Investment thesis

My first bullish thesis about C3.ai (NYSE:AI) stock did not age well since the stock has underperformed the broader U.S. market by far since August. However, I do not expect AI to be a quick win since the company is at the nascent stages of its business life cycle, and substantial volatility is inherent to aggressive growth companies. Actually, recent positive developments, including positive earnings surprises, a strategic focus on a recurring revenue buildup, and a strong balance sheet, provide a firm foundation to build long-term value for shareholders. Moreover, my valuation analysis suggests the stock is more than 40% undervalued. To conclude, I reiterate my “Buy” rating for AI.

Recent developments

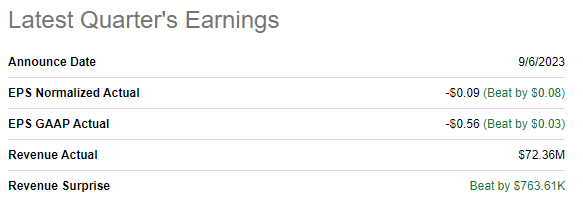

The latest quarterly earnings were released on September 6, when the company topped consensus estimates. Revenue demonstrated a 10% YoY growth., which is a solid improvement compared to the previous three quarters.

Seeking Alpha

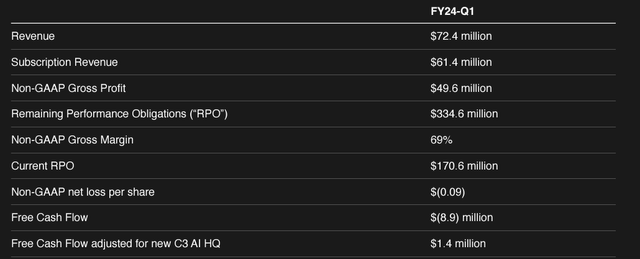

As an investor who is seeking a strong potential long-term bet in C3.ai, consistency in delivering positive earnings surprises is crucial. Therefore, it is important to underline that the company has never missed EPS consensus estimates since it went public, and there was only one slight revenue miss. This means that the management is realistic and fair with growth projections, which is quite important for a growth company because it showcases consistency in growth trajectory. For a software company, securing recurring revenue from subscriptions is crucial; I like that in Q1 FY 2024, subscription revenue constituted 85% of the total. Expanding recurring revenue builds a stable foundation for long-term revenue growth.

AI’s latest earnings presentation

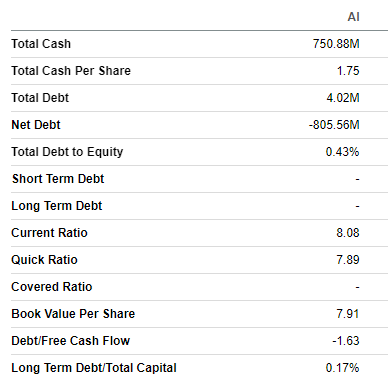

The company is still unprofitable, and its negative net change in cash in Q2 was almost $80 million, which might seem a notable amount. But if we compare it to AI’s massive $800 million net cash position as of the last reporting date, the cash burn rate does not look like a big problem. The balance sheet is a fortress with almost no leverage and strong liquidity, which gives the company a couple more years to continue developing its offerings and investing heavily in marketing.

Seeking Alpha

I like the company’s strategy to build a partner ecosystem to strengthen its market position. According to the latest earnings call, 60% of agreements in Q1 were closed through partners like Google Cloud, AWS, Microsoft, and Booz Allen Hamilton. By leveraging the strengths and capabilities of partners, C3.ai can easily tap into a broader range of expertise, which can potentially unlock more growth opportunities. Having partnerships with big names also makes the company more interested in new collaborations, which could further accelerate market penetration, ultimately offering additional revenue streams.

AI’s latest earnings presentation

Despite artificial intelligence’s appearances in hot headlines becoming rare, the industry is booming, and it is expected to compound at 19% CAGR over the next decade, which is a massive tailwind for C3.ai. As businesses recognize the value of artificial intelligence solutions in streamlining internal processes and making data-driven decisions, C3.ai, with its suite of applications, is well-positioned to meet the increased demand. The company’s expanding customer relationships with the U.S. Department of Defense [DOD] are a vital quality sign for me because government contracts, especially related to the country’s safety, usually have stringent requirements for technology, security, and compliance. The fact that C3.ai meets these high standards gives me solid validation that the company’s technology is robust and secure. Having contracts with the DOD also adds a lot of recognition and credibility to AI, which makes the company well-positioned to absorb secular industry tailwinds.

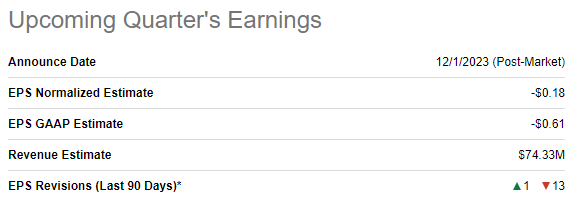

The upcoming quarter’s earnings release is scheduled for December 1. Consensus estimates forecast quarterly revenue at $74.3 million, which means that the topline is expected to increase YoY by an impressive 19%. Revenue growth acceleration is a good sign for investors, especially amid the current highly uncertain macro environment.

Seeking Alpha

Valuation update

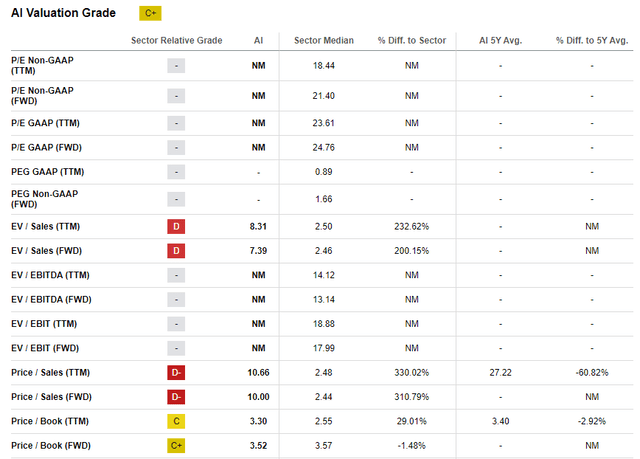

The stock delivered a massive year-to-date 140% rally, significantly outperforming the broader U.S. market. AI’s valuation ratios are substantially higher than the sector median. However, considering the company’s stellar revenue growth profile, high multiples do not necessarily mean overvaluation.

Seeking Alpha

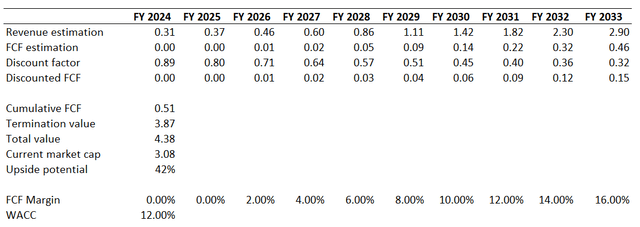

Therefore, let me proceed with the discounted cash flow [DCF] simulation. I use an elevated 12% WACC due to the fact that the company still does not generate positive FCF, and there is a high level of uncertainty about when AI will actually start generating positive net cash flows. I use revenue consensus estimates projecting a staggering 28% CAGR for the next decade, but I consider this fair given the company’s relatively small scale and vast potential for the industry. For the FCF margin, I am conservative and expect the company to start generating positive numbers only in FY 2026 with a further two percentage points yearly expansion.

Author’s calculations

According to my DCF analysis, the business’s fair value is about $4.4 billion, meaning the stock price has a 42% upside potential. That said, my target price for AI stock is $37. Please also pay attention that I am not adding up the current substantial over $800 million net cash position to the fair value calculations to be conservative.

Risks update

AI is an aggressive growth company, and it still does not generate operating profits, which means high risks and a high level of uncertainty for investors. In case the company does not demonstrate the ability to improve profitability as the business scales up, investors might start considering the business model not economically viable. This might lead to a massive stock sell-off due to the investors’ disappointment. It might take several quarters of successful earnings dynamics for the company to regain investors’ confidence in the stock. That said, potential investors should be ready to tolerate substantial short-term volatility and hold the stock over the long term.

Artificial intelligence is a hot topic today, and none of the technology giants plans to miss this megatrend. Established players recognize vast artificial intelligence potential and actively invest substantial resources to dominate this space. AI’s spare capital represents a tiny portion of the hyper-scaler companies’ deep pockets, meaning that larger companies are free to pursue more aggressive development strategies, making it a big challenge for smaller players like C3.ai to compete.

Bottom line

To conclude, despite recent market underperformance, AI is still a good investment opportunity and is still a “Buy”. The company is well-positioned to absorb industry tailwinds with the management’s strategic focus on recurring revenue and realistic planning, which I see in consistent positive earnings surprises. While risks for potential investors exist, I believe that the massive upside potential outweighs all the risks and uncertainties if investors are ready to tolerate short-term volatility.

Read the full article here