Cinema stocks have seen their fair share of ups and downs since their pre-pandemic highs, from lockdowns to increased competition and film industry disruption through a growing number of streaming services, which was initially working against the industry, and now more recently, we see the alternatives complementing each other. If we look at Cinemark Holdings, Inc. (NYSE:CNK), a small-cap stock with a market cap of $1.85 billion, there is a clear pre and post-pandemic stock trend, and long-term investors have lost 58.24% in value over these dramatic film years.

Five year stock trend (SeekingAlpha.com)

While 2023 has been positive for cinema stocks with a growing number of blockbuster hit releases, theatres fully operational and an increase in moviegoers across the globe, a lot of FY2023 will ride on the summer movie season performance, which typically represents 40% of total annual ticket sales. Furthermore, Cinemark has not produced positive earnings since FY 2019 and carries high debt. Cautious of the high short interest at 22.93% and a slow start to the summer box office numbers, I recommend a wait-and-see hold rating, as successful box office numbers will reveal the company’s potential to generate cash.

Company overview

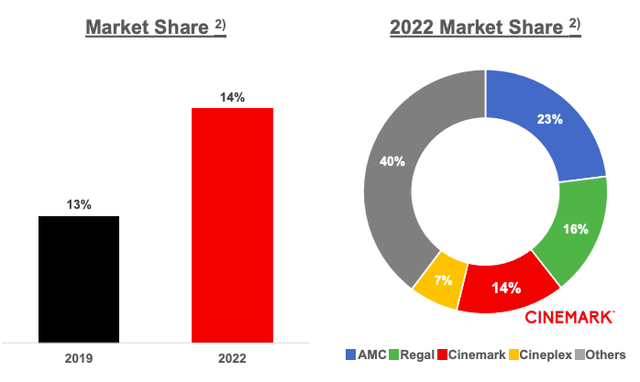

Cinemark was founded in 1984 and operates 518 theatres with 5,847 screens, of which 75% of its business is in the USA and Canada and 25% is in Mexico and Latin America. Cinemark is the third largest exhibitor in terms of screens in the United States, with a market share of 14%. Within its international operations, the company has a market share of 30%. Its market share in the USA has grown since 2019.

Market share USA (Investor presentation 2023)

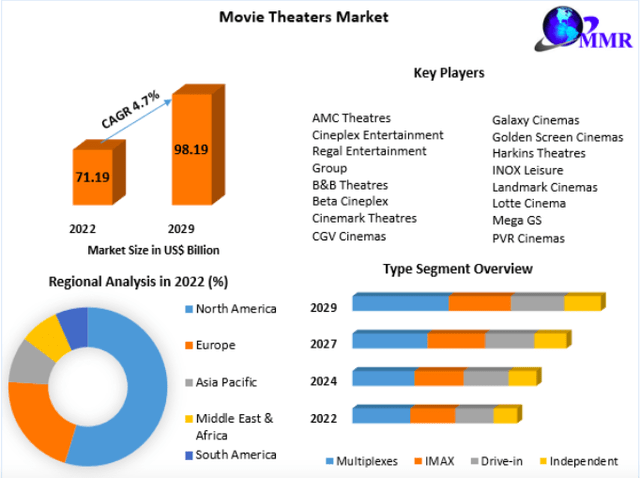

According to industry projections, the worldwide movie theater market is anticipated to reach $98.19 billion with a CAGR of 4.7%. The United States accounts for over half of this market and Cinemark is a key player in the industry.

Movie theatre market (Maximizemarketresearch.com)

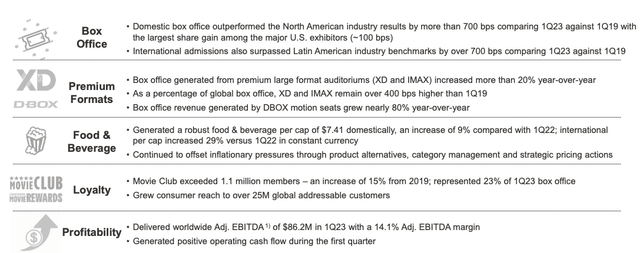

Cinemark has benefited from increased audiences, many film releases, customer loyalty initiatives and premium format strategies. However, we are still waiting to see the same financials as before COVID-19. Cinemark has taken on debt and decreased its cash flow generation, we would like to see this improve in FY2023, and it will be based on the number of new films and box office successes, especially this summer season, which typically sees 40% of annual tickets purchased.

Q1 2023 Highlights (Investor presentation 2023)

Financials and valuation

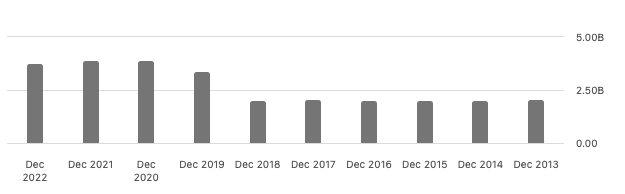

Before FY2020, Cinemark was generating relatively consistent revenues and positive earnings. We can see that revenue of $2.604 billion TTM is slowly recovering. However, it is still well below the FY2019 figures. The gross profit margin has improved over the last three years to 48.36% TTM. However, it remains below the pre-pandemic ratio, which was closer to 50%.

Annual revenue and gross profit (SeekingAlpha.com)

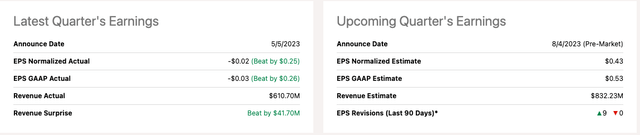

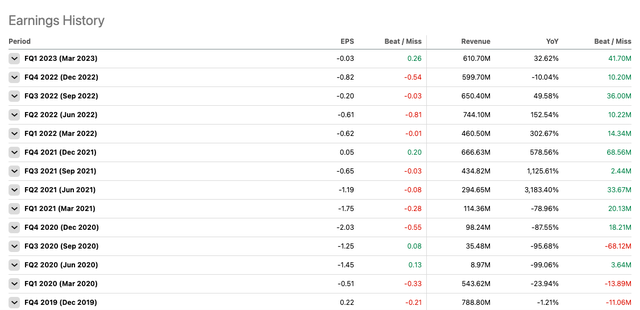

We can see that Cinemark beat earnings expectations in the last quarter, and for Q2 2023, there have been some positive revisions, and the consensus is that normalised EPS will be positive at $0.43. If we look at the earnings history, we can see that the company has frequently missed EPS expectations, for which we should remain cautious.

Upcoming EPS expectations (SeekingAlpha.com) Earnings history (SeekingAlpha.com)

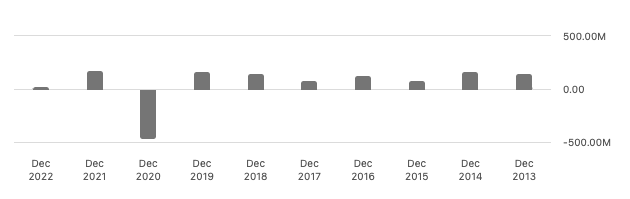

One of Cinemark’s strengths has been its ability to keep positive levered free cash flow, currently $128.91 million. However, the company has been increasing its quarterly cash burn, which was negative in Q1 2023 at $12.7 million. We expect cash flow to improve with the rebound of the box office.

Annual levered free cash flow (SeekingAlpha.com)

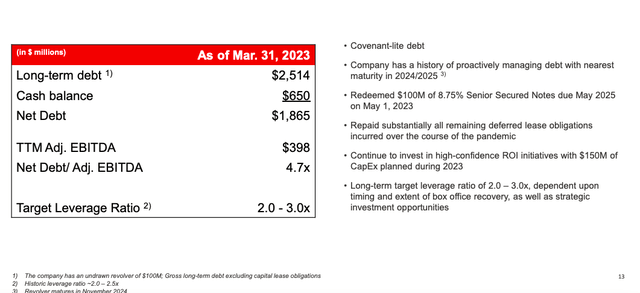

If we look at the balance sheet, the company ended its Q1 2023 with $650 million in cash. Furthermore, the company has $100 million in a revolving credit facility maturing in November 2024. Debt remains high if we compare it to pre-COVID numbers, although we can see that the company can cover its short-term liabilities with a current ratio of 1.12 and a quick ratio of 1.03.

Debt overview (Investor presentation 2023) Annual total debt history (SeekingAlpha.com)

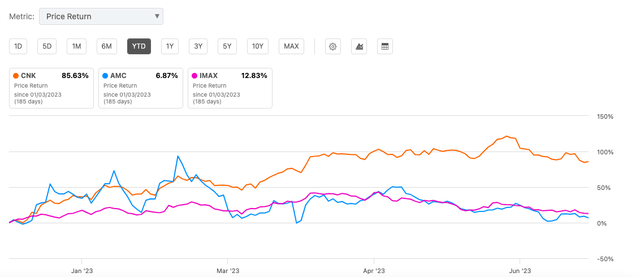

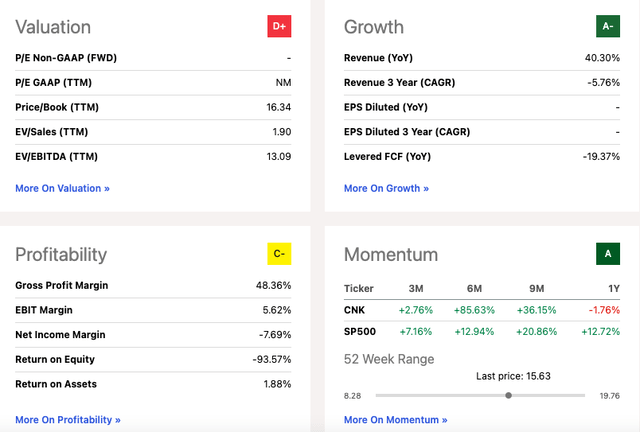

Cinemark is trading well below its price target of $18.59 and well below its pre-pandemic highs. Analysts are neutral to bullish on the stock; Wallstreet gives it a Buy rating of 3.72. However, the stock has recently been downgraded by B. Riley, which suggests IMAX as the better alternative, mentioning the writer’s strike impacting the number of new films and its lack of diversification outside the Hollywood industry. We can see that year to date. The stock has outperformed its peers AMC Entertainment Holdings (AMC) and IMAX Corporation (IMAX). However, investors should be cautious of the high short interest in the stock, indicating negative sentiment towards the company.

Year to date price return versus peers (SeekingAlpha.com)

The company has shown impressive top-line growth at 40.3% YoY; however, it is still producing negative earnings and has a high price-to-book ratio of 16.34, indicating that investors are paying a premium compared to its book value.

Quant rating (SeekingAlpha.com)

Risks

Investing in cinema stocks carries a high level of risk due to the industry undergoing significant changes, and it’s unclear what the future holds for moviegoers. A crucial factor for growth in this industry is the availability of a wide range of films. With fewer movies being released, there is a lower chance of attracting more attendees, which can negatively impact the business’s potential for growth. IMAX has seen growth in international markets thanks to its ability to offer films in different languages, while Cinemark’s primary market is still the United States which could limit its growth potential in the long term.

Final thoughts

Cinemark has outperformed its peers year to date regarding its price return. However, the stock has a high short interest, and we have not seen positive earnings since FY2019. Furthermore, the initial box office numbers of the crucial summer movie season are not particularly impressive. Although Cinemark is expected to produce positive earnings in its upcoming Q2 2023 results, I maintain a wait-and-see hold rating in the hope of increased cash flow, improved profits and higher attendance numbers.

Read the full article here