Do described a friendly and productive relationship with the FDA. We would expect either ADAS-Cog, CDR-SB or a combination of measures to be selected as the primary endpoint.

-

Cuong Do also took a couple minutes at the end of the call to specifically mention that the company had not run a correlation analysis between the cognitive endpoints and change in serum TNF-alpha levels. The reason he gave was somewhat confusing—it essentially boiled down to the fact that the TNF-cognition correlation is the central question given NE3107’s mechanism of action, and the company does not want to potentially unintentionally/functionally unblind the data, out of an abundance of caution for the way results are normally reported.

-

The company believes that if it shows strong improvements on both the cognitive and biomarker endpoints when the data is unblinded, it has the potential to apply for accelerated approval with the FDA in 2024.

-

CEO Cuong Do tempered expectations for the unblinded results, saying he would be very happy with the improvement in one or more patient subpopulations, and/or with non-inferiority to the mAbs on efficacy (and superiority on safety). The company has previously indicated it will split the data by numerous metrics to determine patient populations that are most sensitive to NE3107.

We also note that analysts from both Oppenheimer and Truist asked questions on the webinar. Both seemed intrigued by the data, and their presence lent some credence to the company and its blinded data, in our opinion. The call ran out of time before any other analysts had a chance to ask further questions.

Moving Forward

The company has indicated that it will report the unblinded results from the Phase 3 trial shortly after Thanksgiving.

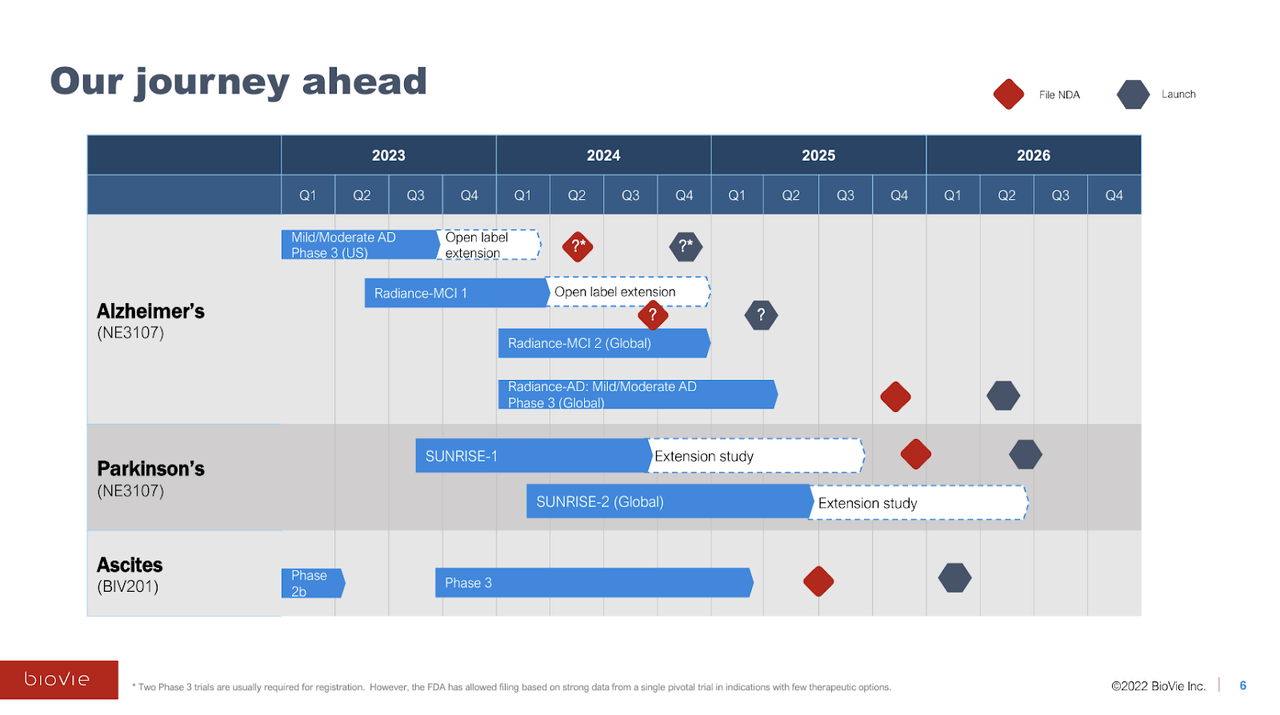

We have not discussed BioVie’s pipeline, but the company is also advancing Phase 3 programs in Parkinson’s disease and, surprisingly to those unfamiliar with the company, late-stage liver disease-associated ascites (abdominal fluid buildup), which is an interesting side to BioVie’s story that requires its own article.

With a lot planned over the coming 12-24 months and only $22 million of cash as of 9/30/23, the company will likely look to raise capital on the back of the unblinded data. We think the company will be aiming to raise $50 million at a minimum, likely $100 million if the stock has an outsized move.

BioVie Company Presentation

(Trial initiation timeline above is inaccurate; SUNRISE-1 and Phase 3 ascites trials have not begun yet.)

While it is unclear how likely accelerated approval in Alzheimer’s would be in the event of a strongly positive data readout after Thanksgiving, It should be an eventful end to the year for BioVie. In addition to the unblinded cognitive and amyloid biomarker data, we are excited to see some of the Phase 3 data surrounding inflammation and epigenetics.

Clinical Misconduct

BioVie hit a bit of a speed bump recently when it included a new risk factor in its 3Q23 10-Q on November 8th. The company disclosed that it had discovered “potential scientific misconduct and significant non-compliance with GCPs (good clinical practice) and regulation at six sites.” The stock fell ~30% on the same day.

It is hard to know what to make of the announcement. It is somewhat buried in the risk section of the most recent 10-Q—it does not even receive its own bullet point and instead occupies the second half of a more generic-sounding risk factor about having to trust third parties to comply with regulatory requirements. It states that BioVie reported the misconduct to the FDA’s Office of Scientific Integrity. The company has not commented on this matter beyond the 10-Q.

There are at least a few cynical ways to interpret this event. In our view, the most important question is: when did the company first discover the non-compliance of these six sites in processing the blinded data? Was it prior to the webcast on November 1st discussing the blinded data in glowing terms? As we have said, CEO Cuong Do has appeared to be relatively transparent with investors so far, so we would assume not. The company may not address the matter until they report the unblinded data after Thanksgiving. The 10-Q mentions that “Sensitivity analysis excluding data from these six problematic sites has been performed and accounted for in the statistical analysis plan for the study”.

While it is only 6 of the total 31 clinical sites in the trial, unfortunately, this event damages the credibility of BioVie and sentiment for the stock and confidence in the company, which could result in handicapped price appreciation even in the event of an otherwise positive data unblinding. We hope there is some sort of inconspicuous and excusable explanation for the misconduct given by management.

Management

Assuming innocence of the clinical misconduct, we have found CEO Cuong Do to be very straightforward and transparent in his interactions with the public/investors. It is refreshing in the small and microcap neurodegenerative space.

Cuong Do has had a successful career, beginning at McKinsey where he aided in the growth of the healthcare business, before becoming Chief Strategy Officer of Lenovo and then Merck. The story that CEO Cuong Do tells on many of his media appearances is that he was brought out of retirement by the opportunity he saw in NE3107, and as a result, he takes all of his compensation as equity.

Many will focus on former Chairman and largest shareholder Terren Peizer when it comes to BioVie’s leadership. The A Failure To Communicate blog has covered the issues surrounding Peizer’s past alleged fraudulent behavior and misconduct well. While Peizer’s shadow looms over the company, the actual operational management team—from the CEO to the CMO, to the VP of Neurodegenerative Clinical Development—are all well experienced. It is hard for us to believe that multiple members of BioVie’s operational team could be in some way manipulated into unethical or unscrupulous behavior.

The primary concern with Peizer should be the fact that he owns 61% of the company. We are not sure of his ability to sell shares of BioVie while under indictment for securities fraud related to Ontrak.

After the original acquisition of NE3107 by BioVie, there was an astronomical set of contingent milestone payments due to Peizer, including over $1 billion upon achieving statistical significance in a pivotal trial and submission of an NDA, and another $1.2 billion upon FDA approval. The contingent payments were revised in May 2021 to include 4.5 million shares issued upon each of 1) the achievement of statistical significance in a pivotal trial, 2) FDA acceptance of an NDA, 3) FDA approval of NE3107, and 4) achieving $1 billion of trailing twelve-month sales. The achievement of the first three milestones (13.5 million shares) would result in 36% dilution.

While we would rather the company had no involvement with Peizer, we think its negative impact is minimal in reality and is mostly restricted to future dilution in the event of significant value-creating events for the company.

Valuation Analysis

At a current market capitalization of $166 million, it seems the market is significantly undervaluing the possibility of a positive data unblinding in late November/early December. If the unblinded data confirms the positive interpretation of the blinded data (e.g. NE3107 delivers ~5 points of absolute ADAS-Cog12 improvement, 3+ points better than placebo), BioVie should trade at least in line with the larger late-clinical-stage neurodegenerative biotechs like Anavex Life Sciences ($573 million market cap) and Cassava Sciences ($963 million).

As we discussed, the blinded data seems to rather strongly support the notion that NE3107 is active and effective in Alzheimer’s disease. Given BioVie’s small market cap, the market either 1) doesn’t believe the company’s blinded results will be confirmed by the unblinded data (inherent in this position is the assumption that the unblinded data will report an extraordinarily high average placebo responses), or 2) the market is not fully aware of BioVie and the encouraging blinded data it reported at CTAD.

It would make sense that the company is still flying under the radar a bit. In a sense, the data has come out of nowhere. All that investors had to form an opinion was a positive 23-patient AD study and a small Parkinson’s study without groundbreaking headline results.

Additionally, the small and microcap neurodegenerative space as a whole has experienced yet another significant leg down in 2023, leaving many investors to abandon the space. BioVie was trading at $8-10+ per share in late 2022 and early 2023 (upwards of $300 million of market cap) following the AD and PD results reported in December 2022. Interestingly, the company was also trading at ~$30+ per share in 2020 and 2021, albeit in a very different market environment, before it had even acquired NE3107 from Neurmedix and was pursuing ascites as its primary clinical program.

It is our view that, at this point, the market has trouble seriously considering the possibility that a therapy could actually significantly improve cognition in Alzheimer’s disease. As a result of numerous clinical failures and the rise of anti-amyloid monoclonal antibodies (which only slow deterioration), we think that the possibility of a therapy that actually improves cognition in Alzheimer’s patients now resides outside of many investors’ Overton window, resulting in a significant discounting of small companies like BioVie.

Anavex Life Sciences, which showed a moderate (~45%) slowing of cognitive decline (not cognitive improvement) in Phase 2b/3 study in Alzheimer’s, trades at a $573 million valuation, though it is also advancing a late-stage program in Rhett’s Syndrome which adds to its addressable market. A comparable market cap for BioVie would yield a share price of around $15 (+245% from BioVie’s 11/20/23 close).

Cassava Sciences has reported results from numerous trials and sub-analyses, most of which have indicated the potential of its lead asset, simufilam, to slow cognitive decline in Alzheimer’s patients. The most recent results from its CMS trial reported a 38% slowing of decline versus placebo at six months. A comparable market cap for BioVie would represent about $26/share (+480%).

We also note that BioVie’s stock rose to a peak of almost $15/share (+240%) late last year on data from 23 Alzheimer’s patients that it presented at CTAD 2022. We also note that BioVie currently has about 19% of floated shares sold short, which could add to the potential upside in the result of a positive readout.

Conclusion

If the full study results confirm the blinded data, it is hard to predict how BioVie’s stock would react, given that it would be the first biotech that we are aware of to report a significant and clinically meaningful (and placebo-adjusted) improvement in cognition in Alzheimer’s disease, rather than just a slowing of deterioration. We think BioVie is worth a speculative position based on the mostly uniformly positive appearance of the blinded data.

Other Risks/Concerns

Some other key risks for BioVie that may impair the public perception of BioVie and/or limit stock price appreciation even in the event of a positive data unblinding:

-

The company is likely to raise at least $50 million at some point in the next two quarters, most likely directly following the data unblinding.

-

BioVie’s Phase 3 is a relatively short treatment duration compared to traditional Phase 3 for anti-amyloid mAbs, which may cause investors to question the quality/durability of results. The results could be deemed as symptomatic improvement (like Donepezil) by the market, rather than disease-modifying.

-

The announcement of potential clinical misconduct found at six of the Phase 3 sites could discount the legitimacy of the blinded results.

-

It is unclear if the ~100 patients that were not included in the unblinded data presentation at CTAD were from the six clinical sites that were found to have engaged in clinical misconduct (which would be suspect on the part of management), or if it is a function of not all the data being “clean” enough to use at the time of CTAD (more understandable). We lean towards the latter.

-

Similarly, if it disclosed that the company knew about the six sites that engaged in clinical misconduct before the November 1st webcast, the market may react negatively.

-

We believe a significant degree of (justified) skepticism has been conditioned into the neurodegenerative space in recent years, which is only magnified by the market’s negative perception of BioVie’s largest shareholder Terren Peizer.

-

Management promoted the blinded data as showing promising separation into two groups, which, in our view, does not appear to be accurate. We have no reason to think that management is intentionally misleading investors, however.

-

The Phase 3 trial enrolled “probable” Alzheimer’s patients, meaning that some of the patients enrolled in the trial may not actually have true AD. We are not sure that this will make a huge difference, as anyone scoring between 14-24 on the MMSE is clearly significantly cognitively impaired, and many of the underlying pathophysiologies resulting in cognitive impairment may still be addressed by NE3107’s MoA.

-

Similarly, the fact that roughly 60% of patients enrolled in Phase 3 were amyloid negative at baseline suggests some portion of the enrolled patients may not have true Alzheimer’s.

-

BioVie has not yet selected a primary endpoint for the trial. The approval decision likely will not be made based on ADAS-Cog alone, the endpoint we focused on for much of this analysis.

-

The NE3107 molecule has been at multiple different companies over the years which were not able to make significant progress in metabolic disorders, which is somewhat germane to BioVie’s explanation of its effects in Alzheimer’s.

Conclusion

The blinded data from BioVie’s Phase 3 in Alzheimer’s disease has confounded our expectations for neurodegenerative disease trial results. It is impossible to ignore that the data appear to indicate underlying efficacy, delivering a level of cognitive improvements beyond what is probable from a placebo effect consistently across six cognitive assessments, and corroborated by reductions in amyloid burden as measured by PrecivityAD. Like many, we are trained to expect underwhelming results in neurodegeneration and thus remain cautiously optimistic and curious about the full study data after Thanksgiving.

While biotech is unpredictable and BioVie’s unblinded data could fail to deliver positive results due to some anomalous data and/or ambiguity regarding data integrity, we think the blinded data suggests a high enough chance of positive results to take a speculative position in BioVie leading up to the data unblinding, or at the very least to pay attention to the story as it unfolds over the next few weeks.

Read the full article here