We’re officially three months into the existence of spot Bitcoin (BTC-USD) ETFs in the United States market. With approximately a week remaining until Bitcoin’s next block reward halving, I think it’s worth taking a bird’s eye view of how Bitcoin is actually being adopted so far in 2024. In this post, we’ll look at US ETF flows, the state of the Lightning Network, and why Bitcoiners may want to consider the Bitwise Bitcoin ETF (NYSEARCA:BITB).

Bitcoin vs Gold ETF Flows

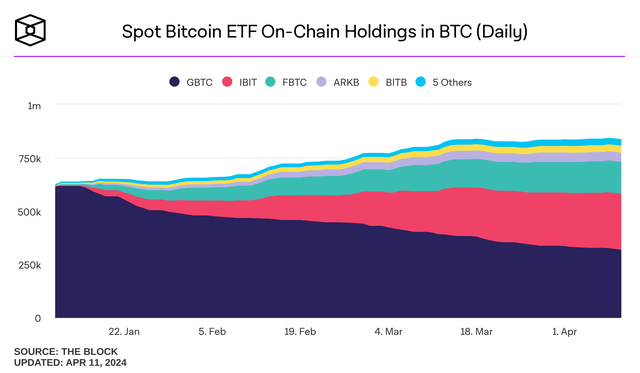

From an asset under management standpoint, I don’t think there can be much debate that these products have been an enormous success so far for in bringing BTC exposure to the broader investment community:

BTC ETF Cumulative Net Flow (The Block)

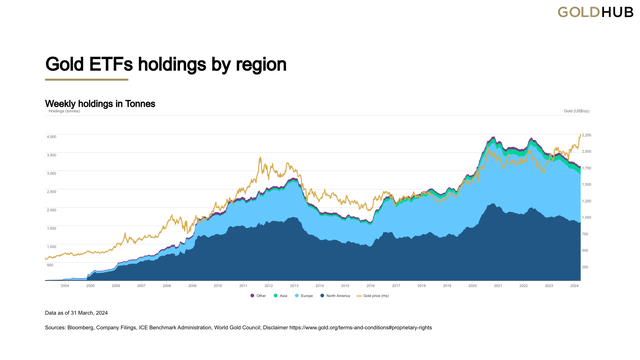

Even when adjusting for the 49% BTC-denominated AUM puke from the Grayscale Bitcoin Trust ETF (GBTC) since ETF conversion, the cumulative net flow of BTC into US-based spot ETFs is over 220k BTC. At a $71k Bitcoin price, the net flow of assets under management represented by these funds is almost $16 billion. This contrasts with Gold (XAUUSD:CUR) ETFs which have seen roughly 113 tonnes come out of the investment products since the start of the year:

Global Gold ETF Flow vs Gold Price (World Gold Council)

There has been an understandable conflation among some in the Bitcoin community that Bitcoin ETF inflow has somehow come at the expense of Gold ETF outflow. In my view, this relationship has been exaggerated and I spent some time dissecting what I believe is really happening in a recent article for Seeking Alpha covering the Sprott Physical Gold Trust (PHYS).

Specifically, Gold started leaving ETFs shortly following US/EU financial sanctions on Russia as foreign central banks have begun to minimize their exposure to the US debt debacle. Coupled with the idea that there are more claims on Gold than can actually physically be delivered, it shouldn’t be a surprise that the price of Gold is doing what it’s doing. This is what I said on my personal blog in early April:

There are 7.5 billion ounces of Gold above ground. When Gold was $2,000/oz way back in February, the value of all the yellow metal was $15 trillion. As of market close today, Gold’s above ground market capitalization is just under $17.5 trillion. Bitcoin’s market cap is a little over $1.3 trillion. Meaning Gold just grew by about two Bitcoin market caps in a matter of a few weeks.

This, I think, provides context on the magnitude of what is happening right now. And while it’s exciting to see the “number go up” gains in Bitcoin from all of this positive BTC net flow over the last 3 months, I do think it’s worth pointing out that BTC wasn’t designed for this kind of “adoption.” And the long-promised scaling the network on L2s has simply not lived up to the hype.

Lightning Network

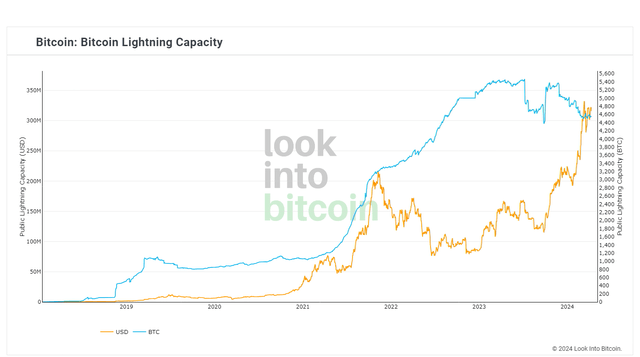

For as much promise as the Lightning Network seemed to have, I don’t think we can realistically say it has accomplished what many within the community have hoped it would – myself included. While I’m not on Nostr, I have used a few applications that utilize Lightning on the back end. In my personal opinion, the UE is still not great. And frankly, high base layer fees challenge the utility of Lightning because the scaling layer still requires opening and closing channels on Bitcoin. Furthermore, batching transactions that cost virtually nothing isn’t a profitable endeavor when base layer fees get high.

Lightning Capacity (LookIntoBitcoin)

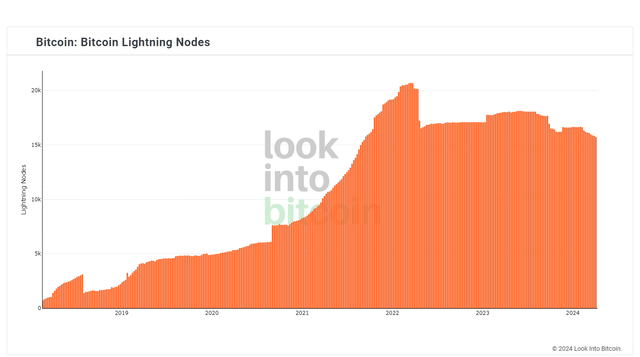

But don’t even take my own opinion for it, capacity growth on Lightning measured in BTC peaked 9 months ago. Despite Lightning Network being in development for years, there’s literally more BTC on Arbitrum (ARB-USD) via Wrapped Bitcoin (WBTC-USD) than on Lightning. Nodes have been dropping as well and that trend actually peaked two full years ago:

Lightning Nodes (LookIntoBitcoin)

Each of these metrics were rising leading up to the last halving in 2020 and that’s simply not the case this time around. Between Lightning, Liquid, and Merlin – each of which are considered “L2” networks – we get a total of approximately 35k BTC on Bitcoin scaling networks. This is obviously dwarfed by the 220k BTC that has flowed to US-based ETFs. Ultimately, it’s all about the fees and it just isn’t cost effective to have small amounts of Bitcoin on the base layer any longer.

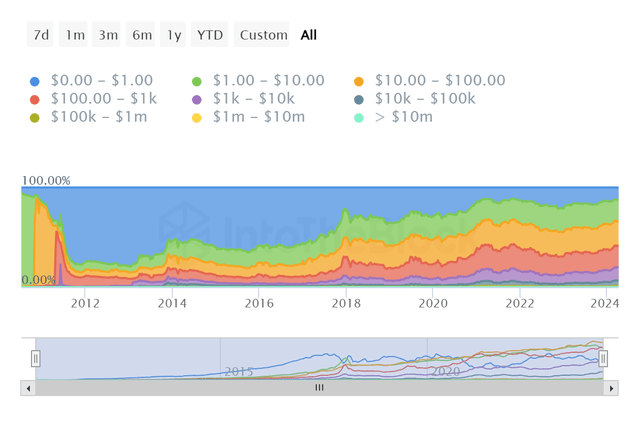

Address breakout (IntoTheBlock)

Consider this: on April 10th, the average Bitcoin transaction fee was $9. At that number, about 34% of the 51.5 million non-zero balance addresses don’t have enough BTC to pay to move it. That is a significant problem for a network that was originally designed for peer to peer transactions and it explains the narrative pivot to “store of value” during and following the block size war. It also clearly shows the fundamental issue with onboarding to Lightning; it’s not economical for the kind of users who benefit from L2s to actually get to them from the primary layer.

All of this is not meant to dunk on Bitcoin or its more diehard supporters. I’m still very much rooting for the success of Bitcoin personally and maintain quite a bit of exposure to the coin. But in my view we have to look at these networks without blinders on and accept that Travis Kling’s assessment of this industry may not be all that far off at this point in time. The good news is it doesn’t have to be this way.

Funding Development via Bitwise’s Bitcoin ETF

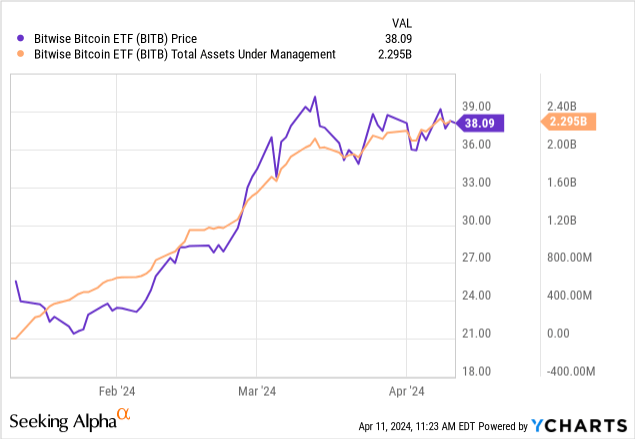

The scaling issues that the Bitcoin network currently has can be addressed. In my view, real on-chain adoption through usage can only further strengthen the value proposition of the network. The Bitwise Bitcoin ETF is one of two ETFs that currently plans to fund Bitcoin development through the fees that the ETF holders pay the company. Per Bitwise’s press release announcing this intention:

The donations have no strings attached and will be made annually for at least the next 10 years.

For BITB holders, 10% of Bitwise’s profits have been committed to funding three different non-profit developers. Those recipients are Brink, OpenSats, and Human Rights Foundation. Initially, Bitwise waived the BITB management fee for either 6 months or $1 billion in AUM:

As the fund is now well ahead of that $1 billion AUM figure, the expense ratio for BITB shares is 0.20% and BITB holders are now indirectly funding non-profit Bitcoin development. In addition to funding development, 0.2% is one of the most competitive rates in the market.

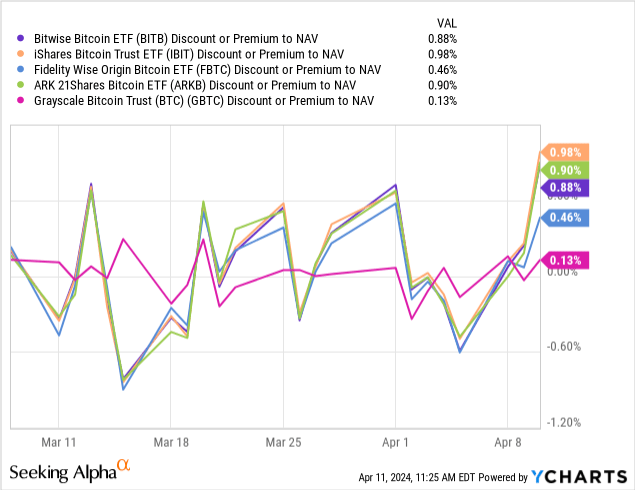

BITB does occasionally trade at a small premium to net asset value and that’s another potential factor to consider. Though it’s far from the only fund that is currently trading slightly above the BTC value underlying the shares.

Risks

Digital assets are not tangible. In my view, there’s a reason why real Gold is flowing out of ETFs while “digital gold” is flowing into them. That said, there is a tremendous amount of faith, energy, and hardware backing Bitcoin that I think is going to be exceedingly difficult to break. In the world of public blockchain networks, Bitcoin is by far the most decentralized network and thus carries an element of “safety” that many of the other blockchain networks likely lack. However, that perception of safety could certainly change as US regulators and government actors appear to be getting more aggressive in fighting this industry. And that brings us to the real reason so many still swear by Bitcoin despite its flaws.

Summary

Ultimately, Bitcoin remains largely an anti-fiat trade. And despite there being an enormous amount of competition in the anti-fiat realm both in and out of crypto, BTC and its many proxies are probably still the fastest horses in that race. If one can accept holding Bitcoin with no less than three layers of intermediaries, than BITB might be one of the more principled options in the market as the company will be funding non-profit developers not named Blockstream.

The halving event is an important reminder that the network is secured by entities that require incentives to continue securing that network. At a certain point, miner revenue from transactions is going to have to become a more meaningful portion of total revenue for these operators. I would argue transaction share growth due only to a shrinking total reward pie is the wrong way to incentivize that security. Problems for the future, perhaps. For now, “number go up” and “dollar down” are still good enough reasons to hoard coins in 2024 in my view.

Read the full article here