Since the last time I wrote about the luxury cruise company Carnival Corporation (NYSE:CUK) (NYSE:CCL) in March this year, its price is up by an eye-popping 120%! At the time, I had given it a Hold rating since there was still some uncertainty around the travel sector and the stock.

Source: Seeking Alpha

Much has changed since, of course. And that is visible in the fantastic price returns it has given over the time period, following updates for both the first and second quarters of 2023 (Q1 and Q2 2023). It is now at the highest level it has seen in a year. This calls for the next big question: Can Carnival Corporation continue to race ahead? Or have we, as investors, missed this ship?

To answer this question, I break it down into three parts to get a better understanding of where the stock is headed:

- Have its numbers improved enough to warrant the rapid price rise?

- What does its outlook indicate?

- How do its market valuations compare with peers now?

Profits turn a corner

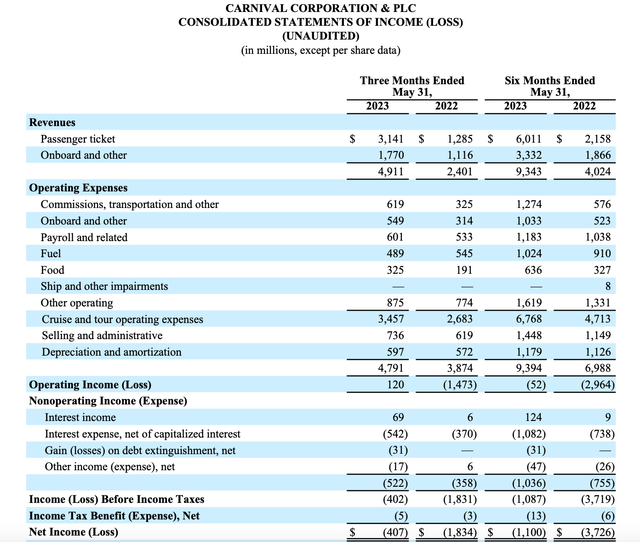

As it happens, there are huge positives to the company’s Q2 earnings reports. First, it clocked USD 120 million in operating profit, making it the first time it has done so since the pandemic. Its net loss also shrunk to 22% of what it was in Q2 2022. Further, revenues continued to show robust growth, more than doubling year-on-year (YoY). Both its cash from operations and adjusted free cash flow turned positive, too.

Source: Carnival Corporation

Underpinning these improvements is rising demand, as travel demand in the US, its biggest market, is returning to pre-pandemic levels. Total bookings reached a new all-time high in the latest quarter. Besides the increase in demand for cruises as such, the company also points to its own strategy that has improved revenues. This includes increasing ticket prices, instead of absorbing higher costs.

Gross margin rises

This is an indication of its pricing power, which is also reflected in a jump in its gross margin to 47.4% from 42.1% in Q1 2023 and 20.5% in Q2 2022. That it has been able to turn in operating income is a further confirmation of the same trend.

This is a particular positive, since it mentions inflation three times, in the context of costs, in its latest release. The concern over inflation stood out since many other companies I have looked at recently are well past the stage of still stressing over it.

The macroeconomic situation is a bit precarious though, with the timeline for the expected US recession having shifted to late 2023 and early 2024. This could impact demand, and its ability to raise prices much more. At the same time, the recovery is expected to start from next year itself as well, so at this time it seems unlikely that Carnival Corporation would be dented much.

Debt in check

Debt levels soared for the company during the pandemic, but it has positive developments on that front too. It has paid down USD 1 billion of near-term debt. Further, it says that 80% of its debt is now at a fixed rate, which will not be impacted negatively by any further interest rate increases. In any case, at under 0.7x, its debt ratio for Q2 2023 doesn’t look terrible to me.

The outlook

Following solid progress in the year so far, Carnival Corporation’s outlook is also positive. It expects occupancy rates of 100% or higher. While it expects net losses this year, this is likely due to the drag from the first-half figures. In Q3 2023 it actually expects an adjusted net profit of USD 950 to USD 1,050 million.

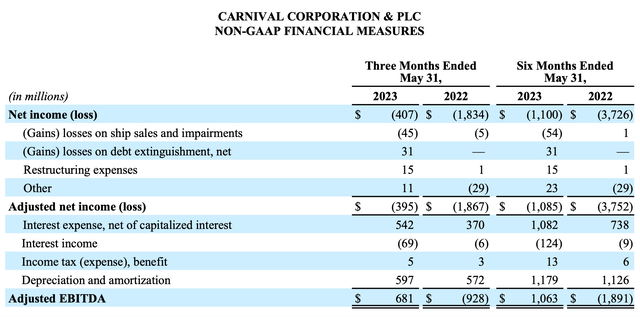

If the gap between the adjusted and net figures stays the same in the current quarter as it did in the first half of 2023 (see table below), we can expect the company to become profitable even on a reported basis from the next quarter itself. It goes without saying, that continued exceptional revenue growth is anticipated, too. Analysts pencil in a 75% increase.

Source: Carnival Corporation

The market valuations

With a robust sales increase expected, its forward price-to-sales (P/S) of 1.14x does not look bad at all. Even compared it one of its closest peers, Royal Caribbean Cruises (RCL), which is trading at a forward ratio of 2x it looks competitive. But Norwegian Cruise Line Holdings (NCLH) has a forward P/S of 1.10x indicating that it might just be fairly priced.

Its trailing twelve months [TTM] P/S indicates a similar. CUK is at 1.4x, which is just a bit lower than that for NCLH at 1.5x and quite a bit lesser than that for RCL at 2.5x.

Since Carnival Corporation has now turned EBIT positive, I also wanted to consider the comparative forward EV/EBIT ratios. CUK is trading at 29.7x presently, which is higher than both NCLH and RCL at 21.8x and 19.5x respectively.

I am inclined to believe, based on its market valuations, that CUK could be due for some price correction in the short term going by its forward multiples. Even though the TTM P/S does suggest a small upside, right now, its price is rising in anticipation of continued growth and the likelihood of turning a net profit. Therefore, the forward multiples are more meaningful right now as I see it.

What next?

For the medium term, however, there is still likely to be an upside for the stock. There’s no denying that its price has risen massively this year, but it is still nowhere near the levels it was at pre-pandemic. And the recovery in its financials is still ongoing.

It is expected to clock strong revenues this year and it has also started making an operating profit once again. It has also started paying off its debts, which rose during the pandemic. With robust trends foreseen for occupancy rates and the pandemic well behind us now, steady improvement in its financials is likely.

There can be speed bumps along the way, as its key market, the US, could see a recession soon enough. But the recession itself is expected to be a shallow one itself, so the company may just come out of it relatively unscathed or recover swiftly from it. Keeping the medium-term perspective in mind, I am upgrading the rating to Buy. Or in the context of the initial question, this ship is yet to sail for investors with some patience.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here