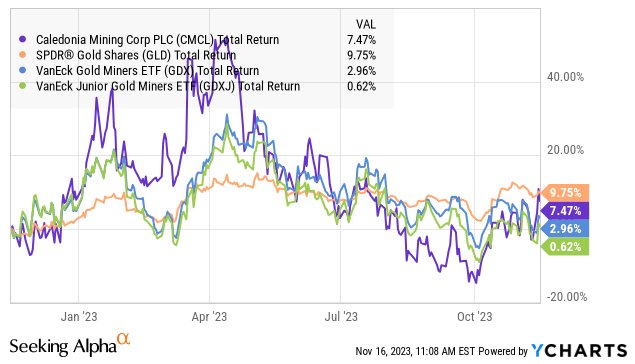

Caledonia Mining Corporation Plc (NYSE:CMCL) reported its Q3 results highlighted by record gold production moving past some operational disruptions in the first half of the year. The gold miner with several high-profile assets in Zimbabwe is reiterating its full-year guidance with an expectation for stronger financial momentum going forward.

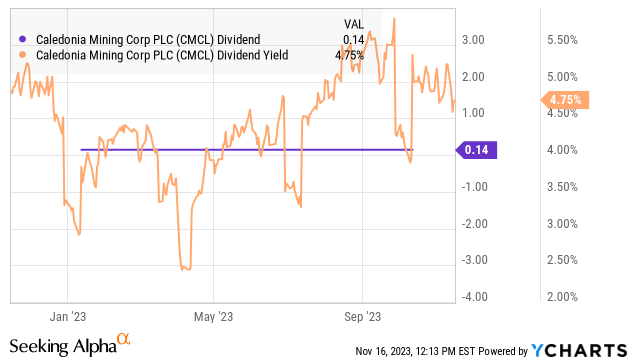

What we like about CMLC is its low-cost production potential with a path to continue ramping up output at the company’s flagship “Blanket” mine. Notably, the company offers a generous quarterly dividend that currently yields 4.8%, making the stock a compelling income idea in the sector. With a bullish view on the price of gold (GLD), we see room for shares of CMLC to rally and ultimately outperform into 2024.

CMCL Q3 Earnings Recap

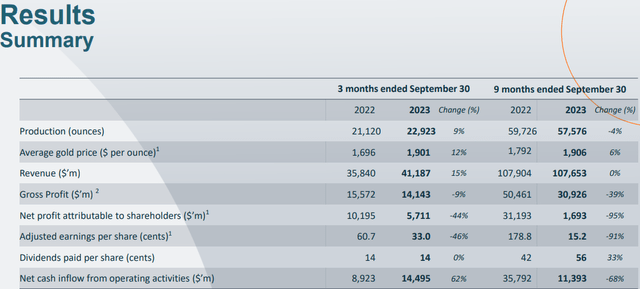

CMCL Q3 adjusted EPS of $0.33 representing a net profit of $5.7 million was down from $0.61 in the period last year, but also up from $0.10 in the prior Q2. Favorably, total gold production at 22.9k ounces was a quarterly record, up 9% year over year, and sharply higher from the 18.5k in Q2.

Revenue reached $41.2 million, benefiting from a 12% higher realized gold price, On the other hand, production costs are also up this year with increased headcount and higher utility rates pressuring margins explaining some of the earnings volatility.

source: company IR

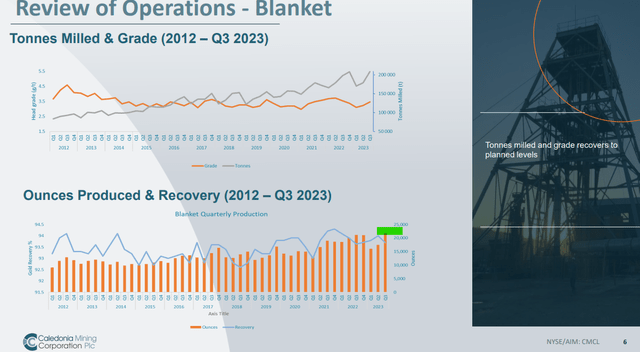

Again, the story here is something of a turnaround compared to weaker results between Q1 and Q2. Prior quarters this year were impacted by lower-than-planned tonnes milled and the timing of maintenance.

Specifically, management cited some poor blasting results and trimming problems that simply delayed what has been an ongoing ramp-up of production at the Blanket facility.

The update now is that production into Q4 is back on track with the guidance to reach between 75,000 – 80,000 for the full year 2023 reiterated. The company is also moving forward with further drilling and exploration activities at Blanket intended to extend the life of the mine.

There is also the smaller “Bilboes” gold project which has faced more difficulties considering its expansion effort and has now been placed into care and maintenance. With expectation is to at least break on the mine looking ahead to a completed feasibility study for a phased development plan to reach its potential. We can also cite separate “Motapa” and the “Maligreen” claims as assets with potential down the line.

source: company IR

Caledonia ended the quarter with $10.8 million in cash and equivalents against $15 million in total debt. Positive operating cash flows that reached $15 million in Q3 suggest strong liquidity

An update here is that the company now intends to sell its solar plant, a 12.2MW facility that served approximately 25% of Blanket’s daily demand. While an amount has not been disclosed, management confirms there is an offer to buy, which we believe would work to strengthen the balance sheet.

Overall, we see the $0.14 per share quarterly dividend representing an annual payout of around $11 million is well-supported by the fundamentals.

What’s Next For CMCL?

Considering 2023 as something of a transitional year for the company and now emerging from operational setbacks, the opportunity here is for the stock to benefit from a clearer outlook. With the guidance to approach 80k ounces of production from the Blanket Mine, the path here is for a strong Q4 which leads a runway for revenues into 2024.

The other dynamic we’re considering is the potential for declining costs on the side of fuel and electricity rates, given the global trend of easing inflation pressures. The result is the potential for firm margins and higher earnings.

source: company IR

We also expect CMCL to perform well alongside the price of gold, eyeing a potential breakout above $2,000/oz. From a macro perspective, the ongoing pullback of bond yields with a building consensus that the Fed has room to cut interest rates by next year has translated directly into some new Dollar weakness as a tailwind for precious metals.

In this case, compared to a bullish thesis for gold as an “inflation hedge” or capturing a flight to safety trade, we believe an expected decline in real rates making cash less attractive is a positive for the sector.

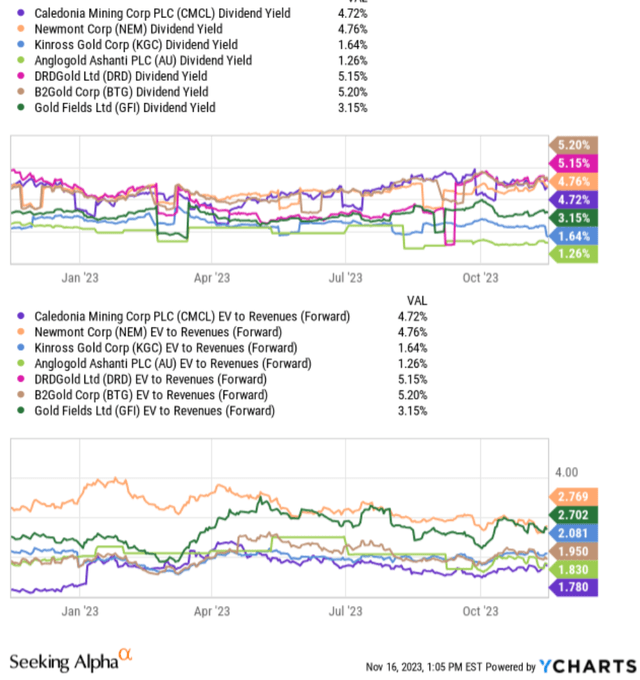

Going back to CMCL’s 4.8% dividend yield, while this is not technically the highest yield available among gold stocks, shares stand out as trading at a price-to-sales discount relative to peers.

The bullish case for CMCL is that it can normalize its cost of production lower towards the long-term potential given the economics of the Blanket mine and Zimbabwe region, justifying a higher premium to the stock.

source: yCharts

Final Thoughts

Caledonia Mining is a high-quality junior miner that is well-positioned to rally going forward. From the stock price chart for CMLC, the recent rally from its low in late September was under $10.00 is encouraging and suggests some new bullish sentiment.

We believe that a scenario where the price of gold gains momentum above $2000/oz opens the door for CMLC to reclaim its high of the year back in April when shares traded above $17.00 as a bullish price target.

In terms of risk, a reversal of the price action in gold would likely drive a new round of volatility. Weaker-than-expected operating results or further setbacks from the company at the Blanket mine or the Bilboes project would also force a reassessment of the earnings outlook. Monitoring points here include the gold production trends and cash flow levels over the next several quarters.

source: finviz

Read the full article here