Canaan Inc. (NASDAQ:CAN) is a technology company with a global presence worldwide. Concretely, CAN’s business centers on building ASIC Bitcoin miner devices. These are specifically designed processors more efficient in speed and energy consumption than GPUs and CPUs. Currently, CAN’s devices are in high demand due to crypto’s recent price recovery. Concurrently with technological mining advances, the crypto market could also benefit from a more accessible and regulated trading environment with the potential approval of new spot Bitcoin ETFs filed by recognized financial firms, providing a growing environment for companies like CAN. I believe this justifies a “buy” rating on CAN despite the underlying risks associated with being so closely interlinked with Bitcoin’s price action.

Business Overview

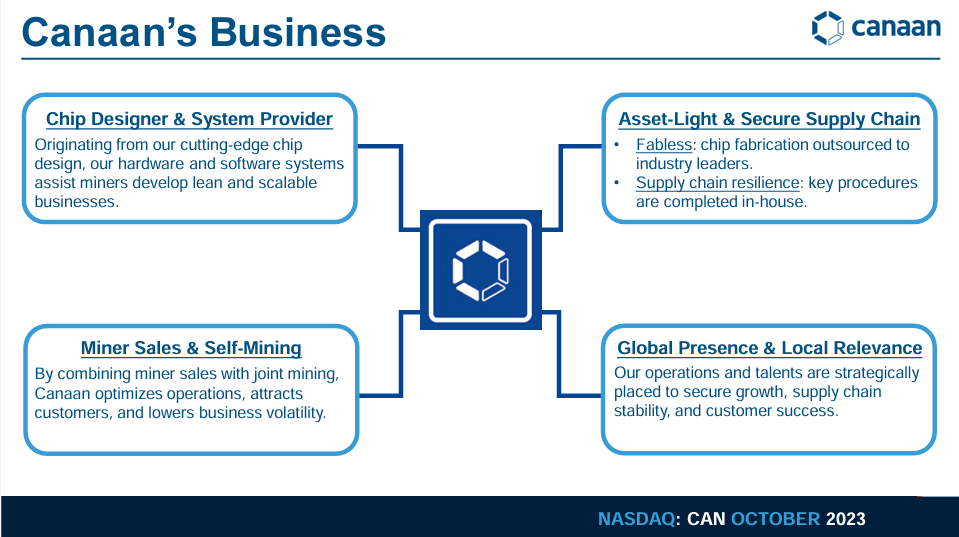

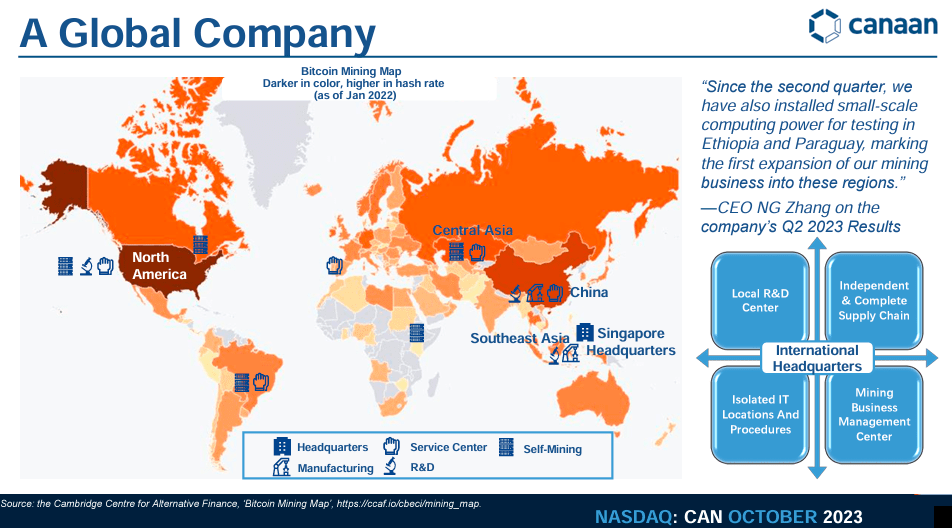

Canaan Inc. was founded in 2013, and its IPO in NASDAQ was in November 2019. CAN is based in Singapore, with offices in continental China, North America, and Central Asia. The company specializes in developing Application-Specific Integrated Circuit [ASIC] chips and the production of computing hardware and software. This particular type of circuit is ideal for Bitcoin mining, which lies at the core of CAN’s value proposition, akin to selling shovels during the gold rush.

Moreover, the company is familiar with the space. In fact, CAN created the first ASIC Bitcoin miner, designed expressly for mining cryptocurrencies. The ASIC miner device differs from other mining hardware types, such as Graphic Processing Units [GPUs] or Central Processing Units [CPUs]. Unlike these other processors, they are designed for mining cryptocurrency coins and optimized for this single type of task. An ASIC Bitcominer is efficient in speed and energy consumption, making it more profitable and competitive than general processors. This means that CAN’s technology is solely useful for Bitcoin mining, restricting its potential in other business verticals and tying CAN’s prospects to Bitcoin itself. Also, each ASIC miner is designed for a specific cryptocurrency mining algorithm, limiting its flexibility as it can’t be repurposed for another task.

Source: CAN’s investor presentation, October 2023.

CAN also provides integrated circuit [IC] manufacture for final mining products. The company’s products are in global markets in countries like the United States, Australia, Kazakhstan, Hong Kong, Canada, Mainland China, Thailand, and Sweden. Here, CAN supplies holistic AI hardware and software solutions such as AI chips, algorithms, and end-products. However, as of 2024, most of CAN’s revenue will still come from Bitcoin mining devices. I think it’s also worth mentioning that CAN’s devices have a reduced carbon emission profile and claim to be part of creating a green mining industry. This matters because it addresses one of Bitcoin’s counterarguments: mining Bitcoin pollutes the environment and consumes too much energy. So overall, CAN emerges into 2024 as a worldwide leader in ASIC chips for bitcoin mining, well positioned against traditional cryptocurrency complaints.

Rising Tide in Crypto: Mining and Regulation

On January 3, 2024, CAN announced the follow-on orders of more than 17,000 Bitcoin mining machines from Cipher Mining Inc. and Stronghold Digital Mining, Inc. The first mentioned company purchased 16,700 A1466 devices to be delivered in April and May 2024 to install them in its Odessa, Texas data center. This firm previously bought 11,000 A1346 machines in May 2023. Stronghold Digital Mining, Inc. also bought 1,100 A1346 mining machines to be delivered to its Scrubgrass offices in January 2024. This company could also purchase an additional 2,500 A1466 mining machines. Stronghold Digital Mining, Inc. purchased 2000 A1346 machines and installed them in its Patha Creek Plant earlier. Cipher Mining Inc. and Stronghold Digital Mining, Inc. reported that the machines they bought were top-performing and provided competitive pricing for energy efficiency and high hash rate.

I estimate this is a significant sale because the implied Thash/s figures of this announcement are roughly 3.0 million. I arrived at this estimate using the press release’s average hash rate of the respective orders. Moreover, in Q3 2023, CAN sold roughly 3.8 million Thash/s, so the approximately 3.0 million Thash/s of this recent order is undoubtedly material. Yet, at the time of the announcement, the shares traded at slightly above $2 per share and are currently below those levels. This alone suggests there might be an investment opportunity at this juncture.

Also, in November 2023, Sam Bankman-Fried, the former CEO of the collapsed exchange FTX, was found guilty of fraud. This verdict had strong implications for the crypto markets. This case showed the need for more stringent cryptocurrency space regulations to avoid fraudulent activities and malpractices and attract institutional investors. After the recent SEC approval of spot Bitcoin Exchange-Traded Funds [ETSs] filed by firms such as BlackRock (BLK), it should bring a significant capital inflow to Bitcoin via these ETFs, effectively acting like onramps from traditional finance into Bitcoin. Spot Bitcoin ETFs would allow a more accessible and regulated way to trade and invest in cryptocurrency beyond the complexity and risk of current crypto exchanges, improving overall market sentiment and leading to greater adoption and growth. It’s reasonable to expect this to increase the demand for Bitcoin mining hardware further, becoming a tailwind for CAN’s business.

Source: CAN’s investor presentation, October 2023.

The market recovery after this verdict exhibits the recognition of a distinction between individual malpractices and the potential of the crypto concept. In my opinion, it could serve as a trigger for better regulatory frames, leading to improved recognition of the cryptocurrency market’s legitimacy. Growing institutional interest in crypto would lead to wider adoption and liquidity for Bitcoin. Together, the technology developments and investments in mining infrastructure suggest a market ready for expansion and incorporation into the mainstream financial landscape. So, I believe the broader context appears highly favorable for CAN as an investment.

A Significant Discount: Valuation Analysis

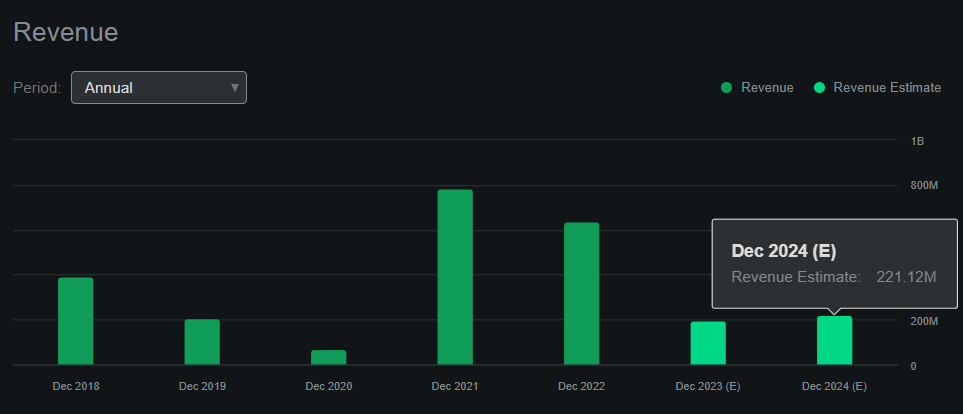

From a valuation perspective, CAN’s Q3 2023 revenues were about $29.9 million. If we annualize those figures, it implies yearly revenues of nearly $120.0 million. However, the recent purchase of roughly 3.0 million Thash/s appears significant and could signal an industry-wide anticipation of favorable times for Bitcoin mining. If this materializes, CAN’s 2024 revenues should be higher than the $120 million revenue run rate implied by the Q3 2023 figures. Indeed, if we use Seeking Alpha’s dashboard on CAN, the projected revenues in 2024 are closer to $221.1 million for the whole year. However, the reality is that CAN is not yet profitable despite this revenue increase, and the same source projects a loss of $0.13 per share in 2024.

Thus, I think the only way we can value CAN is through a multiples-based valuation approach. In particular, I think the sales multiples should be the focus of our analysis. We see that CAN’s sector median forward P/S multiple is 2.87. However, at the forecasted $221.1 million in sales for 2024, CAN’s forward P/S multiple would be 1.65. This is a significant discount relative to the rest of its sector. However, it’s worth noting that CAN’s sector has non-negative P/E ratios, implying profitability, which CAN currently lacks. So, I believe a certain discount is deserved, but CAN now trades at half of the sector’s valuation multiple, which seems excessive. This limits the bearish thesis on CAN, which, coupled with the seemingly bullish developments on crypto, makes me lean bullish on the stock.

Source: Seeking Alpha.

Investment Risks

Nevertheless, it’s worth noting that CAN is a foreign issuer, and we have limited information regarding the latest cash flow figures. However, in 2022, CAN had a negative free cash flow of $201.7 million. This is a staggering figure, especially compared to the company’s latest balance sheet numbers, showing just $40.6 million in cash and equivalents.

I don’t think CAN is on the verge of bankruptcy because 2022 was a notably negative year for crypto. Depending on how you measure it, the price of Bitcoin declined by approximately 65% during 2022, so naturally, it was a particularly bad year for CAN and its sector. But this showcases how intrinsically tied CAN’s business is to the bitcoin price, which exposes shareholders to additional risks given its relatively small liquidity as of Q3 2023. Overall, I think the recent ASIC orders and a seemingly recovering profile in the industry somewhat mitigate this risk. However, it’s still something worth considering before investing in CAN.

CAN’s price doesn’t appear to reflect the improving outlook of its sector. (Source: TradingView.)

Conclusion: Not the Time to be Bearish

Overall, CAN is a direct bet on the future of Bitcoin. Its business is intrinsically tied to the future of this particular cryptocurrency, as its tech’s viability has the demand for Bitcoin embedded into it. This is not necessarily a negative for the stock, but it does expose investors to bitcoin price risk, which is notably volatile. However, from an investment perspective, it appears that CAN trades at an overly pessimistic discount relative to peers. This makes me lean bullish on the stock because there are clear signs of industry-wide recovery in crypto, and CAN is among the most underestimated mining plays in the sector. So, it’s difficult to justify a bearish or neutral stock stance. Hence, I rate it a “buy” with the caveats I previously mentioned throughout the article.

Read the full article here