The Solar Investment Thesis Remains Robust Here

We previously covered Daqo New Energy (DQ) and First Solar, Inc. (FSLR) in April 2024, discussing their uncertain solar PV prospects attributed to the polysilicon supply glut and the intensified pricing competition from Chinese-produced silicon-based solar panels, respectively.

For this particular article, we will be looking at Canadian Solar (NASDAQ:CSIQ) and sharing our findings about the stock, continuing the theme surrounding the solar industry.

CSIQ is Canadian-based company specializing in the manufacturing of silicon-based solar panels and battery storage systems, with primary manufacturing plants in China, Southeast Asia, and the US.

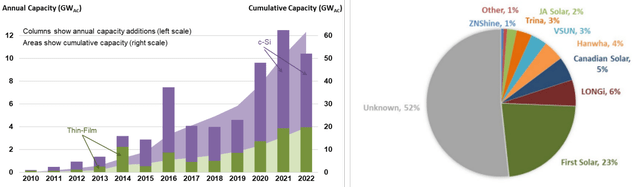

Utility Scale PV Installations In The US By Module Type

Berkley Lab

While still minimal, CSIQ already commands 5% of the Utility Scale PV Installation market share in the US in 2022 (based on the latest data released by Berkley Lab in 2023), underscoring why the Americas comprise 34.4% of its FY2023 net revenues (-3 points YoY) and 53% in FQ1’24 (+18 points QoQ/ +15 YoY).

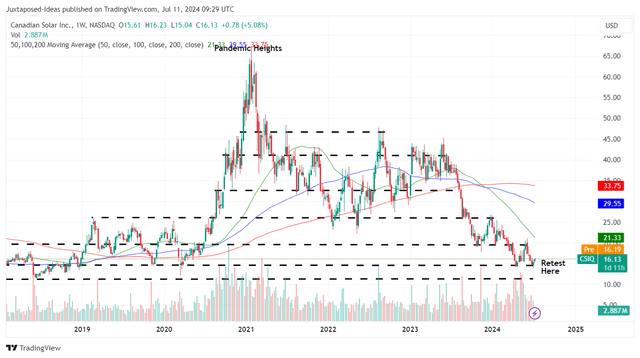

CSIQ 6Y Stock Price

Trading View

Despite the painful normalization in market sentiments surrounding renewable energies after the hyper-pandemic heights, as observed in CSIQ’s volatile stock price movements above, it is undeniable that utility demand remains robust.

This has been observed in the growing solar pipeline of 26.29 GWp (-3.6% QoQ/ +5.1% YoY) and battery energy storage pipeline of 55.93 GWh globally (+2% QoQ/ +19% YoY), with a turnkey utility-scale storage contracted backlog worth approximately $2.5B in FQ1’24 (-3.8% QoQ/ +92.3% YoY).

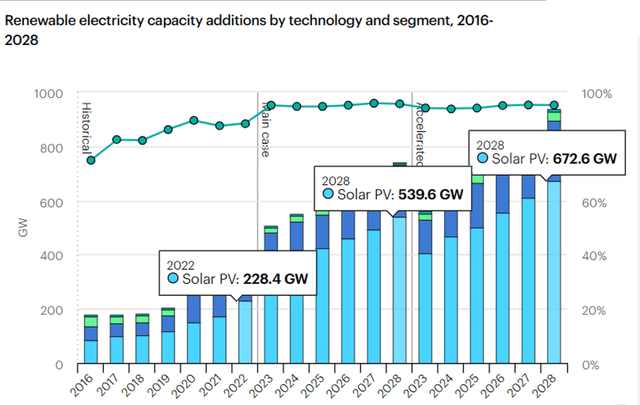

Renewable Electricity Capacity Additions By Technology, 2016-2028

IEA

With the International Energy Agency [IEA] still expecting solar PVs to comprise the lion’s share of renewable energy capacity additions through 2028 (either in base or accelerated case), it is undeniable that solar producers, such as CSIQ, will remain highly relevant over the next few years.

This also explains why the management has guided expansions in its annual manufacturing capacities to 61 GW for solar modules (+7% YoY), 55.7 GW for solar cells (+11.4% YoY), 50 GW for solar wafer (+138% YoY), 50.4 GW for solar ingots (+147% YoY), and 20 GWh for battery storage capacity in FY2024 (+100% YoY).

While the intensified FY2024 capex of $1.8B (+63.6% YoY) implies a drastic step up on a YoY basis, we believe that these efforts will eventually be top/ bottom-line accretive, despite the uncertain funding mix of debt and balance sheet.

This is because CSIQ reports two interesting segments in the Americas, Asia, and the EU, through:

- Recurrent Energy – the operation of solar power and battery energy storage projects, and the sale of electricity, capacity and ancillary services to the local or national grid or other power purchasers, also known as Power Purchase Agreements.

- CSI Solar – the sales of solar system kit, battery energy storage solutions, and other EPC, materials, components, and services.

CSI Solar notably comprises 93.6% of CSIQ’s FY2023 revenues (-2.9 points YoY) and 97.1% of its FQ1’24 revenues (inline QoQ/ -1.7 YoY), implying that the sales of its solar/ battery systems remain its top-line driver while mostly contributing to its FY2024 revenue guidance of $7.8B (+2.6% YoY, with the slower YoY growth attributed to impacted ASPs despite the higher volume sales).

At the same time, the CSI Solar segment is the overall company’s bottom-line driver, since the Recurrent Energy segment remains unprofitable on an EBIT basis.

As a result, while CSIQ (and other polysilicon producers) may continue to face impacted spot prices/ ASPs in FQ2’24, we are not overly concerned since the company remains profitable on a GAAP EPS basis, with spot prices already stabilizing at these bottom levels over the past six weeks – implying that the worst may already be behind us.

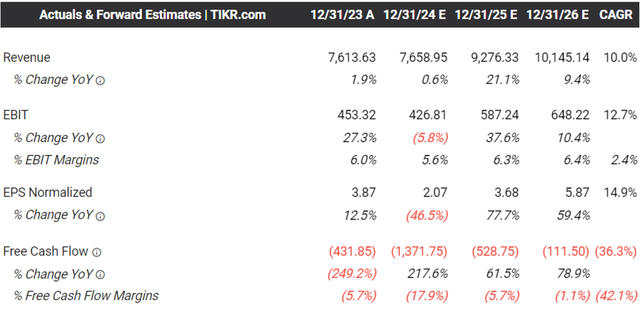

The Consensus Forward Estimates

Tikr Terminal

The same quiet optimism has also been observed in the consensus forward estimates, with CSIQ expected to chart an improved FY2025 top/ bottom line performance and FY2024 likely being a trough year.

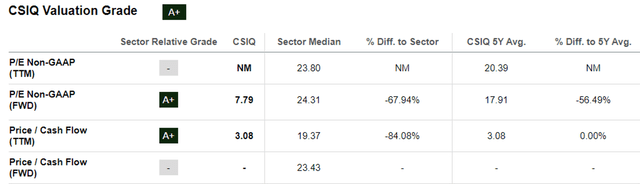

CSIQ Valuations

Seeking Alpha

The same discounted valuations have also been observed in CSIQ’s FWD P/E valuations of 7.79x, compared to its 1Y mean of 8.65x, its 5Y mean of 17.91x, and the sector median of 24.31x, despite the projected bottom-line growth at a CAGR of +14.9% through FY2026.

Even when compared to its silicon solar peers, Daqo New Energy (DQ) at FWD P/E of 3.31x with a projected bottom-line growth at a CAGR of +7.9% through FY2026, and its cadmium telluride solar peer, First Solar (FSLR) at 16.59x at +55.7%, respectively, it is apparent that CSIQ is not expensive here – offering interested investors with a more than decent margin of safety.

So, Is CSIQ Stock A Buy, Sell, or Hold?

CSIQ 1Y Stock Price

Trading View

For now, CSIQ continues to chart lower highs and lower lows after hitting the pandemic heights in January 2021, as market sentiment surrounding electrification also sours from July 2023 onwards.

Even so, the stock continues to trade below its book value of $38.24 in FQ1’24 (-1.1% QoQ/ +20.4% YoY) and our estimated fair value of $22.40, based on the LTM adj EPS of $2.88 (-35.8% sequentially) and the FWD P/E mean of 7.79x (matching its 3Y pre-pandemic mean of 7.79x).

Based on the consensus FY2025 adj EPS estimates of $3.68, there appears to be an excellent upside potential of +63.9% to our 2Y price target of $28.60 as well. These estimates do not appear to be overly aggressive, based on the growing backlog, higher manufacturing capacity, and relatively stable spot prices at the time of writing.

Combined with the recent bounce off its established support levels of $14s, we are initiating a Buy rating for the CSIQ stock here.

Despite so, we would like to highlight a few risks for investors to monitor in the intermediate term.

One, ~80% of CSIQ’s solar manufacturing capacities are based in China and ~15% in Southeast Asia, with CSIQ already facing additional import duties beginning June 2024, attributed to the ongoing EU and US trade ban surrounding Chinese-made polysilicon products.

As a result, while the risk/ reward ratio is skewed to the attractive and the management has guided intensified capex in the US, investors should also size their portfolios according their risk appetite.

Two, with Americas comprising ~50% of its revenues, we may see the ongoing US election trigger near-term uncertainties. This is because the President Trump has “said he’ll dismantle the Inflation Reduction Act, which includes an estimated $370 billion for clean energy,” with the next four months (prior to the conclusion of the election) likely to bring forth further stock price volatility.

Three, this Buy rating does not come with a specific entry point since it depends on individual investors’ investing style, with CSIQ likely to continue underperforming the wider market in the near-term.

As a result, those whom buy in here must also be very patient, since it remains to be seen when market sentiments surrounding the solar industry may reverse.

Read the full article here