Hedge fund manager Mark Yusko is predicting bitcoin will more than double this year to $150,000.

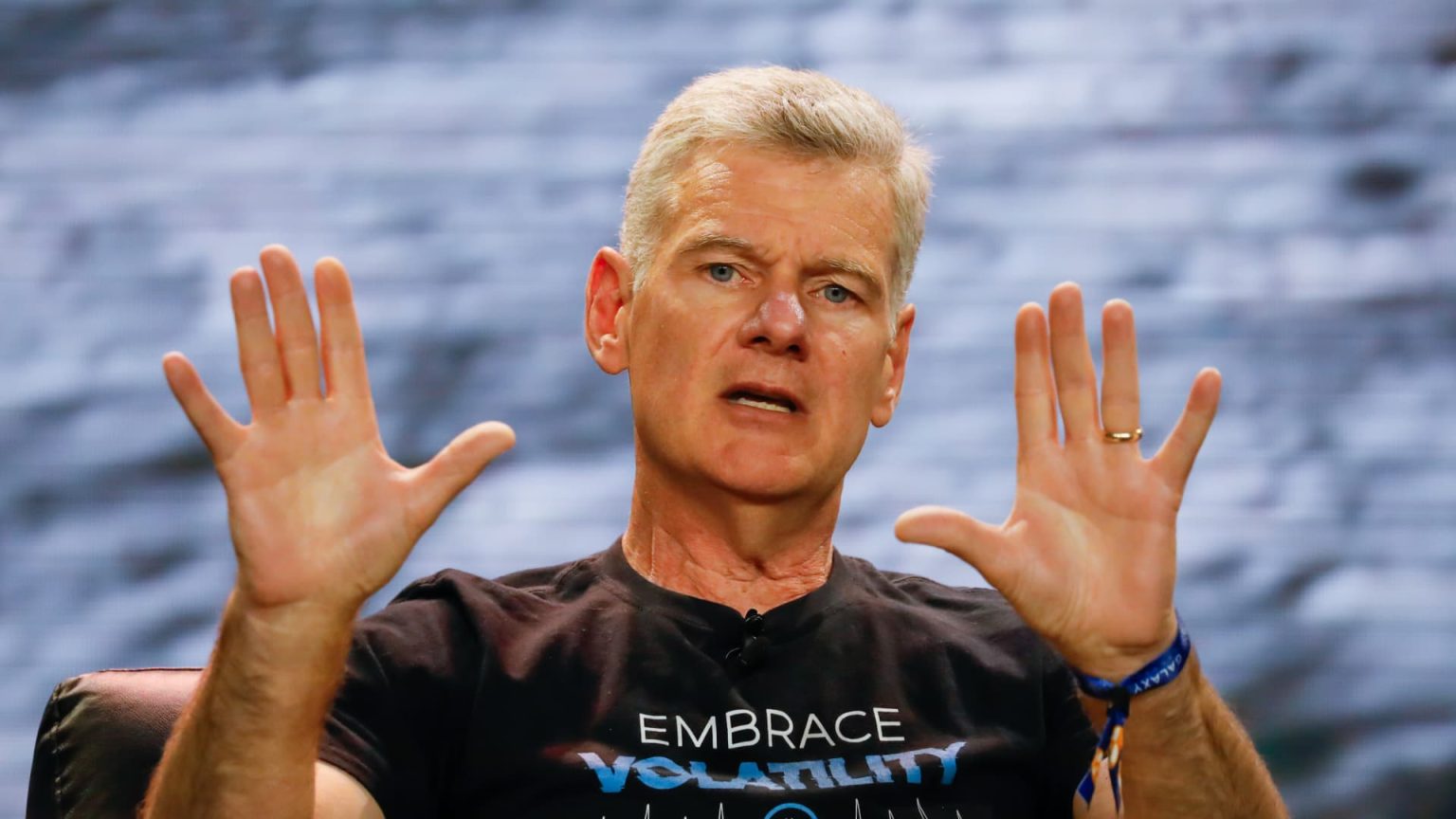

“Get off zero,” the Morgan Creek Capital Management CEO and chief investment officer told CNBC’s “Fast Money” this week.

Yusko thinks investors should have at least 1% to 3% allocated to bitcoin in their portfolios. “Bitcoin is the king. It is the dominant token. It is a better form of gold,” he said.

As of Thursday’s stock market close, bitcoin is up about 159% over the past year. It had surpassed the $73,000 level earlier in March, but was trading around $70,700 Thursday evening.

“The law of large numbers comes in. I think it can go up 10x from here easily over the next decade,” added Yusko.

He lists bitcoin exchange-traded funds, which were launched in January, as a major bullish driver for the cryptocurrency. Yusko expects the bitcoin halving to lead to a supply shock resulting in another round of major tailwinds for the flagship crypto.

The halving, which cuts the bitcoin mining reward in half to limit supply, is expected in late April.

“The big move happens post-halving,” said Yusko. “It starts to become more … parabolic toward the end of the year. And, historically about nine months after the halving, so sometime toward Thanksgiving, Christmas, we see the peak in price before the next bear market.”

Yusko’s firm also has exposure to crypto online trading platform Coinbase. “We think big things are in line for Coinbase,” he said.

Shares of Coinbase are up almost 321% over the past 12 months.

Disclosure: Yusko’s firms own bitcoin, ethereum, gold, Coinbase and Nvidia.

Read the full article here