Editor’s note: Seeking Alpha is proud to welcome Luke Patelsky as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Investment Thesis

Build-A-Bear Workshop (NYSE:BBW) is a differentiated, well-run retail concept, that is extremely cheap, with a transformed business model and excellent balance sheet.

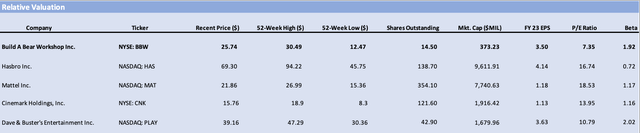

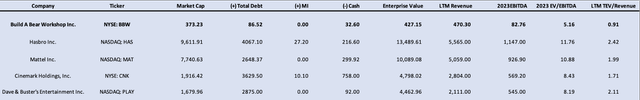

The company trades at a FY23 P/E of 7x, which is much lower compared to its peers Hasbro (HAS), Mattel (MAT), and Dave & Buster’s (PLAY), which have P/E’s of 16x, 18x, and 11x. It is also cheaper on an EV/ EBITDA of 5x, vs its competitors of 12x, 10x, and 8x respectively, despite BBW exhibiting stronger revenue growth over the last 4 years.

The company is not as economically sensitive as it used to be, and I believe the downside is limited due to its strong balance sheet and expanded/diversified business model, allowing earnings to hold up even as other retailers and discretionary companies struggle and slash guidance in August.

BBW’s impressive second-quarter earnings beat on both lines has proven that management’s aggressive revenue and pre-tax income guidance is holding up in a difficult current retail environment.

Assuming management can continue to execute and accomplish their targets, my DCF price target of 38 reflects that the company is still undervalued by 44%.

Competitive Differentiation

Strong Brand Awareness: Over 93% of people are aware of the Build-A-Bear Brand, with nearly 500 global retail locations. The company has access to over 20 million social media followers, including its loyalty members and first-party data contacts, that generate approximately 10 billion incremental annual media impressions over the past few years.

Experience and Emotional Connection: Build-A-Bear Workshop offers a unique and interactive experience where customers can make their own stuffed animals, creating a personalized and emotional connection. The Build-A-Bear experience is unique in that the bear is stuffed right in front of customers, and they can customize the sounds, scents, accessories and names. This creates significant barriers to entry for any potential competitors and differentiates Build-A-Bear products from any of its peers. What percent of BBW’s sales do you think comes from age 16+ and older collectors? 40%, hence a truly multigenerational brand.

Driver of Mall Traffic: 80% of visits to Build-A-Bear Workshop are destination-driven and planned as a special trip as opposed to a normal trip to the mall, seeing a Build-A-Bear store, and deciding to go. Hence, the company is a driver of mall traffic rather than being reliant upon it for sales.

Very Strong Unit Economics: Build-A-Bear Workshop has a 25% 4-wall contribution margin for their stores and a 2-year payback on corporate locations and a 1-year payback on the co-locations. From a return on capital standpoint, co-locations are very profitable, and the company should continue to put up more stores internationally.

Licensing and Partnerships: Partnerships with popular characters, franchises, brands and movies enhance their product offerings and appeal to wider audiences. This diversification has been boosted by Build-A-Bear’s emergence as a co-brand, with a strong licensing portfolio of more than 75 world-class collaborators and licensees, such as Star Wars, Barbie, Harry Potter, Pokémon, and Lord of the Rings. The licenses make up about 35-45% of sales. This summer, BBW stock has surged 25% since its investor day on June 15th due to blockbuster movies like Barbie, and Super Mario Bros. boosting their licensed sales. They are also expanding into e-commerce and entertainment with e-commerce now 15% of sales as well as excitement surrounding the Glisten and the Merry Mission movie coming out near Christmastime.

Resilience And Turnaround From COVID

A positive about BBW is that there is resilient demand for the products as even during COVID-19, the company made 255 million in revenue in a severe economic downturn. If you look at revenue before the pandemic of 339 and took the average of 2021, 2022, and 2023 revenue, you would see that BBW averaged revenue of 378 during this time which shows that over the next 3 years post the COVID shock, BBW increased their revenue by 11.6%. The company was also still free cash flow positive during the pandemic, which is a positive sign for investors.

Intrinsic Valuation

When I valued the company using a DCF model, and projected revenue growth in line with their reiterated guidance from the second quarter earnings call and then modest but consistent growth for the next 5 years, I came to the conclusion that the company is severely undervalued by the market. If margins expand slightly as they should, then my price target of 38 represents a 44% upside.

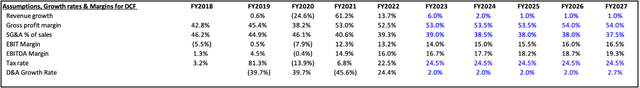

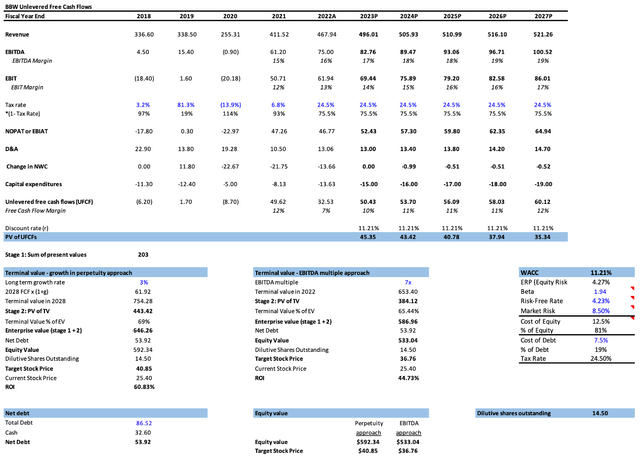

DCF Assumptions (Author’s calculations) Discounted Cash Flow Model (Author’s calculations)

Relative Valuation

Relative Valuation (Author’s calculations) Relative Valuation Continued (Author’s calculations)

Build-A-Bear Workshop trades at a significant discount to its peers on a P/E, EV/EBITDA, and EV/Revenue in the Toy Retail business like Mattel and Hasbro as well as to other experiential companies like Dave & Buster’s Entertainment and Cinemark Holdings. This is despite the fact that Build-A-Bear’s last 4 years CAGR revenue growth of 9% has been much stronger than Hasbro and Mattel at 6% and 5% respectively.

Risks – The Retail Market And Discretionary Spending Weakening

The Retail Market and discretionary spending has been choppy in August with DICK’S (DKS), Macy’s (M), Footlocker, and Petco (WOOF) missing earnings, slashing guidance, and selling off a lot in August. This is due to COVID-19 stimulus going away and consumers having not as much money to spend on discretionary items. For example, Petco’s earnings have been deteriorating as the stock dropped 18% on an earnings miss, and it’s hard for me to make the case that stuffed animals are more important than pets?

However, one such reason for the BBW holdup could be that a lot of these retailers had spiked way past all-time highs and there was still demand for these items during COVID. But for BBW as an experiential retail, that has still never regained its post IPO highs in 2004, the company may be ready to break out as demand for experiential services still seems solid. The key question is why will the BBW’s discretionary income hold up despite all the other retailers slashing their earnings guidance, and is their business model truly that diversified to be recession resistant? I believe YES they are.

Historical Correlation Between Revenue Decline and Margins Contracting

However, if we go into a recession and all of a sudden revenue starts to decline, historically BBW’s margins contract significantly because if people aren’t buying the stuffed-animals, due to the low demand, then they have to mark down their prices leading to stock correction.

For example, from 2014 to 2018 under CEO Sharon Price John, revenue dropped 14% from 392 to 337, and EBITDA margins dropped from 9% to 2%. However, since then, BBW has undergone a transformation by expanding its business model and revenue streams into so many new categories like e-commerce, movies, co-locations, licensed agreement sales, and gaming, so I don’t think this will happen as severely ever again.

Opportunity to Create Shareholder Value By Leveraging the Balance Sheet and Returning Cash to Shareholders

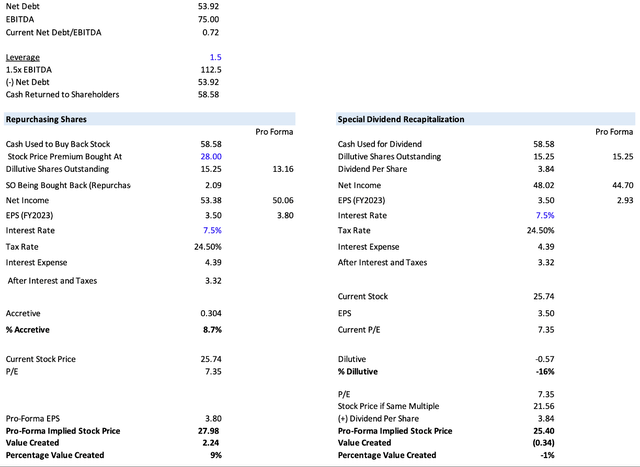

Due to BBW having such a strong balance sheet, management could utilize the balance sheet to enhance shareholder value. If they leveraged the balance sheet to 1.5x EBITDA, that would give them $59 million, which they can use to buy back stock or do a special dividend. When I modeled it out, if they were to use the proceeds to buy back stock, it would be very accretive, and they could actually increase shareholder value by 9% as opposed to losing 1% if they were to do a special dividend. Given they trade at such a low P/E, I believe it makes more sense for them to do a buyback instead of a special dividend. In addition, the special dividend sends the message that they are just a cyclical company and are giving cash back to shareholders in good periods for their business. Repurchasing shares not only creates more value, but sends the message that BBW is recession-resistant and that management really believes in its potential. Lastly, management and the board own 11.4% of the company, which should align their interests to create value for shareholders.

Capital Allocation (Author’s calculations)

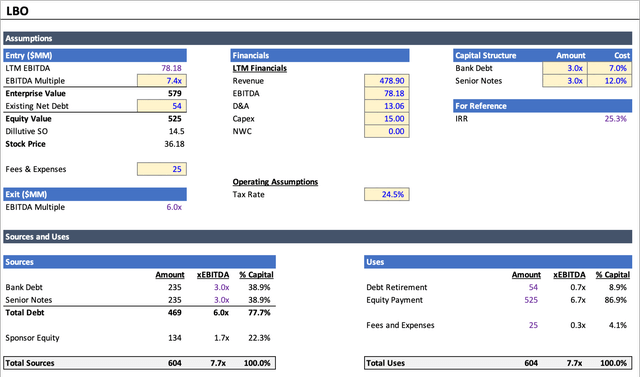

Can BBW Get Bought Out?

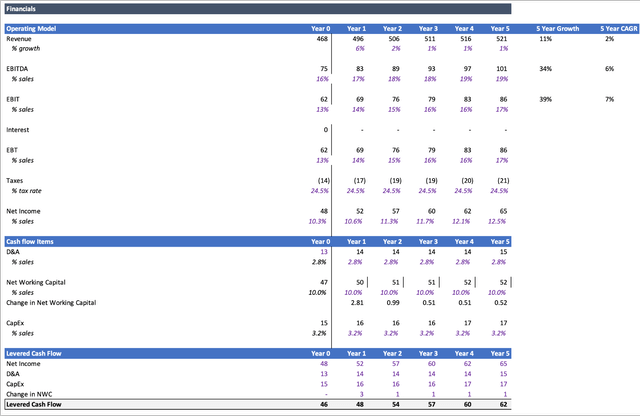

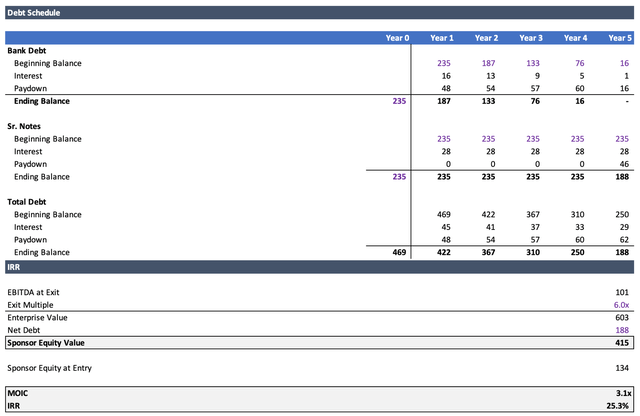

Since the company is so cheap, financial sponsors may become interested in taking the company private. It all comes down to in my opinion if they believe EBITDA can truly stabilize and grow. Can we really grow EBITDA from 75 to 101 over 5 years and maintain robust free cash flow? If the answer is yes, then Private Equity investors could offer 36, or a 40% premium, and make a very attractive MOIC of 3.1x and an IRR of 25%, if levered up at 6x EBITDA, entered at 7.4x and exited at an even lower multiple of 6x.

It’s interesting how on news of the Q2 earnings beat, the stock surged up from 24.40 to as high as 30, but then came back down where it settled in at 25.74. I think at around this price, the market is daring someone to come in and take a chance on it.

LBO Model Sources & Uses (Author’s calculations) Financials – Levered Free Cash (Author’s calculations) Debt Schedule, MOIC, & IRR (Author’s calculations)

Conclusion

In conclusion, Build-A-Bear Workshop presents a compelling investment opportunity. This differentiated and well-managed retail concept offers significant value potential for investors. Its remarkably low FY23 P/E, when compared to industry peers, yet better growth in the last couple of years showcases a stock that is currently undervalued despite holding up earnings in a very difficult market. While it could be tricky short term if we go into a recession given the stock has had such a strong run, long-term I believe the prospects certainly don’t look bearish at all.

Read the full article here