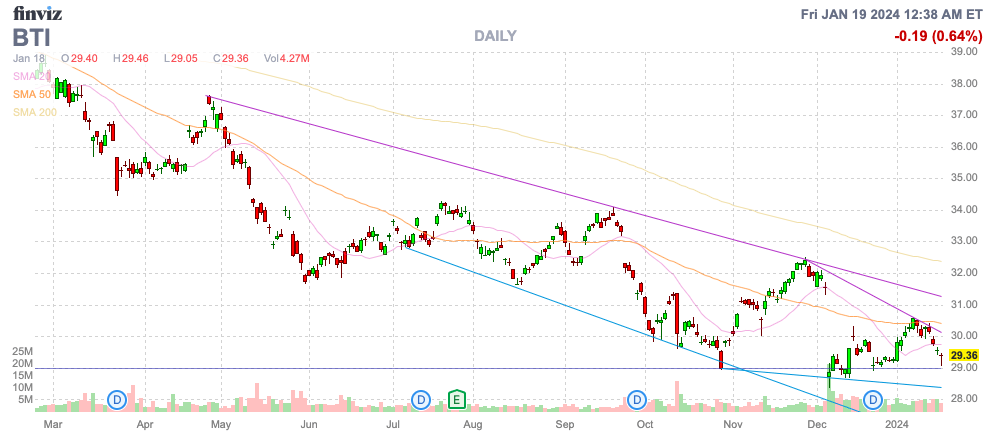

Despite the very large dividend payout, British American Tobacco p.l.c. (NYSE:BTI) has been a huge disaster for shareholders for a long time now. The company has been aggressively investing into cannabis and outlining plans to write down U.S. combustible brands in signs management fears the end game of the main business line now. My investment thesis is slightly Bullish on the stock after the irrational collapse to end 2023.

Source: Finviz

Strange Signals

The company recently announced an additional investment in Organigram (OGI) despite a horrible investment back in March 2021. BTI discusses the goal for a smokeless world, but cannabis moves the company right back into a consumer base regularly smoking joints.

BAT will invest another £74m (C$125 million) between January 2024 and January 2025 and increase its equity position from 19% to 45%. The original investment was £126 million and priced shares at C$3.79 for a stock now trading at C$2.25 following a rally after the BAT investment boost.

BAT needs to find alternative products from cigarettes being outlawed around the world. The UK is trying to implement a law where 14-year olds will never be able to legally purchase cigarettes in a planned smoking ban.

The tobacco company just wrote down U.S. tobacco brands to the massive tune of $31.5 billion. BAT plans to completely write off these brands worth $80 billion on the balance sheet over the next 30 years in an announcement in December that caused the stock to crash.

Currently, BAT only obtains 12% of sales from new product categories suggesting the company isn’t sending a great signal to shareholders by writing down the valuable U.S. brands to zero by 2053. Not to mention, the vape and menthol products in the new categories aren’t without scrutiny.

In fact, the CEO completely contradicted the write down suggesting he believes cigarettes won’t go away in this time period based on this statement on the recent conference call with analysts.

I’m not saying that we – the combustible, the cigarettes will disappear in 30 years in the US. I really don’t believe that, but you cannot justify the value of those brands equating to a number as equivalent to what we have today in the balance sheet.

Either way, BAT has made brutal investments in Organigram in an attempt to enter the cannabis space to help transform the business from combustibles. The original investment in 2021 was down over 50% during this period. In addition, BAT is investing in a Canadian cannabis company with no access to the big U.S. cannabis market reducing a lot of the benefit for investing in cannabis.

The combined moves have to question whether management is making sound judgements on the future. The stock has collapsed despite the forecast for low single digit organic growth and a 2024 sales target around 3% growth.

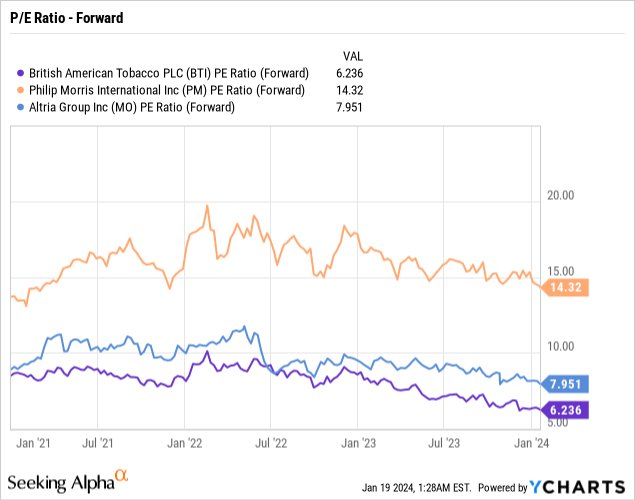

With a dividend yield around 10%, the stock shouldn’t be falling to new lows. BAT now only trades at 6x EPS targets. At 4% EPS growth from a $4.67 base in 2023, the company would hit a 2026 EPS of $5.25.

At this point, BAT is forecasting reaching 50% of sales from non-combustible products in the new categories by 2035. Over a decade away, the company will still be highly dependent on combustibles despite all of the plans to transform the business.

Dividend Struggles

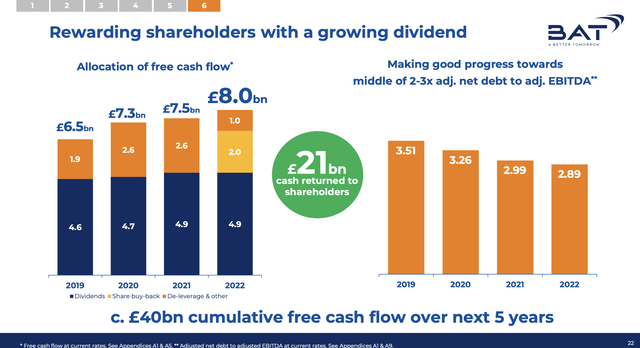

BAT is a prime example of the struggles companies have faced in making large dividend payouts while having large debt balances. As no big shock, the market hasn’t been very rewarding of stocks not focused more on repaying debt versus hiking dividend payouts.

The legacy tobacco company has hiked the dividend payout from £4.6 billion in 2019 to £4.9 billion in 2022 while the leverage ratio remains relatively high at 3x. Even worse, management spent over $1.0 billion annually on share buybacks throughout the period.

Source: BAT 1H’23 presentation

While this appears shareholder friendly, the best move for shareholders in a business struggling to grow is to reduce debt. The only way a company producing FCF can get into trouble is by watching cash flows suddenly turn south while debt rises due to bad capital allocation plans.

BAT still has £37,259 million in net debt and the company spooked the market suggesting valuable brands had a limited future. In such a scenario, BAT would have a hard time repaying debt and naturally the market will panic.

The simple solution is to repay debt and boost cash flows via lowering interest expenses. Share buybacks can occur when debt levels are far lower and the risk of any future default is greatly reduced, even under a scenario where profits are weaker.

BAT remains a giant discount to Phillip Morris International (PM) and Altria (MO) due to the limited non-combustible revenues currently and the company spooking the market. Also, Phillip Morris is forecasted to produce faster growth ahead warranting the higher forward P/E multiple, though the growth rates aren’t large enough to warrant the current large valuation gap.

The low dividend payout ratio in the 65% range should be another boost for BAT, but only after the debt levels are cut, even below the current target of reaching 2.5x EBITDA before adjusting the capital allocation strategy. The company suggests a plan of using excess cash flows for share buybacks and bolt-on M&A deals. The suggestion is that BAT will consider these plans when the leverage ratio hits around 2.5x EBITDA, but the company should consider pushing towards the lower end leverage target.

Takeaway

The key investor takeaway is that BAT is relatively cheap and the large dividend yield of 10% should attract investors, but management needs better messaging to avoid spooking the market again. The irrational investments into Canadian cannabis and the write down of U.S. brands send an unwarranted signal for the business. The reality is that slow growth will reward investors over time, if the company correctly allocates the cash flows to simply repaying debt versus chasing bad investments, even in their own stock.

A big yield of 10% usually signals weakness, but BAT has made several moves making the company appear weak that were unnecessary. The stock should offer a solid return going forward, assuming the company starts making better decisions.

Read the full article here