The recently announced capacity restrictions in the Panama Canal have done more than any other factor to reduce effective fleet supply worldwide

Investment thesis

Following its Q2 earnings, which I covered in a previous article, BW LPG (OTCPK:BWLLF, OTCPK:BWLLY) has reported even more substantial Q3 earnings. The main points supporting the thesis – low leverage, an excellent management track record, the world’s largest fleet of modern dual-fuel ships, and favorable market dynamics – have been strengthened since the previous quarter. The main reason was, of course, the Panama Canal traffic jam.

It is awash in cash, has very low leverage, has an excellent management track record, and has the world’s largest fleet of modern dual-fuel ships. For Q3, it declared a $0.80/sh dividend, bringing its YTD dividend to $2.56. Based on a share price of $14, its annualized yield is about 24%. Its previously reported US listing is proceeding as planned and will give the company access to a much larger investor base.

The VLGC freight sector’s fundamentals are excellent and have been for some time. The Panama Canal is set to operate at reduced capacity. With VLGCs at the back of the line, many shipowners will have to re-route around the Cape or Suez, increasing sailing distances by 50 percent. Given these market factors and strong fundamentals, its ability to generate dividends is unprecedented.

Its upcoming dual listing in the U.S. will likely increase liquidity and reduce currency risk (alleviating investors of the NOK risk).

Finally, the long-term fundamentals of the LPG market support VLGC shipping: large production capacity in the U.S. and demand in the Far East.

Introduction to BW LPG and recent events

BW LPG is perhaps the largest owner-operator of VLGCs in the world, controlling 45 ships, of which 32 are owned. It has one of the largest dual-fuel fleet in the world, totaling 17 ships.

On Oct 2, Kristian Sorensen assumed the CEO role in what appeared to be an orderly transition following former CEO Anders Onarheim’s announcement that he would step down after September 2023. No official reason was given, and Mr. Onarheim has since worked as chairman of a few Norwegian microcaps. He has retired after four successful years at BW LPG. Kristian Sorensen joined BW LPG in late 2022 after leaving the CEO role at peer Avance Gas in what seems to have been preparation for a future CEO role at BW LPG.

BW LPG CEO Kristian Sorensen was interviewed by the Norwegian financial newspaper Finansavisen (in Norwegian) on Nov 16 concerning BW LPG’s Q3 release. Due to the high asset prices, the company is struggling to find good growth opportunities. At this time, Mr. Sorensen said that paying dividends is the best option for shareholders. It has begun looking into investing in other parts of the value chain, such as land terminals.

Its parent company, BW Group Limited, caused a short-term stock crash after block-selling 8.4 million shares on Oct 3 at $ (NOK 120/sh). For comparison, BW LPG closed at NOK 132.20. Post-sale, it owns about 34 percent of BW LPG. BW Group Limited cited a wish to increase liquidity in the stock and rebalance its portfolio of group companies as the reasons for completing the sale.

Change to Dividend Policy: “Core Shipping”

After BW LPG bought Vilma LPG last year and started growing its trading division, BW Product Services, its relative importance has increased. In July, its Product Services division reported a $32 million “timing effect” loss. Necessities following from IFRS aside, all of this amounts to reduced transparency in its dividend policy, which makes me glad that BW LPG has clarified its dividend policy.

In the future, its shipping division’s net profit after tax and net leverage ratio will form the basis. Further, the dividend payout will consider “BW Product Services’ performance; Our capital expenditure plans; and All financing requirements, financial flexibility, and anticipated cash flows of the business.”

Upcoming U.S. Listing (Dual Listing)

The company stated, “The work towards the announced dual listing in the US is on plan, with an expected listing in Q2 2024” in its Q3 earnings presentation. The company will remain listed on the Oslo Stock Exchange and has not announced plans to delist from the OSE.

While giving the company access to a more extensive investor base, the dual listing will alleviate current and prospective investors of the NOK currency risk. The value of the NOK has been sliding for years, and its volatility has increased in later years. In the interview mentioned above, Mr. Sorensen also stated that the company has received complaints about its currency risk related to NOK.

Fundamentals

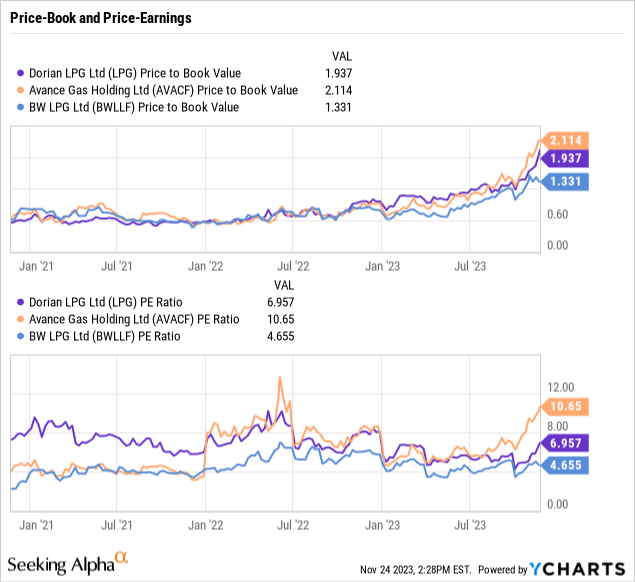

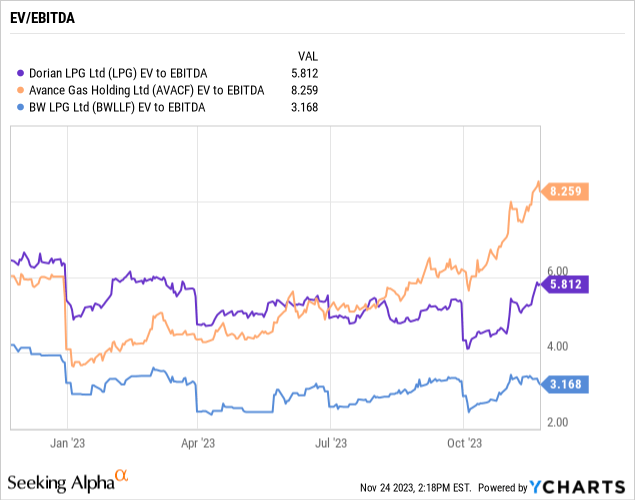

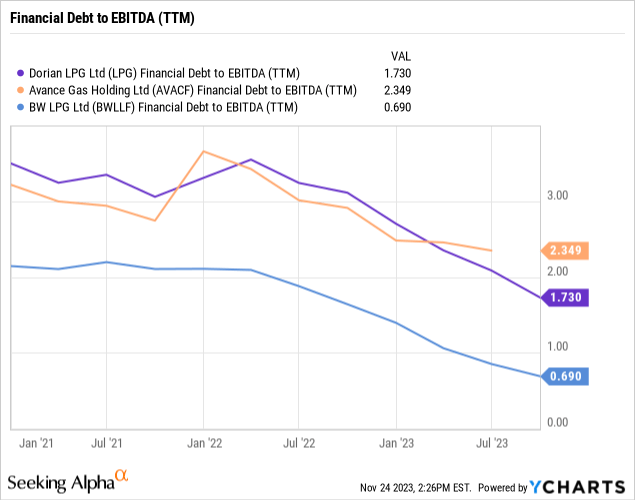

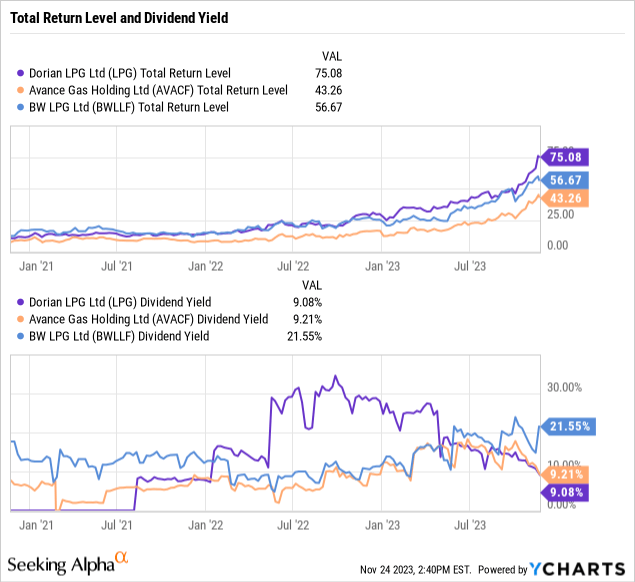

In this section, BW LPG will be compared to its two main peers, Avance Gas (OTCPK:AVACF) and Dorian LPG (LPG). As in my previous analysis, the figures show that BW LPG remains the undervalued, relatively speaking, company of the three.

P/B and P/E

Dorian LPG and Avance have gone from a P/B of less than 1 in a year to about 2. BW LPG comes in somewhat lower, at 1.3. While Avance has the youngest fleet, Dorian’s and BW’s ships are not “old.”

EV/EBITDA

Judging by this metric, Avance Gas has become relatively expensive during the past quarter. Dorian and BW LPG’s figures have remained relatively flat during 2023, meaning that their EBITDA has increased along with their enterprise value.

Debt to EBITDA

BW LPG has operated with significantly lower debt levels than its two peers for some time. While all three have deleveraged further during the past year, BW has reached record low levels.

Total Return Level and Dividend Yield

Comparing the three companies by Total Return Level and Dividend Yield yields an exciting picture. Dorian LPG has recently outperformed in total return, but the rapid price appreciation seen for both Dorian LPG and Avance Gas has sent their dividend yields somewhat down. Again, we see that both Dorian and Avance appear to attract more investor attention than BW LPG.

Valuation

Its peer, Dorian LPG, surged 10 percent after Jefferies issued a buy recommendation on November 20. Setting a $50 price target, Jefferies reported, according to the SA article,

“The recent Panama Canal restrictions, however, change the outlook considerably, tightening VLGC capacity and raising both spot and forward charter rates. The sector is already underpinned by strong US liquids export growth, which is likely to continue next year (..) We are raising our VLGC rate forecast to $75,000/day for 2024, up from $45,000/day.

In a previous analysis, I calculated a valuation of NOK 150 (USD 14) for BW LPG stock. Since then, the Panama Canal’s capacity has declined steeply, effectively reducing the world fleet by increasing sailing distances by up to 50 percent. In addition, shipyards are still booked well into 2026 and 2027, preventing other players from adding capacity to the market. In the interview with the newspaper mentioned above, Mr. Sorensen even said that BW LPG is considering investing in other parts of the value chain as it currently cannot find profitable growth opportunities. Under current market conditions, BW LPG is worth well above USD 14. With its dividend capacity at an all-time high, it looks like a promising case.

Market Outlook

Global Fossil Fuel Demand to Continue, Says EIA Projection

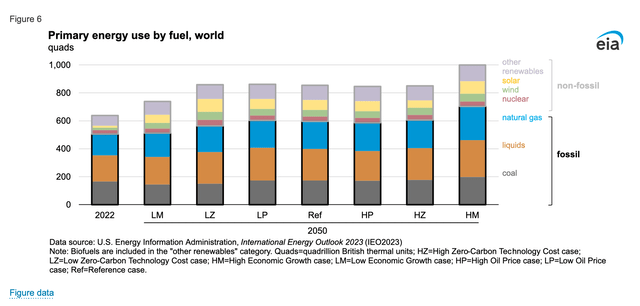

In its International Energy Outlook 2023, the U.S. Energy Information Administration projects that the world will still demand significant quantities of natural gas and liquids in 2050 across all of its scenarios:

World 2050 energy demand mix (IEA, International Energy Outlook 2023)

Further, it says, “[g]rowth in natural gas consumption is widely distributed regionally, but it is most notable in India, the Other Asia-Pacific region, China, Africa, Russia, the Middle East, and the Other Americas region.” The takeaway from this analysis is that the world will still demand natural gas and liquids, and the most significant demand is coming from regions far away from what is currently the world’s largest exporter of natural gas, the U.S.

US Exports

In the same interview mentioned above, Mr. Sorensen commented that he sees the LPG market as a supply-driven market, as LPG is a byproduct of oil and gas production. Domestic LPG consumption in the U.S. remains flat, meaning published production and inventory levels provide export transparency.

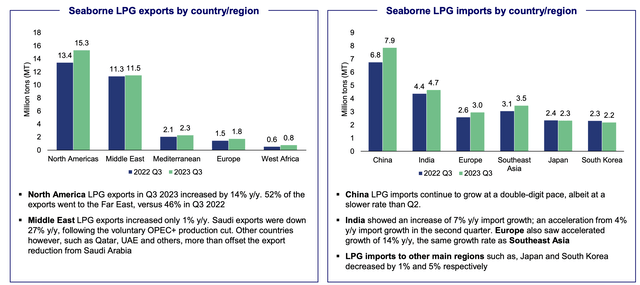

In its Q3 presentation, BW LPG offers this illustration:

Seaborne LPG exports and imports by region (BW LPG Q3 2023 presentation)

According to these graphs – of which data was sourced from IHS and BW LPG’s research – North America has increased its exports significantly in the past year, while China and India have increased imports. The Middle East needs to increase its production to match the increased demand of China and India. This is an excellent combination for shippers such as BW LPG because this dynamic increases ton-mile demand.

The Panama Canal Shows No Signs of Returning to Full Capacity

The Canal’s capacity issues this year have been widely published. Starting in February 2024, the Canal will allow just 18 ships a day.

As mentioned, BW LPG CEO Kristian Sorensen was interviewed by the Norwegian financial newspaper Finansavisen (in Norwegian) on Nov 16 concerning BW LPG’s Q3 release. There, he spoke about, among other things, the Panama Canal. The Canal has driven the market in the past year due to capacity issues. These issues have contributed to absorbing added fleet capacity, a concern going into the year further exacerbated by the fact that LPG ships have lower priority for passage than containers and LNG ships.

According to Mr. Sorensen, if rainfall returns, the issue facing LPG shippers will not immediately disappear due to their low priority.

Fleet additions update

BW LPG has no new builds on order. Instead, it announced its intention to sell a VLGC at no less than $64 million – amounting to a $20 million gain.

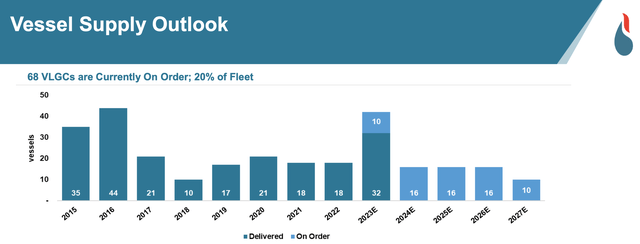

In its Nov 3 investor presentation, its peer Dorian LPG offers this helpful illustration:

Ships on order (Dorian LPG investor presentation, November 2023)

Starting in 2024, a few new VLGCs will be entering the market. At the same time, about 15 percent of the world fleet (57 ships) are candidates for scrapping, according to the same presentation.

Risks

The main risks related to VLGC shipping and BW LPG relate to the export propensity of the U.S., the Panama Canal capacity, and Chinese/Far East demand.

Policy-wise, the U.S. has little appetite for increased domestic use of gas. Instead, it is expanding its export capacity by building new terminals. Still, exports are not without controversy.

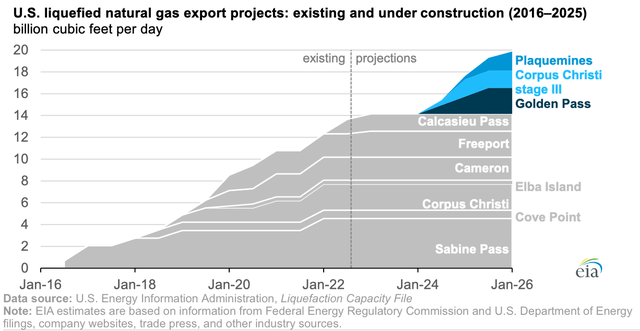

As this EIA illustration shows, a few big projects will be completed in the coming years:

US LNG export capacity, 2024-2026 (EIA)

Yes, this is indeed LNG and not LPG, but considering that LPG is a byproduct of natural gas and oil production, what happens to gas and liquids produced is worth considering.

A sudden change of weather conditions in Panama would, over time, ease the traffic jams in the canal. A dynamic similar to what the container market experienced during the global pandemic would play out: skyrocketing rates and a steep drop and return towards normal levels as the inefficiencies in the supply chain clear.

Reducing Chinese and Indian LPG demand would hurt rates and, thus, the prospects of a company like BW LPG. China’s somewhat slow economic recovery has been more than offset by the Panama problems this year. Still, if China’s woes continue, it could also hurt the VLGC market once the Panama traffic jam eventually clears.

Conclusion

This analysis has updated the investment thesis since I analyzed BW LPG. The company is in excellent shape, riding on the most extended LPG cycle ever.

Comparing BW LPG to its peers using fundamental indicators presented an image of a financially strong company operating at lower debt levels than its peers. Simultaneously, there are indications that it attracts less investor attention. Perhaps it needs access to relative liquidity and a more stable currency that Dorian LPG enjoys (listed on the NYSE and trading in USD) or the high profile of the John Fredriksen-majority-owned Avance Gas. In comparison, BW LPG is somewhat boring.

Ultimately, boring companies amount to a case worth investigating further, and its upcoming listing in the U.S. will be exciting to watch.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here